With half its gas cut off, Europe’s energy crisis means these ASX players are suddenly in the sweet spot

Pic: via Getty Images

European energy prices have gone from eye-watering to outright nightmarish with preliminary Eurostat data showing a 39.2% increase in energy prices in May, up further from a rise of 37.5% in April.

This is best illustrated by the current European Union natural gas import price of about US$32.20 per million British thermal units (MMBtu), which while down about 24% from last month is still a massive 350% higher than it was a year ago.

And while it is tempting to blame it all on Russia’s invasion of Ukraine for the massive jump in energy prices – particularly for gas – it was in truth just the straw that broke the camel’s back.

Prior to the Russian invasion, European markets were already facing structural issues such as the shift in sentiment amongst customers and investors that had seen record low levels of investment in new oil and gas supplies, carbon pricing, much higher than expected post Covid-19 surge in global energy demand, and the panic-inducing dent it made on stockpiles.

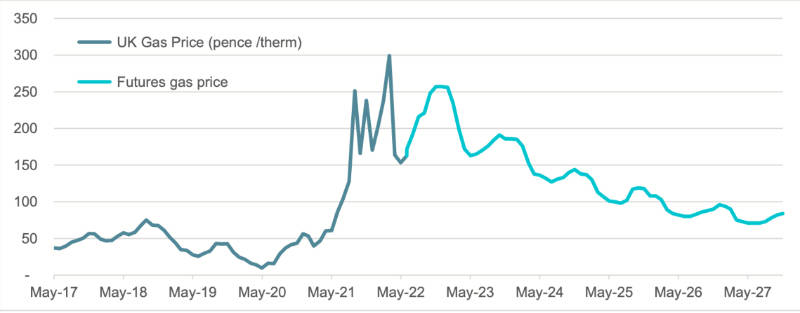

And prices are expected to stay high with research firm MST Access noting that the futures markets are pricing European gas at twice or three times their 2021 levels for at least the next three years.

Matters have certainly not being helped by the EU’s decision to impose a partial ban on Russian oil imports.

But the high prices are also presenting gas opportunities for nimble operators.

Speaking to Stockhead, Hartshead Resources chief executive officer Chris Lewis said that when the company first secured its exploration blocks in the UK’s Southern Gas Basin, gas prices in the country were just eight pence (14c) a therm (100,000Btu).

“So when we got the award blocks, we weren’t very sure whether we would be able to raise any capital and make the investment,” he noted.

“We always believed in the long-term gas market and gas price in the UK and Europe for all the structural issues that you see such as the percentage of the entire diet that comes from gas, and it is not just electricity – you have domestic cooking and heating as well as industrial use.”

“But obviously, 8p a therm is still 8p a therm.”

Fast forward to mid-2021 when there was a much less renewable energy going into the European energy system that combined with the COVID recovery and global competition for LNG cargoes to send gas prices rising, which supported Hartshead’s long-held belief in the longer-term gas future.

The Russian invasion of Ukraine and the resulting sanctions and tit-for-tat demands that Russian gas had to be paid for in roubles sent prices soaring further with Lewis seeing no signs that this will ease appreciably.

“Europe is really interesting because it is not clear where it can get gas from to replace Russian gas. The EU already consumes almost all of Norway’s production, or about 110 billion cubic metres (Bcm), but it took 150Bcm from Russia,” he added.

“There’s still gas to be had out of Norway but it is hard to see how Norway is going to more than double its gas production in the next few years.

“All of these structural issues underpin what we believe is the long-term stability of the market.”

ADX Energy executive chairman Ian Tchacos added that European governments have already extended their timelines for the renewable energy transition and stated quite clearly stated that gas and nuclear are key commodities.

“There’s going to be very strong potential reliance on the import of LNG because you have a backdrop where not only is Russian gas being curtailed but potentially be diminished altogether.

“You also have if you like a decline of existing production from domestic gas both within Europe and the North Sea so the supply demand gap is just going to continue to widen.”

Tchacos noted that Austria had been buying gas at about 120 euros per megawatt hour – pretty much the peak price in March straight after the Ukraine invasion – and storing it in available storage.

“Obviously, the Austrian government feels that is the right thing for them to do, to actually store gas at that price because they recognise potentially in winter it will be even higher,” he added.

These gas opportunities could be hugely lucrative given the forward curve for gas prices in the UK projects prices to be about £1.40 per therm in summer 2024 and £1.50 per therm in the winter.

Easing regulatory framework

The scramble for gas supplies has also meant an easing of regulatory approvals with Lewis noting that there appeared to be a complete 180 turn-about.

“What that means for us is that as long as we are doing the right things in the right ways, we think the regulators will be far more accommodating then previously,” he added.

Lewis pointed to on-platform wind and solar as well as trying to deliver low emissions gas to the UK market as examples.

The UK has also released a new energy security strategy in direct response to the Ukraine situation that besides calling for an acceleration in adopting renewables also called for a refocus on nuclear.

Importantly for oil and gas companies, the strategy includes a statement that the UK Department of Business, Energy and Industrial Strategy would produce a new task force to accelerate new oil and gas developments in the UK.

“We are expecting to see resources and more desire to see things move quickly from the regulator and that comes in with approvals of environmental statements and permits,” Lewis noted.

“All these things that can be a real drag on efficiently developing oil and gas projects in the UK, we now are expecting to see this accelerator task force come in and move things more rapidly.”

MST Access analyst David Fraser pointed out that a UK moratorium on shale gas fracture stimulation that stymied AJ Lucas’ efforts could be abandoned.

This has been supported by the company’s recent statement that the UK Government “remains openminded about onshore gas reserves and has commissioned an impartial technical review on shale gas by the British Geological Society to consider any further scientific updates on seismicity that the Govt. ought to consider”.

The company said it was pleased by this willingness to be open-minded and that it would offer data or technical input from its extensive UK shale database to assist with this review.

“Clearly the transition to renewables is going to continue. But I think people are beginning to find that the wind doesn’t always blow and the sun certainly doesn’t shine as much in Europe, or during peak demand in the morning and evening,” Fraser added.

“You need baseload power and people don’t like nuclear or coal. So you need to have gas peakers and/or lots of very large batteries.

“Even if battery prices come down materially, you then have to double your generation capacity during the day to charge the batteries for the night.

“The world will still need to burn gas in the transition for 20-30 years.”

Gas opportunities to continue

This means there’s plenty of room for gas in the energy mix, particularly in Europe with both Lewis and Tchacos saying their respective companies are fortunate to have existing development assets.

“When we applied for these blocks in the 32nd round, there wasn’t a lot of competition for some of the smaller remaining opportunities that exist in the Southern Gas Basin,” Lewis explained.

“We are expecting the upcoming licensing round to be more competitive due to the gas price macro and the tax relief providing producers with the incentive to start reinvesting their money.

“Both of these are going to lead to increased investment. We will probably see a small renaissance in terms of the oil and gas sector – particularly gas.”

Tchacos adds that ADX was fortunate to have picked up a licence in Austria, where it was drilling within six months of commencing approvals.

“In Australia, you’re looking at well over 12 months now, particularly onshore,” he noted.

He pointed out the company’s acreage was right next to Germany, which is one of the largest consumers in Europe, and had access to good infrastructure through its existing commercial arrangements.

“We have got a very rich prospect inventory of things to drill, some of which are described more as appraisal rather than exploration. Also we are moving towards exploration for a very large gas prospect that we are really excited about.”

While there is undoubtedly lots of room for new gas supplies in Europe, there are also other opportunities that are presenting themselves.

Tchacos noted that banks have started coming to ADX and saying they are interested in financing a solar farm on the land covered by the company’s oilfield.

“And we are really interested in that as when you have an older producing field, you have a lot of pumps and they take electricity, so actually being able to build a solar park would mean getting cheap electricity as well as reducing our emissions,” he explained.

“It is all about efficiency and that’s what you have to do. In way, it is a kind of upcycling, you still need the oil, but you want to produce it as efficiently as possible.”

The solar farm proposal also has the benefit of producing excess power that could be used to generate hydrogen, which could in turn be stored in the oil fields.

ASX oil and gas small caps in Europe

Besides existing oil production in the Vienna Basin and the Anshof discovery in Upper Austria, ADX is also gearing up to test the potentially company-making Welchau prospect that could host 750 billion cubic feet of gas.

The relatively shallow Welchau prospect is potentially connected to the Molln-1 gas discovery well which tested pipeline quality gas down dip from the proposed drilling location.

It is located in the foothills of the Austrian Alps and is analogous to the giant anticline structures discovered in Kurdistan.

Welchau extends laterally over 23km and has a potential gas column height in the prognosed well in excess of 1000m.

While predominantly a provider of exploration, production and directional drilling services, the company also holds a portfolio of onshore petroleum exploration licences that cover almost 2% of England.

While development of these licences has been delayed by the moratorium on hydraulic fracturing announced by the UK Government in November 2019, the company noted that the recent events have reinforced critical security of gas supply is and the benefits of having significant domestic gas production.

As such, the company is confident that gas held onshore in the UK can be a very significant contributor to the UK energy supply.

Doriemus holds a 2.6% interest in the Horse Hill oil project that has just received a full production permit, ending the long string of extended well testing consents that it has been operating on.

The production permit means that operator UK Oil & Gas can now reinject produced saline formation water, something it was forbidden to do under the well testing consents.

Horse Hill-2z will now be converted into a water injector, removing the need for costly transportation and disposal of produced saline formation water at remote third-party sites.

A review of the viability of reinstating Kimmeridge production and further new Portland infill drilling locations are now under way.

Hartshead has submitted its preferred concept for the first phase development of its UK Southern Gas Basin assets, which seeks to produce gas from the Anning and Somerville fields that host best estimate (2C) Contingent Resources of 324 billion cubic feet of gas.

The selected concept consist of six production wells from two wireline capable Normally Unmanned Installation (NUI) platforms at Anning and Somerville.

These platforms will then connect subsea to third party infrastructure for onward transportation and processing to entry into the UK gas network.

Peak production is estimated to be about 140 million standard cubic feet per day with first production expected in late 2024.

Long-time Italian focused gas play Po Valley is poised to award the gas plant and pipeline contract for its Selva Malvezz onshore gas development in the country’s Po Plain.

This is designed to produce 5.3 million standard cubic feet of gas per day.

Additionally, the Emilia Romagna Regional Council has approved the INTESA (local government production agreement) for the Podere Maiar gas field at Selva Malvezzi, a prerequisite for Italy’s Ecological Transition Ministry (MiTE) to grant a Final Production Concession at Podere Maiar.

First gas from Podere Maiar is expected in the first half of 2023, subject to final approval.

At Stockhead we tell it like it is. While ADX Energy and Hartshead Resources are Stockhead advertisers, they did not sponsor this article.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.