Mooners and Shakers: Most Bitcoin holders are in the red, but Coinbase hints this could mean a bottom’s close

Coinhead

Coinhead

Bitcoin, Ethereum and pals are crabbing their way towards Christmas and the new year. The market is desperately hoping no other major implosions occur so we can all just sign off on the 2022 hangover, take another orange pill for good measure (Berocca maybe?) and start anew.

But how about that headline, eh? Let’s talk about that.

Crypto exchange giant Coinbase has this week released its extensive, in-depth 2023 Market Outlook report.

The overall theme is essentially: “The dramatic events of 2022 will shape the crypto landscape for years to come.” And yet it’s been a helluva year for institutional adoption, while Bitcoin’s core investment thesis remains intact and the tenets/advantages of DeFi, stablecoins and NFTs will keep pushing them front and centre in 2023.

Something like that.

But here’s the part about the report that caught our attention, because it plays into the market-bottoming narrative that many (though certainly not all) an analyst and commentator is seeing around these current levels, if not a tad lower.

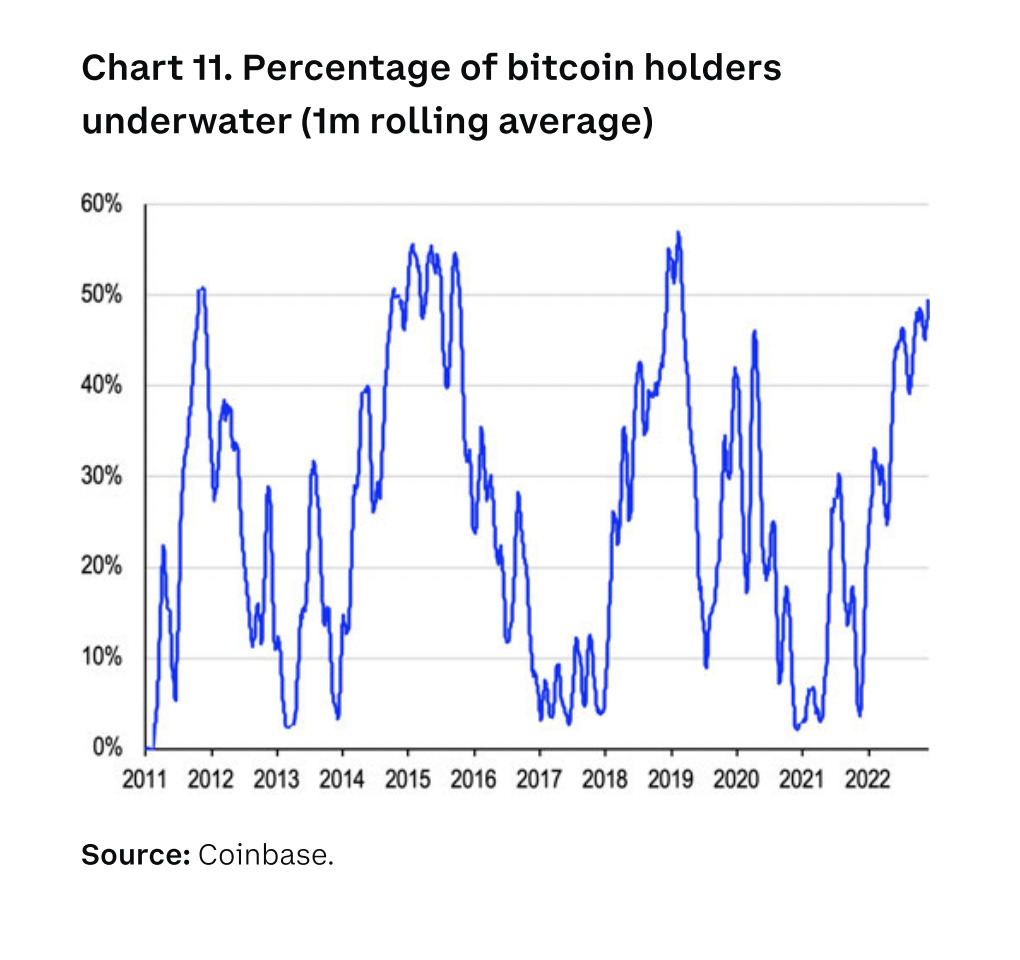

And that’s the fact that Coinbase has determined (based on specific profit/loss UXTO movements) that 50% of Bitcoin holders are now underwater on their investment.

That hardly seems something to shout from the rooftops in excitement, but as the exchange’s report points out, this metric in previous bear markets reached an average of 53% – which, if history repeats or rhymes, could mean this cycle’s bottom is either in or very close.

Referring to the previous market peaks, Coinbase wrote:

“These represent major inflection points for BTC performance, preceding subsequent periods of price appreciation… we believe this metric provides important insights into current cycle positioning.”

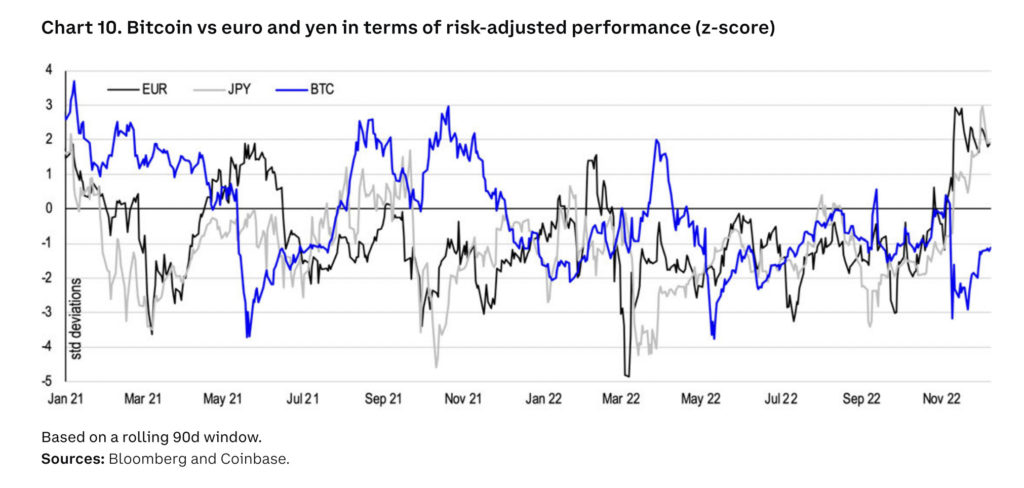

The report also suggests Bitcoin has shown resilience amid the year’s market inflation-affected turmoil and the Fed’s rate hiking, not to mention the crypto industry’s dreadful feet-shooting implosions.

In fact, it points to the fact that BTC has still managed to outperform some of the world’s major currencies this year, including, okay not the US dollar, but the Euro and the Japanese Yen. Maybe that counts for something.

“The value proposition for Bitcoin has only strengthened this year as sovereign currencies around the world have shown signs of stress and central banks continue to grapple with policy credibility,” wrote Coinbase.

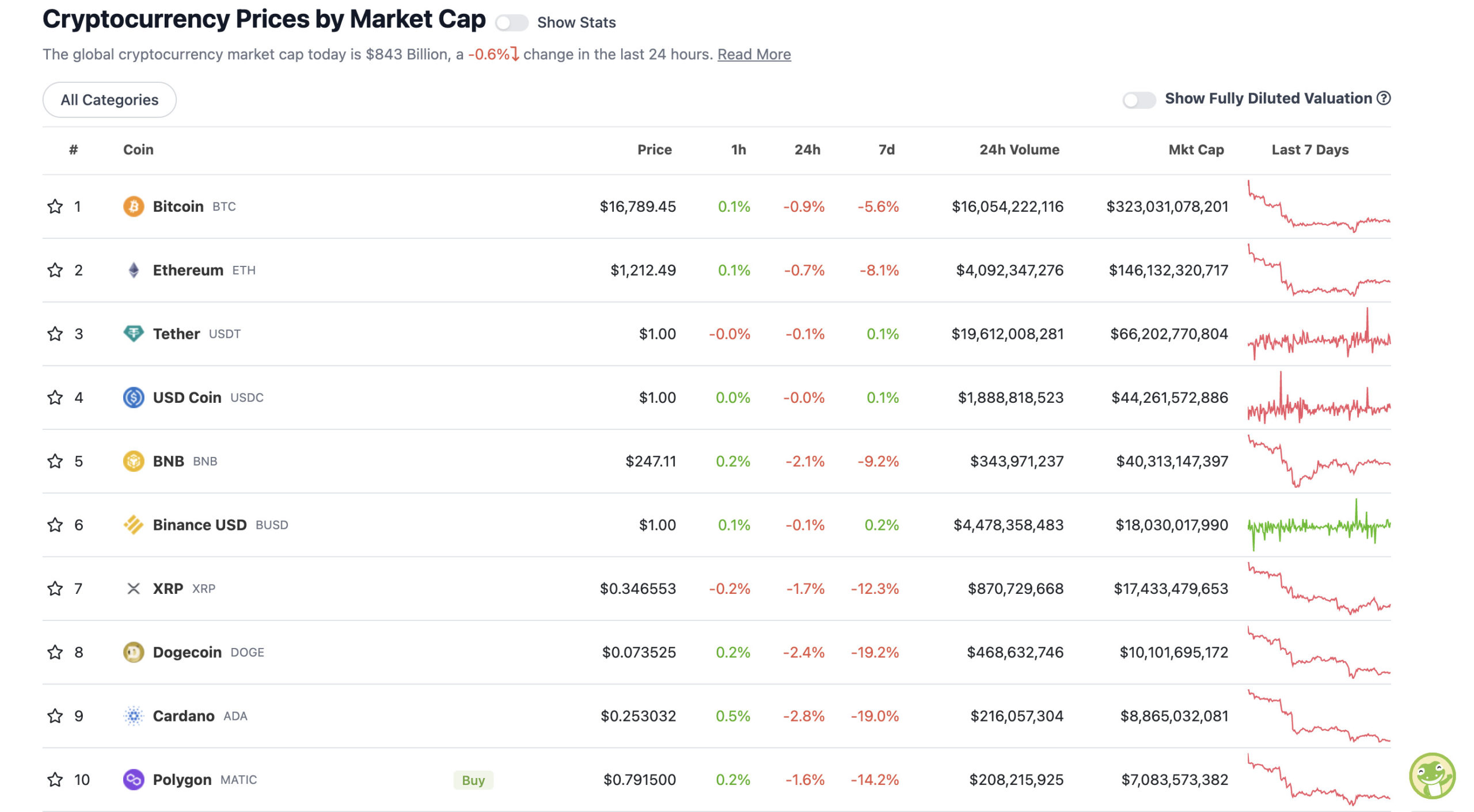

With the overall crypto market cap at US$843 billion, down about 0.6% since this time yesterday, here’s the current state of play among top 10 tokens – according to CoinGecko.

Sweeping a market-cap range of about US$5.8 billion to about US$303 million in the rest of the top 100, let’s find some of the biggest 24-hour gainers and losers at press time. (Stats accurate at time of publishing, based on CoinGecko.com data.)

DAILY PUMPERS

• Toncoin (TON), (market cap: US$3.7 billion) +5%

• Ethereum Classic (ETC), (mc: US$2.3 billion) +4%

• Tokenize XChange (TKX), (mc: US$532 million) +3%

• GMX (GMX), (mc: US$395 million) +2%

• THORChain (RUNE), (mc: US$414 million) +2%

DAILY SLUMPERS

• Chain (XCN), (market cap: US$440 million) -11%

• Trust Wallet (TWT), (market cap: US$636 million) -6%

• Lido DAO (LDO), (mc: US$771 million) -5%

• Arweave (AR), (mc: US$352 million) -5%

• Synthetix (SNX), (mc: US$372 million) -4%

Some randomness and pertinence that stuck with us on our morning moves through the Crypto Twitterverse…

The Office of the Attorney General of The Bahamas announced the extradition to the United States of Sam Bankman-Fried (“SBF”), the former CEO of FTX. SBF will depart from The Bahamas for the United States tonight. pic.twitter.com/WttWmNpIw4

— Latrae L. Rahming (DOC)🇧🇸 (@latraelrahming) December 21, 2022

Meanwhile, contrary to what most of us perhaps thought, given Bahamian prison Fox Hill’s reputation, FTX Founder Sam Bankman-Fried’s time there has apparently been one of relative luxury compared with other inmates.

According to a Bloomberg report, SBF was granted vegan food, cable telly, crossword puzzles, a private phone line – and even his own bed (apparently not so common there).

JUST IN: FTX founder SBF's Bahamas prison perks included cable TV, air conditioning, and vegan food, Bloomberg reports.

— Watcher.Guru (@WatcherGuru) December 21, 2022

JUST IN: FTX founder SBF's Bahamas prison perks included cable TV, air conditioning, and vegan food, Bloomberg reports.

— Watcher.Guru (@WatcherGuru) December 21, 2022

The ETH killer meme is dead.

Never coming back.

— RYAN SΞAN ADAMS – rsa.eth 🏴🦇🔊 (@RyanSAdams) December 21, 2022

BREAKING‼️ #Bitcoin exchange Paxful has removed Ethereum from its market place.

— Bitcoin Archive (@BTC_Archive) December 21, 2022

🚨 @CelsiusNetwork will allow less than $50M to be withdrawn.

Congrats to the 69 people who will get some money back from @CelsiusNetwork 😆 pic.twitter.com/rEVll0YYfk

— Aaron Bennett (@AaronDBennett) December 21, 2022

A really cool thing about Bali is that it's keeping you out of jail, no?

— sassal.eth 🦇🔊 (@sassal0x) December 21, 2022

Jimmy faces the ultimate trial. Stay tuned to https://t.co/h8JXeLkC57 for what comes next. pic.twitter.com/0QVNxrZbWW

— Bored Ape Yacht Club (@BoredApeYC) December 22, 2022