Gas and potash: The commodities and players set to benefit as Russia’s invasion of Ukraine rolls on

Pic: Getty Images

With Russia’s invasion on Ukraine well into its second year, Europe is resigned to the fact energy and food security have now become long-haul concerns.

Spikes in prices and supply disruptions may have dissipated but the steady rise of interest rates, China’s lockdown and reopening, severe weather and broader geopolitical tensions continue to add further pressure and uncertainty to the energy transition and global food system.

The impact has trickled down to most commodities, from nickel to wheat, pig iron and coal, but companies involved in two key products which Russia has been a leading exporter of in terms of global supply could be set to benefit from these conditions.

Europe’s up and coming potash producer

Potassium rich fertilisers like potash, specifically Muriate of Potash (MOP), are used to improve agricultural production and help maintain the productivity of fields that have lost nutrients from years of repeated nutrient removal through harvest.

Russia and key ally Belarus typically account for about a third of the potash market with Russia holding about 18% of global potash production and 14.5% of potash exports, while Belarus accounts for 17% of global potash production and 19.7% of potash exports.

For net importers of potash such as the European Union which faced a shortfall from Russia and Belarus, the conflict meant a fundamental shift in supply from alternative sources.

Accordg to South Harz Potash (ASX:SHP) CEO and managing director Luis da Silva, the West started to supply the West and the East started to supply the East.

“What you saw was demand in Europe being fulfilled from Canada,” he says in an interview with Stockhead.

“If you look at the world map and at the logistics for that to happen, you’ve got product going from Saskatchewan to Vancouver, then it has to be shipped through the Panama Canal to Europe.

“When at a European port, it still needs to get to the customer so in terms of carbon footprint, that obviously has a massive impact.”

From da Silva’s point of view, this places South Harz in a prime position to provide supply in the coming years.

A brownfields gem in a century-long potash mining region

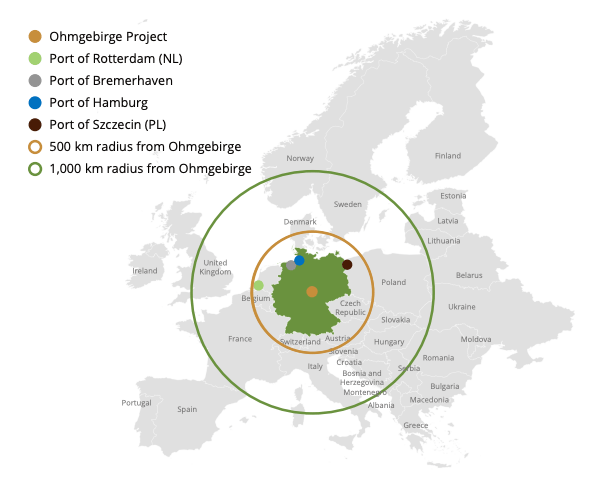

The company owns the Ohmgebirge project in central Germany, a region which boasts a proud century-long history in potash mining and a positive view of future operations.

“Potash originated in the district where we are operating in Germany and what’s left of that industry today is essentially K+S Potash – a multibillion dollar company that has expanded into Canada,” da Silva says.

“Europe is expected to embrace increased home-grown production in the years to come and with our project being essentially brownfields – the geology is known, the mining method is known, and the metallurgy is known – there are no surprises.

“The beauty of our project is that it’s been done for over 100 years so it’s fundamentally de-risked.

“It’s now been 30 years since these mines were closed down… uncles, fathers, and grandfathers were involved in potash mining, and people in the area want the mines back, they understand it, which makes the social licence to operate so much easier and achievable.”

South Harz is about 75% of the way through a pre-feasibility study at the Ohmgebirge project, home to a 5bt resource at 10.8% K2O – comparable in size to BHP’s US$10bn Jansen potash project in Canada.

The company hopes to complete the first round of permitting in the first half of 2024, a DFS by the end of next year, and the second phase of permitting in 2025.

If all goes to plan, South Harz will be in production by 2027.

Europe’s battle for gas

While the battle for fertiliser continues to play out, another is being fought on the energy market with oil and gas, the latter of which is a major raw material used for fertiliser production.

Russia holds 1,688 trillion cubic feet (Tcf) of proven gas reserves as of 2017, ranking first in the world and accounting for about 24% of the world’s total gas reserves of 6,923 Tcf.

Experts believe Russia’s war on Ukraine is in the process of resetting the energy sector as natural gas slowly becomes a higher value product than oil.

According to Hartshead Resources (ASX:HHR) executive director Nathan Lude, the void of pipeline gas has been filled by global LNG, which requires more storage and shipping access into Europe.

“This all ultimately pushed prices higher in the near term which has an immediate price escalation for end users and although the energy crisis in the UK was prominent before the invasion, prices surged to unprecedented levels following the war,” he says.

The UK National Balancing Point (NBP) benchmark rose to a maximum of 875p/therm in August 2022 – or US$107/Mcf – the equivalent of US$640/boe.

“For context, Brent oil has never been over US$148/boe,” Lude says.

“Prices have fallen from this high, but the UK NBP remains elevated versus the 10-year average gas price of 82p/therm.”

Russia’s invasion of Ukraine has made energy security more prominent and a key priority for the UK Government as it strives to meet its 2050 net zero target.

“The significance of domestically produced gas, which is less carbon-intensive, becomes even more pronounced,” Lude says.

“This was evidenced by the release of the British Energy Security Strategy in April 2022, which highlighted the need for the UK to reduce its dependence on imported oil and gas by maximising recovery from its domestic reserves.”

“As part of this strategy, the UK government is now planning to establish oil and gas regulatory accelerators to provide dedicated project support and facilitate the development of projects.

“An Investment & Capital Allowance has also been introduced to incentivise oil and gas companies to invest in new production and offset significant costs to bring projects like Hartshead’s P2607 Licence into production.”

Hartshead to enter production stage in 2025

The gas supply trend in Europe points to historically high prices through to the end of the current forward curve in 2030, Lude says, which suggests much higher industry profitability then what has historically been the case.

“This all bodes extremely well for Hartshead in its Phase 1 development of over 300 Bcf, with 55% of the gas extracted in the first five years of its development.”

Hartshead continues to be extremely active in its development as it advances towards first gas in 2025 at the Anning and Somerville gas fields in the UK.

Hartshead has a three-phase, 800 Bcf development schedule for its Production Seaward License P2607.

Phase 1 is all about Somerville and Anning, two historically producing fields with combined 2P Reserves of 301.5 Bcf.

Development involves six production wells connected to two wireline capable Normally Unmanned Installation platforms. From there, gas will go to Shell’s infrastructure for onward transportation and processing for entry into the gas network.

A final investment decision (FID) for Anning and Somerville is expected in early October, with project financing already secured through a farm-out with North Sea oil and gas producer RockRose Energy.

Near term oil and gas developments in Central Europe

Over in central Europe, ADX Energy (ASX:ADX) holds a portfolio of oil and gas projects in Austria, Romania and Italy.

Its major focus is on near-term oil and gas activities from its Anshof oil discovery and the world-class Welchau gas prospect, which holds a best technical prospective resource of 807 billion cubic feet of gas equivalent.

The fact that this potential resource is situated at the centre of energy-demanding Europe and in close proximity to established gas pipelines makes it a rare opportunity for ADX and Austria, with one of the key objectives of the FFG fund to “transfer leading edge research into industrial applications.”

Speaking with Stockhead, ADX chairman Ian Tchacos says the need for gas supply is well understood in Europe, where gas is recognised as a transition fuel.

“Given we operate in countries like Austria, security of supply concerns has provided greater ministry support for new projects such as our Welchau gas project.

“Our Austrian portfolio is receiving greater attention for farm-outs, for example as with our Anshof field attracting MND Austria – a major European industry firm – to fund and accelerate development because there is greater focus on safe, predictable jurisdictions,” he says.

“The relevance for ADX is that 30% of European gas supply from Russia has to be replaced, which places Welchau and other gas prospects in our exploration inventory in the box seat.”

Who else has gas and potash over in Europe?

Po Valley (ASX:PVE) recently completed the ramp up and commissioning of its Podere Maiar – 1 (PM-1) gas facility in the Selva Malvezzi Production Concession in the Po Valley plains of northern Italy.

The final transition to ongoing production at PM1 – a platform from which the company can actively pursue the exploration nearby lookalike wells – is now underway.

Gas produced during the ramp-up period is estimated to be 1,800,000 standard cubic metres, however, this amount is subject to final reconciliation with commercial stakeholders via standard commercial processes.

Doriemius (ASX:DOR) holds a 4% interest in Horse Hill Developments, which owns 65% of two Petroleum Exploration and Development Licences – PEDL137 and PEDL246 – in the northern Weald Basin between Gatwick Airport and London.

In March, the operator of Horse Hill executed a conditional binding term sheet with Pennpetro Energy plc (PPP), whereby PPP will farm-in to the Horse Hill oil field on an incremental production basis via funding the acquisition of 3D seismic and the drilling of the next infill production well.

On the fertiliser front, PhosCo (ASX:PHO) is assembling its district scale phosphate portfolio in Tunisia’s Phosphate basin to support a potential world-class fertiliser hub.

Phosphate is another critical fertiliser that underpins the world’s food supply with the European Union declaring it as a critically strategic commodity.

Its location in northern Africa on the Mediterranean Sea means it is close to key export markets with Europe right on its doorstep. The capital of Tunis is 210km away by sealed road and the nearest railroad is 35km away, offering two connections to two ports.

At Stockhead we tell it like it is. While South Harz Potash, Hartshead Resurces, and ADX Energy are Stockhead clients, they did not sponsor this article.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.