ASX Small Caps Lunch Wrap: Who’s realised their terrible Russian mistake this week?

News

News

Local markets are down this morning, after Wall Street came back from celebrating President’s Day just in time to post a grisly form slump that has led local stocks, with the exception of our Techies, into the red.

The benchmark is pointing close to 0.5% lower at lunchtime, with Consumer Staples way below the rest of the market, and that’s because supermarket giant Woolworths has delivered an absolute shocker of a half-year report.

I’ll get to that in a moment, but first there’s a story doing the rounds at the moment that is just way too laden with irony and schadenfreude to ignore… so I won’t, and here it is.

About three weeks ago, a fella by the name of Eric Veenstra made one of the biggest blunders in Canadian history, after selling off all of his family’s possessions and taking his wife and eight – eight! – children from Canada to live in Russia.

Veenstra has been remarkably candid about his reasons for doing so – and they all boil down to “There are too many of the gays in Canada, eh?”.

For the “safety” of his children, Veenstra started looking around for somewhere that wasn’t quite so open to the notions of same sex relationships, or questions around gender identity, or any of that other “woke nonsense”.

From across the narrow stretch of water that divides Canada from Russia came the siren song of Vladimir Putin’s famously anti-gay utopia – a place where Veenstra and his wife could raise their tribe of kids away from the unending horrors of acceptance and love.

What could possibly go wrong? Everything. That’s what.

Despite assurances from Russian officials that the family would receive as much help and support as needed – because, really, could there be a better PR coup for Russia right now? – Veenstra’s family is in deep, deep doo-doo.

The family transferred all of their money, raised by selling their property and most belongings and through sympathetic conservative donors on social media, to a Russian bank – which almost immediately froze their assets.

It’s unclear why, but the current best theory is that the bank was simply unsure of how to deal with a customer that A) has money, and B) isn’t an oligarch, and panicked and froze the account.

The thing about Russian banks is that most people that work there speak excellent Russian, and not much else, while Veenstra and his family, on the other hand, speak no Russian at all.

Think back to the last time you had to deal with your local bank over the phone, and the gut spasms, acid reflux and tension headaches that were bundled free with that conversation.

Now do it in a language you don’t understand, with a bank that operates under a very different set of laws to the ones you’re used to that stop banks from just stealing your money and laughing at you about it.

So the family is broke, and understandably, the lady of the household is displeased – and even said so, to a Russian television crew.

“I’m very disappointed in this country at this point. I’m ready to jump on a plane and get out of here. We’ve hit the first snag where you have to engage logic in this country and it’s very, very frustrating,” she said, which I believe translates from Canadian into Russian as “please push me out the nearest window”.

And so, the family is in a proper pickle. No money to live on, none of the promised assistance from Russian officials, and one of the adults is now very high on several lists that a lot of people don’t survive.

I shouldn’t laugh… but I’m going to.

Local markets today are basically the tale of two giants at opposite ends of a length of sturdy rope that’s tied around the hearts of Aussie investors, young and old.

On the happy side, there’s Wisetech Global – a tech company that has lifted revenue, boosted profits and is set to pay out a corker of a divvy to shareholders, at 7.7 cents per share.

On the other hand, there’s Woolworths, which didn’t.

Briefly, the sectors look like this as a result.

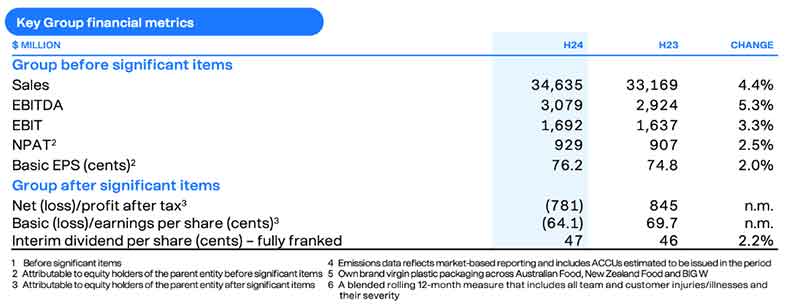

Now, back to Woolworths, because it is undoubtedly the story of the day. The supermarket giant posted a mammoth $781 million loss, despite growing profits by 2.5% over the period.

The table below tells the story.

Woolies was on track to post a handsome NPAT of $929 million – which is, just quietly, outrageous considering the cost of living pressures we’re all enduring at the moment, but would have been excellent news for shareholders.

But then came two one-off write downs that were as expensive as they were unavoidable.

The big one was Woolworths’ booking a $NZ1.6 billion writedown on the value of its Kiwi operation Foodland, while the smaller one was the $209 million fall in the value of Woolies’ stake in ASX-listed Endeavour Group, which operates BWS and Dan Murphy’s liquor stores.

Any way you slice it, -$781 million is a terrible number on the bottom of a balance sheet, and Woolworths CEO Brad Banducci is copping it from all sides today.

He’s stepping down from the role of CEO, effective in September. The company has said that was “always the plan anyway”, and that after nine years in the job, Banducci was ready to move on.

However, Daniel Wild, deputy executive director of the Institute of Public Affairs, reckons Banducci’s resignation is “a warning to woke corporates and the elite director class to stop disrespecting mainstream values and running down Australia”, and I think he might be onto something there.

NZ grocery company Foodland, and those two massive cold-beer merchants must have really disrespected mainstream values and run down Australia, and it all happened on Banducci’s watch.

Either that, or Daniel missed the memo that Banducci was already leaving – and that planning for his resignation was sufficiently advanced that the company was able to announce that Amanda Bardwell is stepping up from her role at the helm of the company’s e-commerce division and into the top job.

But that’s neither here nor there. Banducci’s clearly out because he didn’t sell us all bucket hats in January. Mystery solved, case closed.

In the US overnight, the S&P 500 fell by -0.60%, while the blue chips Dow Jones index was down by -0.17%, and the tech-heavy Nasdaq tumbled by -0.92%.

There were some winners – notably, retail giant Walmart’s shares rose +3% to a record high after the retailer’s sales and earnings per share came in above analysts’s estimates, delighting Walmart customers to such a degree that all six of their collective teeth were on show when they smiled.

But, things are tense on Wall Street, because the Big Show is approaching. Nvidia Corp’s much anticipated results release is due later today, and short dated options on the stock show that it will move by 10% on Thursday morning US time.

In other US share news, Home Depot was flat despite Q4 sales decline and a weak guidance.

Microchip stocks however struggled, with Super Micro Computer falling -2% and market darling Advanced Micro Devices by almost -5%, and Capital One said it’s buying Discover Financial Services in a US$35.3 billion megadeal.

In Asian market news, Shanghai is down 0.16% in early trade, Hong Kong’s Hang Seng is flat and Japan’s Nikkei is running 0.15% lower as well.

Here are the best performing ASX small cap stocks for 21 February [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

Code Company Price % Volume Market Cap ATH Alterity Therapeutics 0.005 25% 1,111,510 $17,531,019 CAV Carnavale Resources 0.005 25% 2,048,500 $13,694,207 RGL Riversgold 0.01 25% 471,824 $7,741,292 SIT Site Group Int Ltd 0.0025 25% 1,000,000 $5,204,980 AUZ Australian Mines Ltd 0.021 24% 78,233,768 $19,210,670 RCR Rincon 0.049 23% 14,057,126 $8,846,055 NGL Nightingale Intel 0.066 20% 608,865 $5,908,860 ACW Actinogen Medical 0.044 19% 3,736,296 $86,163,400 SRT Strata Investment 0.17 17% 103,672 $24,566,419 BMG BMG Resources Ltd 0.014 17% 6,175,414 $7,605,566 CUL Cullen Resources 0.007 17% 454,493 $3,421,039 TIA Tian An Aust Limited 0.25 16% 38,981 $18,620,898 AML Aeon Metals Ltd. 0.008 14% 380,202 $7,674,804 GSR Greenstone Resources 0.008 14% 622,500 $9,576,794 TEM Tempest Minerals 0.008 14% 1,062,500 $3,633,871 MTM MTM Critical Metals 0.105 14% 4,569,758 $11,435,265 AXN Alliance Nickel Ltd 0.041 14% 25,189 $26,130,226 SHG Singular Health 0.125 14% 483,732 $17,244,129 ARD Argent Minerals 0.009 13% 296,000 $10,334,072 AUR Auris Minerals Ltd 0.009 13% 483,750 $3,813,008 WTC Wisetech Global Ltd 88.8 11% 589,520 $26,624,014,517 ALV Alvo Minerals 0.15 11% 120,907 $12,572,592 GMN Gold Mountain Ltd 0.005 11% 14,814,420 $10,250,454 NKL Nickelx 0.04 11% 476,231 $3,161,346 SPQ Superior Resources 0.01 11% 441,200 $18,010,984

Alterity Therapeutics (ASX:ATH) was out in front on Wednesday morning, rising steadily after presenting new data, including new baseline biomarker data on ATH434 from its ongoing Phase 2 randomised, double blind clinical trial, was presented at the American Academy of Neurology (AAN) 2024 Annual Meeting in Denver, Colorado on Tuesday.

Australian Mines (ASX:AUZ) was up on news of a new, second exploration target prospective for niobium and rare earths at the Jequie Rare Earth Project located within the state of Bahia in Fabulous Brazil.

Rincon Resources (ASX:RCR) continued to make hay from Monday’s announcement that the company has grown its tenement size in the West Arunta region to more than 260km2, after a new exploration licence application was granted over an area that contains the historic ‘Mantati’ copper-lead-zinc occurrence.

Singular Health Group (ASX:SHG) was also in the good books, announcing that it has raised $4,123,142 through a recent capital raising via institutional, sophisticated and professional investors, resulting in the issue of 37,483,101 fully paid ordinary shares.

Argent Minerals (ASX:ARD) has reported extensive gold, silver, copper, lead and zinc mineralisation has been confirmed by a rock chip reconnaissance program over the Henry prospect within the Kempfield project in NSW, returning high-grade polymetallic assays up to 14.05g/t Au, 85.2g/t Ag, 0.5% Cu, 0.41% Pb and 0.28% Zn.

NickelX (ASX:NKL) was back in the news, after issuing an amended announcement relating to the identification of uranium mineralisation and priority target areas from data compilation and review at the Elliot Lake uranium project in Ontario, Canada.

Here are the most-worst performing ASX small cap stocks for 21 February [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

Code Company Price % Volume Market Cap MRL Mayur Resources Ltd 0.25 -21% 719,699 $105,871,877 ROG Red Sky Energy 0.004 -20% 354,694 $27,111,136 TMX Terrain Minerals 0.004 -20% 3,880,000 $7,158,353 WML Woomera Mining Ltd 0.004 -20% 25,246 $6,090,695 CTD Corp Travel Limited 16.2 -18% 3,778,256 $2,904,566,058 DVL Dorsavi Ltd 0.014 -18% 50,796 $10,143,248 5GN 5G Networks Limited 0.14 -18% 4,811,456 $58,198,709 ABE Ausbondexchange 0.025 -17% 20,000 $3,380,043 CHL Camplify Holdings 2 -17% 350,978 $171,600,838 CHK Cohiba Min Ltd 0.0025 -17% 500,000 $10,764,733 GCM Green Critical Min 0.005 -17% 1,001,636 $6,819,510 TMB Tambourahmetals 0.089 -15% 115,484 $8,708,737 ME1 Melodiol Global Health 0.012 -14% 4,138,677 $3,946,177 GTI Gratifii 0.007 -13% 900,000 $10,953,781 PNM Pacific Nickel Mines 0.035 -13% 1,189,527 $16,730,124 LM8 Lunnon Metals 0.22 -12% 809,531 $54,459,059 EVZ EVZ Limited 0.19 -12% 39,561 $26,034,762 ARC ARC Funds Limited 0.115 -12% 16,327 $3,909,926 CHW Chilwa Minerals 0.16 -11% 17,625 $8,257,500 AL8 Alderan Resource Ltd 0.004 -11% 2,000,000 $4,980,876 GBZ GBM Rsources Ltd 0.008 -11% 496,295 $8,019,703 OSL Oncosil Medical 0.008 -11% 2,170,000 $17,770,870 PAB Patrys Limited 0.008 -11% 1,597,250 $18,517,026 SFG Seafarms Group Ltd 0.004 -11% 25,728 $21,764,696 MXO Motio Ltd 0.025 -11% 150,001 $7,509,554

GTI Energy (ASX:GTR) has announced that planning for the 2024 field season in Wyoming has progressed well and permitting is on track to facilitate drilling during Q3.

Dateline Resources (ASX:DTR) has received firm commitments to raise A$1,478,346 (before costs) via the issue of 123,195,548 new Ordinary shares at A$0.012 per share. The offer includes a 1-for-2 option three year option exercisable at A$0.03 per share.

West Wits Mining (ASX:WWI) has announced that the Industrial Development Corporation of South Africa has begun work to complete its due diligence investigation as part of its proposed ZAR300 million (approximately US$15.8 million) debt facility to fund development capital for the Qala Shallows project.

Hot Chili (ASX:HCH) has executed an Option Agreement with Bastion Minerals (ASX:BMO) for the right to acquire 100% of Bastion’s Cometa Project in Chile, near Hot Chili’s Costa Fuego Copper-Gold Project in the coastal range of the Atacama Region, Chile.