Yowie is swimming in cash but still isn’t making a profit

Health & Biotech

Health & Biotech

Yowie’s problems over the last few months have cast a pall over half-year results that look rough but actually aren’t too bad.

The Aussie icon — which makes chocolates in the shape of a mythical Aussie ape-like creature — said revenue dropped 16 per cent from the year before to $US8 million ($10.2 million).

But it hadn’t been forced to pay a large stock adjustment fee, they’d be in the black.

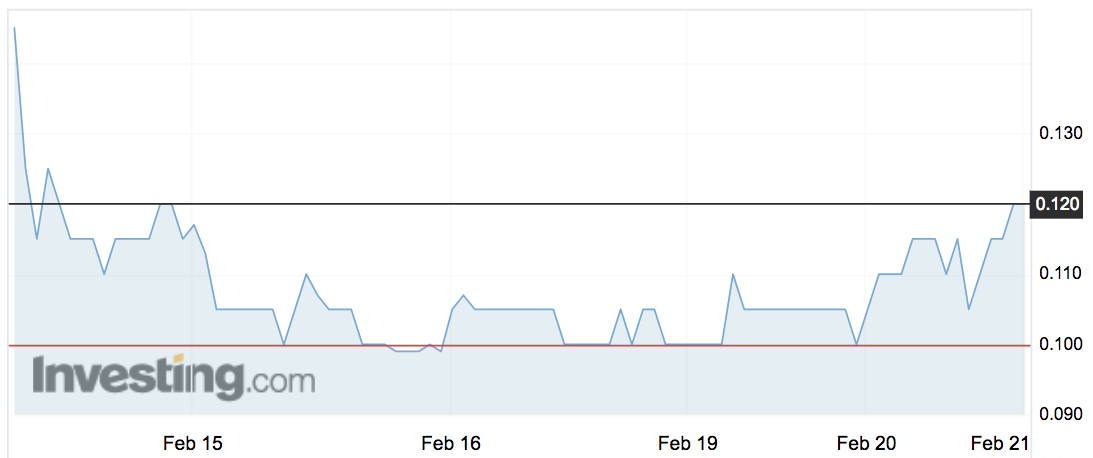

Yowie shares fell 8 per cent to 11c on Wednesday, after rising almost 15 per cent on Tuesday.

Yowie revealed a surprise $US1.95 million ($2.5 million) bill in January, after a US customer demanded retrospective payments based on stock adjustment over the past two years.

Had that not happened, revenue would have been up 7.3 per cent to $US10 million.

As it is, they managed to reduce the half-year loss by 27 per cent, from $4.4 million to $3.2 million.

Yowie also admitted in January that a much-vaunted North American expansion plan wasn’t going to plan due to higher competition and hesitation among retailers to commit to another low-cost confection product.

Yowie chief Bert Alfonso quit as the company cut sales growth from 55 per cent to 17 per cent.

They had a cash burn of $3.3 milion but also has $22.7 million in the bank, which is one of the beauty spots attracting a consortium of investors that yesterday built a 19.998 per cent position in the business.

They believe the business is undervalued.