Conrad inks ‘transformational’ production sharing contracts for two highly prospective Indonesian gas blocks

Conrad's two new PSCs are sweet prizes indeed. Pic: via Getty Images

Conrad Energy Asia has firmed its hold over two Indonesian licences with existing gas resources and the potential to host multi-trillion cubic feet of gas.

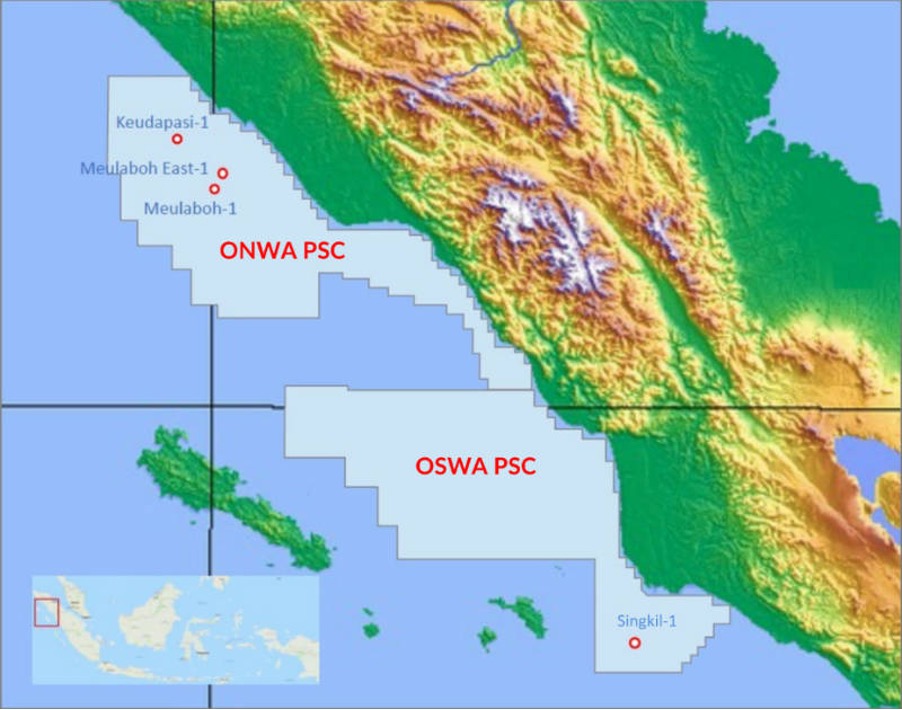

The company has signed Production Sharing Contracts (PSC) for the Offshore North West Aceh (Meulaboh) and Offshore South West Aceh (Singkil) PSCs located offshore northwest and southwest of Indonesia’s Aceh Province.

Both PSCs have existing shallow water discoveries that were made in the 1970s but never developed, despite flowing gas to surface at potentially commercial rates, due to low prices and poor regional demand at the time.

While the Contingent Resources from these finds provide a level of certainty for Conrad Asia Energy (ASX:CRD), it is the additional prospectivity in both the shallow and deeper-water areas of the PSCs that really has hearts aflutter.

The deep water areas have several large structures with multi-trillion cubic feet potential, and the company has already identified gas chimneys and flat spots on seismic data which are indicative of potential hydrocarbons.

Despite the existing finds and strong potential, the two PSCs are classified as “frontier area” and have been granted attractive fiscal terms which are amongst the most favourable in Indonesia.

“The award of these two PSCs is a transformational event for Conrad as these blocks contain discoveries that significantly increase our resource base and offer the opportunity for Conrad to add several gas projects to its existing large Mako gas project,” managing director Miltos Xynogalas said.

“Conrad’s initial scoping study of gas markets in the region has been positive and we are optimistic of commercialising these discoveries and delivering a portfolio of growth opportunities to our shareholders.

“There is significant upside for Conrad in the exploratory opportunities that exist in both the shallow- and the deep-water areas, where we have already identified a host of high impact gas plays.

“The deep-water areas potentially contain several multi trillion cubic feet in size gas leads, with evidence of hydrocarbon accumulations from observed gas chimneys and seismic flat spots. The most prospective leads are in 1,000 metres of water, which by global standards is not deep.”

Xynogalas added that major companies have already expressed an interest in reviewing the Conrad’s data, which ties in with its intention to seek partners to participate in exploration efforts.

Chairman Peter Botten, who was managing director of Oil Search from 1994 until 2020, noted that gas is an important transition fuel for the world’s fourth most populous country as it moves away from coal.

“Indonesia is looking to double its gas production by 2030 and is actively encouraging the exploration and development of natural gas where it recently announced it would need some US$170 billion in upstream investment by 2030,” he added.

Extensive work program

Conrad has a busy time ahead for the two PSCs having committed to work programs totalling US$15m for each of the two areas.

This includes geological studies for 2023, 500km2 of 3D seismic acquisition for 2024 and the drilling of a well for 2025.

Costs for its work in 2023 will be funded from its recent public offering on the ASX while subsequent activities are expected to be funded from various sources including farm-in partners as the PSCs are matured and the commencement of cash flow from the Mako gas field.

Meulaboh covers 9,182km2 and contains the Meulaboh-1 and Meulaboh East-1 gas discovery wells which intersected gas columns of 90ft and 30ft while flowing gas at maximum rates of 6.7 million standard cubic feet of gas per day (MMscfd) and 7.99MMscfd respectively.

The 10,700km2 Singkil block contains the Singkil-1 gas accumulation that intersected a 270ft gas column and flowed gas at a maximum rate of 10.06MMscfd.

This article was developed in collaboration with Conrad Asia Energy, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.