Mooners and Shakers: Crypto market cautiously positive ahead of Fed announcement

Coinhead

Coinhead

With about two hours (at the time of writing) till the fateful US Federal Reserve briefing on inflation-tackling measures, the crypto market has been in “relief rally” mode, regaining some of its recent lost ground.

And it’s been a frenetic 24 hours for news, with various revelations possibly contributing to a more positive vibe on top of rumours the Fed’s short-term interest-rate hikes might not be as severe or imminent as first expected.

(And yep, that hit of hopium might’ve aged like milk by the time you’re reading this.)

— Lyn Alden (@LynAldenContact) January 26, 2022

Two of the bigger news bites doing the rounds right now include…

• Russia’s president Vladimir Putin reportedly indicating he’s not on board with his central bank’s plan to ban crypto in the nation.

BREAKING 💥 President Vladimir Putin: Russia has "some advantages" in #Bitcoin mining 🇷🇺 pic.twitter.com/sJGKx8pIMs

— Bitcoin Magazine (@BitcoinMagazine) January 26, 2022

While acknowledging volatility risks inherent in the asset class, Putin said in a video conference that Russia has “certain competitive advantages, especially in so called crypto mining”. He was referring specifically to “surplus in electricity and well-trained [crypto] teams present in the country”.

• American commercial bank Five Star‘s announcement of a partnership with New York Digital Investment Group (NYDIG) to allow customers to buy, sell, and hold Bitcoin by the middle of 2022. Five Star is a US$5 billion financial institution. Quite big, then.

On to various crypto price movements…

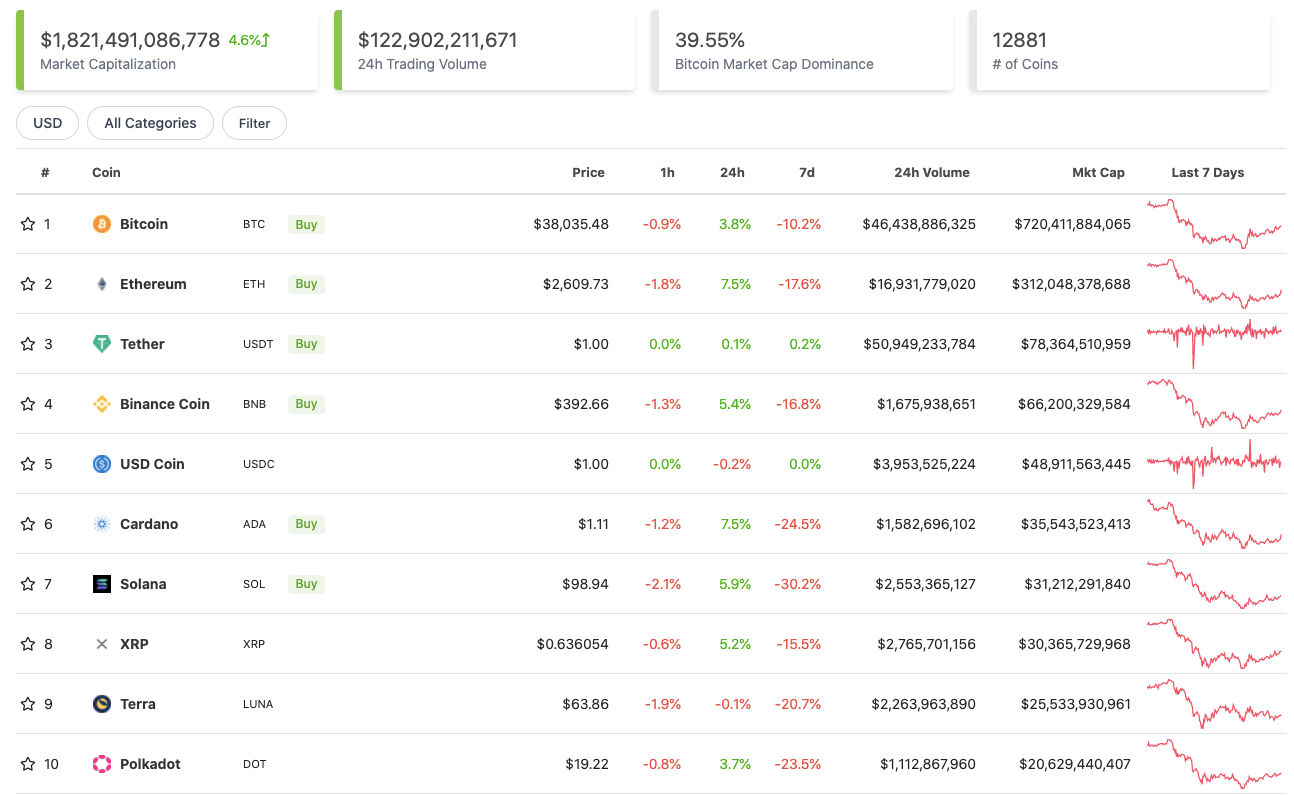

With the overall crypto market cap up about 7% over the past 24 hours, here’s the state of play in the top 10 by market cap at the time of writing – according to CoinGecko data.

The no.2 crypto by market cap, Ethereum (ETH), is leading the top-10 gains today, perhaps on the back of some general positive sentiment around the “rebrand” of its building network upgrade, phasing out “Eth2” and “Eth 2.0” terminology.

It can’t hurt, either, that Ark Invest (US$23.9 million assets under management) has just publicly indicated it sees ETH reaching as high as US$180,000 per coin before the end of the decade. (Along with a… ahem… US$1 million Bitcoin.)

Sweeping a market-cap range of about US$20 billion to about US$900 million in the rest of the top 100, let’s find some of the biggest 24-hour gainers and losers at press time.

DAILY PUMPERS

• Theta Fuel (TFUEL), (market cap: US$1.1b) +33%

• Waves (WAVES), (mc: US$1.1b) +32%

• Helium (HNT), (mc: US$2.9b) +21%

• Gala Games (GALA), (mc: US$1.64b) +18%

• Ecomi (OMI), (mc: US$1.85b) +17%

DAILY SLUMPERS

• Pocket Network (POKT), (market cap: US$902m) -7%

• Cosmos (ATOM), (mc: US$9.9b) -5%

• Maker (MKR), (mc: US$1.64m) -3%

• Osmosis (OSMO), (mc: US$2.46b) -2%

• OKB (OKB), (mc: US$5.9b) -1%

Moving below the crypto unicorns (in some cases well below), here’s just a selection catching our eye, including three GameFi projects and two DeFi protocols (Frontier and Maple)…

DAILY PUMPERS

• Luna Rush (LUS), (market cap: US$7.5m) +80%

• Frontier (FRONT), (mc: US$46m) +60%

• Decentral Games (DG), (mc: US$135m) +50%

• Maple Finance (MPL), (mc: US$63m) +22%

• Fancy Games (FNC), (mc: US$13.6m) +18%

DAILY SLUMPERS

• SquidDAO (SQUID), (market cap: US$16.7m) -26%

• Wonderland (TIME), (mc: US$528m) -25%

• Popsicle Finance (ICE), (mc: US$92m) -13%

• Aeternity (AE), (mc: US$38m) -9%

• Spell (SPELL), (mc: US$643m) -8%

Wonderland, part of renowned DeFi architect Daniele Sestagalli’s group of developing products, is having a shocker this week, with its token price now having fallen 95% since its November all-time-high.

The project has reportedly suffered a major “liquidation cascade”, according to this Crypto Briefing article.

So…. Wonderland is now a SPAC that uses its balance sheet to bail out leveraged $TIME degens that got liquidated as a result of the CEO's leveraged TIME position triggering a cascading liquidation.😆

Did I get that right? 🤣 https://t.co/xbjPm75Qvu

— DefiMoon 🦇🔊 (@DefiMoon) January 26, 2022

I went a couple of hours offshore to wind down. Now I’m back and if you think I’m not going to fight to maintain the roadmaps and deliver the best shit in DeFi you’re completely wrong anon. You can take away some of my money but you can’t take away my passion for building !

— Daniele never asks to DM (@danielesesta) January 26, 2022

Not to dampen a better day in the market, but… some very big brains in the crypto space concerned with pushing positive regulations through in the US have highlighted another brewing governmental storm cloud.

It’s regarding the proposal of a “special measures” power for the US Treasury Secretary that, if granted, could have potentially dire ramifications for the crypto industry in the US.

Jerry is not an alarmist by nature; quite the opposite. When he uses double sirens & all-caps, you know it's time to pay attention. Read this & stay tuned 👇 https://t.co/YS4f0ZukfJ

— Jake Chervinsky (@jchervinsky) January 26, 2022

Yeah, we’ve heard these sorts of concerns before… But given the fact this would empower essentially one person with the ability to ban exchanges and other financial institutions from engaging in crypto transactions, this is potentially another very serious US regulatory issue that will needs strong, opposing voices.

Ah, whatever, probably just a storm in a teacup… right?

First they ignore you, then they laugh at you, then they fight you, then you win. Let's do this #Bitcoin https://t.co/uj0Ihk3Ut0

— Tyler Winklevoss (@tyler) January 26, 2022

https://twitter.com/raphschoen/status/1486241753032273921