Mooners and Shakers: Bitcoin resisted; ‘Frog Nation’ cryptos plummet over Wonderland drama

Coinhead

Coinhead

As the dust settles after yesterday’s ultimately “hawkish” briefing on inflation tactics from the US Fed, Bitcoin has slipped back into rangebound, heavily resisted territory.

Meanwhile, a key figure involved in the Wonderland DeFi protocol has been outed as having a financially shady past, causing further dumpage to the TIME price and related “Frog Nation” tokens (see more, further below).

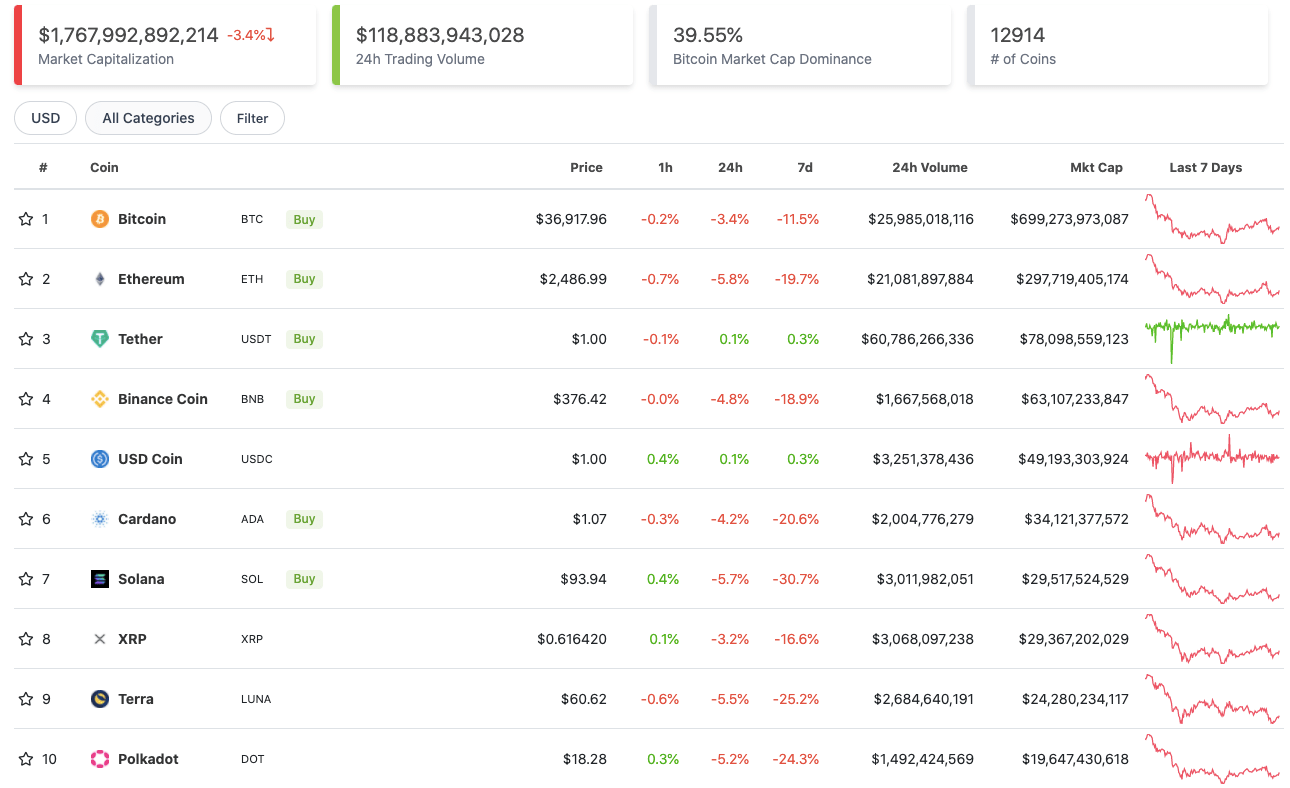

With the overall crypto market cap down about 3.5% over the past 24 hours, here’s the state of play in the top 10 by market cap at the time of writing – according to CoinGecko data.

Having led the charge into yesterday’s pre-FOMC meeting relief rally yesterday, Ethereum (ETH) is leading the top 10 coins back down out of it at the present moment with a 5.8% dip over the past 24 hours.

The Market Mover in Chief, Bitcoin (BTC), meanwhile looks to be meekly sliding back into its recently familiar “consolidation” range, which is about $US28k to US$38k, according to the analyst Rekt Capital.

Both he, and Dutch trader Michaël van de Poppe are targeting a similar level for the OG crypto that must flip into support if any kind of bullish conversation is to renew for the market.

#Bitcoin rejected at $38K and hit the first important level of support at $36K here.

Might have a short-term bounce, but anything sub $37.5K isn't shouting for bullishness. pic.twitter.com/cDXR5AEroM

— Michaël van de Poppe (@CryptoMichNL) January 27, 2022

Things are shaky and uncertain, at least in the short term, for crypto prices (and plenty of other assets) right now. And as has been well documented, that’s partly based on the Fed’s hawkish tone about belt-tightening and interest-rate hikes this year as well as some other macro-economic and global political factors at play.

Let’s see how the US stock markets, still a bit of a leading indicator for crypto, react today. At the present moment, the S&P 500 and Nasdaq have opened in a “hmm, yeahnah, dunno” kinda mood, trading pretty flat at about +0.3%.

Sweeping a market-cap range of about US$19 billion to about US$871 million in the rest of the top 100, let’s find some of the biggest 24-hour gainers and losers at press time.

DAILY PUMPERS

• The Sandbox (SAND), (market cap: US$3.16b) +6%

• Theta Network (THETA), (mc: US$3b) +5.5%

• FTX Token (FTT), (mc: US$5.4b) +4%

• Filecoin (FIL), (mc: US$3b) +3%

• Decentraland (MANA), (mc: US$3.5b) +2.5%

DAILY SLUMPERS

• Celsius Network (CEL), (market cap: US$870m) -11%

• OKB (OKB), (mc: US$5.4b) -10%

• Quant (QNT), (mc: US$1.3m) -9.7%

• Waves (WAVES), (mc: US$1b) -9%

• Axie Infinity (AXS), (mc: US$3.5b) -8.8%

Moving below the crypto unicorns (in some cases well below), here’s just a selection catching our eye…

DAILY PUMPERS

• cVault.finance (CORE), (market cap: US$129m) +40%

• Numeraire (NMR), (mc: US$163m) +28%

• Pegaxy Stone (PGX), (mc: US$35m) +27%

• Trader Joe (JOE), (mc: US$163m) +19%

• Netvrk (NTVRK), (mc: US$85m) +18.5%

DAILY SLUMPERS

• Wonderland (TIME), (market cap: US$317m) -42%

• Popsicle Finance (ICE), (mc: US$55m) -41%

• Spell Token (SPELL), (mc: US$461m) -30%

• Redacted Cartel (BTRFLY), (mc: US$113m) -27%

• Opulous (OPUL), (mc: US$33.6m) -22%

Soooo… TIME, ICE and SPELL… also known as three protocols within the “Frog Nation” suite of DeFi projects spearheaded by Daniele Sestagalli… Here’s the unfortunate story for their investors, in a nutshell.

The identity of Avalanche-based DeFi protocol Wonderland’s treasury manager “0xSifu” has been revealed to be Michael Patryn, the co-founder of the collapsed Canadian crypto exchange QuadrigaCX.

QuadrigaCX made news in 2019 after its operator, and Patryn’s former partner, Gerald Cotten made off with US$169 million of investors’ funds.

According to reports, following the fallout from the exchange’s rort, Patryn was identified as Omar Dhanani, a financial criminal who spent 18 months in prison in the US on identity-theft charges in 2005.

Fast forward to today, and Patryn (or Jason Bourne, or whatever it is he’s now calling himself in the past five minutes) has been freshly “doxxed” again, by a self-described “on-chain sleuth” who goes by the Twitter handle “zachxbt.eth”.

1/ This needs to be shared @0xSifu is the Co-founder of QuadrigaCX, Michael Patryn. If you are unfamiliar that is the Canadian exchange that collapsed in 2019 after the founder Gerald Cotten disappeared with $169m

I have confirmed this with Daniele over messages. pic.twitter.com/qSfWNnQPhr

— zachxbt (@zachxbt) January 27, 2022

What seems almost as galling for Wonderland investors, is that it turns out that Daniele Sestagalli – the well-respected founder of Wonderland, abracadabra.money (SPELL) and Popsicle – was aware at least a month ago of 0xSifu’s real identity yet had chosen to do nothing about it.

It is really cool you have a new friend and your family likes him, but this not how you run a 1B fund.

That's not some sort of hobby project anymore.It's time to act like a professional or much more than just your reputation is on the line. You are "playing" with others money

— Ed_NL (@Crypto_Ed_NL) January 27, 2022

In a further statement, Sestagalli wrote: “Now having taken some time to reflect, I have decided that he [Patryn] needs to step down till a vote for his confirmation is in place. Wonderland has the say to who manages its treasury not me or the rest of the Wonderland team.”

While Wonderland has dumped the hardest, now down 96.8% from its November peak, all of Sestagalli’s DeFi projects are unfortunately taking a collateral-damage hit today.

This pretty much sums up the mood on Crypto Twitter today regarding the Wonderland/Frog Nation fallout…

my thoughts on frog nation pic.twitter.com/bLdh3ZhHeC

— theweeknd.eth (@LilMoonLambo) January 27, 2022