Guy on Rocks: As the market rewards mineral discoveries, this rare earths nearology play is a better than average bet

Experts

Experts

‘Guy on Rocks’ is a Stockhead series looking at the significant happenings of the resources market each week. Former geologist and experienced stockbroker Guy Le Page, director, and responsible executive at Perth-based financial services provider RM Corporate Finance, shares his high conviction views on the market and his “hot stocks to watch”.

News this week was dominated by a whopping 2.3% weekly gain in the US dollar index (DXY) to 108.07 which saw precious metals across the board soften with gold off US$30/oz to US$1,763.1/ounce, platinum off US$67 to US$894/ounce and palladium down 3.8% to US$2,056/ounce.

Surprisingly, there was no economic data to support such a big move in the USD.

US 10-year treasuries were also up 14 basis points for the week to close at 2.98% with the 6-month yield curve remaining inverted.

No doubt the market will be keen to see what Jerome Powell has to say at the Jackson Hole Symposium later this week.

In an interview with Kitco News, TD Commodities analyst Daniel Ghali said he believes that the rate rises will be a lot higher than what the US Fed is hinting at.

Recent economic data such as new housing sales, off 5.9% in July, are pointing to a recession. Economic data due out this week includes durable goods orders, personal consumer expenditures and housing data. Projections for the September rate hike vary from 50-75bps however I don’t believe this is going to put a dent in the inflation with a series of 75-100bps most likely required to bring it under control; particularly important with wage inflation now running at +5%.

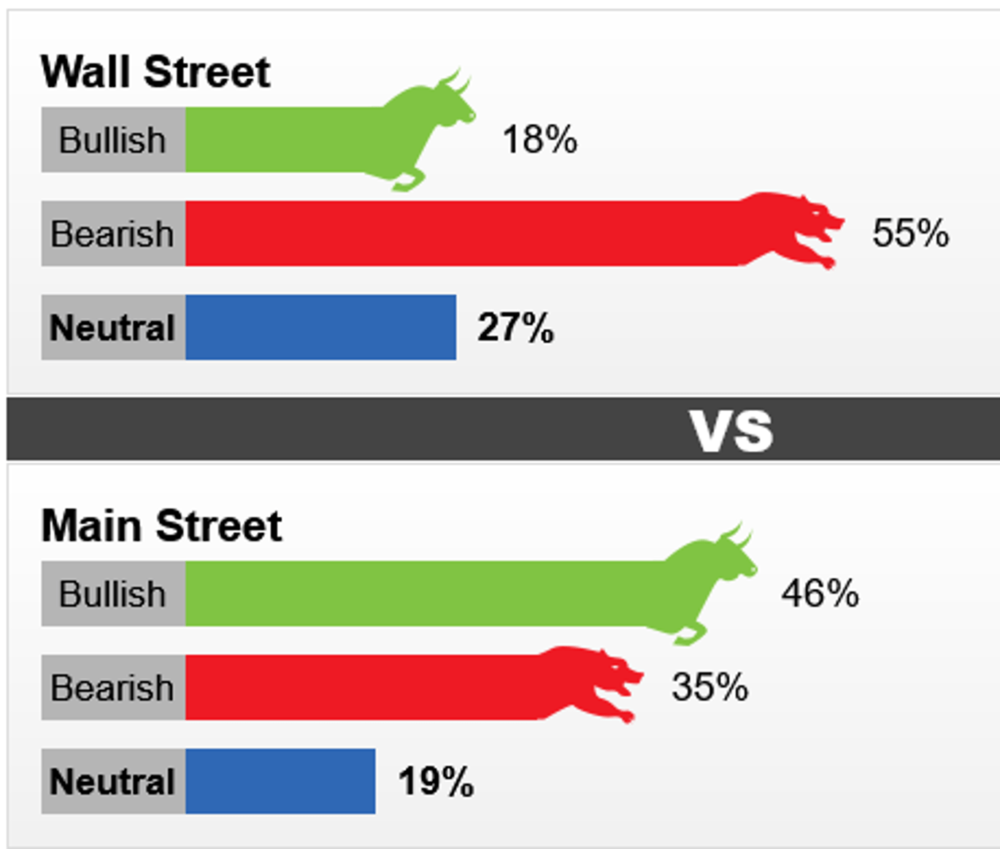

Kitco’s weekly gold survey results (figure 1) revealed that Wall Street is now bearish on gold prices next week with 55% expecting prices to fall, 27% to stay at current levels and 18% punting on a lift.

The Main Street side remained bullish for next week with 46% of the 709 retail participants surveyed believing gold will go higher, 35% believing there will be a fall and 19% neutral.

The bearish gold sentiment didn’t stop the Chinese Swiss gold imports rising by nearly 150% in July while gold was trading below US$1,800/oz.

Have a think about this – the West is selling, and China is buying gold. So, who has got this trade right? I’ll back the Middle Kingdom on this one.

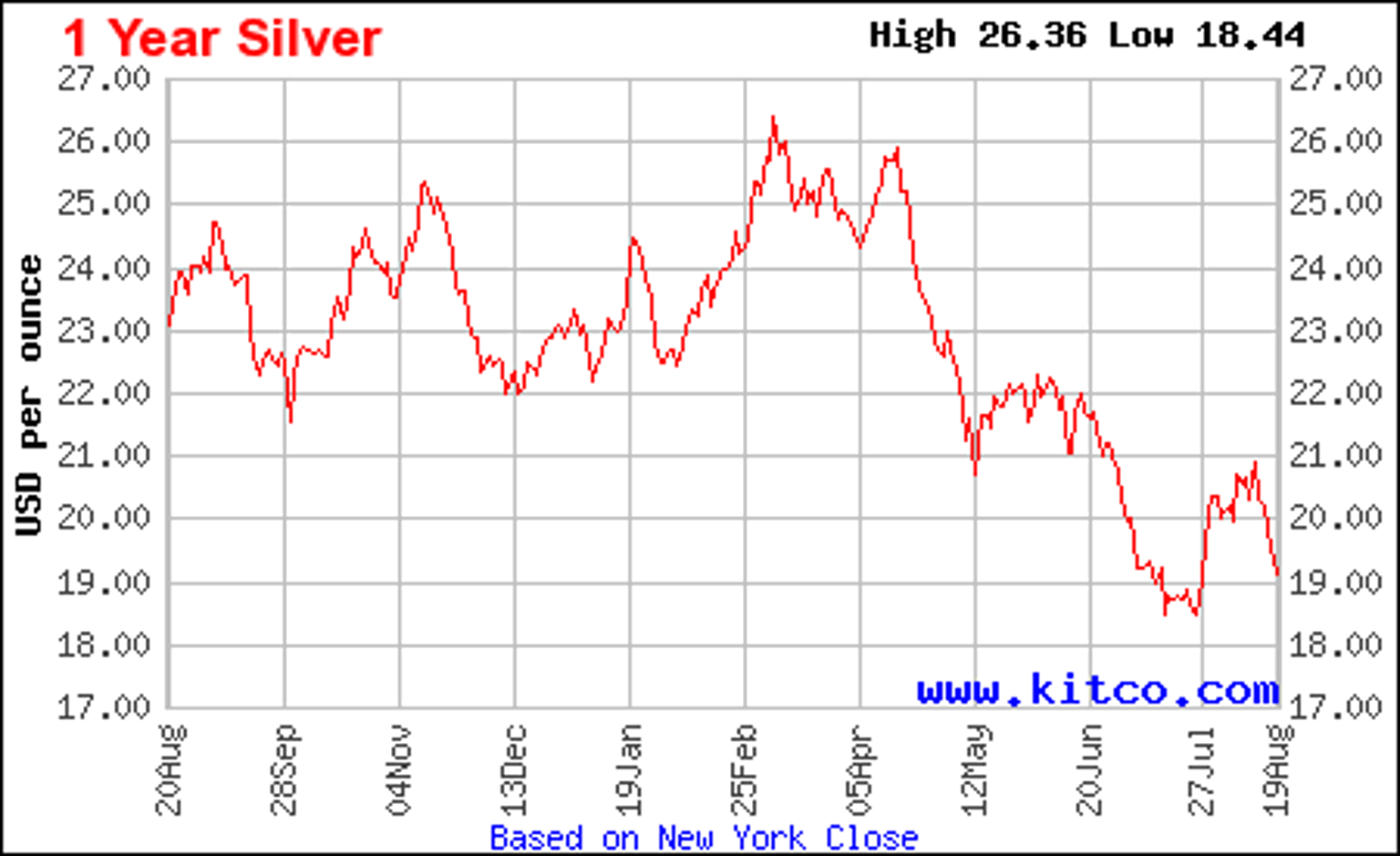

The gold–silver ratio also closed up over 90 for the first time since July 2020.

Silver, trading at just over US$19/ounce (figure 2), has been more the domain of the Canadian miners but there is a lot of chatter about the recent depletion of supplies that are likely to “suck up all the silver that’s available” over the next 10 years, according to David Morgan, founder and author of The Morgan Report.

Morgan pointed out that silver was one of the first elements on the periodic table that the US Geological Survey considered would be in short supply a number of years ago.

Around 70% of silver is mined as a by-product of base metal mining and industrial demand from photovoltaics to semiconductors, is continuing to increase at a rapid rate. Silver usage in solar has increased from 9-12% over the last three to four years according to the Silver Institute.

Silver, like cobalt, is very difficult to substitute as nothing reflects light or conducts electricity as well as silver.

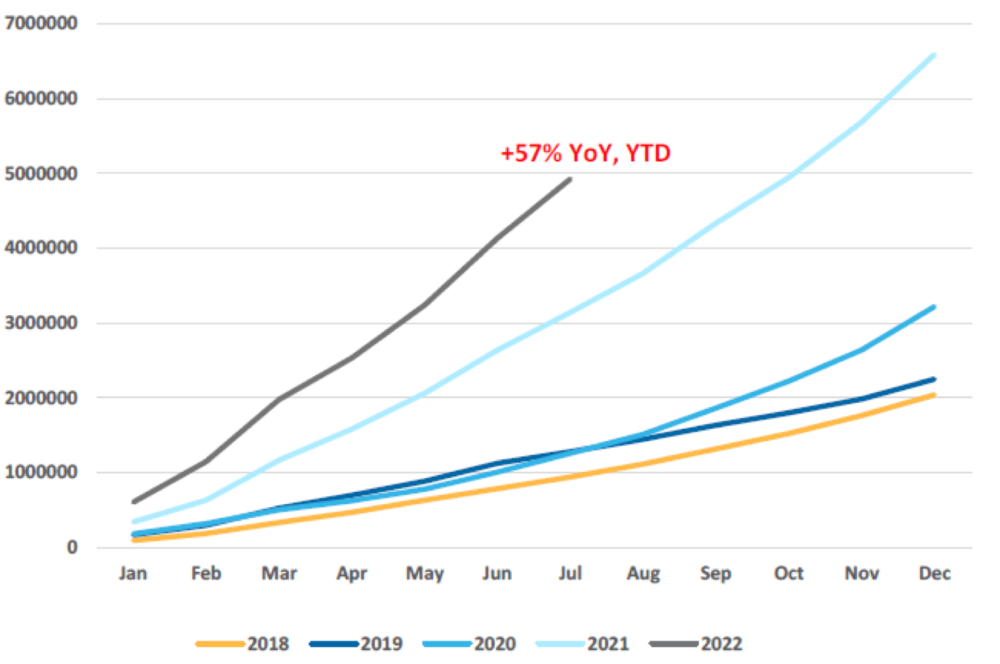

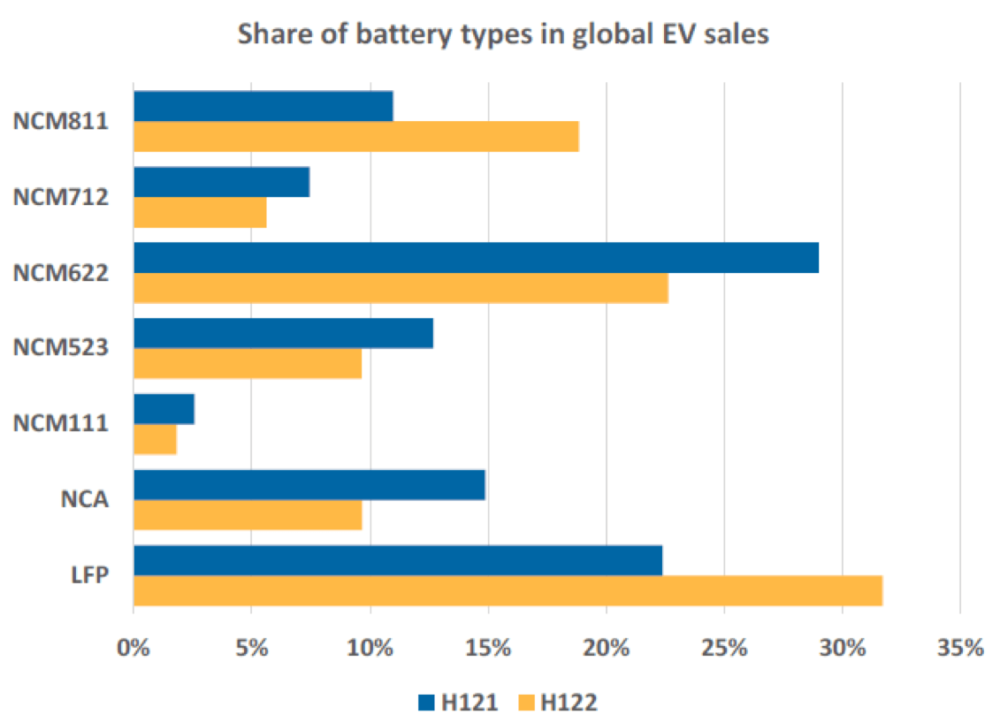

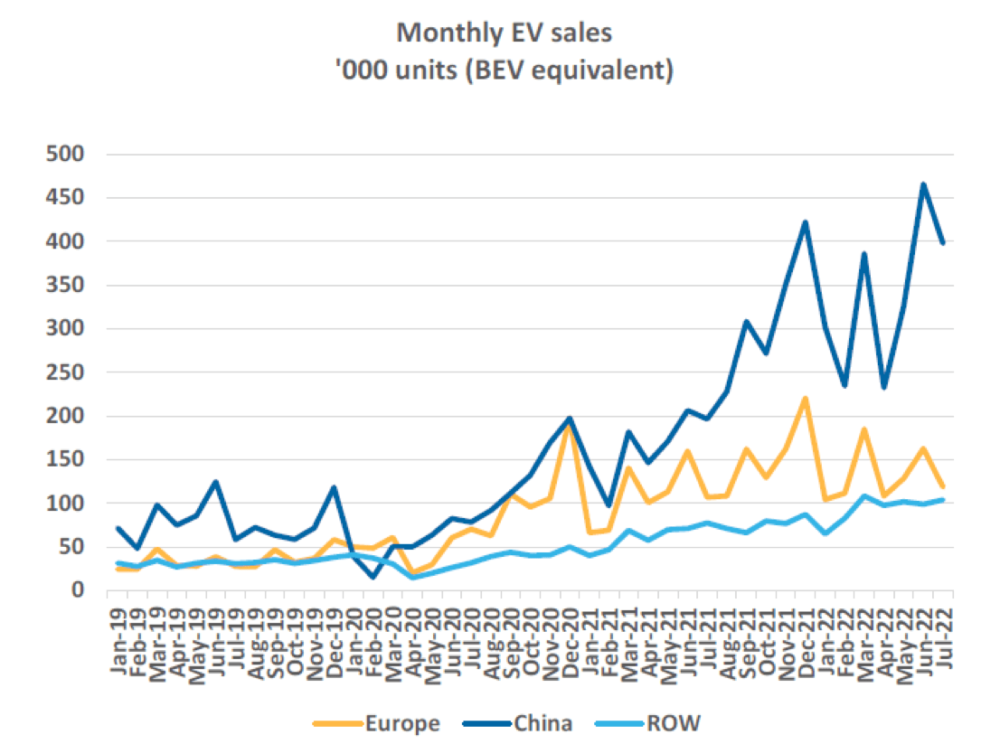

Despite the soft macro-economic data around the world’s largest economies, China, which accounts for around 60% of the EV market in 2022, has seen continuing strong growth (figure 3, 4) in battery chemistries deployed in electric vehicles particularly from LFP (lithium iron phosphate, that contains no nickel or cobalt) as well as high-nickel NCM 811 batteries, both have which have doubled in production over CY 2022.

On the other hand, European sales (figure 5) have been somewhat disappointing growing at a tepid 10% YoY in the first half.

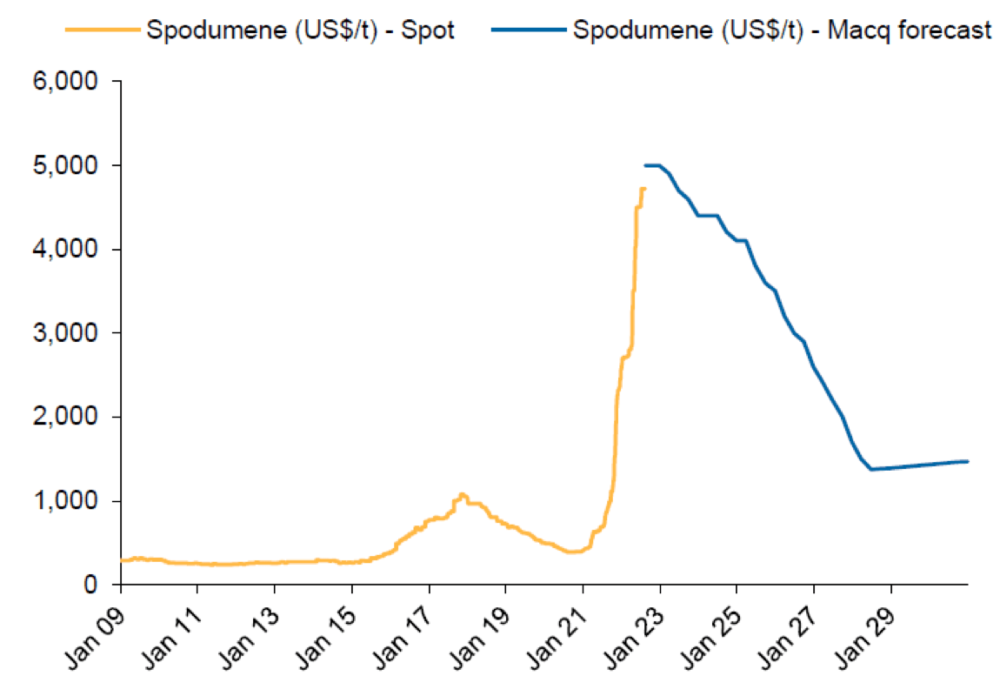

All good news for lithium prices (figure 6) which are anticipated, according to Macquarie, to peak around US$5,000/tonne for spodumene concentrate.

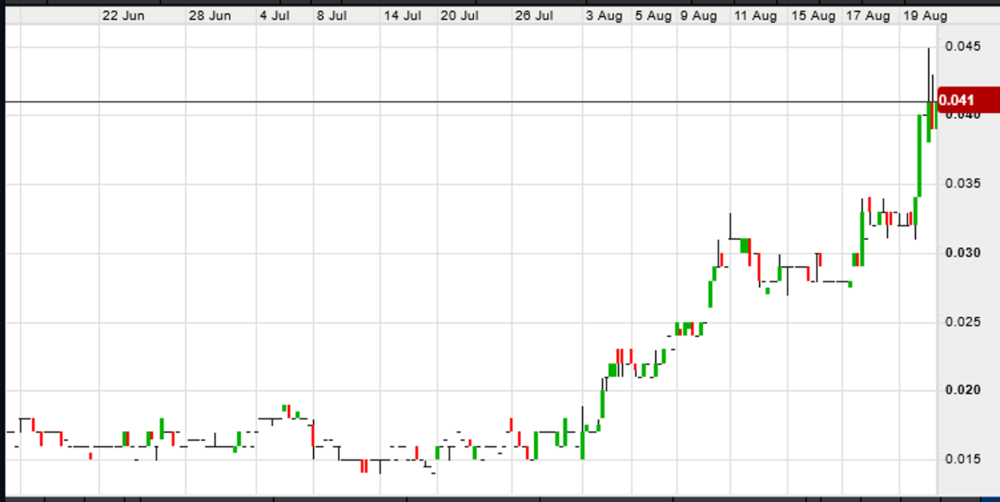

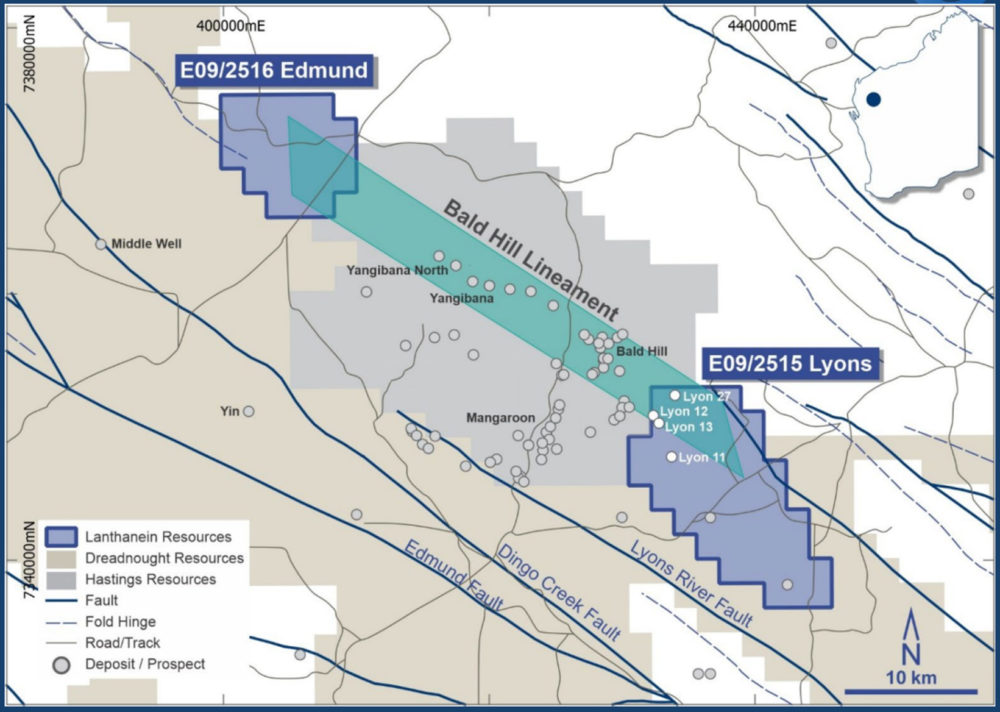

Lanthanein Resources (ASX:LNR) (figure 7) is a recently capitalised player in the emerging Gascoyne REE district.

The Brian Thomas-led team acquired the Edmund and Lyons tenements in January 2022. With progress at the project starting to trickle, LNR could offer a much cheaper entry point (Mkt Cap ~$38m) than Dreadnought Resources (ASX:DRE) (Mkt Cap ~$283m) and Hastings Technology Metals (ASX:HAS) (Mkt Cap ~$430m), whose tenements abut LNR (figure 8), for exposure to REEs in the Gascoyne.

HAS’ Yangibana Project (figure 8) is due to commence production in 2023.

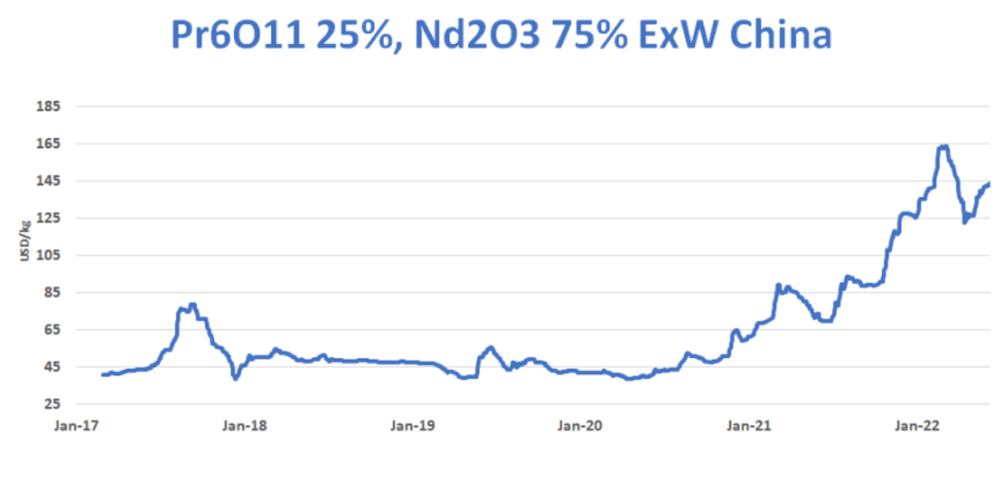

Yangibana has a high-grade resource of 27.4Mt @ 0.97% TREO, which delivered a post-tax NPV8 of $1b and IRR of 26%. Importantly, Yangibana has a high NdPr:TREO ratio of 52%, making it one of the highest value REE projects for ore value per kg. With NdPr prices on a tear (figure 9), the project is only looking stronger.

LNR’s Lyons and Edmund tenements are better-than-average nearology plays.

The prospects on the tenements are characterised by outcropping ironstones of >2.5km strike length. Analogous outcropping ironstones host REEs at HAS’ Yangibana and DRE’s Yin.

A March ground-truthing campaign reported peak rock chips grades of 8.01% TREO, and importantly, phosphate mineral monazite, further supporting comparison to Yangibana and Dreadnought ironstones.

A maiden drill program is planned to begin next month to target high-grade rare-earth mineralisation associated with these ironstones.

The ASX is still offering genuine upside on the back of discoveries, evidenced by Meeka (ASX:MEK) (15 August), Cobre (ASX:CBE) (27 July), Galileo (ASX:GAL) (11 May 2022), and more.

At a market cap of $27m, LNR is presenting as a great bang-for-buck speculative investment that could significantly re-rate on a discovery.

At RM Corporate Finance, Guy Le Page is involved in a range of corporate initiatives from mergers and acquisitions, initial public offerings to valuations, consulting, and corporate advisory roles.

He was head of research at Morgan Stockbroking Limited (Perth) prior to joining Tolhurst Noall as a Corporate Advisor in July 1998. Prior to entering the stockbroking industry, he spent 10 years as an exploration and mining geologist in Australia, Canada, and the United States. The views, information, or opinions expressed in the interview in this article are solely those of the interviewee and do not represent the views of Stockhead.

Stockhead has not provided, endorsed, or otherwise assumed responsibility for any financial product advice contained in this article.