Mooners and Shakers: Fear grips crypto market, and what the frog is going on with Pepe?

Coinhead

Coinhead

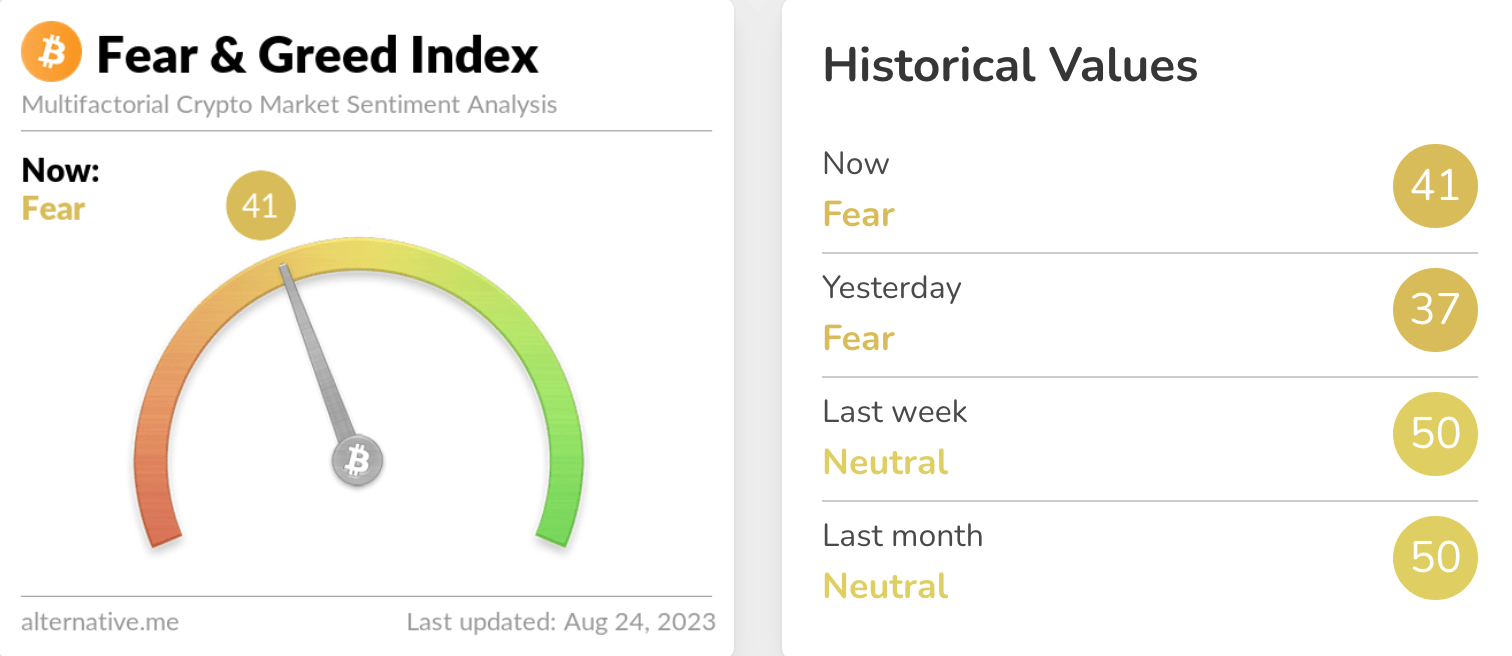

Bitcoin is keeping its head above the US$26k water line for now, but the feeling across the cryptosphere is fearful, according to the leading market sentiment tracker. Meanwhile, what the frog is going on with Pepe?

We’ll briefly examine that particular cartoon amphibian-themed meme coin further below.

But regarding the sentiment tracker – that’d be the Crypto Fear & Greed Index – it’s flipped to fear from recent neutral territory ever since Bitcoin gave up its longstanding US$29k level of intense boredom.

Bit by bit, it’s inching ever closer into its citrussy blood orange zone – ‘Extreme Fear’, which, for some is a squeaky-bottomed time of “why the hell did I pump that last remaining $200 into $PEPE?” self reflection.

For others, however, who have stablecoin dry powder on the sidelines waiting for these very market-dipping moments, it’s quite possibly a time to rub hands together and chuckle to themselves smugly, like Auric Goldfinger, as they prepare to deploy, or step up, Operation Dollar Cost Average.

Now, here’s something else.

Still on matters of sentiment, Santiment, which is one of the leading blockchain analytics outfits, believes the fact that traders are increasingly referring to current conditions as a “bear market” – a term that’s apprarently hit an 11-week high on social platforms – is actually a bullish signal.

Er, wut? Allow them to explain…

“Historically, when traders show FUD (fear, uncertainty and doubt), the probability of price rises increases considerably,” wrote the firm in a new tweet/X post.

🐻 A positive sign that #crypto markets will rebound is the fact that traders are increasingly referring to current market conditions as a #bearmarket. Historically, when traders show #FUD, the probability of price rises increases considerably. https://t.co/jxENgl1nNz pic.twitter.com/K8W7uAotz6

— Santiment (@santimentfeed) August 24, 2023

The bigger-spending end of the crypto investment pool is apparently accumulating Bitcoin again.

“Bitcoin jumped back as high as $26,800 Wednesday as key whale and shark addresses are now collectively adding to their stacks once again,” Santiment continued.

“There are currently 156,660 wallets holding 10 to 10,000 BTC, and they have accumulated $308.6 million since August 17th.”

The world’s most dominant Game of Life and Monopoly winner, the US$10 trillion asset manager BlackRock, as every man, woman and Doge in the crypto space knows by now, is sniffing around the market’s beloved Bitcoin, and has been for some time now.

It’s widely assumed to be the leading candidate for approval of the first spot BTC ETF in the US. That is, if someone will ever lever the SEC’s Gary Gensler away from where he’s lying – right in the way in the middle of that road.

There have been rumours going around that the Larry Fink-led firm has been accumulating an absolute shedload of the bull goose crypto asset over the past three months.

Certainly someone or something has, with one address reportedly responsible for the purchase of a whopping 118,000 BTC in that time – which represents more than US$3.1bn.

🤯🏦🚀 Explosive news in the crypto world! Rumors swirling that financial titan BlackRock is using Coinbase to quietly accumulate #Bitcoin . 🌐🔥

When giants like BlackRock make moves, it's hard to ignore. 📈💼

Could this be a game-changer for the crypto market? Keep your eyes… pic.twitter.com/kVIusNp4V8

— Seth (@seth_fin) August 23, 2023

It's Gemini. Not Blackrock.

— CoinScreener.ai (@coinscreener_ai) August 22, 2023

“Crypto Rover” there was one analyst suggesting it might be BlackRock, although others think it was the Winklevoss twins’ exchange and custody firm Gemini.

In any case, Rover continued with another popular BlackRock-based theory doing the rounds…

BlackRock aims to reduce the price of #Bitcoin, enabling them to purchase at a more favorable rate.

Once they've sufficiently acquired their desired amount, the Spot #Bitcoin ETF will be introduced, marking the onset of a Bull Market.

This is expected to happen in 2024. pic.twitter.com/B3cyEduamF

— Crypto Rover (@rovercrc) August 24, 2023

Finishing this little chin stroke, though, a reminder from Lark “the Crypto Lark” Davis…

Reminder, Blackrock will pump our Bitcoin bags, but they are not our friends… far from it indeed. pic.twitter.com/OZGlB7JAov

— Lark Davis (@TheCryptoLark) August 24, 2023

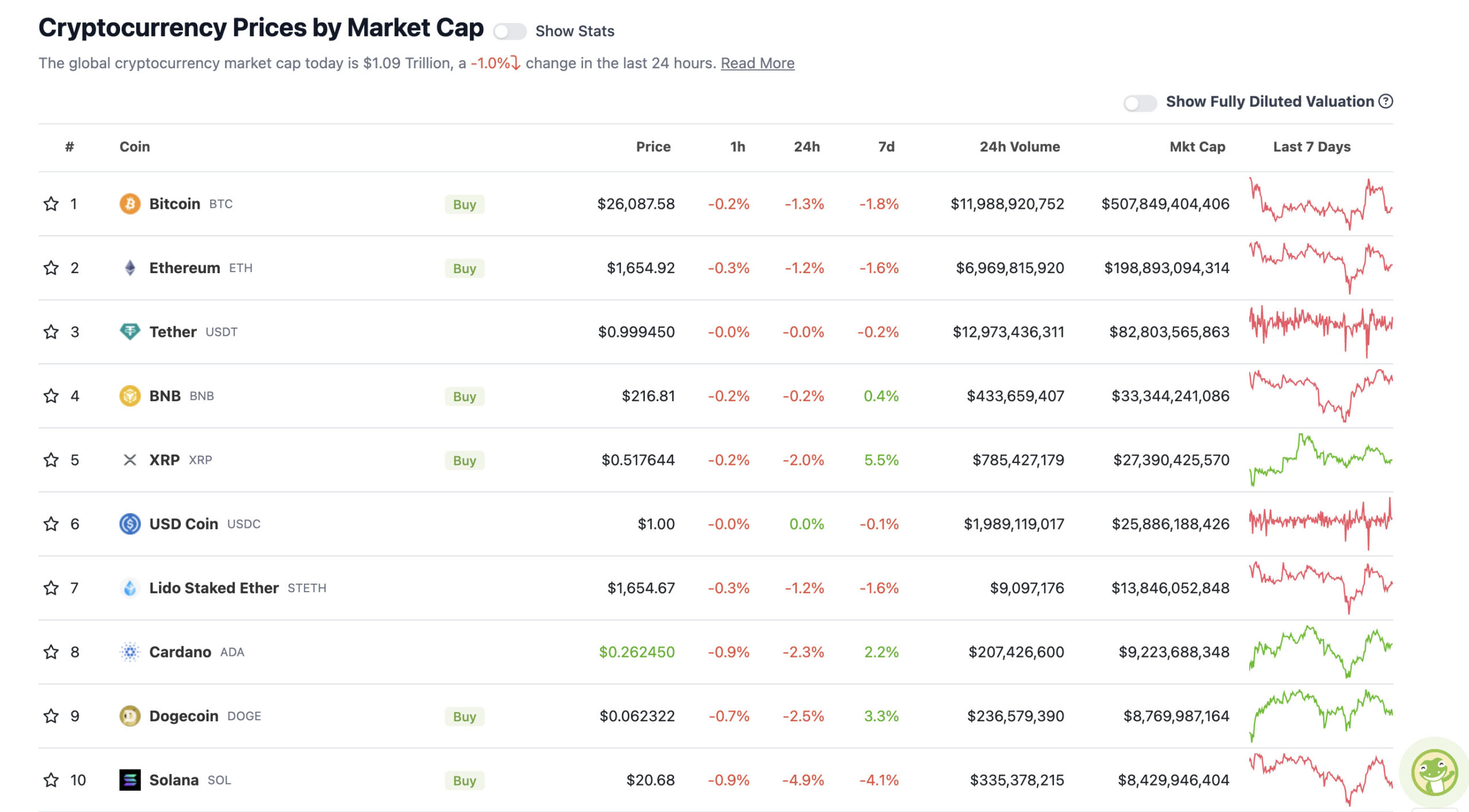

With the overall crypto market cap at US$1.09 trillion, down a tad since this time yesterday, here’s the current state of play among top 10 tokens – according to CoinGecko.

Some of the biggest 24-hour gainers and losers at press time. (Stats accurate at time of publishing, based on CoinGecko.com data.)

PUMPERS (11-100 market cap position)

• Rollbit Coin (RLB), (market cap: US$559 million) +1%

Annnd, that’s it for the pumpers on this Friday afternoon in the cryptoverse.

Rollbit, eh? What is it again? It’s an online crypto-based casino narrative – a platform that combines casino-style gaming and crypto trading with up to 1,000x leverage, incorporating its RLB utility token.

Look, it’s not exactly our favourite crypto narrative, considering crypto trading and investing feels risky enough as it is… but it’s certainly had a barnstorming year to date. And, in fact, it’s up more than 11,000% over the past 12 months. Mind boggling, really.

SLUMPERS

• Pepe (PEPE), (market cap: US$368 million) -21%

• Sui (SUI), (market cap: US$394 million) -9%

• THORChain (RUNE), (market cap: US$440 million) -9%

• ImmutableX (IMX), (market cap: US$626 million) -9%

• Maker (MKR), (market cap: US$909 million) -8%

• Injective (INJ), (market cap: US$599 million) -7%

Okay, then, – Pepe the frog coin, what’s up (actually down)?

The price of $PEPE has plopped off its near $500m market capped lily pad today and has sunk more than 20% at the time of writing.

This reportedly comes after recent changes to a “multisig wallet” and new token transfers, which have caused ripples of fear regarding a “rug pull” by the “project’s” developers.

1/4

1 hour ago, the Pepe multisig wallet, changed the amount of signatures required on their multisig from a 5/8 to 2/8. This comes after sending $15.7 million worth of $PEPE to exchanges.

A breakdown of what we know: pic.twitter.com/bxBxp6Nzqz

— ASXN (@asxn_r) August 24, 2023

Those transfers are $16m worth of $PEPE, and about 3.8% of the total supply of the coin. According to data from blockchain custody app Safe Global, they were moved from the developers’ wallet to various crypto exchanges, made overnight (AEST).

Allegations aimed at the developers, accusing them of getting the hell out of dodge have been coming thick and fast on social media, causing a swell of negative sentiment round the popular meme coin.

Lmfao I love the blockchain. The moment $Pepe devs moved the threshold for their multi sig to 2 (to rug ?) that shit was such a gift of a short ….

Just follow the chain …. It’s all transparent pic.twitter.com/6ymN4S2IyU

— Wizard Of SoHo (🍷,🍷) (@wizardofsoho) August 24, 2023

Some pertinence and randomness that stuck with us on our morning moves through the Crypto Twitterverse.

Could Bitcoin Crash to $22,000 In September?

To answer this question, we need to first focus on August

What was the worst #BTC August drawdown in history?

-17% in 2014 and -18% in 2015

Currently in 2023, $BTC is now down -16%

If BTC were to drop -18% this August, BTC would… pic.twitter.com/58pJKUwvHj

— Rekt Capital (@rektcapital) August 24, 2023

Sam Spratt's 'IX. The Monument Game' was just purchased for 420.69 ETH from @kukulabanze 🫨

One of the most competitive bidding wars I can remember for some time.

Now for the 'Player' editions to go live. pic.twitter.com/8uhgdhgj8H

— Matt Willemsen (@matt_willemsen) August 24, 2023

Apple (AAPL) has been the largest part of my stock portfolio since 1998. I also traded AAPL every day of my life for 18 years straight. I even made owning AAPL a requirement to join my organization. That's how obsessed I was with it. Now that obsession has moved to #Bitcoin… pic.twitter.com/Wg5XVFI4xr

— Oliver L. Velez ⚡️ 13% Bitcoiner (@olvelez007) August 24, 2023

BREAKING: 🇴🇲 Oman is investing $1.1 Billion on #Bitcoin Mining Infrastructure – Forbes 🔥

— Bitcoin Archive (@BTC_Archive) August 24, 2023