What Morningstar’s moat rankings mean, and how they can be used to make investment decisions

Experts

Experts

At a Berkshire Hathaway annual general meeting in 1995, a shareholder asked CEO Warren Buffett how he goes about spotting a good company.

The then 65-year old Sage of Omaha replied: “What we’re trying to do is find a business with a wide and long-lasting moat around it, something that surrounds and protects a terrific economic castle with an honest lord in charge of the castle.”

Buffett went on to explain that there are some key traits a company with a ‘moat’ must have.

“It may have a moat because it’s a low-cost producer in some area, it can be because of its position in the consumers’ mind, it can also be because of a technological advantage…”

“The most important thing in evaluating companies is therefore figuring out how big the moat is around the business,” Buffett said.

The moat concept has since proliferated and adopted by the investment community. Morningstar for example, is one of the top research companies to have taken it to a new level.

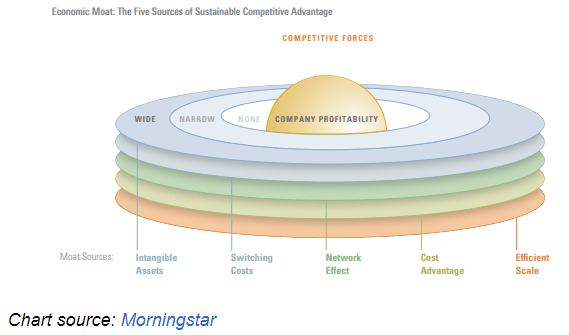

Morningstar issues what it calls an Economic Moat Rating – a ranking of a company’s ability to fend off competition and earn high returns on capital for many years to come.

Brian Han, Morningstar Australia’s director of equity research, explained to Stockhead what these rankings mean and how they can ultimately be used to make investment decisions.

Han explained that companies with wide moats can theoretically be found in any sector, but the industry structure does have a big influence.

“In Australia for example, the position of the Big Four banks makes it very difficult for competitors to overcome because of the scale and cost advantage they have,” Han told Stockhead.

Companies in heavy industries like utility or infrastructure also often have wide moats because of the humongous capital needed to start the business.

“That alone deters new entrants. And because Australia is a relatively small country, spending that amount of capital upfront is just not worth it,” Han added.

On the other side of the spectrum, Han says Consumer Discretionary is one sector prone to hosting smaller or no moat companies.

“But even in retail, you can have a moat even though retail generally shouldn’t have one.

“In the US for example, you have a wide-moat Amazon where they have such scale and a network effect where a virtuous cycle of buyers and sellers attract more buyers and sellers, and so on.”

Essentially, Morningstar assigns a Wide, Narrow, and No moat ranking to each stock under its coverage.

The research company has identified five sources of moats – switching costs, the network effect, intangible assets, cost advantage, and efficient scale.

Morningstar also assigns a Moat Trend rating of positive, stable, or negative, depending on whether a company’s sources of moat are growing stronger or getting weaker.

“Depending on what business the companies engage in, it may have implications on how we assess the moats,” Han told Stockhead.

“We do regularly perform a review depending on how the company is going, whether it has changed, and how their industry is changing.”

Han explained what each of the five moats means, and gave examples of the kind of ASX companies that possess wide moats in each category:

Switching costs

Switching costs are basically obstacles that keep customers from changing from one product to another.

They are obstacles that would be make it too expensive or troublesome for customers to switch away from a company’s products to a new supplier.

Switching costs are not just monetary, they can also be measured by the effort and time it takes to switch to a competitor.

“In the US, an example would be Oracle. The whole Oracle system is just completely integrated and embedded that customers find they can’t switch even if they’re not happy with it,” Han said.

“In Australia, Cochlear (ASX:COH) is a good example where switching costs are high because they have all these relationships with the clinics and hospitals.”

The network effect

The network effect occurs when the value of a product increases for both new and existing users as more people use that product.

Experts believe the network effect moat has become more relevant as the world becomes more digital.

“Seek (ASX:SEK) will be a good example of a company having a network effect moat. In the US, Meta comes to mind,” explained Han.

“Once you develop a network effect, it’s very difficult for competitors to break into.”

Intangible assets

Intangible assets are things such as patents, government licenses, and brand identity that keep competitors at bay.

For some companies, brand power is their main source of economic moat – think Ferrari or Louis Vuitton. Customers are willing to pay premium pricing for those brands.

“Coca Cola also comes to mind in the US. In Australia, gambling machine manufacturer Aristocrat Leisure (ASX:ALL) is a good example of a company with strong intangible assets,” Han said.

Cost advantage

A company with a cost advantage can produce goods at a lower cost, allowing them to undercut their competitors or achieve higher profitability.

Companies that come to mind here are Walmart and Amazon. If a price war was to break out tomorrow, these giants would most likely outlast all other competitors.

“Most giant pharmaceutical drug makers are also good examples of this,” says Han.

“In Australia, Woolworths (ASX:WOW) is one where its scale means that costs are durably lower than competitors.”

Efficient scale

Efficient scale benefits companies operating in a market that only supports one or a few competitors, limiting rivalry.

These are often businesses with huge upfront capital costs that limit the number of new entrants. Examples would be utility and infrastructure companies.

“Sydney Airport used to be a good example before they were acquired. Auckland Airport (ASX:AIA) is also a good example of this category,” Han said.

“In the US, there are plenty of examples of companies having these characteristics, such as railway companies.”

Han says it depends on the timeframe, because the starting point could be when those companies have already been entrenched.

“But real life examples do show that companies with wide moats consistently generate returns above the cost of capital,” said Han.

“There are also empirical studies to show that they become more and more valuable.”

Han also explained that investors should not stay away from narrower moat companies.

“Ultimately, it’s a function of price. If a narrow moat company is trading with a decent enough margin of safety, we’re willing to recommend it.

“Obviously we do a valuation analysis, and if a company’s stock price trades at a discount to intrinsic value, I think it’s our duty to recommend it.”

NOW READ: Van Eck: Cross the MOAT, storm the castle

The views, information, or opinions expressed in the interview in this article are solely those of the interviewee and do not represent the views of Stockhead.

Stockhead has not provided, endorsed or otherwise assumed responsibility for any financial product advice contained in this article.