ASX Small Caps and IPO Weekly Wrap: Does anyone else want to pretend this week didn’t happen?

Clearly distressed at having lost his entire piggy bank on tech stocks this week, Teddy threw his owner out the window in despair. Pic via Getty Images.

What an opening stint of the trading year it’s been for 2024, starting off with a bumper day on Tuesday that saw the ASX 200 hit a 22-month high of almost 7633 points, before it all fell in a heap over the remaining three days of the holiday-shortened week to land on -1.64% for the week.

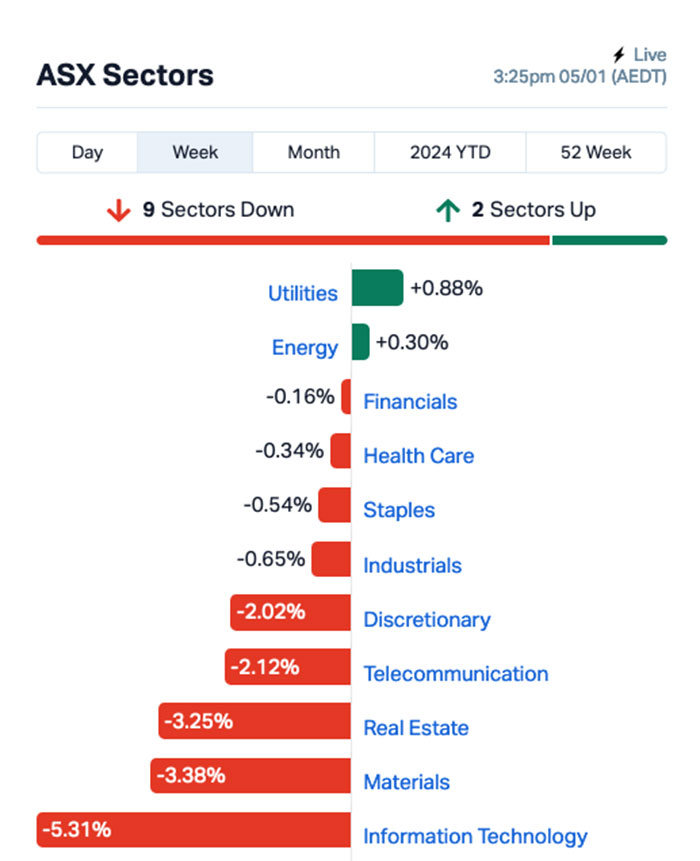

It’s been particularly brutal for InfoTech stocks, which have gone from outright market darling in 2023 to the object of angst and ire, losing around 5.3% over the past four sessions and leaving many an investor wondering WTAF just happened?

It’s a similar, if somewhat slightly less bloody, result for Materials and Real Estate, which have both shed more than 3.2% since Tuesday morning, and Telcos and Consumer Discretionary weren’t much better, both losing more than 2.0% apiece.

In fact, the only sector making headway worth a damn was Utilities, which – 30 minutes out from market close on Friday – was pointing just 0.8% higher after four lengthy and tedious sessions on the bourse.

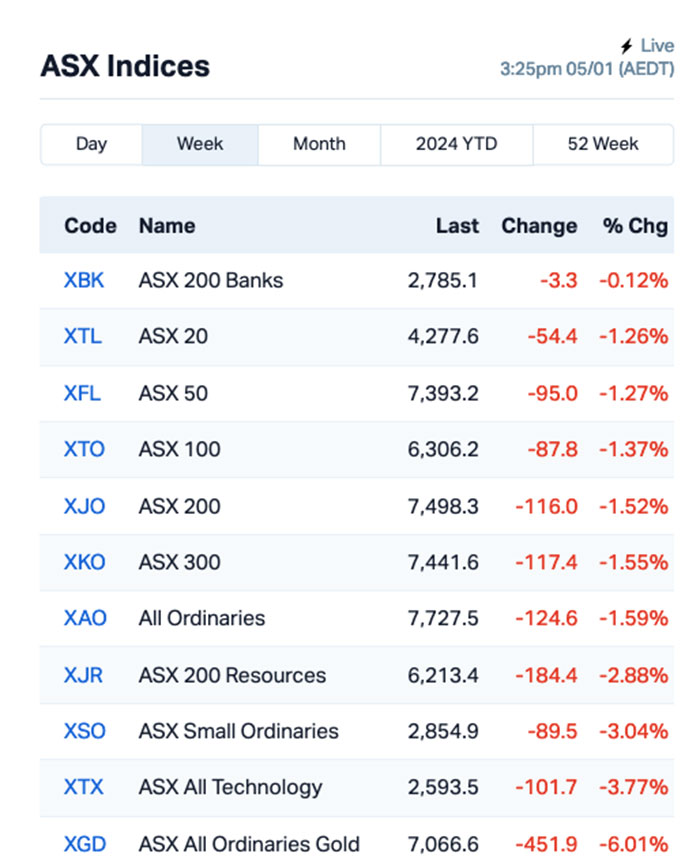

A more granular look at things tells an even more worrisome tale of grim news and teary eyes – the best of the indices on the list belongs to the banks, and even they’re down 0.12% for the week.

The mostly-reliable goldies have had a week well worth bronzing, dropping more than 6.0% since the market opened for the year.

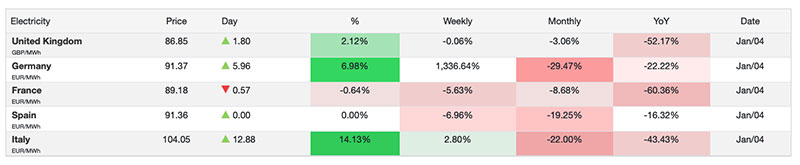

That said, if you’re licking your wounds this week and feeling a little sorry for yourself, spare a thought for the people of Germany, who – by the looks of one of my go-to sources for commodities pricing – are in for the Bill Shock to End All Bill Shocks…

Here’s hoping for their sake that 1,336% hike is just a data glitch…

SMALL CAP WINNERS THIS WEEK

| Code | Company | Price | % Week | Market Cap |

|---|---|---|---|---|

| MTM | MTM Critical Metals | 0.1175 | 173% | $10,938,079 |

| OEQ | Orion Equities | 0.165 | 143% | $2,582,123 |

| LNU | Linius Tech Limited | 0.003 | 100% | $14,817,722 |

| CPO | Culpeominerals | 0.057 | 90% | $6,294,368 |

| CRB | Carbine Resources | 0.008 | 78% | $4,413,902 |

| FFG | Fatfish Group | 0.028 | 75% | $31,975,513 |

| CE1 | Calima Energy | 0.1025 | 58% | $40,671,850 |

| DAF | Discovery Alaska Ltd | 0.029 | 53% | $7,027,041 |

| BPP | Babylon Pump & Power | 0.006 | 50% | $14,979,884 |

| FHS | Freehill Mining Ltd. | 0.009 | 50% | $17,099,007 |

| MTL | Mantle Minerals Ltd | 0.003 | 50% | $18,592,338 |

| SRX | Sierra Rutile | 0.1375 | 48% | $55,150,738 |

| BPH | BPH Energy Ltd | 0.067 | 46% | $56,425,982 |

| BDG | Black Dragon Gold | 0.048 | 45% | $7,224,122 |

| EYE | Nova EYE Medical Ltd | 0.275 | 45% | $54,329,235 |

| STK | Strickland Metals | 0.13 | 44% | $195,886,577 |

| PAM | Pan Asia Metals | 0.18 | 44% | $36,080,607 |

| AKM | Aspire Mining Ltd | 0.15 | 43% | $93,912,842 |

| CRS | Caprice Resources | 0.038 | 41% | $6,702,608 |

| CUF | Cufe Ltd | 0.021 | 40% | $24,068,360 |

| ECT | Env Clean Tech Ltd. | 0.007 | 40% | $17,185,862 |

| LLI | Loyal Lithium Ltd | 0.42 | 40% | $36,646,420 |

| PEC | Perpetual Res Ltd | 0.014 | 40% | $8,820,412 |

| RCR | Rincon | 0.039 | 39% | $6,040,538 |

| KZR | Kalamazoo Resources | 0.15 | 36% | $18,850,642 |

| RAD | Radiopharm | 0.098 | 36% | $28,987,849 |

| ICI | Icandy Interactive | 0.038 | 36% | $46,977,199 |

| DYM | Dynamicmetalslimited | 0.19 | 36% | $5,775,000 |

| DOC | Doctor Care Anywhere | 0.084 | 35% | $27,864,811 |

| NPM | Newpeak Metals | 0.023 | 35% | $1,999,035 |

| NWF | Newfield Resources | 0.135 | 35% | $149,031,700 |

| A1G | African Gold Ltd. | 0.036 | 33% | $6,095,204 |

| BP8 | Bph Global Ltd | 0.002 | 33% | $2,753,345 |

| LSR | Lodestar Minerals | 0.004 | 33% | $8,093,589 |

| SRY | Story-I Limited | 0.004 | 33% | $1,505,619 |

| BGE | Bridgesaaslimited | 0.053 | 33% | $5,969,853 |

| BIO | Biome Australia Ltd | 0.25 | 32% | $49,816,627 |

| ENV | Enova Mining Limited | 0.021 | 31% | $12,177,657 |

| HCT | Holista CollTech Ltd | 0.013 | 30% | $3,624,401 |

| SGC | Sacgasco Ltd | 0.013 | 30% | $10,101,719 |

| CXU | Cauldron Energy Ltd | 0.031 | 29% | $30,586,655 |

| PXX | Polarx Limited | 0.009 | 29% | $11,477,317 |

| MTC | Metalstech Ltd | 0.25 | 28% | $44,404,329 |

| COE | Cooper Energy Ltd | 0.16 | 28% | $382,805,543 |

| BBT | Bluebet Holdings Ltd | 0.255 | 28% | $39,214,262 |

| AW1 | Americanwestmetals | 0.165 | 27% | $58,925,557 |

| MVP | Medical Developments | 0.95 | 27% | $90,620,480 |

| M24 | Mamba Exploration | 0.063 | 26% | $3,524,525 |

MTM Critical Metals (ASX:MTM) took out top spot on the winner’s list this week, but it took the long way getting to the top of the ladder.

MTM dropped an announcement to the market about a third set of assays from Viridis Mining and Minerals’ Colossus REE project in Brazil returning an average grade of 3,002ppm TREO across 113 drill holes.

That news was met with a huge spray of apathy, if not outright unconsciousness, from investors, and the company’s price plummeted 23% over the course of the day.

But then, things changed and MTM moved rapidly over the next two sessions to end up flavour of the week, topping out at +173% with a share price of $0.1175 a pop.

Orion Equities (ASX:OEQ) banked a solid second place with +143% for the week, after news that its subsidiary CXM is set to pocket a $5 million royalty payment from Iron Miracle, following the sale of CXM’s Paulsens East Iron Ore Project.

Linius Tech managed a 100% bump despite having less-than-boo to say to the market so far this year, while Culpeo delivered a 90% hike on news of a “large (1.7km x 0.5km footprint) copper-gold porphyry system” at its La Florida Prospect, inside the Fortuna Project in Chile.

Languishing at the bottom of the league for the week was Keybridge Capital (ASX:KBC) which sank like a stone after tipping its hand to the market by announcing that it wants to buy 100% of enviro-chocolatier Yowie Group (ASX:YOW).

Keybridge put in an offer at $0.034 per share on the final trading day of 2023 – by lunchtime on the next trading day (02 January), Yowie had sailed past that mark and it’s been crickets and tumbleweeds about the proposed deal since then.

SMALL CAP NOT-WINNERS THIS WEEK

| Code | Company | Price | % Week | Market Cap |

|---|---|---|---|---|

| KBC | Keybridge Capital | 0.042 | -38% | $8,708,189 |

| ADS | Adslot Ltd. | 0.002 | -33% | $6,448,991 |

| JAL | Jameson Resources | 0.031 | -31% | $13,507,733 |

| IS3 | I Synergy Group Ltd | 0.005 | -29% | $1,824,482 |

| RIL | Redivium Limited | 0.005 | -29% | $13,654,274 |

| NOV | Novatti Group Ltd | 0.06 | -28% | $21,674,019 |

| PKD | Parkd Ltd | 0.02 | -26% | $2,080,278 |

| ZNC | Zenith Minerals Ltd | 0.12 | -25% | $49,333,324 |

| BCT | Bluechiip Limited | 0.012 | -25% | $10,339,859 |

| CGO | CPT Global Limited | 0.12 | -25% | $5,027,684 |

| JAV | Javelin Minerals Ltd | 0.0015 | -25% | $2,176,231 |

| JAY | Jayride Group | 0.03 | -25% | $7,032,274 |

| ME1 | Melodiol Glb Health | 0.0015 | -25% | $7,093,236 |

| MHC | Manhattan Corp Ltd | 0.003 | -25% | $8,810,939 |

| PNX | PNX Metals Limited | 0.003 | -25% | $16,141,874 |

| WFL | Wellfully Limited | 0.003 | -25% | $1,478,832 |

| CI1 | Credit Intelligence | 0.13 | -24% | $12,326,330 |

| CTN | Catalina Resources | 0.004 | -20% | $4,953,948 |

| DCL | Domacom Limited | 0.016 | -20% | $6,968,028 |

| DOU | Douugh Limited | 0.004 | -20% | $4,328,276 |

| EDE | Eden Inv Ltd | 0.002 | -20% | $9,167,534 |

| GML | Gateway Mining | 0.02 | -20% | $7,829,565 |

| CHN | Chalice Mining Ltd | 1.415 | -20% | $575,665,690 |

| AHI | Advanced Health | 0.11 | -19% | $27,461,048 |

| ALM | Alma Metals Ltd | 0.009 | -18% | $10,026,007 |

| ICE | Icetana Limited | 0.028 | -18% | $7,409,596 |

| NYM | Narryermetalslimited | 0.066 | -18% | $3,359,550 |

| TBN | Tamboran | 0.19 | -17% | $433,747,072 |

| HRN | Horizon Gold Ltd | 0.25 | -17% | $43,451,977 |

| AMD | Arrow Minerals | 0.005 | -17% | $20,842,591 |

| ATH | Alterity Therap Ltd | 0.005 | -17% | $14,011,802 |

| CTO | Citigold Corp Ltd | 0.005 | -17% | $14,368,295 |

| MEG | Megado Minerals Ltd | 0.03 | -17% | $7,633,667 |

| MSG | Mcs Services Limited | 0.01 | -17% | $1,980,997 |

| NAE | New Age Exploration | 0.005 | -17% | $9,866,444 |

| OAR | OAR Resources Ltd | 0.0025 | -17% | $7,931,183 |

| SFG | Seafarms Group Ltd | 0.005 | -17% | $24,182,996 |

| TAS | Tasman Resources Ltd | 0.005 | -17% | $3,563,346 |

| ST1 | Spirit Technology | 0.067 | -16% | $53,059,539 |

| PVT | Pivotal Metals Ltd | 0.021 | -16% | $14,281,171 |

| FRB | Firebird Metals | 0.135 | -16% | $19,218,789 |

| T88 | Taitonresources | 0.079 | -15% | $4,248,189 |

| BTH | Bigtincan Hldgs Ltd | 0.17 | -15% | $110,925,556 |

| MDX | Mindax Limited | 0.051 | -15% | $126,824,644 |

| EWC | Energy World Corpor. | 0.023 | -15% | $76,973,031 |

| PYC | PYC Therapeutics | 0.094 | -15% | $362,088,112 |

| TMK | TMK Energy Limited | 0.006 | -14% | $42,858,055 |

| ADY | Admiralty Resources. | 0.006 | -14% | $7,821,475 |

| CCO | The Calmer Co Int | 0.006 | -14% | $5,144,971 |

| EEL | Enrg Elements Ltd | 0.006 | -14% | $6,059,790 |

HOW THE WEEK SHOOK OUT

Monday 01 January, 2024

Everyone was either asleep, or busy shaking firework debris from their ear canals – but, luckily, the market wasn’t open so nothing of value was lost.

Tuesday 02 January, 2024

The first day back for the ASX in 2024 started with a confused bang for MTM Critical Metals (ASX:MTM), when it surged more than 35% on no news early in the day, before a trading halt was requested at 11:23am “pending [the company] releasing an announcement”.

That announcement did eventuate, but it did some weird things to MTM’s price. Stay tuned.

Culpeo Minerals (ASX:CPO) was also enjoying a rapid rise in fortune, ostensibly off the back of last December’s announcement of significant widths of visible copper mineralisation intersected at very shallow depth at the El Quillay Prospect, Fortuna Project in Chile.

Meanwhile, Pan Asia Metals (ASX:PAM) jumped around 20% early in the day on news that the company has signed on the dotted line to convert existing MOUs into binding Option Agreements to purchase 100% of the ~1,200km2 Tama Atacama Lithium Brine Project, one of the largest lithium brine projects in South America.

PAM says that Tama Atacama is a Tier 1 asset in a Tier 1 jurisdiction “in the truest sense of the term ‘Tier 1’”, citing “extensive lithium surface anomalies with elevated lithium results up to 2,200ppm Li and averaging 700ppm Li (270ppm Li cutoff) extending over 160km north to south”.

The landscape changed a little over the course of the afternoon, with minnow Perpetual Resources jumping 40% just after lunch, despite no news since it announced rock-chip and grab samples showing “encouraging presence of pathfinder elements, suggesting potential for LCT-type pegmatites within Perpetual’s Brazil exploration permits” a couple of weeks before Christmas.

Nova Eye Medical (ASX:EYE) picked up where it left off at the tail end of last year, adding nicely to its tally on the back of news that proposed changes to the US Medicare system that would have negatively impacted the company are no longer going to be pushed into effect.

The company had been staring down the barrel of five major Medicare Administrative Contractors altering what’s known as Local Coverage Determinations to restrict or deny coverage for several procedures, including canaloplasty for minimally invasive glaucoma surgery at the end of January, 2024 – however, those proposals have now been completely withdrawn.

Wednesday 03 January, 2023

The Small Caps winners for the day included Pan Asia Metals (ASX:PAM), which is continuing to surge on yesterday’s news that it has put pen to formal papers to acquire 100% interest in the massive Tama Atacama Chilean lithium brine asset, which comprises some 1,200km2 of “Tier 1” ground.

PAM had been eyeing off full control of Tama Atacama for good reason – the project is one of the largest lithium brine projects in South America, representing roughly 13% of the highly prized Pampa del Tamarugal Basin in Chile’s Atacama Desert.

It also boasts super high-grade lithium in surface assays up to 2,200ppm Li, averaging 700ppm Li extending over 160km north to south – so, naturally, everyone’s a bit excited about the new deal.

Meanwhile, Viridis Mining and Minerals (ASX:VMM) was making waves on news that a third set of assays from Viridis Mining and Minerals’ Colossus REE project in Brazil, have returned an average grade of 3,002ppm TREO across 113 drill holes.

Colossus is starting to stack up as a world-class REE project, and those assays make perfect sense when you consider that it lies within Brazil’s pro-mining state of Minas Gerais and directly adjacent to Meteoric Resources’ (ASX:MEI) Caldeira project.

MEI’s Caldeira has a monster existing resource of 409Mt @ 2,626 parts per million (ppm) total rare earth oxides (TREO) – the highest grade for any Ionic Adsorption Clay (IAC) project known.

Aside from those two, the winner’s list early in the day was dominated by a number of little companies moving sharply despite the absence of fresh news, including Genetic Technologies (ASX:GTG), NickelX (ASX:NKL) and Taruga Minerals (ASX:TAR).

Later in the day, it was a safe bet that something’s afoot at Cufe this week, after a news-less 35% surge throughout the session ended with the company calling a pause in trading a bit over an hour before the market closed.

Orion Equities (ASX:OEQ) also lifted late in the day, after announcing that its subsidiary CXM Pty Ltd stands to pocket about $5 million in a royalty payment from Miracle Iron Holdings, after Miracle moved to acquire the Paulsens East Iron Ore Project located in the Pilbara, Western Australia from Strike Resources (ASX:SRK).

Strike was, naturally, also up nicely, banking a better-than 26% boost for the session.

MTM’s announcement dropped – and so did its trading price. By a lot. Which is weird because it seemed like it was pretty good news.

Thursday 04 January, 2024

Out in front of Small Caps land early was Culpeo Minerals (ASX:CPO), which – it seems – is unable to stop delivering great news, backing up December’s big announcement with a fresh one about the company delineating a “large (1.7km x 0.5km footprint) copper-gold porphyry system” at its La Florida Prospect, inside the Fortuna Project in Chile.

Culpeo says that surface sampling results have returned grades up to 3.96% Cu and 2.61g/t Au, with mineralisation styles that are analogous to the company’s Lana Corina Prospect, which itself returned drill intersections of 257m @ 1.10% Cu Eq and 169m @ 1.21% CuEq.

Orion Equities (ASX:OEQ) was continuing its efforts to make hay off the back of Wednesday’s announcement that its subsidiary CXM Pty Ltd stands to pocket about $5 million in a royalty payment from Miracle Iron Holdings. That’s after Miracle moved to acquire the Paulsens East Iron Ore Project located in the Pilbara, Western Australia from Strike Resources (ASX:SRK).

And Wednesday’s high-flyer, Pan Asia Metals (ASX:PAM), is also continuing its blistering run, up another 15.8% on recent news that it is set to acquire a 100% interest in the massive Tama Atacama Chilean lithium brine asset, which comprises some 1,200km2 of “Tier 1” ground.

MTM Critical Metals (ASX:MTM) made a remarkable recovery from Wednesday’s form slump, which saw it shed 23% of the back of news that drilling results “further confirm rare earth element (REE) and niobium (Nb) mineralisation over broad intervals in previously untested parts of the Pomme carbonatite complex”.

MTM took off at a brisk pace around 2:00pm, closing out the day 50% better off at $0.105 per share.

Friday 05 January, 2024

The morning’s big winner is Calima Energy (ASX:CE1), which has popped a very healthy 61.5% gain this morning on news that it has executed definitive agreements for the sale of of 100% of its wholly-owned Canadian subsidiary Blackspur Oil Corp to Astara Energy, for the princely sum of C$75 million – roughly 83.3 million of our puny Australian dollarydoos.

Which is, of course, big news – but the major reason why Calima’s gone absolutely gangbusters this morning is this little nugget in the announcement:

“It is the Company’s objective to distribute no less than 85% of the funds received from the Blackspur Sale to Calima shareholders in the most tax effective form and the Company will seek an ATO ruling on this matter in a timely fashion.”

Calima is currently trading at $0.105, which comes with a free hit at a slice of just under $71 million, depending on how the ATO decides to rule on the offer.

International bookie Michael Sullivan’s Bluebet (ASX:BBT) is up more than 25% this morning, after releasing a boilerplate non-denial of media speculation about a possible merger between it and rival Matt Tripp’s BetR.

“BlueBet is regularly involved in discussions with third parties regarding strategic initiatives, including Betr, aimed at maximising value for its shareholders,” the company said.

So that’s a very firm “possibly”, which was enough to get the more punt-friendly investors away from the pokies for a few minutes this morning.

And MTM Critical Metals (ASX:MTM) is still making the most of its recent news about rare earth element (REE) and niobium (Nb) mineralisation over broad intervals in previously untested parts of the Pomme carbonatite complex – the same news that saw the company shed 27% to $0.07 the day it dropped has since seen the company’s price climb 85.7% to $0.13… What a time to be alive.

Later in the day, BPH Energy (ASX:BPH) saw a flurry of activity for no particular reason that I was able to spot during a slightly-more-than-perfunctory look at the headlines, climbing around 22% to close out the week up by more than 43%.

Havilah Resources (ASX:HAV) made a late play for the headlines, dropping an announcement that it has found graphite at its Birksgate prospect in the Curnamona Province of northeastern South Australia, located approximately 50 km north-northwest of Kalkaroo.

But… it looks like it missed the mark, hardly surprising since the announcement came mid-afternoon on a very slow Friday, with results from a single drillhole, with a peak graphite interception of 4.9% over 21m from 36m – which, in the grand scheme of things, isn’t a show-stopper.

IPOs that (didn’t) happen

Kali Metals (ASX:KM1)

Expected listing: January 5, 2024

IPO: $15 million at 25 cents/share

Lithium explorer Kali Metals was established from the spinout of a portfolio of lithium assets owned by ASX-listed Kalamazoo Resources (ASX:KZR), with assets in the Lachlan Fold Belt.

It was slated to list today, but as far as I can tell, it remains MIA at the close of play. Word on the street is that Monday is launch day… stay tuned.

IPOs we’re waiting for

Infini Resources (ASX:I88)

Expected listing: January 16, 2024

IPO: $5.5 million at 20 cents/share

I88 is looking to capitalise on lifting uranium prices with its planned ASX listing mid-month.

Focused on lithium and uranium exploration, I88 has eight projects including a mix of brownfield and greenfield assets in Canada and Western Australia.

Its WA lithium projects include Pegasus, Parna and Yeelirrie. In Canada it has the Des Herbiers Project and Valor projects in Quebec, the Tinco Project in Saskatchewan and Portland Creek Uranium Project (Newfoundland and Labrador) along with the Paterson Lake Project (Ontario).

Sixty Two Capital is lead manager of the float.

Golden Globe Resources (ASX:GGR)

Expected listing: January 18, 2024

IPO:$6 million at 20 cents/share

The gold explorer with projects in Queensland, WA and NSW was down to list on the local bourse in October 2023. In the last four years, the company says it has acquired four projects with high prospectivity including Dooloo Creek and Alma in Queensland, Crossways in Western Australia, and Neila Creek in NSW.

GGR says each of these projects offers substantial opportunities for gold resources, including high-grade copper. The explorer has conducted extensive drilling and sampling at Dooloo Creek, yielding impressive results over the past two years.

There are plans for further drilling across all GGR projects, with an immediate focus on Neila Creek and ongoing efforts at Dooloo Creek.

K S Capital is lead manager of the float.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.