ASX Small Cap June Winners: PayGroup pops 164pc on unicorn interest, resources players end on a high

Pic: DBenitostock / Moment via Getty Images

- Literally every sector had a red month, but mining was the worst

- PayGroup gets surprise $120m takeover offer from US unicorn Deel

- Tempest Minerals signed JV to explore near the Karara Magnetite Iron mine

June was a month of global economic crises, which prompted a crisis of market confidence. The inflation crisis, met by some crisis mismanagement on the part of global central banks. The energy crisis is actually a coal meets gas crisis, the result of a structural crisis in the transition to renewable energy to deal with the climate crisis.

That crisis is really thanks to the crisis in Ukraine.

The ASX200 was down 8.86% for the month – and literally every sector was in the red.

Special mention to materials (mining) as the biggest loser, down 13.95%, closely followed by financials down 12.84% and real estate down 10%.

Wall Street even ended the month with its worst start to the year in more than 50 years.

So, what happened?

China started to reopen in June after not quite dealing with COVID-19 but also not quite dealing with the mad lockdowns imposed on some 40 plus cities.

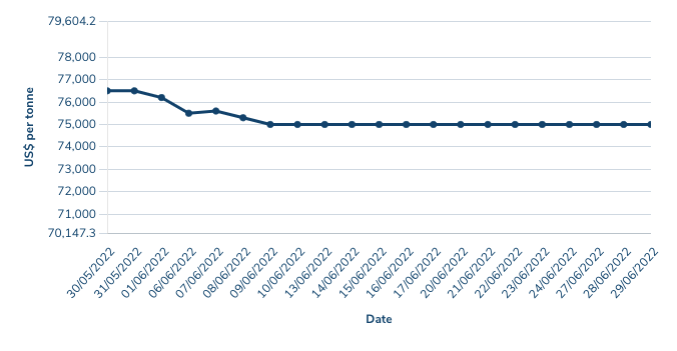

And battery metals took the brunt of China’s economic slowdown – except for lithium which held steady despite calls from Goldman Sachs that oversupply would send prices tumbling to US$16,000/t.

Oil and gas not looking so hot

There was also surprise bump for oil early in the month with OPEC agreeing to lift production by circa 650k barrels a day for July and August and the EU announced a wee bit of a ban on Russian oil.

But fast forward to the EOFY and oil is on track for a third straight weekly loss, with recession fears at the forefront of moves that have brought crude WTI prices down from ~US$120/bbl to around US$105/bbl.

Then gas became a problem. Not in a gross way but in more of a ‘uh oh how are we going to cook dinner’ kind of way.

In Sydney wholesale electricity prices have gone up 3x in Australia since early April and wholesale gas prices are 3-4 times above normal levels (with divergences skewed to the east coast).

The RBA went and hiked the cash rate again, and AMP now expects the cash rate to rise to 1.5-2% by year-end and to peak at 2-2.5% by mid next year.

The cash rate whisperer Dr Shane Oliver says greater sensitivity to higher interest rates will end up putting a cap on exactly how much the RBA ultimately needs to hike to get on top of this inflation business, but AMP believes it’ll be well below the average forecast market expectations for a cash rate of 4% or more.

And national home prices fell for the second month in a row according to data from CoreLogic.

Show Me the ASX Small Caps Winners!

Scroll or swipe to reveal table. Click headings to sort.

| Code | Company | Price | % Month | Market Cap |

|---|---|---|---|---|

| AHN | Athena Resources | 0.021 | 200% | $15,446,383.60 |

| PYG | Paygroup Limited | 0.95 | 164% | $113,594,181.12 |

| TEM | Tempest Minerals | 0.097 | 98% | $46,438,488.19 |

| HRL | Hrlholding | 0.16 | 88% | $79,101,008.96 |

| LCT | Living Cell Tech. | 0.009 | 80% | $10,282,909.78 |

| PVE | Po Valley Energy Ltd | 0.052 | 73% | $54,526,315.39 |

| GRE | Greentechmetals | 0.28 | 70% | $8,132,799.74 |

| SLX | Silex Systems | 2.12 | 60% | $430,447,418.10 |

| RSH | Respiri Limited | 0.055 | 57% | $41,901,549.03 |

| WIA | WIA Gold Limited | 0.089 | 56% | $41,146,290.25 |

| CPO | Culpeominerals | 0.22 | 42% | $9,679,370.14 |

| RGS | Regeneus Ltd | 0.061 | 42% | $18,692,651.75 |

| RFA | Rare Foods Australia | 0.07 | 41% | $14,051,994.60 |

| LIN | Lindian Resources | 0.115 | 40% | $99,510,092.52 |

| LVH | Livehire Limited | 0.4 | 38% | $115,068,950.49 |

| ARO | Astro Resources NL | 0.004 | 33% | $18,820,965.06 |

| GTG | Genetic Technologies | 0.004 | 33% | $27,701,895.43 |

| RD1 | Registry Direct | 0.016 | 33% | $6,688,710.48 |

| TGR | Tassal Group Limited | 4.81 | 33% | $1,028,993,456.99 |

| AVR | Anteris Technologies | 29 | 32% | $397,849,795.20 |

| SIX | Sprintex Ltd | 0.071 | 31% | $17,917,157.22 |

| BIR | BIR Financial Ltd | 0.03 | 30% | $5,443,085.01 |

| AUA | Audeara | 0.095 | 30% | $7,048,935.59 |

| DTC | Damstra Holdings | 0.135 | 29% | $28,346,602.68 |

| TTT | Titomic Limited | 0.27 | 29% | $53,670,474.65 |

| NUH | Nuheara Limited | 0.16 | 28% | $12,033,833.52 |

| HPR | High Peak Royalties | 0.07 | 27% | $14,626,947.93 |

| AFA | ASF Group Limited | 0.05 | 25% | $39,628,688.70 |

| NWE | Norwest Energy NL | 0.043 | 23% | $295,133,650.06 |

| RAP | Resapp Health Ltd | 0.135 | 23% | $111,760,620.01 |

| NTI | Neurotech Intl | 0.071 | 22% | $48,838,938.82 |

| LLO | Lion One Metals Ltd | 1.51 | 22% | $16,144,880.74 |

| 8CO | 8Common Limited | 0.11 | 22% | $24,371,573.16 |

| DSE | Dropsuite Ltd | 0.195 | 22% | $132,964,277.94 |

| NCL | Netccentric Ltd | 0.092 | 21% | $26,037,072.90 |

| 1AG | Alterra Limited | 0.017 | 21% | $5,912,196.66 |

| CAF | Centrepoint Alliance | 0.29 | 21% | $56,805,747.81 |

| ECL | Excelsior Capital | 1.875 | 20% | $54,364,629.38 |

| CDX | Cardiex Limited | 0.335 | 20% | $34,085,647.00 |

| LPE | Locality Planning | 0.061 | 20% | $10,441,292.90 |

| CDD | Cardno Limited | 1.95 | 19% | $62,887,667.43 |

| HHR | Hartshead Resources | 0.025 | 19% | $46,369,303.15 |

| CUP | Countplus Limited | 0.72 | 19% | $82,240,242.48 |

| TZL | TZ Limited | 0.115 | 19% | $25,611,433.11 |

| RCE | Recce Pharmaceutical | 0.9 | 18% | $158,105,749.90 |

| SIG | Sigma Health Ltd | 0.5975 | 18% | $614,380,321.28 |

| SCT | Scout Security Ltd | 0.039 | 18% | $5,215,418.10 |

| AD8 | Audinate Group Ltd | 7.815 | 18% | $581,866,723.62 |

| PSQ | Pacific Smiles Grp | 1.8 | 16% | $287,247,488.40 |

| AII | Almontyindustriesinc | 0.95 | 16% | $16,920,494.65 |

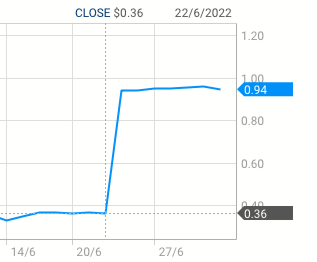

The standout winner this month was payroll, HR and human capital manager PayGroup (ASX:PYG) which found itself the subject of a rather terrific $120 million takeover bid from American startup unicorn Deel.

Deel’s Aussie business wants to snap up and eat PayGroup in an all-cash feast of human resource deliciousness.

Deel wants to pay the group one Aussie dollar for each shiny new share – a 175% premium on PYG’s close of around $0.36 on the 22nd of June.

For the financial year ended 31 March 2022 (FY22), PYG achieved record organic growth in Annualised Recurring Revenue (ARR) of $39.1m, an increase of 44% on the prior year (FY21: $27.2m).

It puts this down to its acquisition of Integrated Workforce Solutions (IWS) last year, which is a cloud-based workforce management platform specialising in solutions for the franchise and retail sector in Australia and New Zealand.

“Throughout the year, PayGroup successfully integrated the platform with our existing infrastructure, significantly expanding the geographic reach of the franchise and retail platform,” the company said.

In FY22, cross-sells and up-sells represented 24% of new contracts signed, and PYG said it continued to see significant momentum in monetisation opportunities with the payments offering now annualising at $2.5m.

The latest monetisation solution, Accessing Wages Earned, was launched in India during the year and is on track to go live in Australia in FY23.

As of market close today, the company is now trading up 164% at $0.94.

The $46m market cap stock Tempest Minerals (ASX:TEM) is up 98% for the month.

In June it signed a non-binding conditional memorandum of understanding (MOU) with Karara Mining (ASX:KML) for an exploration Joint Venture (JV) over KML’s exploration leases along strike from the Karara Magnetite Iron mine in WA.

The agreement allows TEM access to 138km2 of underexplored Yalgoo Greenstone Belt, and they’ll have the exclusive right to earn up to 70% of the project area over four years.

In May the company flagged multiple geochemical anomalies including trace elements consistent with rocks known to host lithium pegmatites at its Rocky Hill project in WA.

But notably, in March TEM spiked hard on a potentially very large copper discovery.

The first 709m-long hole of a two-hole diamond drilling program at ‘Orion’, part of the flagship ‘Meleya’ project in WA, pulled up three mineralised copper sections.

The second, 1,021m-long hole hit more of the same, and assays are pending.

Meleya is part of TEM’s 900sqkm ‘Yalgoo’ tenements, where the company has +50km strike length of a previously unexplored segment of a mineral-rich greenstone belt.

The belt hosts several world class mines, including one of Australia’s most successful high-grade copper-zinc and precious metal operations, ‘Golden Grove’.

Also ahead this month by about 88%, is HRL Holdings (ASX: HRL) which says it’s on the happy end of an unsolicited, non-binding indicative offer from ALS (ASX:ALQ) to acquire 100% of the ordinary shares of HRL for $0.16 cash per share.

HRL, a diversified environmental and laboratory service provider, says talks are only preliminary and no agreement has been landed and there’s no guarantee one will.

In response to the NBIO bid, the stock entered into a Process Deed on 7 June under which ALS is being provided with the opportunity to undertake due diligence and negotiate transaction documentation on an exclusive basis to 20 July 2022.

HRL has agreed to certain due diligence, exclusivity, notification and break fee provisions during this period.

Po Valley Energy (ASX:PVE) jumped 73% – and our gas man Bevis Yeo says it’s probably something to do with Europe having half its gas cut off.

The Italian focused gas play is poised to award the gas plant and pipeline contract for its Selva Malvezz onshore gas development in the country’s Po Plain.

This is designed to produce 5.3 million standard cubic feet of gas per day.

Additionally, the Emilia Romagna Regional Council has approved the INTESA (local government production agreement) for the Podere Maiar gas field at Selva Malvezzi, a prerequisite for Italy’s Ecological Transition Ministry (MiTE) to grant a Final Production Concession at Podere Maiar.

First gas from Podere Maiar is expected in the first half of 2023, subject to final approval.

Greentech Metals (ASX:GRE) is up 70%, sneaking an announcement into the end of the month that it has kicked off maiden reverse circulation drilling at the Osborne nickel target just 20km west of Azure Minerals’ (ASX:AZS) 4.6Mt Andover nickel-copper-cobalt project.

The company is also basking in the glow of a bunch of new drilling results – including a highlight 32m @ 2.43% copper — which could substantially increase the size of the ‘Whundo’ copper-zinc project in the Pilbara region of WA.

The results confirm that the high-grade copper and zinc at Whundo persists at depth and beyond the current resource envelope, GRE says.

Then there’s the bonus gold grades of up to 3.34g/t, which accompany the higher-grade copper zones and “further enhances the potential economics of the project”.

Whundo is at the core of a much broader copper and zinc system, GRE exec director Thomas Reddicliffe says.

“Drilling has demonstrated that the mineralisation at Whundo remains open at depth and with grades persisting,” he says.

“This and the identification of two additional mineralised horizons provides further impetus for the company to build upon the known resource.”

Assay results for three additional holes drilled at Whundo, and seven holes drilled at the nearby ‘Ayshia’ deposit are expected in the coming weeks.

Once all assays are received, GRE will look to update the existing resource at Whundo/Ayshia of 3.6 Mt @ 1.2% copper and 1.4% zinc.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.