Van Eck: Cross the MOAT, storm the castle

Experts

It’s a marathon, not a sprint, but it’s hard not to notice that businesses with wide economic moats are enjoying 2023 a lot more than everyone enjoyed 2022.

As we enter the second month of 2023, it’s a good time to peer over the walls and take another look at what a wide economic moat is and how it can add ballast to your portfolio’s defences.

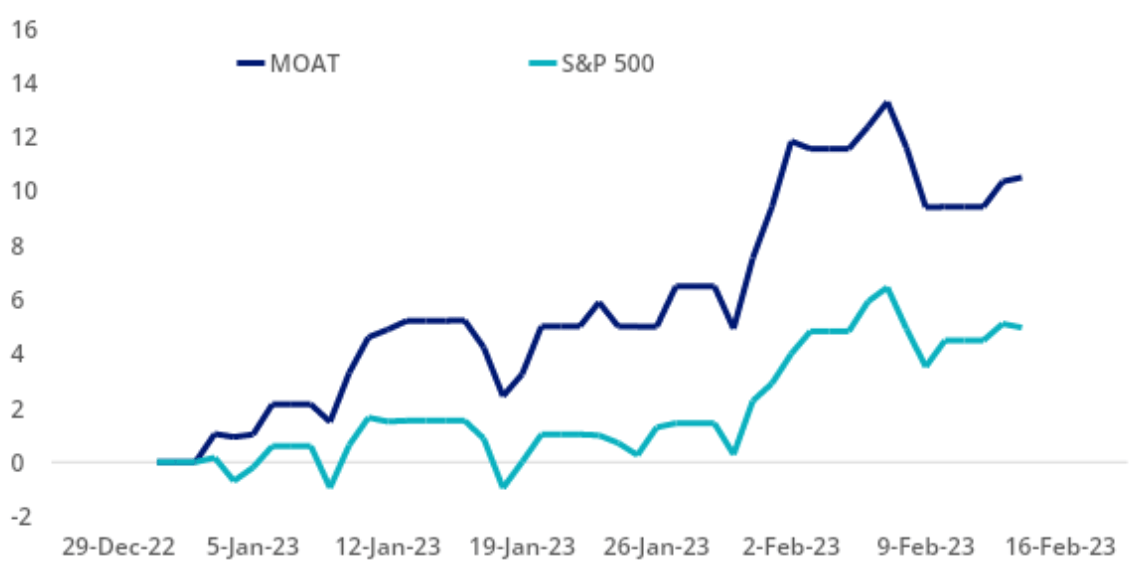

VanEck’s Morningstar Wide Moat ETF (MOAT) actually managed to touch a new record high in the last week. It’s up almost 10.5% – more than 5% higher than the S&P 500 Index for the year to Valentine’s Day.

Russel Chesler, head of investments and capital markets at Van Eck, says diversity is key during market uncertainty and MOAT gives investors access to a diversified portfolio of attractively priced US companies with sustainable competitive advantages.

In the world of finance a moat is a term originally coined by the Oracle of Omaha Himself, Warren Buffett.

Back in the mid-1980s, no one knew what would become of George Michael, Omaha wasn’t yet the “Woodstock of Capitalism” and Warren Buffett had yet to scale the extraordinary heights he maintains today.

But Buffett was already in the habit of penning his fab annual letter to the shareholders of his Berkshire Hathaway, the company he runs with Charlie Munger.

In the 1986 edition, Buffett first shared the idea of a corporate “moat” – let’s call it a competitive bulwark. This is the ability of a company to outface competition and to generate a profit significantly (and durably) higher than the cost capital.

His analysis concerns GEICO, the low-cost car insurance subsidiary which he took control of (and which is still part of the holding company’s historical assets).

“The difference between GEICO’s costs and those of its competitors is a sort of moat that protects a coveted castle. Nobody understands this concept of a moat around a castle better than Bill Snyder, the president of GEICO. He has continued to expand this moat by lowering costs further, allowing him to defend and strengthen the franchise.”

As Buffett suggests, cost advantage is one source of a company’s competitive bulwark. But it’s not the only one.

A company can defend its positions by being the one that offers the best value for a given price, but it can also offer essential products or services to its customers, take advantage of a network effect or intangible assets (trademarks, patents) that allow it to generate higher levels of profitability than its competitors and than the industry in which it operates.

These days an ‘Economic Moat’ is a proprietary Morningstar data point, and it refers to how likely a company is to keep competitors at bay for an extended period.

It’s based on a simple concept: invest in companies with sustainable competitive advantages trading at attractive valuations.

Russel Chesler says there’s a number of ETFs on the market now which have turned this well-known philosophy into an investment strategy.

The result is an index, the Morningstar Wide Moat Focus Index that MOAT tracks, he told Stockhead.

“When constructing the index, Morningstar assigns each company it analyses an Economic Moat Rating of ‘wide’, ‘narrow’ or ’none’.

“Companies assigned a wide moat rating are those in which Morningstar has very high confidence that excess returns will remain for 10 years, with excess returns more likely than not to remain for at least 20 years. Companies with a narrow moat rating are those Morningstar believes are more likely than not to achieve normalised excess returns for at least the next 10 years.

“A firm with either no sustainable competitive advantage or one that Morningstar thinks will quickly dissipate is assigned a moat rating of ‘none’,” Russel adds.

On top of all this, Russel says there’s got to be clear evidence the company benefits from at least one of the following five moat sources.

Breaking down the five different types economic moats:

Salesforce

Cloud based software company Salesforce’s stock is up over 21% in the last month. The company could be described as having a wide moat arising primarily from switching costs, with support from a network effect as well.

The company has been piquing analyst’s interest recently. “We believe Salesforce.com represents one of the best long-term growth stories in software,” says Dan Romanoff, senior equity analyst at Morningstar. “Even as revenue growth is likely to dip below 20% for the first point in the next several years, we believe ongoing margin expansion should continue to compound earnings growth of more than 20% annually for longer.

Boeing

Airline business Boeing closed 2022 on a positive note, with two important pieces of news lifting some uncertainty over its path to recovery. The company won a reprieve from a regulatory deadline for the new versions of the 737 Max under a $1.7 trillion spending deal from Congress enabling the airline to make some enhancements to the jets.

Another boost to the airline came from the return of 737 MAX jets to active flight service in China after the government lifted the severe zero-COVID-19 travel restrictions in the country. Domestic air travel alone accounts for around one sixth of global traffic (in normal times) according to Morningstar.

Boeing has a wide moat due to its intangible assets and switching costs. According to Morningstar, “the firm is turning a corner operationally and benefits from intangible assets stemming from the technical complexity of its products as well as switching costs from the time and effort the military faces to switch suppliers, as well as a lack of viable alternative suppliers.”

The company’s stronger aircraft sales have landed the stock an upgrade from Credit Suisse to Hold from Sell, with the investment firm saying it sees “improved operational performance taking place at the company”.

Alphabet

Financial services firm Morningstar recently said Google parent company, Alphabet’s shares are undervalued at US$96.94. In a note on the 30th January 2023 Morningstar had a US$160 fair value estimate on the stock.

According to Ali Mogharabi, senior equity analyst Morningstar, Alphabet has a wide moat rating, thanks to durable competitive advantages deriving from its intangible assets, as well as the network effect.

“Alphabet dominates the online search market with 80% plus global share for Google, which it generates strong revenue growth and cash flow. We expect continuing growth in the firm’s cash flow, as we remain confident that Google will maintain its leadership in search.”

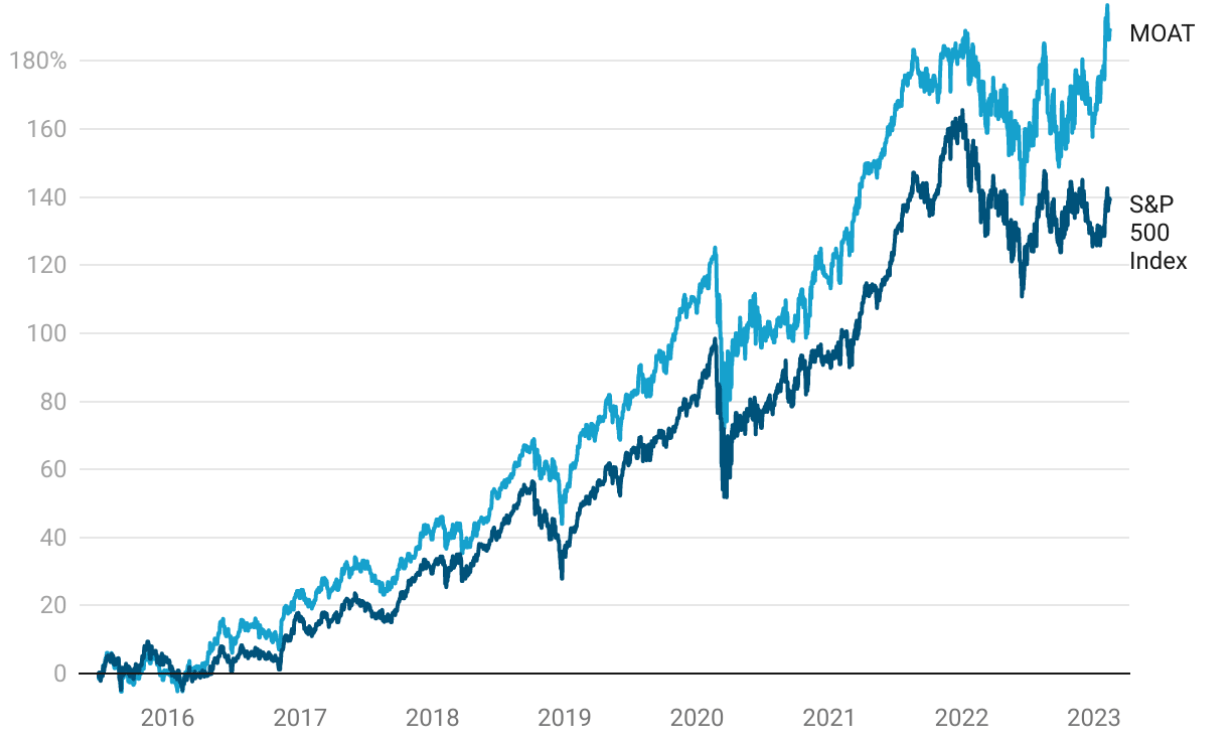

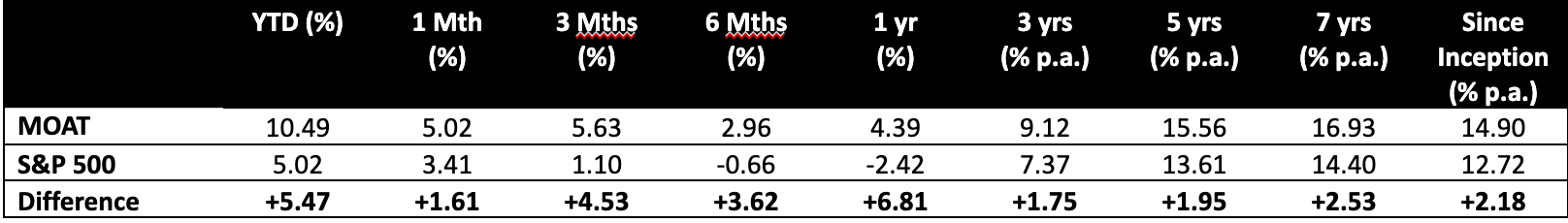

“All of the above companies are held by our MOAT ETF which has outperformed the S&P500 index since inception – a testament to MOAT’s value and quality approach.”

Trailing performance to 14 February 2023

The chart and table above show past performance of MOAT, the S&P500 Index and the NASDAQ-100 Index.

An investment in the MOAT carries risks associated with: ASX trading time differences, financial markets generally, individual company management, industry sectors, foreign currency, country or sector concentration, political, regulatory and tax risks, fund operations and tracking an index. See the PDS for details.

Any views expressed are opinions of the author at the time of writing and is not a recommendation to act. You should consider whether or not an investment in any Fund is appropriate for you. Investments in a Fund involve risks associated with financial markets.

The Morningstar® Wide Moat Focus Index™ was created and is maintained by Morningstar, Inc. Morningstar, Inc. does not sponsor, endorse, issue, sell, or promote the Fund and bears no liability with respect to the Fund or any security. Morningstar®, Morningstar Wide Moat Focus Index™, and Economic Moat™ are trademarks of Morningstar, Inc. and have been licensed for use by VanEck. Past performance is not a reliable indicator of future performance.