North Sea oil and gas is blossoming as Hartshead nears final investment decision

Energy

Energy

Hartshead Resources is sailing over to finalise pipeline routes and survey its Anning and Somerville gas fields as it progresses towards a final investment decision on Phase 1 development.

Hartshead has a three phase, 800 Bcf development schedule for its Production Seaward License P2607, containing four existing gas fields in the UK Southern Gas Basin.

Phase 1 is all about Somerville and Anning, two historically producing fields with combined 2P Reserves of 301.5 Bcf.

Development involves six production wells connected to two wireline capable Normally Unmanned Installation platforms. From there, gas will go to Shell’s infrastructure for onward transportation and processing for entry into the gas network.

An final investment decision (FID) for Anning and Somerville is expected in early October, with project financing already secured through a farm-out with North Sea oil and gas producer RockRose Energy.

First production is expected in 2025, with peak production to hit ~140 million scf/day.

Gardline Vessel ‘Ocean Observer’ has now deployed to Anning and Somerville to commence a survey which will confirm the seabed and sub-seabed soil conditions, enabling Hartshead Resources (ASX:HHR) to finalise pipeline design and installation efficiencies.

In addition to the commencement of the pipeline survey, the oil and gas play has received bids for the Engineering, Procurement, Installation and Commissioning (EPIC) contract for the Anning and Somerville platforms.

Hartshead says it “will now review the technical and commercial elements of each bid prior to providing recommendations to the JV operating committee as to which company to award the contract to”.

Harsthead COO Keith Bush says the Anning and Somerville development is rapidly taking shape.

“In conjunction with the ongoing subsea survey programme, receipt of the platform bids allows the team to continue to progress the development program towards the execution phase of the project.”

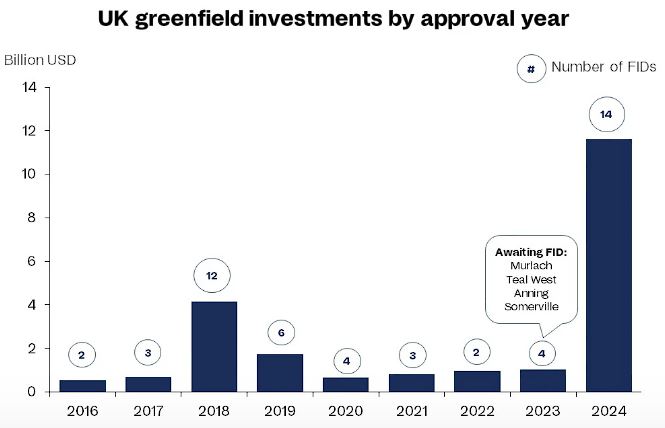

North Sea oil and gas is booming with increased investment and production after overcoming recent challenges and is on course to achieve significant growth – with Rystad Energy predicting 14 new fields given the green light next year in the UK alone.

In Norway, the number of exploration wells is expected to reach 35 this year and is anticipated to grow to 36 next year.

“It has also been a good year for new discoveries, with similar volumes as last year already uncovered,” Rystad says.

This article was developed in collaboration with Hartshead Resources, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.