You might be interested in

Energy

Gas and potash: The commodities and players set to benefit as Russia’s invasion of Ukraine rolls on

News

ASX Small Cap June Winners: PayGroup pops 164pc on unicorn interest, resources players end on a high

Energy

Energy

Tuscany-focused energy play Po Valley has been blocked from selling its Italy oil licences.

It was trying to sell two onshore exploration licences in northern Italy to a London resources company called Delta Energy, until one of Delta’s major shareholders blocked the deal.

Po Valley (ASX:PVE) chairman Michael Masterman says he is not too upset though.

“While it is disappointing that Delta seemingly backed the oil sale process, Po Valley is buoyed by the fact we have now retained these assets in our project portfolio at a time the oil price and therefore project development upside, has firmed substantially above that when the Delta deal was first struck in August last year,” Mr Masterman said.

Brent oil, the international benchmark, was trading at a four-year high of about $US83 a barrel on Thursday morning.

Exploration assets tend to take a few years to develop into a producing field, however.

The Delta deal was lined up in August last year and Delta had already done some work to find out how much oil there could be in the Cadelbosco di Sopra licence and neighbouring Grattasasso licence.

Mr Masterman says there could be an extra 10m barrels of oil in the two areas.

The failed deal comes after Po cancelled a separate sale of its gas fields, owned by a subsidiary, to another partly-owned subsidiary, Saffron Energy, for 200m shares.

The Australia tax office indicated they’d not give Po a demerger capital gains tax exemption and the independent expert said the deal was neither fair nor reasonable.

Po is now stuck with both oil and gas fields, even though it had willing buyers, and it’s planning to focus on the gas assets first.

It’s buying another two exploration licences in Italy for EUR1.13m ($1.8m).

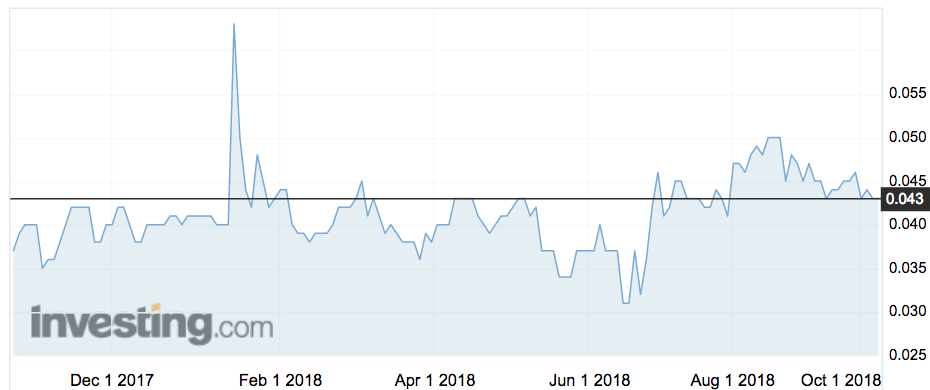

Po Valley’s ASX shares were flat at 4.3c.