ASX Small Caps Lunch Wrap: Are tomatoes about to push Spain and France to the brink of war?

News

News

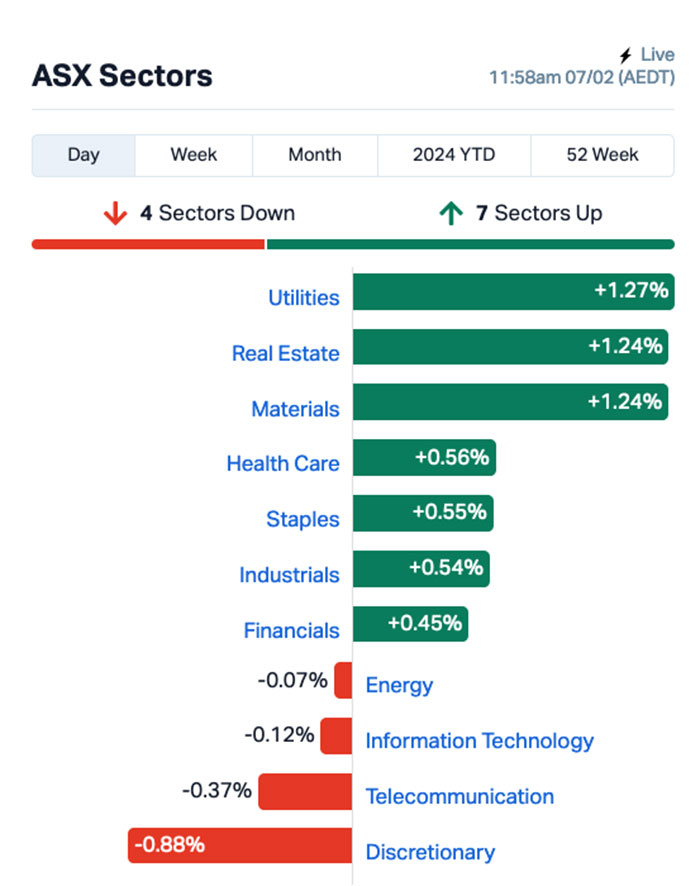

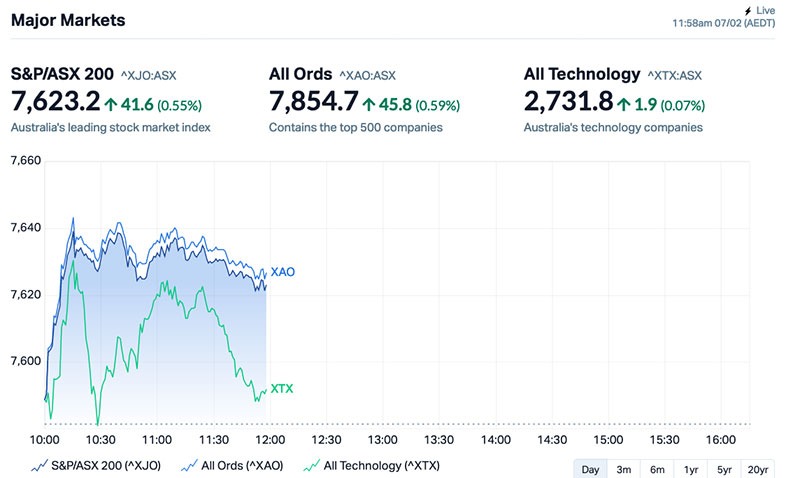

Local markets have rallied this morning, with the bulk of the sectors in far happier territory than they have been for the week so far, and the benchmark is up about 0.4% as we head into lunch.

It’s nothing particularly remarkable – but it’s nice to see that some semblance of calm has returned to the ASX.

Except for the InfoTech sector, which is providing a proper white-knuckle thrill ride, whipsawing between great and terrible with awe-inspiring speed.

But before we get too deep into whatever it is that the market’s doing this morning, I have some curious news from Europe, where certain citizens of Spain and France are teetering on the edge of yet another conflict.

Being neighbours in Europe rather lends itself to being at war with another country, and neither France nor Spain have been immune from getting a bit greedy, or unhappy with the hooligans they live next to, and sending armies over borders for a bit of a scrap from time to time.

This is especially true of the years before the invention of football – the round ball kind that Europe enjoys, not the oval-shaped ball thuggery that continues to baffle most of the EU to this day.

But this latest round of intra-European fisticuffs has nothing to do with religious or political ideology, and – unlike the ructions currently underway several thousand kilometres to the east in Ukraine – it’s not about egregious land-grabs by men who really, really underestimated those whose land they were trying to steal.

The current stoush between France and Spain is about tomatoes – specifically, a very public fight over which nation’s organic tomato produce is superior.

The row erupted because of former French environment minister Ségolène Royal, who is currently in the running to be the next President of France, and who has taken a leaf from the populist presidential candidate’s handbook by attacking the people next door in a bid to look cool.

While trying to whip up a spot of nationalist fervour among her voter base, Royal has foregone the usual high-impact fear-mongering topics of debate – such as immigration, threats of violence and whichever culturally defining behavioural oddities that could possibly be pinned on the people next door.

Instead, Royal has been taking aim at Spain’s current tomato crop, as a row between French farmers and everyone else, whether they like it or not, deepened during the week.

“Have you tasted the so-called organic Spanish tomatoes? They’re inedible!” Royal said recently. “Spanish organic is fake organic.”

On their own, those are clearly fightin’ words, but Royal quickly doubled-down, declaring that “Spanish fruits and vegetables do not meet French standards and should not be on [supermarket] shelves.”

The comments have been like a red rag to a bull – something Spanish people are all-too familiar with – prompting a measured response from current Spanish Pedro Sánchez, who invited Ms Royal to Spain to eat some tomatoes.

“[Royal] has not had the good fortune of trying a Spanish tomato. You will see that the Spanish tomato is unbeatable,” Sánchez said, with the air of a man who is highly confident that he knows what he’s on about.

Sadly, however, the response has not been quite so calm from his countrymen.

Sputtering with all the outrage they can muster, a Spanish organic farmers’ association has gone bleating to Brussels to lodge a formal complaint over the comments.

Local farmer Bartolo Ramirez has called into question Royal’s ability to taste food, claiming “That lady has a palate problem… Unlike in France and elsewhere, we have sun all year round. And that’s why our tomatoes, in addition to complying with all the strict regulations, have the flavour they have.”

Strong words indeed, but they are nothing compared to a string of attacks on trucks carrying Spanish produce, the most recent of which ended with the total destruction of a cargo of fruit, vegetables and wine at the Boulou tollgate, just a few kilometres from the border.

The conflict’s got all the hallmarks of a typically European disagreement. It’s dumb enough that it’s memorable, while at the same time being exactly the kind of ideological proxy that can put a much-needed sheen of respectability on generational hatred of ‘those bastards from over the fence’.

If it escalates any further, I’ll let you know… but for now, it’s probably best to focus on far less tomatoey happenings. Like ‘how the market’s going this morning’, that kinda thing.

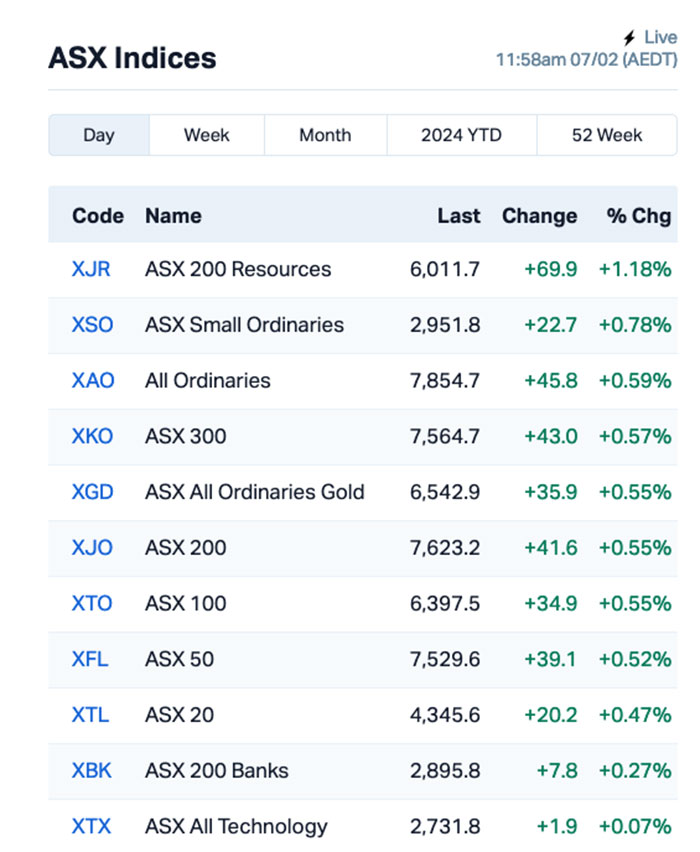

It’s lunch time, and the ASX 200 benchmark is sitting at +0.53%, thanks to solid rallies from Utilities, Real Estate and a well-overdue rebound for the beleaguered Materials sector, with each of those sectors better than 1.2% higher at the tail end of the morning session.

However it’s not all plain sailing today. Consumer Discretionary has taken a hit this morning, and investors with InfoTech heavy portfolios are no doubt begging for the morning’s wild ride to slow down, as that sector has bounced around like an unmedicated child since the bell rang today.

A more granular look at who’s doing what has the XJR All Ords Resources index at the top of the ladder, with the likes of miners Champion Iron (+5.28%) and Lynas Rare Earths (+5.41%) putting in some decent numbers.

A number of the market’s lithium players are also surging this morning, including Latin Resources which has delivered a better-than 10% jump, and Patriot Battery Metals has added 13.2% this morning as well.

Up the fancy end of town, global luxury online platform Cettire has soared nearly 23% this morning, after announcing that it has achieved Great Things in H1-FY24, which have delivered an adjusted EBITDA of $26.1 million.

The juicy numbers for Cettire are in the detail, though – the company has reported spectacular revenue growth on PCP, with gross revenue of $460.5 million (+90% on PCP) and sales revenue of of $354.3 million (+89% on PCP), with a +83% surge in customer numbers to about 576,000.

So… I’ve been getting emails pointing out that I keep kicking US Fed Chair Jerome Powell at every opportunity, which some of you reckon is a little unfair. Probably because he super-old and it’s not really a fair fight.

Tto which I respond with a hearty “whatever”, followed up with “here’s why you’re wrong and I’m right”.

Wall Street rallied last night – which isn’t surprising, because that’s what Wall Street does from time to time, when the mood strikes it.

The reason that rally is interesting is because not one, but two Fed Reserve bigwigs had their turn at the podium last night.

“It would be a mistake to move rates down too soon or too quickly without sufficient evidence that inflation was on a sustainable and timely path back to 2%,” said Fed Reserve Bank of Cleveland president Loretta Mester.

Meanwhile, Minneapolis Fed chief Neel Kashkari said we’ve seen good progress on inflation, but “we’re not all the way there yet”.

Both of those statements are materially identical to the tone and messaging that we got from Jerome Powell since Friday – yet, overnight, the S&P 500 rose by +0.23%. The blue chips Dow Jones index was up by +0.37%, and the tech-heavy Nasdaq lifted by +0.1%.

When Powell said the same thing, it was enough to send the ASX into a miserable nosedive for two whole sessions.

QED, it’s Powell that’s the problem – him and the overall decline of America into political and social chaos. But mostly Powell. He’s a menace, and needs to be stopped.

I am considering setting up a GoFundMe page to finance the purchase of a solid platinum gimp gag to present to him for Valentine’s Day – which I reckon is just the ticket for telling him that we love him, but we’d really like it if he stopped talking in public for a while.

(I look forward to more angry emails – but just so you guys know, the angrier you get, the funnier I find it.)

In brief US stock news, software company Palantir soared more than 30% after unveiling its artificial intelligence advancements and Toyota jumped +5% as it raised full year profit guidance by 9%, while Spotify was up +4% after reporting strong guidance and user growth in Q4.

In Asian markets, Japan’s Nikkei is up just a tickle on +0.09%, Shanghai markets are similarly inching forward at +0.07% and Hong Kong’s Hang Seng is 0.90% better off in early trade.

WINNERS

| Company | Price | % | Volume | MARKET CAP | |

|---|---|---|---|---|---|

| LNU | Linius Tech Limited | 0.003 | 50% | 500,000 | $9,878,481 |

| PUA | Peak Minerals Ltd | 0.003 | 50% | 36,457 | $2,082,753 |

| SHN | Sunshine Metals Ltd | 0.014 | 40% | 15,213,414 | $12,240,084 |

| PVL | Powerhouse Ven Ltd | 0.044 | 38% | 3,836 | $3,863,782 |

| GTI | Gratifii | 0.008 | 33% | 303,659 | $8,215,336 |

| MRD | Mount Ridley Mines | 0.002 | 33% | 158,227 | $11,677,324 |

| ADY | Admiralty Resources | 0.009 | 29% | 75,360 | $9,125,054 |

| IS3 | I Synergy Group Ltd | 0.009 | 29% | 71,000 | $2,128,563 |

| HMY | Harmoney Corp Ltd | 0.675 | 29% | 83,791 | $53,531,177 |

| HTG | Harvest Tech Grp Ltd | 0.029 | 26% | 693,137 | $16,237,157 |

| CTO | Citigold Corp Ltd | 0.005 | 25% | 3,339,119 | $12,000,000 |

| DOU | Douugh Limited | 0.005 | 25% | 100,000 | $4,328,276 |

| TMX | Terrain Minerals | 0.005 | 25% | 200,000 | $5,726,683 |

| NKL | Nickelx Ltd | 0.048 | 23% | 2,200 | $3,424,792 |

| CTT | Cettire | 3.89 | 23% | 6,833,155 | $1,208,525,157 |

| YOW | Yowie Group | 0.034 | 21% | 45,851 | $6,119,901 |

| FAU | First Au Ltd | 0.003 | 20% | 330,016 | $4,154,983 |

| DVL | Dorsavi Ltd | 0.013 | 18% | 509,772 | $6,563,278 |

| GSM | Golden State Mining | 0.013 | 18% | 403,333 | $3,073,077 |

| MRR | Minrex Resources Ltd | 0.013 | 18% | 639,344 | $11,933,543 |

| CC9 | Chariot Corporation | 0.3 | 18% | 195,595 | $20,855,521 |

| AGN | Argenica | 0.68 | 17% | 198,212 | $57,710,477 |

| ASP | Aspermont Limited | 0.007 | 17% | 97,737 | $14,632,582 |

| CNJ | Conico Ltd | 0.0035 | 17% | 33,412 | $4,710,285 |

| MTL | Mantle Minerals Ltd | 0.0035 | 17% | 7,289,152 | $18,592,338 |

Sunshine Metals (ASX:SHN) was out in front on Wednesday morning, popping a 40% spike on news that there’s been a significant upgrade to the company’s Liontown resource (not to be confused with Liontown Resources (ASX:LTR), which is a whole different company).

Sunshine’s Liontown resource (again, not the company) has increased 21% to 2.94mt @ 10.6% ZnEq, which includes a 116% increase in Indicated Resources to 1.85mt @ 10.9% ZnEq, now 63% of the total resource.

For what it’s worth, Liontown Resources (the company, not the resource) is also moving sharply today – up nearly 10% last time I checked, without any announcement… so I am growing concerned that there might be investors throwing money at the wrong thing in their rush to get behind Sunshine’s fabulous news.

Direct-to-consumer unsecured personal loan specialists Harmoney Corp (ASX:HMY) posted a solid gain for the morning as well, up 28.6% despite not having much to say to the market for about a week.

Yowie Group (ASX:YOW) is up again as well, after the apparently-stalled takeover bid by Keybridge Capital (ASX:KBC) was thrown a lifeline by regulators late on Tuesday.

“Keybridge has sought, and received, consent from the Australian Securities and Investments Commission (ASIC) … to enable unaccepted offers under its takeover bid for Yowie,” according to an announcement that arrived after hours on Tuesday.

There was, apparently, a SNAFU at Keybridge during the Christmas break, and I suspect someone forgot to put something in the mail – meaning Keybridge “did not dispatch the Bidder’s Statement within the 28-day time period prescribed by item 6 of subsection 633(1)”.

But, ASIC has seen fit to allow things to continue like nothing happened, and Keybridge is set to deliver a new bidder’s statement shortly as the takeover bidding continues.

LOSERS

| Company | Price | % | Volume | MARKET CAP | |

|---|---|---|---|---|---|

| EE1 | Earths Energy Ltd | 0.015 | -63% | 21,391,041 | $21,728,533 |

| JAV | Javelin Minerals Ltd | 0.001 | -50% | 101,087 | $3,267,458 |

| SLB | Stelar Metals | 0.08 | -45% | 4,497,528 | $7,599,149 |

| BP8 | BPH Global Ltd | 0.0015 | -25% | 947,368 | $3,671,126 |

| MOH | Moho Resources | 0.006 | -25% | 2,415,400 | $4,287,529 |

| NRZ | Neurizer Ltd | 0.006 | -25% | 10,119,602 | $11,273,566 |

| SCN | Scorpion Minerals | 0.015 | -25% | 726,139 | $8,189,124 |

| 88E | 88 Energy Ltd | 0.004 | -20% | 39,599,694 | $123,627,103 |

| CTN | Catalina Resources | 0.004 | -20% | 202,477 | $6,192,434 |

| NFL | Norfolk Metals | 0.15 | -19% | 874,364 | $6,535,124 |

| CHW | Chilwa Minerals | 0.13 | -19% | 10,000 | $7,340,000 |

| MRZ | Mont Royal Resources | 0.09 | -18% | 50,000 | $9,353,277 |

| AHN | Athena Resources | 0.0025 | -17% | 19,000 | $3,211,403 |

| CCO | The Calmer Co Int | 0.005 | -17% | 7,703,175 | $5,144,971 |

| NVQ | Noviqtech Limited | 0.0025 | -17% | 25,000 | $3,928,336 |

| TMK | TMK Energy Limited | 0.005 | -17% | 205,444 | $36,735,476 |

| FCG | Freedom Care Group | 0.15 | -14% | 5 | $4,179,684 |

| BUY | Bounty Oil & Gas NL | 0.006 | -14% | 7,053,457 | $10,489,507 |

| MHC | Manhattan Corp Ltd | 0.003 | -14% | 570,983 | $10,279,429 |

| FRX | Flexiroam Limited | 0.019 | -14% | 183,328 | $14,533,358 |

| RC1 | Redcastle Resources | 0.013 | -13% | 277,200 | $4,924,262 |

| SPX | Spenda Limited | 0.014 | -13% | 3,745,815 | $69,191,325 |

| VFX | Visionflex Group Ltd | 0.007 | -13% | 30,750 | $11,335,930 |

| DEL | Delorean Corporation | 0.052 | -12% | 70,988 | $12,727,534 |

| PAT | Patriot Lithium | 0.115 | -12% | 50,000 | $9,050,227 |

Golden Mile Resources (ASX:G88) has secured a cornerstone investment, through a placement worth just over $1 million to Gage Resource Development, which has received 81,833,348 fully paid ordinary shares at $0.013 a pop.

Paradigm Biopharmaceuticals (ASX:PAR) has been given a handsome R&D tax benefit, pocketing a $7,363,876 incentive refund for the 2023 financial year, bringing the company’s current cash balance to approximately $34.5 million.

Pursuit Minerals (ASX:PUR) has kicked off drilling activities at the Rio Grande Sur Lithium Project following the recent granting of environmental permits and commissioning of drill rigs, for a maiden drilling program comprised of an initial 4 diamond drill holes at the Salar tenement.

And Neurotech (ASX:NTI) has announced that 11 autism spectrum disorder (ASD) patients taking part in the Company’s world-first Phase I/II clinical trial examining the daily use of Neurotech’s proprietary broad spectrum cannabinoid drug therapy, NTI164 have successfully passed the 90-day mark in the study.