The Crypto Candlestick: T’was a ‘hangover year’ for coins but foundations for next boom are solid

The winner of the Emote Crypto 2022 competition, yesterday. (Getty Images)

When it comes to crypto, the echo chamber can be deafening. Which is why we asked ThinkMarkets analyst Carl Capolingua to give us his non-industry-biased views on the crypto year almost passed, and what lies ahead the rest of the year.

‘Without fresh meat, crypto is dead’

So, crypto 2022… What. The. Hell. Happened? What’s your quick take, Carl?

As a technical analyst who’s seen my fair share of cycles over 30 years of watching markets, it feels like 2022 was “that year”. The year after the boom. The hangover year. We topped out [on Bitcoin] in November 2021, and 2022 was pretty much one-way traffic – down.

Were you buying any dips?

Put it this way, basically, for me, 2022 was a story of demand destruction. On the way up, any pullback was an opportunity to buy. Buy the dips, sell the rips! There was a reliable wall of demand to soak up profit taking from insiders and early adopters. But when the tide turns, rips are RIP and dips keep dipping!

So, the market – which let’s face it was full of investors new to market cycles – learned pretty quickly to stop buying those dips. If you kill the dip buying, and the supply is still there (insiders and early adopters plus now opportunistic hedge funds on the short side!), you kill FOMO.

And if you kill FOMO, you kill fresh meat coming into the grinder. Without the fresh meat, from a pure price/momentum perspective, crypto is dead. And that’s where it will remain until the conditions conspire to create the next boom in demand… which can facilitate the next boom in prices.

Sounds fair. And to quote Lloyd Christmas from Dumb and Dumber… “So… you’re telling me there’s a chance…” How do you think the perception of the crypto industry looks to most people now?

It’s toast! I come from an equities background and money managers I talk to always viewed crypto as a bit of a novelty, but at the start of this year, many were warming up.

Warming up – because of the wider institutional adoption narrative?

They were starting to take it seriously as a new alternative asset class. They appreciated the segment of the crypto universe focussed on disruption, particularly those disrupting the financial services industry.

And they could see the benefits of streamlining payments via the blockchain and of smart contract capabilities.

Regulation was always the bugbear, though. And the events of 2022 have turned anyone I speak to who “is not of the crypto world” off crypto. “We’ll look at it again once it’s regulated” they say…

But like the fabled regulation, serious money managers might take a long time to materialise!

‘The foundations for the next boom are there’

How can crypto fix itself in 2023? What do you think needs to happen for the industry to regain some of the trust it’s lost and for the market to gain some solid momentum once again?

Hmm, too-hard basket! As I said, the “serious” money managers I talk to all provide the regulation excuse when it comes to what’s holding them back. What does that term – regulation – even mean? It’s such a vague and generic term, and the events of 2022 point to any forthcoming regulation as falling on the restrictive side of the ledger.

That is, as in restricting the return of the capital, which is so essential to sparking and maintaining the next boom. The reason why 2020-21 was so good was because of the unrestricted, unencumbered flow of capital from fiat into ones and zeros.

I’m not getting the sense you’re seeing much in the way of silver linings for the crypto industry and market?

Look, there are a bunch of money managers out there who did the due diligence this time. Many probably got quite comfortable with the concepts. If the bad news dies down, time heals all wounds.

There will be far more institutional eyes on the next boom, and I expect they’ll be more forthcoming with their capital. Similarly, for the retail public, many at least dipped a toe in this time. Even if that toe got bitten off, at least they got the accounts open. Um, well, let’s hope those accounts still exist!

But they got familiar with the main names – where you get info and news, and how to read a chart and so on. The foundations for them funding the next boom are there.

2024 might be a better bet

What broad, and/or specific predictions do you have for the crypto industry and market in 2023?

I expect it will be another tough year for crypto. I do not expect to see the conditions that could create enough loose liquidity in the average Joe’s wallet to facilitate a huge funnelling of fiat into crypto.

If anything, financial conditions are going get tighter next year as cost-of-living pressures and slowing economies reduce the availability of cash for speculative investments. There are substantial linkages now between crypto and other risk-on assets such as (particularly) stocks in the NASDAQ Composite. So, a recovery in the Comp could help put a floor under crypto.

Even though we’ve seen a bounce in equities, it’s been at the value/defensive end of the spectrum, not in riskier Comp stocks, and I’m not even sure how long the value rally will last. Liquidity could be very tight in 2023.

Perhaps 2024 might be a better bet as interest rates start to pull back and liquidity conditions loosen.

‘It’s crypto, so price rises create more price rises’

What are the charts telling you?

From a technical perspective, the short-and-long term trends in majors like Bitcoin and Ethereum remain well-entrenched to the downside. I would at least need to see an extended period of basing (i.e., sideways price action) to demonstrate supply has found a balance with demand before I could even contemplate the low is in.

That’s the gentle scenario. The more brutal scenario would be a blow-off low – where sellers capitulate into the current demand vacuum. This would be evidenced by a sharp and substantial price drop on massive volume. A quick clearing of the dead wood, a reset if you will.

Until then, I’ll be watching my trend indicators and the price action for signs demand is returning and supply is backing off.

It’s crypto, so price rises create more price rises. We just need to stop going down first!

History doesn’t repeat, but it sure often rhymes

Speaking of technical analysis, Carl threw us a couple of charts to include in this article. Of course, we could attempt to tell you exactly what they mean and represent ourselves, but we figured we’d best let him do that instead…

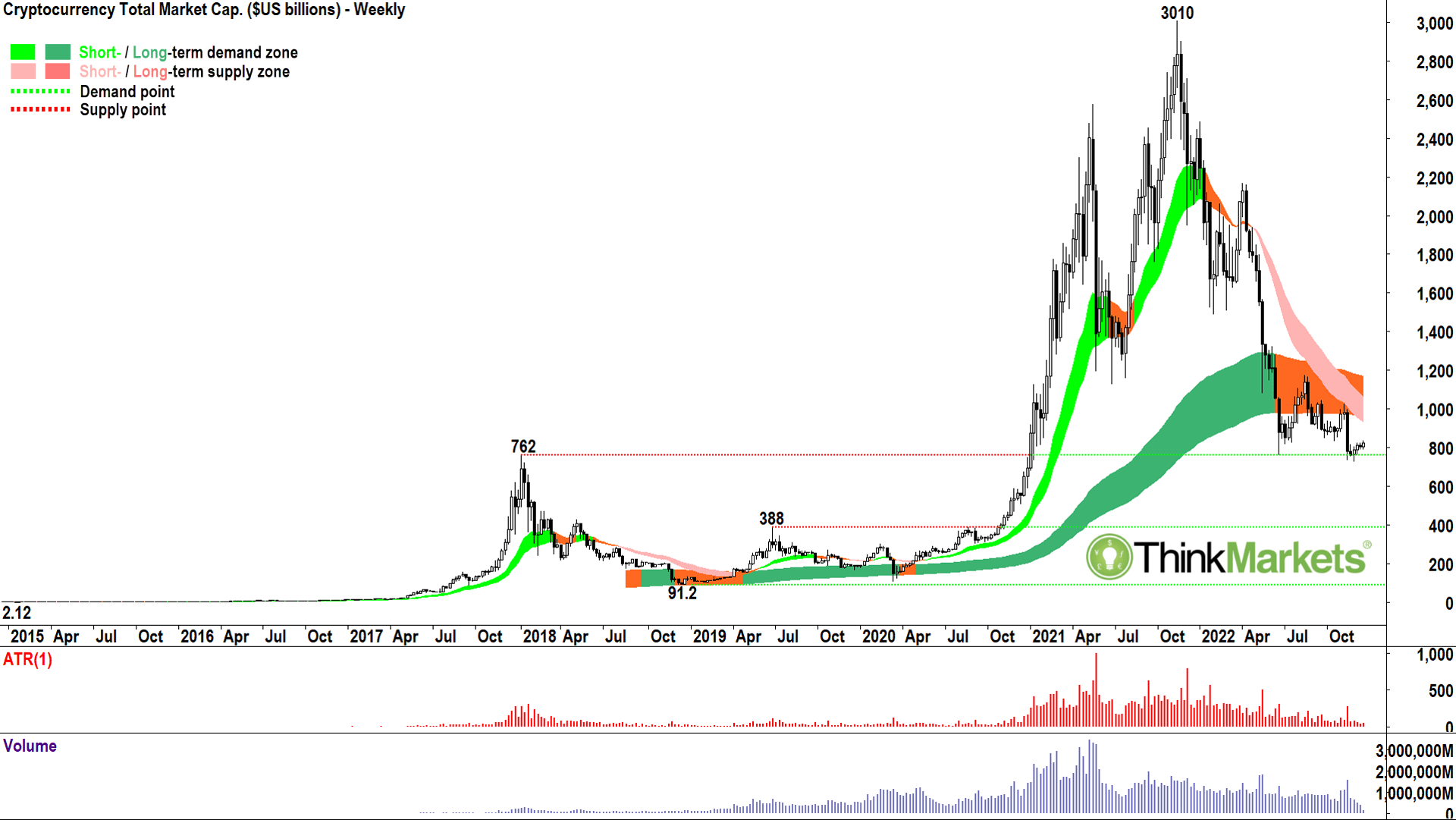

“This is a longer-term (weekly) chart of the crypto universe total market capitalisation,” explained the ThinkMarkets analyst. “The cycles in this confidence driven asset class are clear. The 2020-2022 rise-and-demise pattern appears to be a magnified version of the 2017-2019 move. History doesn’t repeat, but it sure does rhyme (or something to that effect!).

“We’re bumping along the base set by the 2017 bull market high of $762 billion, but failing it, we could see a move back to the 2019 bull market high of $388 billion. The shorter-term trend ribbon is clearly set to the downside, and the longer-term trend ribbon is rolling over – typically a sign the short-term downtrend can extend further.

“Candles and price action show the downdrafts are far more severe than the rallies, a typical distribution pattern. In short – I can’t see the signs a long-term low is being forged here.

“Finally, note how volatility and volume have been on a steady decline since the 2021 peak. Volatility (particularly upside volatility) creates interest, and interest is the hydrogen which inflates the crypto balloon!

“Similarly, volume demonstrates interest at the coalface, i.e. where the assets are changing hands. There was a similar volatility and volume drop off after the 2017 bull market. I would need to see both indicators swing higher to call an end to the current bear market.”

‘Crypto thrives on FOMO’

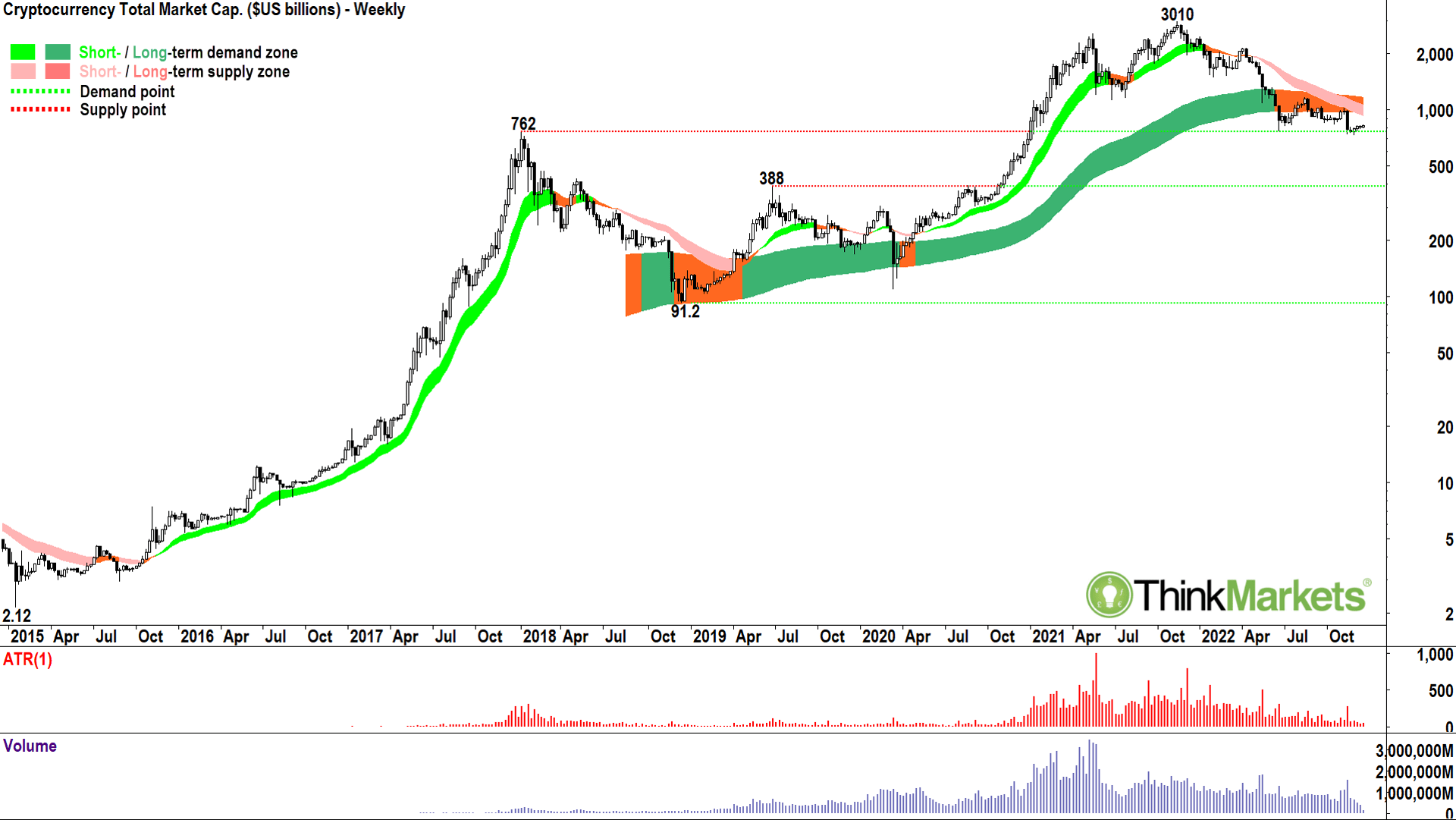

“This time I’m using a logarithmic chart,” continued Capolingua. “All moves now can be compared on an equal basis in terms of their percentages. This chart shows that despite all the hype of the 2020 bull market, it paled in comparison to the 2015-2017 run.

“The decline from the 2017 high to the 2018 low was just over 88%. If it were to repeat that peak-to-trough decline this time, we could be looking at a low around the 2019 bull market high of $388 billion. This would not surprise me based upon the technicals discussed above.

“In either case (linear or logarithmic scales), it’s hard to get really excited about a meaningful and sustainable rally in crypto until we’re trading back above the long-term trend ribbon. This implies a crypto universe total market capitalisation of greater than $1.18 trillion (USD).

“These are all just numbers on a chart and may appear meaningless to the ‘crypto is going to change the world’ die-hards, but my view as a technical analyst is: Nothing makes a market more attractive to potential investors than rising prices.

The most powerful stimulant of investors’ animal spirits is the fear of missing out. Crypto thrives on #FOMO! So, my view is crypto needs to go up so crypto can go up!”

Having shared his largely bearish viewpoints with us, Capolingua did recently tweet out the following in response to the market ticking up slightly after some cooler-than-expected US CPI inflation data:

#Bitcoin update:

What doesn't kill you makes you stronger!? 🤔

Post #FTX low @ 15563 holding

Pressure on ST trend easing / price action shows basing pattern = demand holding 💪

But! Still killer LT downtrend = ⚠

Scope for drift 📈 to $20k vs Close < 15563 = 📉☠#crypto pic.twitter.com/NOpNhBzwtl

— Carl Capolingua (@CarlCapolingua) December 13, 2022

Dare we dream?

Carl Capolingua is a Melbourne-based analyst with global broker ThinkMarkets, and has more than 30 years’ experience in financial markets. He’s held senior analyst roles at a number of financial institutions and specialises in Australian and US stock markets.

None of the views presented in this article represent financial advice.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.