Conrad Asia Energy identifies small-scale LNG as Aceh gas development option

Small-scale LNG is a possible option to commercialise Conrad’s shallow-water gas fields in Aceh. Pic: Getty Images

- Small-scale LNG identified as feasible commercialisation option for Conrad’s offshore Aceh gas fields

- Aceh PSCs have gross 2C contingent resource of 214Bcf in three of four discovered shallow-water gas accumulations

- Upcoming 3D seismic survey aiming to increase the discovered resource size

- High exploratory success rates of close to 70% provide confidence of further resource upgrades

- Numerous technology partners with proven technology and active small scale LNG plants provide certainty and optionality

Special Report: A screening study has identified small-scale liquefied natural gas as a feasible commercialisation option for Conrad Asia Energy’s two offshore Aceh production sharing contracts.

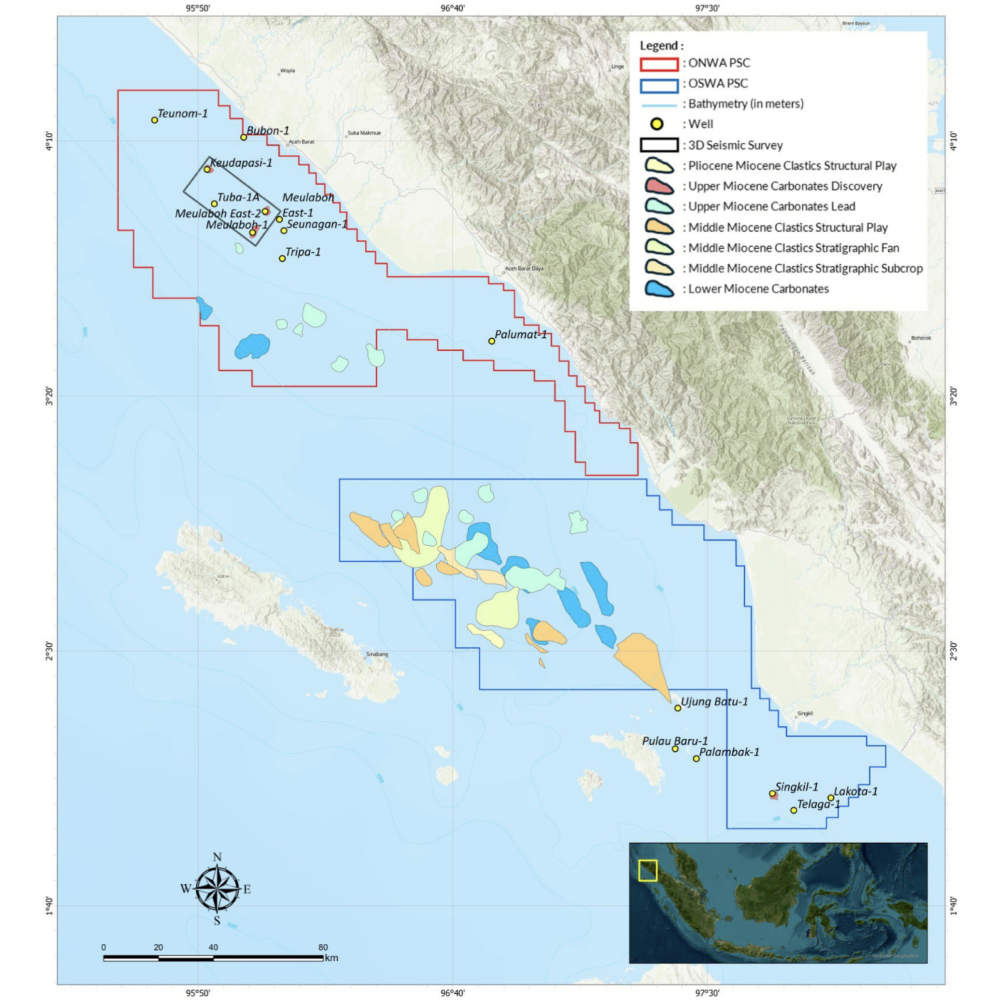

The Offshore North West Aceh (ONWA) and Offshore South West Aceh (OSWA) PSCs currently have a gross, best estimate (2C) contingent resource of 214 billion cubic feet of gas (161Bcf attributable to the company) in three of the four discovered gas accumulations.

The shallow water PSC (ONWA) with proven discoveries currently hasan estimated net present value of US$88m attributed to it by Competent Persons Reports (CPRs) assuming a contractor take of 72.1% for supply into the domestic market.

Conrad Asia Energy (ASX:CRD) has spent the last two years investigating commercialisation options for the current discoveries in shallow-water areas near shore as well the multi-trillion cubic feet prospective resource potential in deep-water areas about 30km offshore.

In February 2024, it reached a memorandum of understanding with PT Perusahaan Gas Negara (PGN) to cooperate in the provision of gas for LNG from discovered gas resources from ONWA and OSWA.

Ahead of this, it commissioned THREE60 Energy to conduct a high-level screening study to test the technical and commercial feasibility of a small-scale LNG plant – with capacity of <0.5Mtpa – as an outlet for gas from Meulaboh Main and East fields.

Small-scale LNG plants are currently being developed across Asia by numerous companies with proven technology and active plants that support gas supply of 20-40 million standard cubic feet (MMscf) per day.

Previous plans for developing the two fields had involved a US$132m development involving three horizontal production wells fed into one simple, normally unmanned installation and a 32km pipeline to shore.

Feasible commercialisation option

The screen study found that small-scale LNG is a feasible gas commercialisation option for the discovered gas resources in the two PSCs due to their near-shore location and flow-tested near pure methane content.

It found that numerous technology providers exist with proven technology and active plants that could support a 20-40MMscfd sales gas supply.

Such plants were found to have readily defined and benchmarked capex and opex costs while having the ability to be sized for either lower or longer gas buyer plateau requirements.

Existing small-scale LNG plants with ~30MMscf/d capacity range operating elsewhere in Asia are estimated to have a breakeven price of circa US$2-4 per million British thermal units.

CRD will now work with PGN to further mature the small-scale LNG opportunity for the discovered Aceh resources as well as investigate its options for the 15Tcf prospective resources.

“The gas markets in Aceh continue to grow and provide opportunities to commercialise our discovered resources. In addition, the enormous exploratory potential for additional gas is exciting, especially as we continue to de-risk our exploration prospects through advanced geophysical analysis,” managing director Miltos Xynogalas said.

“The CPRs have indicated the value of our discovered resources at US$88 million based on a domestic market commercialisation option. Additional options are now being evaluated which include gas to power, compressed natural gas or small-scale LNG.

“We have been working to mature some of these options in partnership with PGN, Indonesia’s largest gas company and the small-scale LNG option is looking particularly favourable as several of such projects are now being brought into commercial production.”

Potential for more discoveries

Xynogalas added that developing the shallow-water discoveries is a significant opportunity as the historical success rate for such finds is close to 70%.

“We are aiming to bolster our discovered resources in the shallow-water areas with the upcoming 3D seismic,” he noted.

“We are also actively engaged with major companies in seeking a farm-in partner in the deeper water areas.

“Regionally, the deep-water areas offshore northern Aceh have recently yielded some of Asia’s largest gas discoveries there by generating considerable interest in the region.”

This article was developed in collaboration with Conrad Asia Energy, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.