You might be interested in

Coinhead

Animoca Brands reveals strong financial position as it looks to capitalise on a big web3 year

Coinhead

The Bitcoin Halving: This Time it’s Institutional – coming to a crypto portfolio near you

News

Coinhead

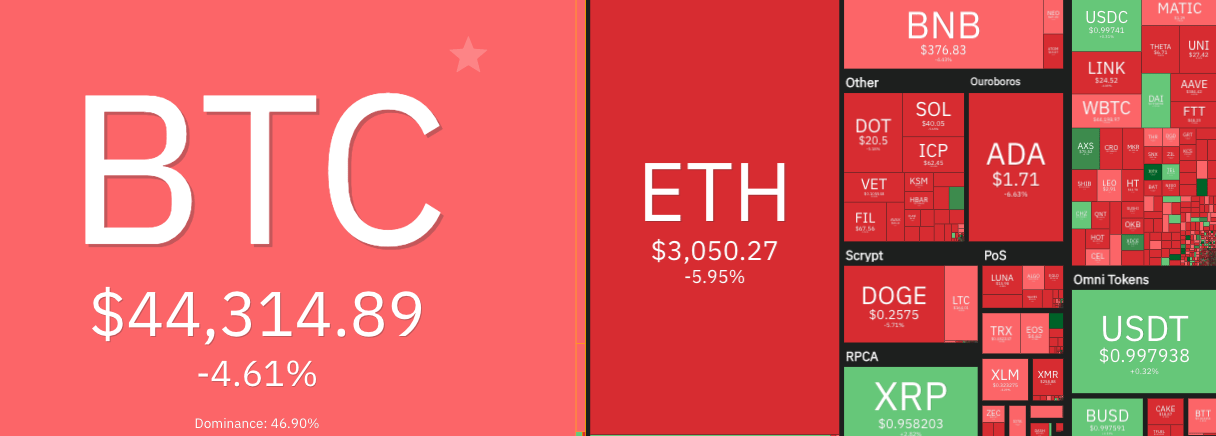

The crypto market has lost quite a bit of steam as we grind towards the weekend, but Bitcoin’s “golden cross” chart pattern still looks like playing out on Friday or Saturday.

“In retrospect, it was inevitable”, tweeted Elon Musk in January about buying Bitcoin (BTC), sending the market parabolic for a while. And the quote works just as well for any post-pumpage crypto dip, which we’re having right now.

In spite of some air being released from crypto today, though, Bitcoin is still heading towards a golden-cross moment, according to popular crypto technical analyst Rekt Capital.

The opposite of a “death cross”, the golden variety occurs when the short-term exponential moving average (EMA) breaks above its long-term exponential moving average. The 50-day and 200-day EMAs are at play in this instance.

https://twitter.com/Stoiiiiiic/status/1425841460134309891

But wait… let’s not get too excited about this supposedly bullish chart indicator just yet. Some view both golden and death crosses as lagging indicators. If those people are right, any price positivity from the golden cross may have already occurred.

As for Ethereum (ETH), it’s in danger of losing its US$3K level at the time of writing, but its many proponents are sticking to the protocol’s strengthening gas-burning narrative.

More than $100M in $ETH has been burnt since the recent #Ethereum fork. pic.twitter.com/QAtU8bNgy3

— Marvin Steinberg 🦄 (@MarvinSteinberg) August 12, 2021

It’s been an eye-opening week for DeFi. The US$600 million Poly Network fiasco was one of the biggest individual thefts the world has ever seen, let alone the biggest ever in crypto.

And now we’ve got another one. DAO Maker (not to be confused with MakerDAO), a crypto project fundraising platform, was exploited today to the tune of US$7 million, according to Coindesk and China-based blockchain security analysis firm PeckShield.

What’s with these similar name hacks lately

PolyNetwork ❌

Polygon Network ✅DAO Maker ❌

Maker DAO ✅— tomuky.eth ⟠ (@tomuky) August 12, 2021

The hacker reportedly accessed the protocol’s balance by taking advantage of a bug on DAO Maker’s contract. Ah yes, the old bug-on-the-contract trick – straight from the “shadowy super coder” handbook.

In a Twitter thread, DAO Maker revealed that 5,521 users were affected, with an average loss of US$1,250.

The project’s CEO, Chris Zaknun, was conducting a livestream at the time of writing and has pledged to reach out to all affected DAO Maker users over the next five days, once his team have figured out a compensation plan.

Meanwhile, the Poly Network hacker, who even Poly Network themselves are now calling “Mr White Hat”, is still in the process of returning large portions of the assets he stole.

As our communication with Mr. White Hat is going on, the remaining user assets on Ethereum are gradually transfered to the multisig wallet (0x34D6B21D7B773225A102b382815e00Ad876E23C2) requested by Mr. White Hat. pic.twitter.com/FdSfJ6ZIUt

— Poly Network (@PolyNetwork2) August 12, 2021

Happy-ish ending for Poly Network or not, all these latest DeFi exploits are certainly keeping the increasingly important insurance players in the crypto space interested…

Looks like a rough week on the hack front 😬

Don't put off getting covered any longer. It's not worth it.

🐢🐢

— Hugh Karp 🐢 (@HughKarp) August 12, 2021

• Uniswap has become the first DeFi protocol to generate more than US$1 billion worth of fees paid to liquidity providers.

• DBS Bank, a Singaporean multinational, has been approved by the Monetary Authority of Singapore to offer crypto services to asset managers and companies.

• Coinbase has beaten analysts’ expectations by about US$300 million with its Quarter Two earnings report, pulling in US$1.9 billion in transactional revenue.

• Valkyrie Digital Assets has become the fourth company to file for a BTC ETF via cash-settled futures contracts. This route may be the way to SEC hearts.

• US Democrat Anna Eshoo has urged her friend, House Speaker Nancy Pelosi, to pass the positive crypto-tax amendment to the Senate’s infrastructure bill.

• Mawson Infrastructure, an Aussie digital and crypto firm, has bought 17,352 Bitcoin miners from Chinese company Canaan Creative, the company said today.