Mooners and Shakers: Bitcoin steadies but stares nervously down a Jackson Hole

Coinhead

Coinhead

Bitcoin bounced a bit overnight, back above US$26k, where it’s remained steady for several hours now.

Look, it’s not the world’s most thrilling update, but we’ll take that over capitulation and yet more “Bitcoin is dead” (again) sentiment.

Speaking of which, let’s check in with the official source for how many times Bitcoin has kicked the bucket – the Bitcoin Obituaries site belonging to crypto info platform 99bitcoins.

The most recent “death” was a couple of days ago (a mention from billionaire investor Chamath Palihapitiya, who actually said “Crypto is dead in America”) but, for the Bitcoin-focused site, that brings the deceased BTC figure up to 474.

Palihapitiya, by the way, has made a ton of money from the crypto market in the past, regularly appears as a guest on the All-In YouTube channel, and seems to change his crypto predictions tune about as often as Coinhead changes its underpants. (Which is quite a lot, especially during the bear market.)

Generally speaking, however, Palihapitiya has been known as a long-term Bitcoin bull. For full context, he’s talking about crypto’s woes in America at the moment as it continues to stay in SEC lawman Gary “The Gunslinger” Gensler’s gun sights.

Allow us to explain.

US Federal Reserve boss Jerome Powell is due to return to Wyoming for the Jackson Hole Symposium – a financial forum that often winds up with the Fed’s comments influencing the trajectory of markets.

Last year at this event, Powell struck a hawkish tone (something he’s pretty good at) and a significant price drop in markets ensued.

Keith Alan from crypto/blockchain data analytics gurus Material Indicators is wary of that happening again, based on a set of similar looking charts and conditions leading into the event to what we had at pretty much exactly this time last year.

Remember when #FED Chair #Powell spoke from Jackson Hole last year and his hawkish tone triggered a 29% #BTC dump that took 5 months to recover? 🤮#JPow returns to #JHole this Friday and there are some similarities in the PA we are seeing now and the PA we saw leading up to… pic.twitter.com/GqhsnSFgBz

— Keith Alan (@KAProductions) August 23, 2023

That said… Alan also notes that since last year’s Jackson Hole event, that are some circumstantial macro differences:

“To be clear, the similarities in the current PA, relative to last year’s PA do not mean that price will react the same way this time.

“Since last year’s event, core inflation has come down and JPow has become much more measured in his comments. Besides, we don’t know if he’ll be hawkish or dovish.”

For good measure, let’s grab some bullish takes, before we check the price action and get on out of here for another day.

Firstly, here’s the founder of crypto investment firm Pantera Capital, Dan Morehead, who believes the crypto market has seen enough pain this cycle.

“Our view is that we’ve seen enough,” Morehead wrote in his firm’s latest blog post. “There’s just so long markets can be down.”

#Bitcoin recently experienced the longest period of negative year-over-year returns in its history, lasting 15 months.

The longest period prior was just under a year.

Our view is that we’ve seen enough – there’s just so long markets can be down.

More: https://t.co/REfxkTp9CJ pic.twitter.com/UCEMMcznAM

— Dan Morehead (@dan_pantera) August 23, 2023

What goes down, must, er, go up? Look, we’ll take it.

“Bitcoin experienced the longest period of negative year-over-year returns in its history, lasting 15 months (2/8/22–6/12/23),” notes Morehead and Pantera further,” adding: “The longest period prior was just under a year (11/14/14–10/31/15).

“We believe the combination of recent positive events – the XRP ruling and endorsements by BlackRock et al. – in addition to the Bitcoin Halving expected to occur in April 2024, provide a strong setup for the next bull market for digital assets.”

Meanwhile, there’s this, too, from another analytics firm, Glassnode, which thinks Bitcoin could be readying for a moon mission of all-time-high epic-ness sooner than many are predicting. And that’s based on the US dollar peaking out, “setting the stage for a prime bitcoin environment”.

Bitcoin's Last Consolidation Phase

📉 Dollar expected to peak at 106 level, setting the stage for a prime bitcoin environment.

🍂 Up next: Bitcoin aiming for 37K before soaring higher in the autumn ! #Bitcoin #DollarIndex @HenrikZeberg pic.twitter.com/37OaEzDHK9

— 𝗡𝗲𝗴𝗲𝗻𝘁𝗿𝗼𝗽𝗶𝗰 (@Negentropic_) August 21, 2023

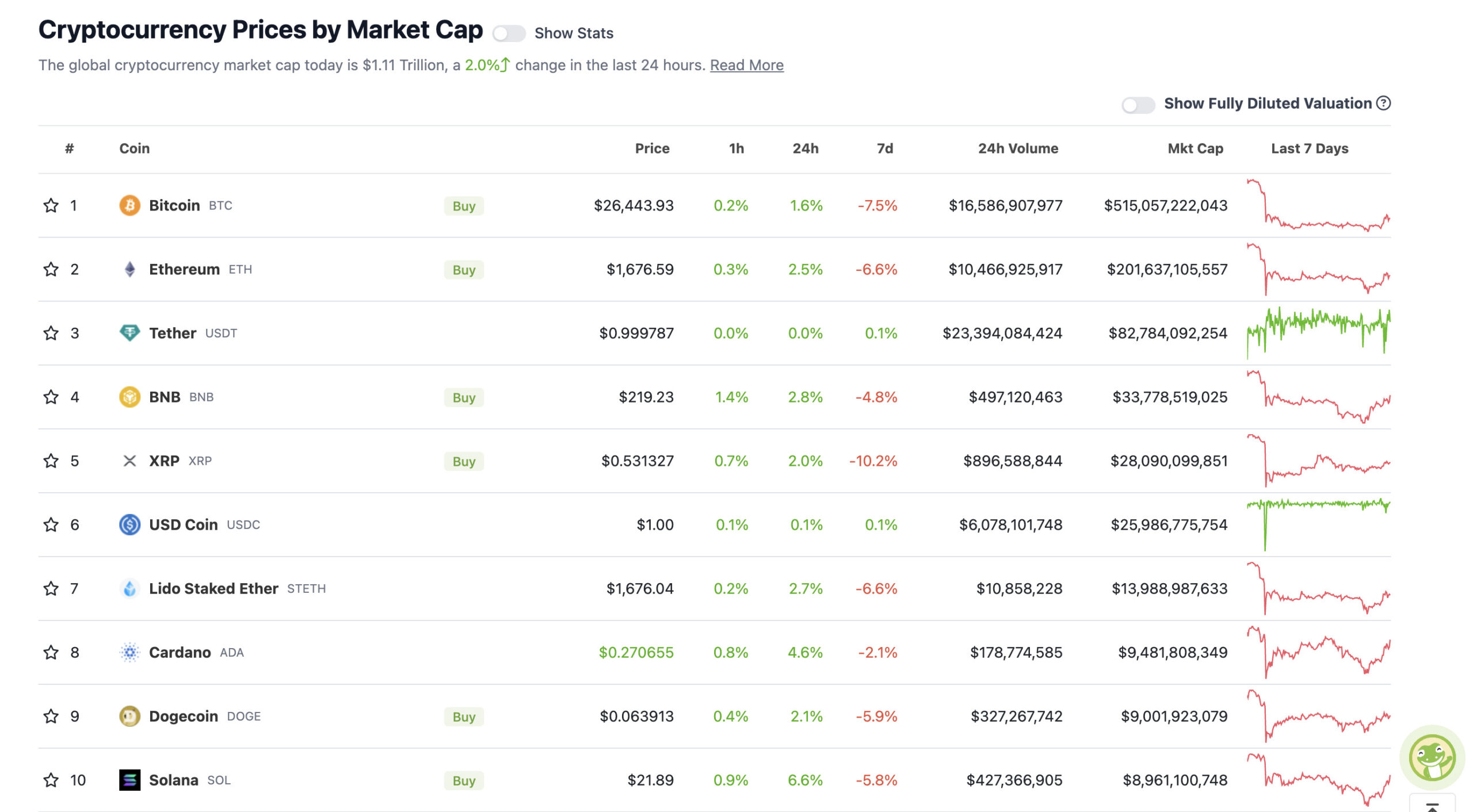

With the overall crypto market cap at US$1.11 trillion, pretty flat since this time yesterday, here’s the current state of play among top 10 tokens – according to CoinGecko.

Solana is up on the news that Solana Pay is integrating with Shopify, one of the world’s biggest e-commerce platforms, for a new payment function.

The protocol will now be included as a payment option on Shopify and USDC, the second-biggest stablecoin by market cap, will be the first crypto payment option for the integration.

1/ 🛍️Shopify 🤝Solana Pay

Today, Solana Pay integrates with @Shopify, empowering the millions of entrepreneurs and merchants on Shopify to accept fast, web3 native payments with no transaction fees through the end of 2023. https://t.co/q63KeBllXB

Learn more 👇 pic.twitter.com/QEb1LzqS51

— Solana (@solana) August 23, 2023

Some of the biggest 24-hour gainers and losers at press time. (Stats accurate at time of publishing, based on CoinGecko.com data.)

PUMPERS (11-100 market cap position)

• dYdX (DYDX), (market cap: US$379 million) +11%

• ImmutableX (IMX), (market cap: US$683 million) +9%

• FRAX Share (FRAX), (market cap: US$452 million) +8%

• Render (RNDR), (market cap: US$548 million) +7%

• Maker (MKR), (market cap: US$984 million) +7%

SLUMPERS

• Monero (XMR), (market cap: US$2.578 billion) -3%

• Optimism (OP), (market cap: US$1.2 billion) -2%

Some pertinence and randomness that stuck with us on our morning moves through the Crypto Twitterverse.

NEW: It does seem bizarre to approve a #Bitcoin futures ETF and not a spot ETF in the USA – Financial Times

Yes, very bizarre… 🤨

— Bitcoin Archive (@BTC_Archive) August 23, 2023

$BTC is the most oversold since the Covid-19 drop.

Whether your macro bearish or not, you should not be looking to add or start short positions here.

Trading is about managing risk/reward and right now the risk is far greater on shorts than the reward.#bitcoin #cryptocurrency

— Roman (@Roman_Trading) August 23, 2023

As an engineer at Alameda Research, I had my entire life savings stolen from me by my former boss: Sam Bankman-Fried.

Now, after months of recuperation from the craziness of the FTX collapse, I’m ready to tell my story.

Let’s start at the beginning:

(1/25) 🧵#SBF #FTX pic.twitter.com/x5wKvT0Dy2

— Adi (e/acc) (@aditya_baradwaj) August 23, 2023