ASX Small Caps and IPO Weekly Wrap: A Benchmark bonanza, but harder to pick than a broken nose

News

News

That was a weird old week on the ASX, but it’s ended with the market in a hugely favourable position for investors.

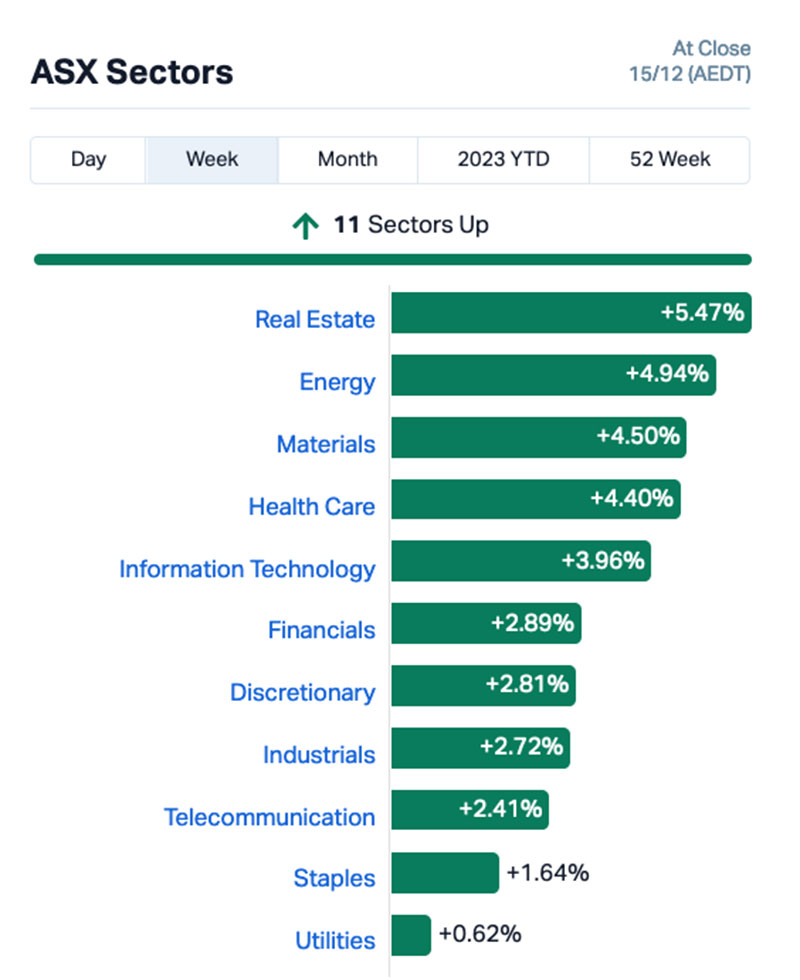

The benchmark stacked on a ball-tearing 3.76% or thereabouts, with a five-day run of good fortune that just kept gathering momentum like a thing possessed.

Monday was ssslllooowww, but as the week wore on, the combination of news and data from the US and local sources kept on swinging the market’s way, leading to an outright blitz of gains yesterday, backed up by a solid round to end the week today.

A look at the sectors shows that a lot of the heavy lifting was done by the Real Estate sector, which saw about 5.5% growth over the past 5 days, with the Energy sector banking near 5% gains as well.

Energy’s movements this week were driven largely by a really volatile burst of activity among global commodities, which has left natural gas prices down by more than 6.2%, while crude oil prices recovered from their recent slump to end the week 1.2% higher.

Other commodities have also been pretty variable this week – gold fell below but then regained its position above US$2,000/oz, surging 1.6% for the week, while the price for silver has surged more than 5% over the past 5 days.

It was a terrible week for cobalt, which shed nearly 11%, but a super week for platinum which saw the precious metal move nearly 15% higher.

| Code | Company | Price | % Week | Market Cap |

|---|---|---|---|---|

| BAT | Battery Minerals Ltd | 0.125 | 257% | $18,139,207 |

| NZS | New Zealand Coastal | 0.002 | 100% | $3,334,020 |

| SIH | Sihayo Gold Limited | 0.002 | 100% | $24,408,512 |

| YPB | YPB Group Ltd | 0.002 | 100% | $1,580,923 |

| JAY | Jayride Group | 0.04 | 90% | $9,376,365 |

| CXU | Cauldron Energy Ltd | 0.026 | 86% | $23,775,848 |

| AMD | Arrow Minerals | 0.0025 | 67% | $9,071,295 |

| MKR | Manuka Resources. | 0.096 | 63% | $54,001,926 |

| ADS | Adslot Ltd. | 0.003 | 50% | $9,673,487 |

| CT1 | Constellation Tech | 0.003 | 50% | $4,413,601 |

| KEY | KEY Petroleum | 0.0015 | 50% | $2,951,892 |

| JAV | Javelin Minerals Ltd | 0.003 | 50% | $2,176,340 |

| KNB | Koonenberrygold | 0.041 | 46% | $4,909,713 |

| AUE | Aurumresources | 0.285 | 46% | $9,125,000 |

| WC1 | Westcobarmetals | 0.081 | 45% | $10,751,229 |

| VHT | Volpara Health Tech | 1.095 | 42% | $278,539,867 |

| TTT | Titomic Limited | 0.041 | 41% | $37,495,152 |

| HAL | Halo Technologies | 0.175 | 40% | $20,071,758 |

| EWC | Energy World Corpor. | 0.025 | 39% | $61,578,425 |

| GGE | Grand Gulf Energy | 0.011 | 38% | $22,000,094 |

| HPG | Hipages Group | 0.89 | 37% | $119,858,489 |

| S3N | Sensore Ltd | 0.13 | 37% | $4,731,121 |

| M2R | Miramar | 0.027 | 35% | $4,019,478 |

| NGY | Nuenergy Gas Ltd | 0.031 | 35% | $42,947,709 |

| SIG | Sigma Health Ltd | 0.995 | 34% | $1,106,943,855 |

| AUH | Austchina Holdings | 0.004 | 33% | $8,311,535 |

| CTN | Catalina Resources | 0.004 | 33% | $4,953,948 |

| ENT | Enterprise Metals | 0.004 | 33% | $3,207,884 |

| GML | Gateway Mining | 0.032 | 33% | $9,944,476 |

| IEC | Intra Energy Corp | 0.004 | 33% | $6,643,126 |

| IPB | IPB Petroleum Ltd | 0.012 | 33% | $6,216,347 |

| MCT | Metalicity Limited | 0.002 | 33% | $8,970,108 |

| NVQ | Noviqtech Limited | 0.004 | 33% | $5,237,781 |

| RML | Resolution Minerals | 0.004 | 33% | $3,771,875 |

| RMX | Red Mount Min Ltd | 0.004 | 33% | $10,694,304 |

| SRY | Story-I Limited | 0.004 | 33% | $1,505,619 |

| T3D | 333D Limited | 0.008 | 33% | $597,225 |

| BLY | Boart Longyear | 1.705 | 31% | $504,544,306 |

| BLU | Blue Energy Limited | 0.026 | 30% | $49,976,287 |

| DGR | DGR Global Ltd | 0.026 | 30% | $27,136,030 |

| JPR | Jupiter Energy | 0.022 | 29% | $27,947,266 |

| ATP | Atlas Pearls Ltd | 0.155 | 29% | $64,246,774 |

| AL3 | Aml3D | 0.099 | 29% | $21,199,834 |

| BFC | Beston Global Ltd | 0.009 | 29% | $13,979,328 |

| NTM | Nt Minerals Limited | 0.009 | 29% | $7,739,126 |

| REM | Remsensetechnologies | 0.023 | 28% | $2,430,717 |

| BCA | Black Canyon Limited | 0.14 | 27% | $9,539,805 |

| IXC | Invex Ther | 0.081 | 27% | $6,012,308 |

| BGE | Bridgesaaslimited | 0.033 | 27% | $3,701,309 |

| SLX | Silex Systems | 4.17 | 27% | $976,816,751 |

There was a very clear winner on the market this week, with the trophy landing in the lap of Battery Minerals (ASX:BAT), thanks to a barnstorming 247% climb over the past 5 days.

Things started moving for Battery Minerals more than a week ago, on 05 December, when the company announced the results of ongoing targeting work at its Spur and Stawell Projects, saying:

“Reprocessing of historic induced polarisation (IP) geophysical data has upgraded the Spur and Spur South Prospects, defining a strongly resistive, southerly plunging anomaly away from existing mineralisation, including 86m @ 1.56g/t Au, 536ppm Cu.”

And:

“Assay and screen fire results have been received from the Stawell Project, upgrading the prospectivity of the Frankfurt Prospect for large scale IRG mineralisation.”

Results from the latter looked like this: 118.9m @ 0.1g/t Au, 11.8ppm Mo from 17.1m, including 16.1m @ 0.34g/t Au from 108.4m.

The gains began slowly, but kept on gathering steam, with the company’s share price growing each day since, including a couple of sprints that were hard enough to attract the attention of the ASX watchdogs, who issued a Please Explain on 14 December.

The company said it is not aware of any news that the rest of the world doesn’t already know about what it’s up to at the moment, but pointed to a placement at a premium price of $0.38 to strategic resources investors on 8 December, followed by the subsequent substantial shareholder notices from these strategic investors over the following few days as the possible reason why it’s seen such spectacular growth this week.

Cauldron Energy (ASX:CXU) is the next small cap winner of note, up around 88% for the week, presumably off the back of a scoping study from Cauldron’s Bennet Well uranium deposit, part of the company’s Yanrey Uranium Project in Western Australia.

I’ve explained that in more detail down below, so read on for more information.

And Manuka Resources (ASX:MKR) is another wild child of the market this week, which has been climbing steady and strong for no apparent reason since 28 November.

With very little in the way of things to say to the ASX – other than to answer a price query a couple of days ago – Manuka has since climbed from $0.041 a pop to today’s total of $0.096 at the time of writing.

So… you can see what I mean when I say that this week has been a bit of a head-scratcher in many respects… but, if you’re just happy taking an “all’s well that ends well” approach to the markets, then this is probably just a week you can chalk up as a win, and hope for more of the same when the market opens again on Monday.

| Code | Company | Price | % Week | Market Cap |

|---|---|---|---|---|

| PBL | Parabellumresources | 0.066 | -81% | $4,423,300 |

| EMU | EMU NL | 0.001 | -50% | $2,024,771 |

| RNO | Rhinomed Ltd | 0.02 | -50% | $7,142,992 |

| TG6 | Tgmetalslimited | 0.405 | -40% | $21,093,605 |

| SHN | Sunshine Metals Ltd | 0.015 | -40% | $18,360,127 |

| XPN | Xpon Technologies | 0.02 | -38% | $3,170,550 |

| HMD | Heramed Limited | 0.022 | -37% | $8,385,426 |

| NKL | Nickelxltd | 0.04 | -35% | $3,600,422 |

| NIM | Nimyresourceslimited | 0.145 | -34% | $19,808,870 |

| AVW | Avira Resources Ltd | 0.001 | -33% | $2,133,790 |

| GTGDA | Genetic Technologies | 0.2 | -33% | $23,083,316 |

| SIT | Site Group Int Ltd | 0.002 | -33% | $7,807,471 |

| VPR | Volt Power Group | 0.001 | -33% | $10,716,208 |

| ZMM | Zimi Ltd | 0.027 | -33% | $3,130,332 |

| NHE | Nobleheliumlimited | 0.115 | -32% | $33,589,328 |

| T88 | Taitonresources | 0.1 | -31% | $6,990,691 |

| WEC | White Energy Company | 0.04 | -31% | $2,941,466 |

| MSG | Mcs Services Limited | 0.014 | -30% | $2,773,395 |

| NES | Nelson Resources. | 0.0035 | -30% | $2,454,377 |

| AQX | Alice Queen Ltd | 0.005 | -29% | $3,454,921 |

| AI1 | Adisyn Ltd | 0.019 | -27% | $2,876,173 |

| BMM | Balkanminingandmin | 0.11 | -27% | $8,524,862 |

| LBT | LBT Innovations | 0.011 | -27% | $15,077,452 |

| PTX | Prescient Ltd | 0.07 | -26% | $53,151,106 |

| FL1 | First Lithium Ltd | 0.4 | -25% | $31,172,992 |

| 1AG | Alterra Limited | 0.006 | -25% | $4,992,883 |

| AOA | Ausmon Resorces | 0.003 | -25% | $3,020,998 |

| FG1 | Flynngold | 0.048 | -25% | $6,819,129 |

| PNX | PNX Metals Limited | 0.003 | -25% | $21,522,499 |

| WFL | Wellfully Limited | 0.003 | -25% | $1,478,832 |

| YAR | Yari Minerals Ltd | 0.009 | -25% | $4,823,578 |

| CI1 | Credit Intelligence | 0.19 | -24% | $17,168,816 |

| WSR | Westar Resources | 0.019 | -24% | $3,892,508 |

| OEQ | Orion Equities | 0.07 | -24% | $1,095,446 |

| CL8 | Carly Holdings Ltd | 0.013 | -24% | $3,757,185 |

| EMD | Emyria Limited | 0.052 | -24% | $18,698,099 |

| VTX | Vertexmin | 0.13 | -24% | $8,113,083 |

| 5EA | 5Eadvanced | 0.215 | -23% | $76,915,043 |

| AUZ | Australian Mines Ltd | 0.01 | -23% | $8,505,444 |

| BUX | Buxton Resources Ltd | 0.15 | -23% | $25,987,034 |

| 8IH | 8I Holdings Ltd | 0.017 | -23% | $6,075,052 |

| KGD | Kula Gold Limited | 0.017 | -23% | $7,129,218 |

| LM1 | Leeuwin Metals Ltd | 0.155 | -23% | $7,132,423 |

| AXN | Alliance Nickel Ltd | 0.039 | -22% | $34,114,462 |

| IVZ | Invictus Energy Ltd | 0.16 | -22% | $264,647,124 |

| M2M | Mtmalcolmminesnl | 0.025 | -22% | $2,933,588 |

| 4DX | 4Dmedical Limited | 0.75 | -21% | $289,254,012 |

| XST | Xstate Resources | 0.011 | -21% | $3,536,711 |

| PLN | Pioneer Lithium | 0.19 | -21% | $5,400,750 |

| VN8 | Vonex Limited. | 0.019 | -21% | $6,874,744 |

Monday 11 December, 2023

Leading the Small Caps winners list – and waaaay out ahead of the rest of the market – was debutante LTR Pharma (ASX:LTP), which made a stunning entrance on the ASX this morning to be up 70% in the space of a couple of hours, and closed out the day by cracking the ton, up 100%.

LTR Pharma’s immediate success can be pinned on the fact that it’s done what a lot of microcap pharmaceutical companies don’t do – and that’s come to the ASX with a developed, patent-protected product that makes immediate sense the moment it’s explained.

The company makes a product called Spontan, which looks like a nasal decongestant spray, but acts on an entirely different part of the male anatomy as a rapid, on-demand fix for erectile dysfunction.

LTR Pharma is in the process of commercialising Spontan, it’s got a successful Phase I human proof of concept study under its belt – which indicates a 6x faster effect compared to oral administration of tablets like Viagra – and the company says it’s got a clear pathway to market, progressing to bioequivalence study with expedited regulatory filings in the US and Australia within 1-2 years.

The next two on the ladder are slightly curious – West Cobar Metals (ASX:WC1) and Cauldron Energy (ASX:CXU) have both banked better-than +30% gains, despite neither having any recent news that might explain why they’re moving that way today.

For what it’s worth, West Cobar did get a speeding ticket from the ASX, to which it responded with (words to the effect of) “nothing to see here… we’re also mystified” – but Cauldron seems to kjust be puddling along, well out in front of the rest of the small cappers with a big grin on its face.

The next best performer with actual news was Pact Group (ASX:PGH), which went sailing through +22.5% today because it’s the target of an off-market takeover that got very juicy this morning.

Bennamon Industries is the entity behind the bid, and today it announced that it really wants to buy Pact holus bolus – as indicated by Bennamon upping its per share offer from $0.68 cash per Pact share to $0.84 cash.

That’s a chunky 21% push in price, and quite a sizeable step up from Pact’s previous closing price – whether it’s going to be enough to entice the required number of shareholders over the line remains to be seen.

And a couple of short bursts to round out the list: MetalsGrove Mining (ASX:MGA) is up on news that the company has entered into a strategic agreement to acquire six new lithium claims in Zimbabwe, while Grand Gulf Energy (ASX:GGE) rose sharply on news that the Jesse-1A well has unexpectedly flowed significant helium to surface at concentrations consistent with the previous downhole sample of 1% helium.

Tuesday 12 December, 2023

Leading the Small Caps winners on Tuesday was UK-based telehealth company Doctor Care Anywhere Group PLC (ASX:DOC), which is making some decent (and rapid) gains this morning after news broke that the company is set to repay its December 2022 senior loan facility with AXA PPP Healthcare Group.

In second place, it was Widgie Nickel (ASX:WIN), which took off on an uphill sprint late in the day, seemingly of its own accord, as the company hasn’t had much to say to the market for quite some time.

It’s also been on a steady decline in trading price since early October, falling from $0.23 to $0.082 Monday, so this sudden rush of blood to the head is a little mysterious – the price for nickel did jump overnight to reach US$16,300/tonne, but that’s hardly enough to move Widgie’s needle to the extent that it moved yesterday.

Titomic (ASX:TTT) was on a slow burn Tuesday, but managed to squeak into the Top 3 by the close of play, thanks to news that the company has signed on to a strategic manufacturing partnership agreement with Stärke Advanced Manufacturing Group (Stärke), a global, advanced manufacturer headquartered in South Australia.

The announcement makes no specific mention of precisely what the two companies are going to be collaborating on, but it does mention that Stärke is quite heavily into “various high-performance sectors, including defence, aerospace, and automotive”. Make of that what you will.

Wednesday 13 December, 2023

Leading the market was Healthcare large capper Sigma Healthcare (ASX:SIG), which flew on news of a multi-billion dollar merger being put together to allow retail behemoth Chemist Warehouse to backdoor list on the ASX.

The actual news from Sigma was only tangentially related to that merger, as it was all about the completion of a fully underwritten 1 for 1.85 pro-rata accelerated non-renounceable entitlement offer to raise approximately $400 million.

Koonenberry Gold (ASX:KNB) celebrated a win through an announcement featuring two words investors love to read: “visible gold”.

Drilling at the company’s Bellagio gold prospect hit widespread quartz veins below the weathered zone, containing visible gold down dip from the Koonenberry’s previously reported intercept of 10m @ 1.61g/t Au, which – just so we’re clear – did not have any visible gold.

“Below the strongly weathered zone, quartz veins are associated with sericite-silica hydrothermal alteration and trace arsenopyrite over a +125m wide zone,” KNB says.

“This is significant as sericite-silica alteration is a common feature of many orogenic gold systems” – orogenic referring to the crumple zone that makes mountain ranges when two tectonic plates collide.

Another worth a mention in the winner’s list was American West Metals (ASX:AW1), on the rise after revealing it is sitting on the only known domestic Indium resource in the United States.

Indium is one of those rare critical minerals that most people have never heard of, but it’s a pretty important element in the manufacture of things like mobile phones and emojis.

AW1’s indium resource isn’t just unique in terms of its geological placement, but also pretty big – the company is reporting a JORC compliant resource of some 23.8Moz of indium at the site, nestled cheek-by-jowl with an equally impressive total of 119 Koz of gold, 1.3Mt zinc, 49Kt copper and 10Moz silver.

Thursday 07 December, 2023

Doing well was Battery Minerals (ASX:BAT), which has been on a tear for the past few days and appears to be gathering even more steam, since announcing it had completed a private placement to two strategic investors at $0.038 per share, with 14.76 million new fully paid ordinary shares issued to raise $560,880 on 8 December.

Since then, Battery Minerals has raced well beyond that valuation, and at the time of writing is sitting at $0.110, making the 08 December buy-ins one of the most remarkably prescient transactions of the month.

Breast cancer detection tech company Volpara Health Technologies (ASX:VHT), climbed more than 42% today on news that Korean-listed cancer detection tech company Lunit wants to spend up big on a total takeover.

Lunit has offered Volpara shareholders $1.15 per share in cash, giving the deal an implied value of around $300 million, which the Volpara board has very enthusiastically endorsed.

Kore Potash (ASX:KP2) is up nicely this morning, on slim volume, a few days an after-hours announcement of management changes at the company, which saw acting CFO Amanda Farris resign and new CFO Andrey Maruta step in to replace her.

And RTG Mining (ASX:RTG) is having a belter this morning as well, on the back of news that the company has confirmed multiple styles of mine alisation and more encouraging gold and copper grades along 6.5km of skarns and new structures at its 90% owned Chanach gold-copper project in the Kyrgyz Republic.

Dimerix (ASX:DXB) climbed quickly late in the day on no news, while Cooper Metals (ASX:CPM) put on more value on the back of Tuesday’s news that the Raven Cu-Au prospect at the Mt Isa East Cu-Au project had been extended, thanks to fresh RC drilling.

Friday 15 December, 2023

The Small Caps market was in a rather vague mood on Friday, with a number of the chart leaders at various stages of the day occupying senior positions without fresh news to explain why they were there.

That includes Complii Fintech Solutions (ASX:CF1) , which soared 40% post-lunch, with the only recent news to the ASX being the disbursement of performance-related shares to three directors, totalling 26 million shares (about $640,000 worth when issued) a few days prior.

Similarly, Next Science (ASX:NXS) took off after lunch, racing through a 28% gain with a near-tenfold increase in trading volume over the 4-week average, again on no fresh news.

Cauldron Energy (ASX:CXU) enjoyed a solid 24% boost in trading price on friday afternoon, with its most recent announcement already two days old – a scoping study from Cauldron’s Bennet Well uranium deposit, part of the company’s Yanrey Uranium Project which encompasses a total area of 1,270km2 about 100km south of the town of Onslow in Western Australia.

Cauldron says that Bennett Well is home to a JORC compliant 30.9 million pounds (about 14,000t) of contained uranium oxide, Indicated plus Inferred Mineral Resource of 38.9 million tonnes grading 360ppm eU3O8.

Microcapper Javelin Minerals (ASX:JAV), which is showing a 50% bump according to the steady stream of data pouring out of the ASX computers.

The last piece of information coming directly from Javelin was an entitlement offer prospectus which arrived with very little fanfare from the company on Tuesday, casually announcing that the company is offering a cheeky 1,000,000,000 new shares (and an equally enormous number of attaching options) to existing shareholders at $0.001 a pop.

Both Icon Energy (ASX:ICN) and Resolution Minerals (ASX:RML) have posted sizeable percentage gains this morning, in the absence of any market-shifting news.

Global Uranium (ASX:GUE) is up more than 26%, proving that the company name is something of a misnomer as the win has come via news that the company’s exploration licence for the Enmore gold project in New South Wales has been extended for six years.

If the name is unfamiliar to you, you’re not alone – it was recently rebadged from Okapi Resources (ASX:OKR) .

And Gold Mountain (ASX:GMN) is climbing today, most likely on the back of two announcements to the market yesterday.

The first was a company update, outlining where things are at with Gold Mountain’s activities in Brazil, where it has secured 57 tenements at the application stage in the Jequié Block of the Sao Francisco craton, cheek-by-jowl with Brazilian Rare Earths.

The company also announced yesterday that it has discovered anomalous lithium concentrations within stream sediment samples at its Juremal project, which is also in Brazil.

Expected listing: December 11th

IPO: $7m at $0.20

Closed at $0.38 at the end of Day 1, up 90%

LTR Pharma is a clinical stage, biotech company pioneering a novel intranasal technology – SPONTAN – designed to treat erectile dysfunction in 10 minutes or less.

That’s all the market needed to know before getting behind the little pharma that most assuredly could, lending considerable steam to the launch that saw it close 90% at the end of Day 1.

SPONTAN is said to provide on-demand delivery and faster effect. A lower dose provides less systematic exposure and reduced side effects.

According to LTP, benefits of SPONTAN include enhanced trans mucosal absorption, increased bioavailability and lower drug dose.

Erectile Dysfunction (ED) is a condition in which you are unable to get or keep an erection firm enough for satisfactory sexual intercourse. ED can be a short-term or long-term problem.

LTP is targeting a US FDA New Drug Application (NDA) filing for SPONTAN, which is expected to be completed by the end of the first quarter of 2025 under the 505(b)(2) approval pathway regulatory strategy.

Enlitic (ASX:ENL)

Expected listing: December 18th

IPO: $35m at $0.83

Enlitic is a healthcare IT company that harnesses AI to manage medical imaging data in radiology, such as MRI, CT, X-ray and ultrasound images.

The Enlitic platform standardises, protects, and analyses data to create a database that improves clinical workflows, increases efficiencies, and expands capacity.

The company says it owns the industry’s first localised real-world medical imaging database that unlocks the value of historical diagnostic images, aligned with real-time diagnostics, and linkage to real-world data across any critical care solutions.

Health care providers using the Enlitic platform would have their productivity increased, and have their costs decreased, says the company.

Fuse Minerals (ASX:FSE)

Expected listing: December 18th

IPO: $10m at $0.20

Fuse has three ongoing minerals exploration projects – Mt Sydney and Mt Sandman in WA, and Eastern Isaac in Queensland.

The flagship Mt Sydney Project covers a strategic landholding (100%-ownership) of 1119km2, and is located on the under-explored Pilbara Craton-Paterson Province margin in WA.

Fuse’s work on the Mt Sydney Project to date shows VHMS gossans high-grade polymetallic vein outcrops mineralised breccia, and magmatic copper-nickel drill targets across this very large area of tenure.

The project has limited past exploration, with only 1106m of drilling over 484km2.

The Mt Sandman Project is situated on the complex boundary of two major tectonic units of WA – the Proterozoic Gascoyne Province and the Palaeozoic Carnarvon Basin.

Rock chipping has confirmed base metal association with barite and carbonate rocks up to 6g/t Ag >1% Pb & 0.3% Zn.

The Eastern Isaac Project in Qld meanwhile is a 25% ownership project, with the option to earn up to 80%.

The Project comprises three copper/gold project areas totalling 637km2: Gotthardt of 93km2, Valkyrie of 254km2, and Hamilton Park of 290km2.