Guy on Rocks: Roll out the barrel, this uranium tiddler’s not dead yet

Experts

Experts

‘Guy on Rocks’ is a Stockhead series looking at the significant happenings of the resources market each week. Former geologist and experienced stockbroker Guy Le Page, director, and responsible executive at Perth-based financial services provider RM Corporate Finance, shares his high conviction views on the market and his “hot stocks to watch”.

Gold put on around US$30/ounce over the last week and is sitting at US$2,046/ounce as tensions continue to rise amid ongoing missile attacks off the coast of Yemen and a drone attack on a US base in northeastern Jordan.

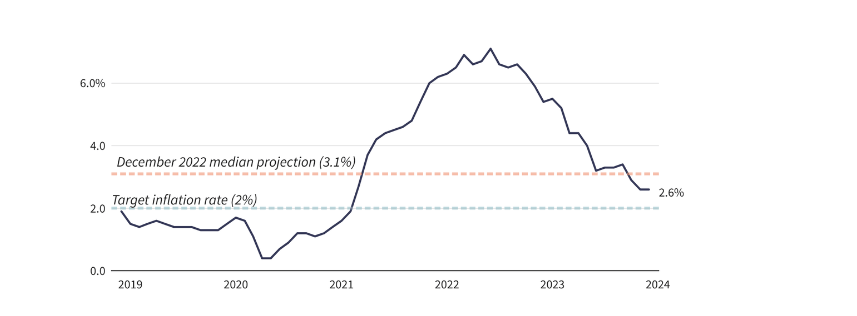

The FedWatch is now predicting a 34.5% chance of a rate cut in March as Jerome Powell poured cold water on accelerated rate cuts which look more likely around May.

As expected the Fed held interest rates unchanged at 5.25-5.5% at the meeting on Wednesday. Inflation also appears to be falling faster than expected at 2.9% year over year, a drop of 0.30% compared to November which returned 3.2%. Inflation peaked at 7.1% in June 2022.

Economic news from the US was also stronger with 4Q GDP showing the US economy remained robust growing at 3.3%.

Despite the news of Evergrande going into administration, copper futures remain relatively strong rising to US$3.85/lb per pound in January, after another round of economic stimulus in China which indicated it will shortly cut its reserve requirement ratio which should add a further CNY 1 trillion in liquidity to the property market.

This follows on from a recent pledge of CNY 2 trillion of foreign funds to be mobilised as part of an equity rescue package.

A recent rise in copper stocks at Chinese warehouses over January has seen a sharp fall in the Yangshan copper premium.

As Morgan Stanley recently pointed out (Morgan Stanley Research 31/2/2024) copper supply remains tight following the closure of the 400ktpa Cobre Panama mine together with a number of guidance downgrades, a larger market deficit.

Furthermore, Morgan Stanley noted the struggling mine output and rising smelting capacity that have seen a fall in copper treatment charges as smelters scrabble for supply.

The bank is forecasting copper prices to rise to US$9,000/tonne by 2Q 2024.

Similarly iron ore prices have remained strong in response to recent Chinese stimulus initiatives, offsetting the news of the Evergrande administration.

The market will no doubt be interested in the Chinese PMI figures due out this week. Overall, the Chinese economy looks weak with Q4 GDP coming in at a modest 4.1% QoQ annualised.

Notably steel production in December was down 15% on the previous month to around 67.4Mt with steel consumption also down 19%.

One commodity that has failed to respond is oil which is trading just under US$76/BBL (figure 5) with slowing growth and increasing supply from non-OPEX producers keeping a lid on prices.

Surprisingly, worsening tensions around the Strait of Hormuz, which accounts for approximately 20% of the world’s oil travels, has had little effect on oil prices.

Saul Kavonic, from MST Marquee, pointed out that despite the broadening conflicts, oil supply has been largely uninterrupted.

Kavonic however commented that an escalation of Iran’s participation in the region could significantly change the oil dynamic. Over to Uncle Joe Biden who has indicated his willingness to respond to the recent drone attack in Jordan…

An article earlier in the week by Tim Moore from the Financial Review revealed that Bank of America’s analyst Michael Wedmer is projecting lithium-rich spodumene concentrate to fall by a further 63% compared to their earlier projections in the wake of weak EV demands.

Widmer now believes spodumene will retreat to $US650 this year from earlier forecasts of $US1438 in CY 2025 – he is forecasting $US1763/tonne compared to earlier projections of $US2188.

Estimates vary however I do recall seeing recent analyst reports that suggested that the incentive price to bring on new production was in the order of US$1,300-US$1,400/tonne so spodumene prices on or around US$1,000/tonne would certainly put pressure on new developments.

There has been some serious turmoil in the lithium space which has included Core suspending operations at its Grants Mine in the Northern Territory and more recently Albermarle laying off over 300 staff equating to 4% of its work force in the face of falling lithium prices.

Pilbara Mines recently hosed down expectations of a first half dividend.

No doubt there will be a trade here somewhere as a sustained period of very low lithium prices are likely to see a rapid decline in lithium production. The EV market is clearly not going away, it is just slowing down.

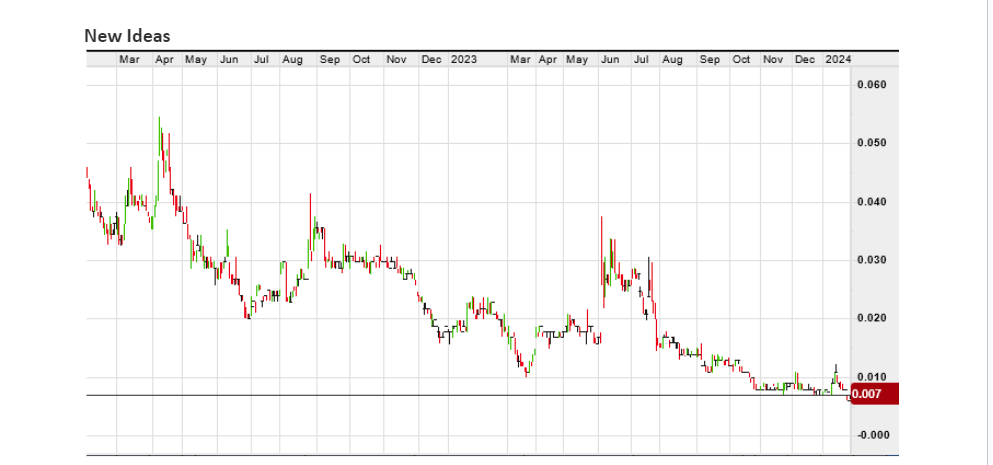

I brought Adavale Resources (ASX: ADD) to the attention of the Stockhead faithful last year on the back of some interesting nickel exploration results from their Luhema Project along strike from the Kabanga Nickel Project (58Mt @ 2.62% Ni) in Tanzania.

It appears the company has been seeing the ball about as well as Marnus Labuschagne this season (or for the slightly more mature Stockhead faithful, about as well as Greg Chappell who returned four ducks in a row in the 1981-1982 Test Series) with the share price drifting from over 5 cents to settle at a very respectable 0.7 cents at the close of trade Thursday.

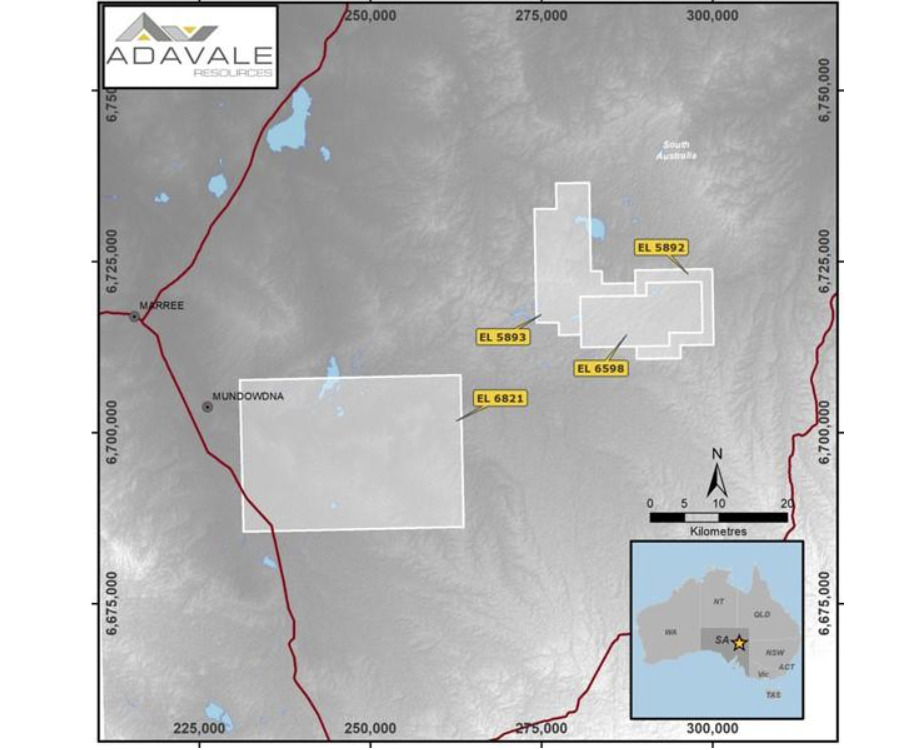

Not to worry, the company has switched its attention to its 100% owned Lake Surprise tenements in the Flinders Rangers region of South Australia (figure 7) which cover total area of around 1,600km2.

The licences cover sandstones that are prospective for roll-front uranium mineralisation with a number of strong radiometric anomalies supported by outcropping uranium bearing minerals up to 560ppm U3O8.

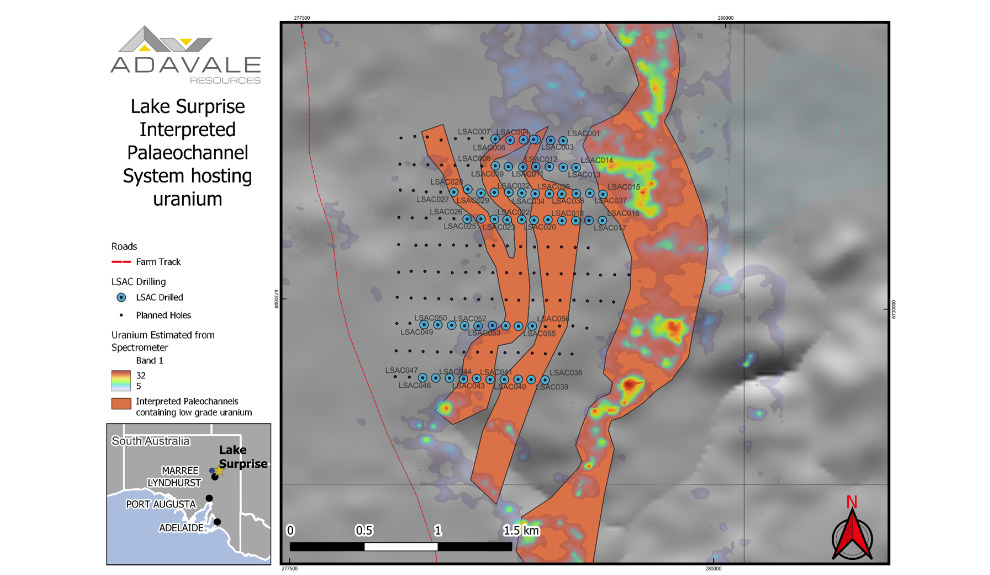

The region has good provenance with a number of existing uranium orebodies on the eastern side of these ranges include Beverley, Honeymoon, Gould’s Dam and Yarramba, and the Mt Gee project. A 56-hole drilling program by ADD early last year identified anomalous uranium associated with gamma anomalies within a braided channel system.

In a state that derives its revenue from agriculture, Olympic Dam, wine and making movies about South Australian mass murders, it would be good to see a revival in uranium exploration.

The company is initially planning a soil sampling and gravity program along existing pastoral tracks which line up with the recently interpreted palaeo-channel systems within the two Mundowdna licences (figure 7).

No doubt encouraging results will see more infill sampling followed up with a scout drilling program.

At an enterprise value of around $5m following the recently closed $1.5m placement at 0.70 cents (with 1:1 free attaching 2-year options), together with the tailwinds from a surging uranium price, I think Adavale may be worthy of consideration.

The directors, after all, don’t want to end up being thrown into a barrel by a disgruntled shareholder in some rural town if they fire a blank on this exploration play.

Mind you, as the aussietowns.com website points out, the Snowtown movie did win six awards at the 2023 Australian Film Institute and two at Cannes, so there could be a second leg (or torso) to this play after all….

At RM Corporate Finance, Guy Le Page is involved in a range of corporate initiatives from mergers and acquisitions, initial public offerings to valuations, consulting, and corporate advisory roles.

He was head of research at Morgan Stockbroking Limited (Perth) prior to joining Tolhurst Noall as a Corporate Advisor in July 1998. Prior to entering the stockbroking industry, he spent 10 years as an exploration and mining geologist in Australia, Canada, and the United States. The views, information, or opinions expressed in the interview in this article are solely those of the interviewee and do not represent the views of Stockhead.

Stockhead has not provided, endorsed, or otherwise assumed responsibility for any financial product advice contained in this article.