We spoke to energy czar St Baker on why it just piled into State Gas, and loves EVs

Energy

Energy

Australian energy security has been high on the list of talking points with the Albanese Government scrambling to secure more gas for domestic use on the east coast to – at the very least – put a cap on further price increases.

There’s good reason for this.

According to the Australian Energy Regulator, east coast gas prices averaged between $28.81 per gigajoule in Brisbane to $29.74/GJ in Adelaide during the second quarter of 2022, roughly three times higher than it was during the last quarter.

This has in turn impacted on electricity prices with the quarterly electricity spot prices in the second quarter hitting their highest ever average prices from $228 per megawatt hour in Tasmania to $344/MWh in Queensland – which raises no end of questions given the preponderance of liquefied natural gas exporters in the latter state.

The reasons for this sorry state of affairs could fill an article or three all on their lonesome, but can likely be condensed into the following points: Years of underinvestment in gas exploration and development, geopolitical tensions, and governments on both sides of the political divide letting gas exporters have their merry way.

So when an investment fund which has historically invested hundreds of millions (if not billions) into Australia’s gas infrastructure makes a substantial investment into a junior gas explorer, people tend to sit up and take notice.

And that is exactly what happened when the St Baker Group increased its stake in State Gas (ASX:GAS) from 3% to 12% by pumping in close to $7m to fund the explorers gas commercialisation plans.

St Baker – run by energy entrepreneur Trevor St Baker who founded ERM Power, which was sold to Shell for $617m in 2019 – is supremely familiar with Australia’s gas landscape, having been involved in the construction of over 2,500MW of new gas-fired power generation over the decade to 2009, laying over 300km of gas pipeline and entering gas purchase contracts worth $10bn.

The fund also has a strong presence in the electric vehicle sector with a focus on the infrastructure necessary for the electrification of transport networks as evidenced by its investments in leading ultra-fast charger manufacturer Tritium and Evie Networks, which is building an EV charging network across Australia.

State Gas itself is no mere gas explorer given that its executive chairman Richard Cottee is a veteran oil and gas executive who grew QGC from a $30m market cap into one of Australia’s major coal seam gas players prior to its $5.75bn acquisition by BG Group.

With the strong interest in this deal, Stockhead took the opportunity to sit down for a chat with Trevor St Baker to find out a bit about the why behind the investment and some of his views on Australia’s energy sector.

St Baker, who described himself as a “patient, small investor in State Gas” prior to the recent deal, noted that Queensland and Australia needed more gas and when the company, which has been progressively proving up its natural gas and coal seam gas deposits, put forward concrete commercialisation plans, it spurred him to act.

“They’ve had some recent successes with this horizontal drilling but what really prompted me to respond with a further investment is that they’re now going to market and they’ve got a pathway to market both in respect of this compressed natural gas trucking and then the building of a 50km pipeline to connect to the State’s pipeline,” he explained.

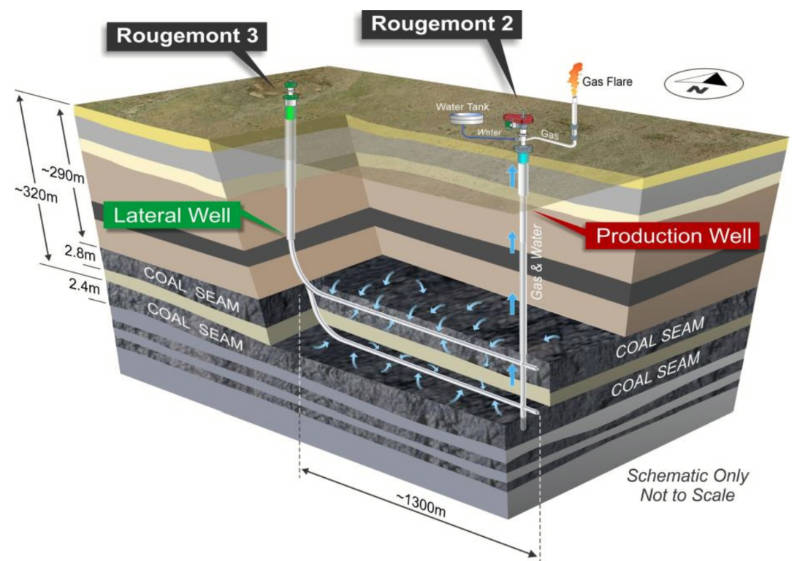

State Gas recently successfully intersected its Rougemont-2 well with the first horizontal section (lateral) of its Rougemont-3 well and unveiled plans to start trucking CNG from its Reids Dome gas field in the first quarter of 2023 to help meet current market shortfalls while work begins on a large capacity pipeline, which could increase gas sales by 15 times.

“They are actually investing in selling their gas and the revenue from that will contribute to the funding of the pipeline and the full development of their gas resource at a time when the state and the country is so hugely short of gas as reflected in the high price, which is what prompts us to capitalise on the high price with more supply,” St Baker added.

St Baker also touched on high gas prices, noting that natural gas is a high-priced fossil fuel in a country that has a lot of low-cost fossil fuels and was used primarily to provide peaking power – when electricity demand hits its highest point during the day.

“The idea that gas could replace coal isn’t feasible and isn’t the requirement either,” he added.

Rather he noted that coal-fired and gas-fired baseload power stations had been making way for subsidised renewables, which was appropriate as part of a pathway to greatly reduced emissions in Australia and the rest of the world.

However while he expected the combination of solar and wind power with batteries would increase from the current 20% of the energy mix, the lack of baseload renewables such as hydro meant that Australia still needed its coal-fired plants.

“When the Hazelwood plant closed it increased the amount of gas that we need for peaking gas and the amount of time that gas price was dictating the price of electricity. So Hazlewood resulted in an increasing price of electricity,” he pointed out.

“Liddell’s closing and the price is going up. It is 1/4 closed now. It’ll be 3/4 closed next March, and there is no doubt that the price will go up when Liddell closes completely.

“Now that Eraring is giving notice that they expect to close in 2025, there is no way that there is enough electricity generation sources to keep the lights on when the sun goes down.

“We have as much gas being curtailed as is being supplied into the market at the peak times of the sun already and the idea that we’re going to build more gas, more solar power all at the same time and then piped or transported to some place to be stored so it can be then supplied into the market in the next three years to support the closure of Eraring is simply impossible.”

St Baker also called out Australian energy bureaucrats who have focused on the emissions reductions brought about by the closure of these plants as well as the plants with capacity of 5,000MW that AGL is closing by 2035.

“It is impossible to build the batteries, the solar and the transmission lines by then and the energy bureaucrats aren’t telling the ministers that it’s impossible,” he claimed.

“The same energy bureaucrats are not actually responding to years of consultative work with the generators as to how to keep the existing power stations in service, able to operate at their minimum loads, having made way for sun and wind instead of closing down completely.

“They have done the easy part of bringing renewables to deliver the power while the existing power stations are still in service when the sun’s shining and the wind’s blowing but not at other times.”

He also critiqued their focus on residential customers noting that while they can offset their power usage with rooftop solar (which he praised) and batteries, they made up just a third of electricity demand.

“Two-thirds of the electricity demand is business, which hasn’t got enough roofs to put rooftop solar on to solve the other part of the problem,” he lamented.

Building up enough renewable power, storage and transmission infrastructure can only be done at huge costs and time and St Baker certainly does not believe that it can be done before existing power stations stop operations.

“We need 24/7 power to keep the jobs in Australia. It’s ridiculous but then electricity is only between 25% and 30% of the emissions.”

If it wasn’t already clear from the St Baker group’s investments, St Baker is a big believer in electrifying transportation, though he readily admits that his interest is not due to the potential for emissions reduction.

“I had a dream of electrifying the transport sector in the 1960s for health reasons, as EVs would get rid of all the gasoline fumes in cities, which is a major health hazard,” he noted.

Not that emissions reduction isn’t important, with St Baker noting that a paper presented at a recent conference highlighted that the only way to achieve Australia’s intermediate emissions targets was to electrify the transport sector, which was already being done.

“Not to save the planet, but because electricity into an electric vehicle can fuel a car at up to a fifth of the cost of gasoline. And it only needs a fraction of the maintenance costs of a gasoline car,” St Baker explained.

“Electric motors need much less maintenance than an internal combustion engine. I’ve got an 11-year-old Nissan Leaf myself and it has never had a mechanical repair.

“This is what the Americans are doing, they are throwing money at rolling out charging stations to replace the gasoline everywhere in the country by 2035.

“They’re putting hundreds of billions of dollars into providing an incentive for private capital to build the ultra-fast charging stations on all of the highways and interconnecting roads between cities and within cities all over America so that they are present when the EV take-up takes place.

“At the same time, all of the car companies are converting to electric cars. They’re not doing it to save the planet. They’re doing it because EVs are now shown to be the cheapest form of transport in trucks, buses, school buses, and certainly in motor vehicles.”

And St Baker is certainly putting his money where his mouth is.

Besides funding gas companies which have the potential to meet supply shortfalls, his fund has been involved in supporting the electrification of the transport sector.

One of his most successful investments was into a group of University of Queensland graduates whose previous claim to fame was their solar powered car taking third place during the World Solar Challenge in 1999 and were looking at producing one of the first DC fast chargers for motor vehicles.

Tritium is now one of Australia’s fastest growing technology companyies, first winning a contract to roll out America’s first network of 50KW fast chargers through Chargepoint and a massive contract to supply ultrafast charges to Ionity – a consortium of mostly German car manufacturers and BlackRock’s Global Renewable Power platform.

While Tritium’s chargers were originally built just in Brisbane, the scale of its contracts has led it to build a factory capable of producing 30,000 ultra-fast chargers per annum in Tennessee.

“We are also in electric buses and low-cost EVs with BYD,” St Baker added.

“There’s a whole raft of angles to this which are business opportunities which would have got the business hat on.

“But all this is aimed achieving the business objectives of reducing emissions and creating jobs in Australia. That’s the driver for our investments in St Baker Energy.”