You might be interested in

Energy

Rock Yarns: ADX Energy cooking with gas and condensate (and maybe oil!)

Energy

An offer ADX can't refuse: a highly prospective gas licence offshore Italy with a possible proven oil redevelopment project

Energy

Energy

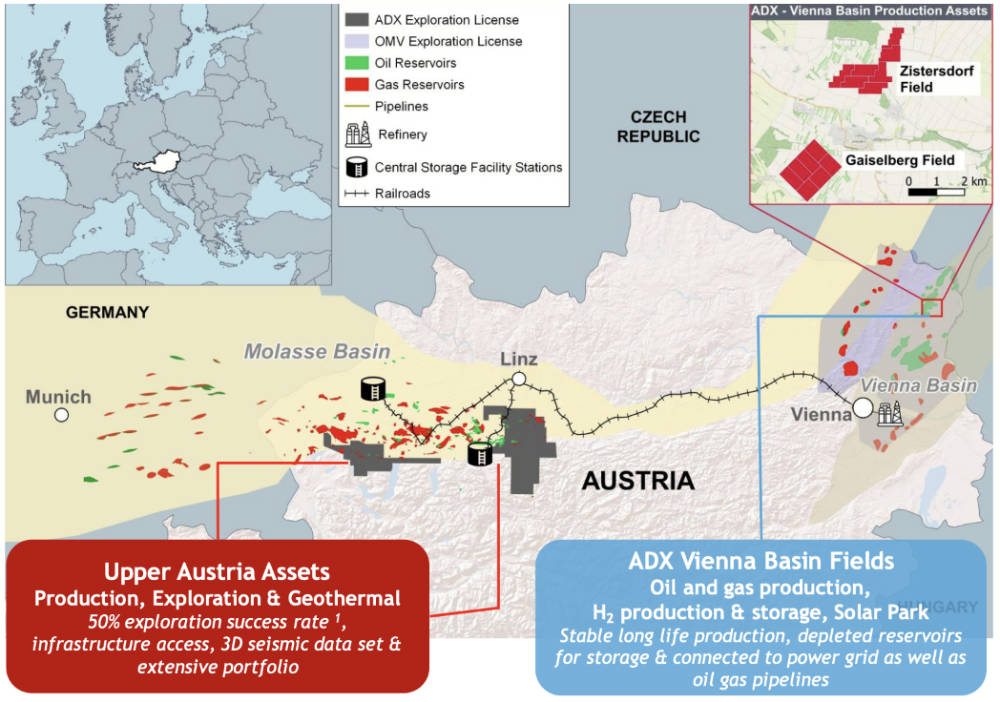

Special Report: ADX Energy’s recent board renewal is fuelled by the recognition the company will be aggressively ramping up activity as it proceeds with the next stage of its development.

The appointment of John Begg – a highly credentialled energy professional with substantial exploration experience – as a non-executive director comes as ADX Energy (ASX:ADX) prepares to drill out and further develop its highly prospective exploration portfolio in Austria.

While there is plenty of attention around the Welchau-1 gas exploration well currently being drilled – and for good reason, given the potential for it to host a big 807 billion cubic feet of gas – it is far from the only well the company will drill this year.

Speaking to Stockhead, ADX executive chairman Ian Tchacos said the company was looking at drilling up to three more wells this year subject to rig availability. And, as a result, it will need people not only in Australia, but also in Austria where it operates.

“We are making changes to the board because the company continues to change in activity and scope. It is appropriate to do so,” he said.

“It is about bringing people who have appropriate experience to support what we are doing on the ground with greater technical oversight and new ideas.

“The reality is we are strengthening the board and also strengthening our management team in Austria to deal with everything there.”

ADX Energy is an emerging gas player in Austria. Pic: Supplied (ADX)

Tchacos says both the board and management team are looking to build a company based on “existing stable production, increased production through development and further cashflow, and exploration based primarily in the near term on gas”.

“The market looks for activity and we certainly want activity in terms of exploration but we also want to build cashflow because it is what enables you to keep the team together that can continue to generate opportunities. I believe what sets the Company apart is not just identifying good drilling prospects its our ability to introduce very credible partners to fund exploration and reduce risk” he said.

At the core of company’s cash flow is its Vienna Basin fields which currently produce about 250 barrels of oil equivalent per day.

This is ADX’s bread and butter, delivering it sales revenue of $2.51 million in the December 2023 quarter.

Furthermore, the company owns the ground where its Vienna Basin fields are located, with Tchacos noting that it is also looking at complimentary renewable energy opportunities there that can add value and extend asset life.

However, it is not the only source of cash flow.

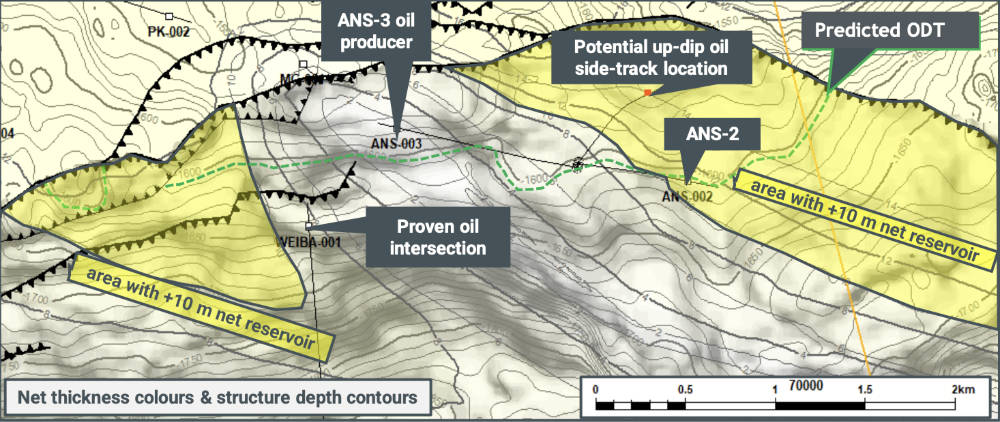

The Anshof oil field. Pic: Supplied (ADX)

ADX also operates the 50%-owned Anshof oil field, where the Anshof-3 discovery well had produced oil at a constrained rate of 140 barrels per day from October 2022 through a temporary production facility before the well was shut-in after reaching the regulatory limit of 36,000bbl of test production.

A step change is on the horizon though with the company poised to sidetrack the Anshof-2 well which intersected a shallower than predicted oil-water contact that was offset by the flattening of the structure increasing updip volume and the existence of a much thicker reservoir intersection.

The planned Anshof-2 sidetrack will be completed as an oil producer, while a permanent production unit with capacity of 3,000-4,000bpd is expected to be hooked up to Anshof-3 for commissioning in March 2024, followed by a production restart in April.

This facility will ensure that ADX will be able to produce the Anshof wells at full capacity.

Exploration is also critical to ADX’s long-term plans with the Welchau-1 exploration well having the potential to be transformational given it could host a best technical prospective resource of 807 billion cubic feet equivalent (Bcfe) of gas.

This is an astounding amount of gas to find in the middle of Europe, given a single Bcf of gas can power more than 24,000 average homes for a year.

Needless to say, a successful discovery would have little or no difficulty in securing offtake, though Tchacos pointed out the company would still need to follow-up with appraisal wells.

Additionally, while the field is just 14km from an open access pipeline, the process needed to build one will still take about three years. However, it would still be much faster compared to an offshore development that could take 5-10 years.

“I think one thing that is worth pointing out, Welchau took us quite a bit of time to get our environmental clearance – about nine months,” Tchacos added.

“Typically, it takes 4-6 months in Austria, and two years in Australia.

“The reality is that things are much more efficient in Austria and that’s a big benefit for us, not only in the exploration phase but also the development phase.

“The law in Austria is very clear, if you work under the law and provide your applications in accordance with the law, then you know it is going to happen.”

While Welchau is the most significant gas well the company is drilling this year, it certainly isn’t the only.

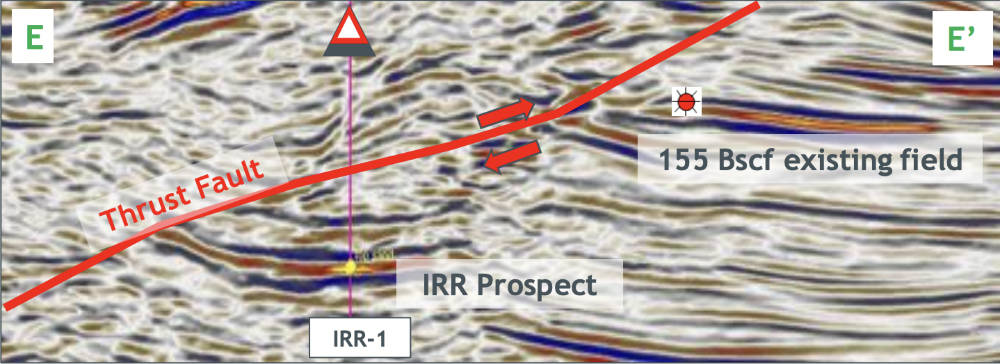

The IRR prospect. Pic: Supplied (ADX)

ADX is also planning to drill the IRR-1 well in Q4 2024 targeting a prospect next to an analogous discovery which to date has produced over 150 BCF of gas.

The IRR prospect is one of two covered by the company’s agreement with MND Austria, which paid back costs of €450,000 and has committed €4.5 million for exploration drilling to earn 50% of a dedicated “investment area” within the ADX-AT-I licence in Upper Austria.

The target Miocene turbidite reservoirs have a proven flow capacity of up to 45 million standard cubic feet of gas per day.

As previously noted, any gas discovery which ADX makes will likely find a ready market given the fossil fuel is considered to be a transition fuel in Europe.

This is particularly true as while the transition to net zero is viewed as important, it is taking longer than expected.

“I think what really is materialising is that the transition will take longer and is costing more to accomplish, we need some interim measures to ensure the lights don’t go out, this especially important in Europe which has a high dependence on Russian and imported gas,” Tchacos said.

“With renewables, you create alternative energy but it is not continuous so also need energy that is fairly instantaneous and that’s the big advantage that gas has.

“You can either run in base load or run it as peak, so that’s why I think gas is going to be relevant for much longer.

“It is also cheaper and faster to develop, while also producing about half the level of CO2 emissions as coal.”

What makes any potential gas that ADX might produce especially important is that much of Europe’s gas is currently imported.

“Austria imports about 90% of its gas, and unfortunately, 76% of that is still coming from Russia via Ukraine, and the agreements for transport via Ukraine actually end in October 2024,” Tchacos noted.

“It is quite a precarious situation.”

This article was developed in collaboration with ADX Energy, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.