Another 15Tcf in Indonesian waters could make Conrad Asia a pivotal supplier in the world’s fastest growing gas market

Energy

Energy

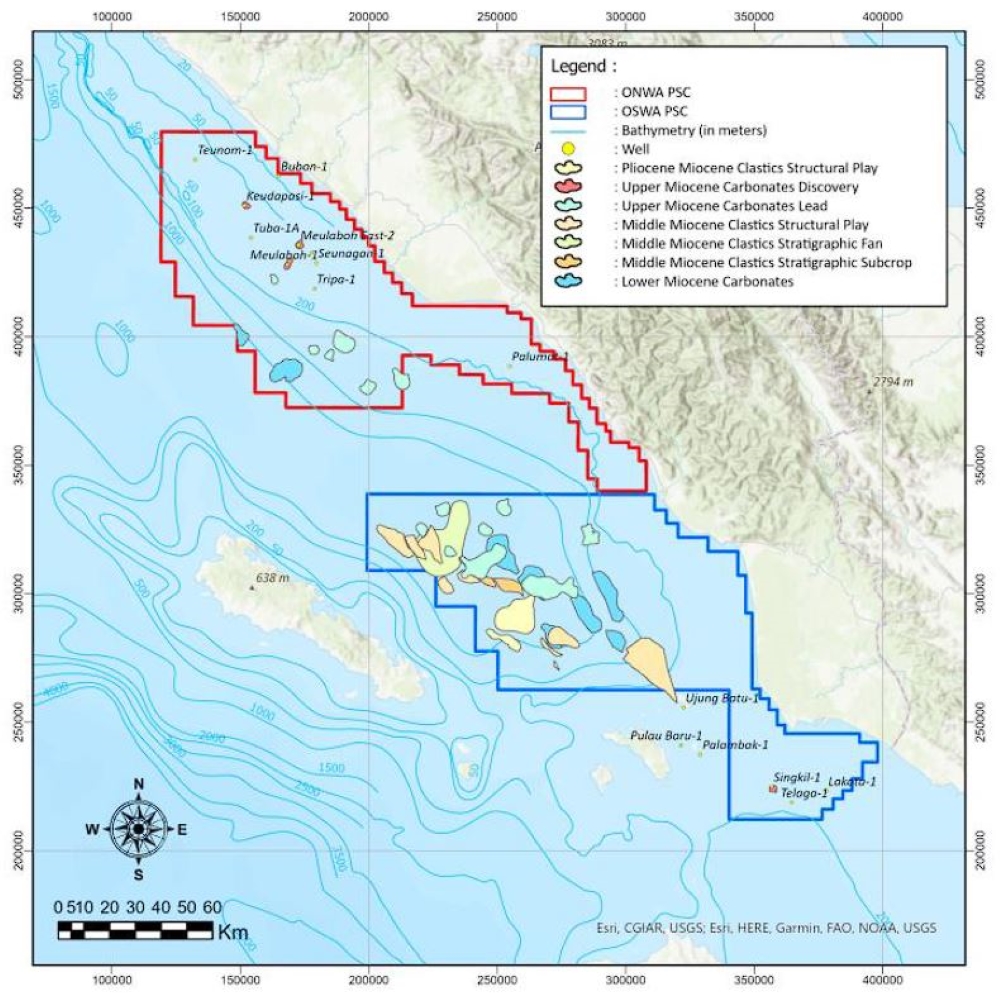

Special Report: 38 leads, or targets, have been identified at Conrad Asia’s Offshore North West Aceh (ONWA) and Offshore South West Aceh (OSWA) gas plays in Indonesia, with four of the leads reported as having prospective resource potential of more than 1 trillion cubic feet in recoverable gas.

This represents a large inventory of gas development opportunities that could transform Conrad into a major regional gas supplier.

Peter Botten, former chairman of energy retailer AGL, is steering Conrad Asia Energy (ASX:CRD) towards gas production off the coast of northwest Aceh, Indonesia, where it’s determined that the two highly prospective gas blocks it was awarded this year contain proven shallow water gas accumulations, with scope for very large gas exploration in the deeper waters.

The Singkil and Meulobah discoveries were made in the 1970s and were successfully flow tested at commercial rates with almost pure methane gas that were not developed at the time due to low gas prices.

The PSCs host several large structures in the deep-water areas with identified gas chimneys and flat spots on seismic data – an indicator of potential hydrocarbons – that could host multi-trillion cubic feet (Tcf) of gas potential.

“Having large structures with scientific evidence of gas in a proven hydrocarbon region is particularly exciting” said Conrad Managing Director, Miltos Xynogalas.

For context, every billion cubic feet of gas – of which there are a thousand in a Tcf – can provide enough electricity for 24,315 average homes for an entire year, so that’s a whole lot of gas.

Indonesia — the fourth most populous nation on earth — is an epicentre of growing gas demand, leading the government to target a 100% increase in gas production by 2030.

The OSWA (Singkil) PSC covers a massive 10,700km2 within the offshore Sibolga Basin, where 30 leads have been identified within the Miocene carbonate build-ups and have combined, unrisked prospective resources of 14.6Tcf – 10.4Tcf of which are attributable to CRD.

While still early days, these preliminary estimates have been derived from an extensive data suite that includes mapping of ~17,000km of 2D seismic data and reservoir properties from well logs from 16 historical wells within and adjacent to the PSCs.

The slightly smaller ONWA (Meulobah) PSC still covers a sizeable 9,182km2 in the same basin and contains the previously reported shallow water Meulaboh, Meulaboh East and Kaudapasi gas discoveries. 3D seismic is expected to be shot next year.

Eight new leads have been identified in deep-water Lower and Upper Miocene carbonate build-ups with a combined unrisked resource of 910Bcf, with 656Bcf attributable to CRD.

“This is a very large area that is grossly underexplored hence the number of leads will most probably grow as we continue to acquire more seismic data. Unlike Australia, the Indonesian government at all levels is encouraging gas development recognising its importance not just for power generation, but also fertliser and petrochemicals,” Xynogalas continued.

The proven upper Miocene carbonate play – where existing biogenic discoveries have been found – is the focus of future planned work. The exploration success rates in the shallow water Miocene carbonate areas are very high (close to 70%), so Conrad is confident it can continue on this trajectory with modern seismic techniques.

CRD plans to acquire additional data from geological fieldwork carried out in adjacent onshore areas, as well as from petrographic and geochemical analyses of available cuttings and core samples from past wells.

Reprocessing of the existing 2D seismic data within the PSCs is planned and CRD has commenced planning to acquire 500km2 of modern 3D seismic data in each PSC in 2024, seeking to delineate near field, low-risk drilling opportunities in the shallow-water areas.

It’s also continuing to evaluate the deep-water prospective targets where circa 15Tcf of recoverable P50 gas is present in the hopes of attracting partners.

CRD Managing Director Miltos Xynogalas, says the ONWA and OSWA PSCs continue to evolve into a major project area for Conrad.

“The CPRs of the discovered resources in the shallower waters increased Conrad’s net 2C Contingent Resources by 75% (increased from 215 Bcf to 376 Bcf) and now the world-class deeper water exploratory potential has added an enormous quantum of prospective upside.

“Several large structures with multi-Tcf potential have been identified and seismic studies of the structures show DHIs (gas chimneys and flat spots), signifying the presence of hydrocarbons.

“The future program, involving reprocessing of existing 2D seismic and acquiring additional 3D seismic data will enable us to refine our estimates of gas volumes and chances of discovery.”

Meanwhile, CRD is also focusing on its cornerstone Mako gas field containing 413Bcf, owning 76.5% of the Duyung PSC. The field has easy access to infrastructure and is already connected and sending gas through to Singapore and Mayalsia.

Mako remains the near-term focus, where we recently signed a term sheet to supply gas to Singapore and expect to finalise the gas sales agreement in the coming months.

“The importance of natural gas to Asian economies is becoming increasingly important and this is now the obvious fuel of choice in the energy transition.”

This article was developed in collaboration with Conrad Asia, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.