Who made the gains? Here are the top 50 ASX miners and explorers for March

Hafthor Bjornsson of Iceland competes at the Truck Pull event during the World's Strongest Man competition. Pic: Victor Fraile/ Getty/ Stockhead.

In March, we saw punter sentiment bounce back in a big way, with 16 resources stocks making gains of 100% and above.

That’s the best return since September last year, when investor excitement over mushrooming commodity prices – particularly lithium and uranium — was at its frothiest.

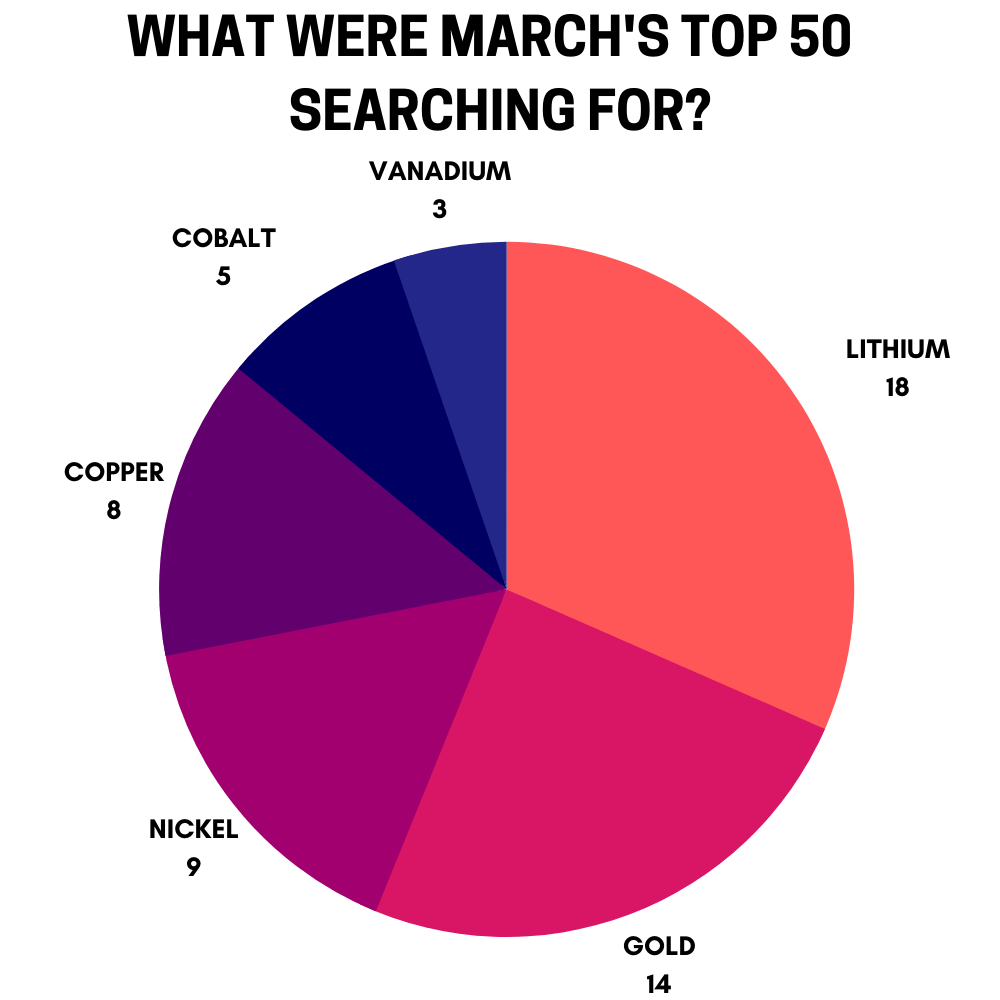

Nickel may have been March’s most talked about commodity, but it was lithium – with important cameos from copper and vanadium – which drove the gains last month.

(Read our in-depth analysis of the best and worst performing metals here.)

Eighteen stocks in our top 50 had lithium exposure, including a few of the billion dollar bigguns like Lake Resources (ASX:LKE), Sayona Mining (ASX:SYA) and Core Lithium (ASX:CXO).

Here’s a breakdown of the six most popular commodities:

Here are the top 50 ASX resources stocks for the month of March >>>

Scroll or swipe to reveal table. Click headings to sort. Best viewed on a laptop

| CODE | COMPANY | 1 MONTH RETURN % | SHARE PRICE | MARKET CAP | LOOKING FOR |

|---|---|---|---|---|---|

| TEM | Tempest Minerals | 639.1% | 0.17 | $73,611,666 | copper, gold |

| RGL | Riversgold | 326.1% | 0.098 | $32,525,257 | lithium |

| REC | Recharge Metals | 308.3% | 0.49 | $14,662,125 | copper, gold |

| LRS | Latin Resources | 268.1% | 0.1325 | $140,804,706 | lithium |

| AVL | Australian Vanadium | 188.2% | 0.098 | $271,861,775 | vanadium |

| CXM | Centrex | 175.0% | 0.22 | $83,935,882 | phosphates |

| MLS | Metals Australia | 164.4% | 0.1375 | $40,032,090 | lithium, graphite |

| LKE | Lake Resources | 147.5% | 2.24 | $2,540,585,191 | lithium |

| ARL | Ardea Resources | 140.7% | 1.625 | $276,346,568 | nickel, cobalt |

| SYA | Sayona Mining | 126.7% | 0.255 | $1,703,859,890 | lithium |

| CPO | Culpeo Minerals | 125.0% | 0.27 | $10,779,299 | copper, gold |

| TZN | Terramin Australia | 122.2% | 0.06 | $126,993,763 | copper, gold, zinc |

| BNR | Bulletin Resources | 120.8% | 0.265 | $75,415,577 | lithium |

| ARU | Arafura Resources | 118.4% | 0.415 | $565,902,326 | rare earths |

| COB | Cobalt Blue | 113.8% | 0.93 | $261,909,485 | cobalt |

| BKY | Berkeley Energia | 102.2% | 0.455 | $202,837,505 | uranium |

| MTC | Metalstech | 97.3% | 0.365 | $56,665,961 | gold |

| KNI | Kuniko | 94.1% | 1.31 | $54,743,124 | cobalt, nickel, copper |

| TMT | Technology Metals | 93.3% | 0.58 | $117,105,299 | vanadium |

| CXO | Core Lithium | 88.3% | 1.45 | $2,358,210,548 | lithium |

| IKW | Ikwezi Mining | 84.5% | 0.95 | $38,617,475 | coal |

| 1MC | Morella Corporation | 84.2% | 0.035 | $175,991,276 | lithium |

| VMS | Venture Minerals | 81.1% | 0.067 | $93,517,625 | nickel, copper, PGE, tin, iron ore |

| QXR | Qx Resources | 80.5% | 0.074 | $54,836,913 | lithium, gold |

| IXR | Ionic Rare Earths | 78.4% | 0.091 | $296,748,258 | rare earths |

| FAU | First Au | 77.8% | 0.016 | $10,974,753 | gold |

| FFX | Firefinch | 76.2% | 1.145 | $1,231,152,329 | gold, lithium |

| AQC | Auspaccoal | 76.0% | 0.22 | $11,106,658 | coal |

| RMI | Resource Mining Corp | 75.0% | 0.035 | $13,384,885 | nickel, cobalt |

| MEG | Megado | 71.1% | 0.13 | $5,165,856 | gold |

| ESS | Essential Metals | 70.8% | 0.555 | $117,244,193 | lithium, nickel |

| EUR | European Lithium | 70.3% | 0.155 | $161,263,816 | lithium |

| QEM | QEM Limited | 70.0% | 0.255 | $28,922,950 | vanadium |

| HIO | Hawsons Iron | 68.8% | 0.27 | $185,913,767 | iron ore |

| GL1 | Global Lithium | 66.7% | 2.3 | $353,509,574 | lithium |

| RCR | Rincon | 65.0% | 0.165 | $6,975,960 | gold, copper |

| AGY | Argosy Minerals | 64.2% | 0.4925 | $623,054,082 | lithium |

| SNG | Siren Gold | 64.0% | 0.41 | $37,997,965 | gold |

| NC1 | Nico Resources | 63.4% | 1.005 | $83,760,002 | cobalt, nickel |

| PHO | Phosco | 63.0% | 0.15 | $35,059,525 | phosphates |

| GME | GME Resources | 62.7% | 0.096 | $54,053,159 | gold, nickel |

| AVZ | AVZ Minerals | 62.7% | 1.285 | $4,263,297,904 | lithium |

| WIN | Widgie Nickel | 62.1% | 0.535 | $120,000,000 | nickel |

| AX8 | Accelerate Resources | 61.9% | 0.068 | $15,714,452 | lithium, manganese |

| GES | Genesis Resources | 60.0% | 0.016 | $10,176,937 | gold, silver |

| MIO | Macarthur Minerals | 59.1% | 0.525 | $79,435,651 | iron ore |

| LPI | Lithium Power International | 58.2% | 0.87 | $249,638,566 | lithium |

| BRX | Belararox | 57.1% | 1.1 | $32,296,223 | zinc, copper, lead, gold, silver |

| DMM | DMC Mining | 56.0% | 0.195 | $5,304,000 | nickel |

| GLN | Galan Lithium | 55.7% | 2.11 | $601,497,525 | lithium |

March Top 10

#10 SAYONA MINING (ASX:SYA) +127%

SYA owns advanced exploration assets in Canada’s Quebec province, where it announced a doubling of the Authier and North American Lithium projects’ combined resource to 119.1 Mt at 1.05% Li2O at the start of March.

It subsequently joined a wave of advanced lithium stocks like Lake Resources (ASX:LKE), AVZ Minerals (ASX:AVZ) and Core Lithium (ASX:CXO) in the ASX 300 index.

Entry into major indices like the ASX 300 and ASX 200 can spur price rises and sharp volume increases for new entrants.

#9 ARDEA RESOURCES (ASX:ARL) +141%

ARL listed in 2017 on the back of its Kalgoorlie Nickel-Cobalt Project (KNP), now one of the more advanced nickel-cobalt projects on the ASX.

The KNP hosts 5.9Mt of contained nickel and 380kt of contained cobalt, making it the largest nickel-cobalt resource in the developed world.

That’s enough to power 147m electric vehicles, ARL says.

The $1.165 billion project would mine cobalt-nickel laterite ore which will undergo a process to produce Mixed Hydroxide Precipitate for the growing international battery market.

In March, it received Major Project Status from the Aussie Government, which helps streamline the approvals process and provides access to additional sources of potential project funding.

#8 LAKE RESOURCES (ASX:LKE) +147%

A recent entrant into the ASX 300, as mentioned above.

LKE has set its sights on becoming a global scale player in lithium carbonate production, planning to deliver 100,000t a year by 2030 from its ‘Kachi’ project in Argentina.

To measure the scale of that ambition, consider that Allkem (ASX:AKE), one of the largest lithium producers on the ASX and a $6 billion company, produces around 12,600tpa of battery and technical grade lithium carbonate currently at its Olaroz project.

In March, LKE teed up a non-binding MoU with Japan-based trading company Hanwa Co to negotiate for up to 25,000tpa offtake of lithium carbonate over 10 years.

LKE says the finalisation of a binding long-term agreement with Hanwa will bolster its financial position as it moves towards a Final Investment Decision later in the year.

#7 METALS AUSTRALIA (ASX:MLS) +164%

On 21 March this lithium-graphite junior said initial RC drilling of the recently discovered ‘Foundation’ target at the ‘Manindi’ project in WA had intersected thick pegmatite with “visible lithium bearing minerals”.

The hits are under recent rock chip sample results averaging 1.29% Li2O, 0.51% Rb over the entire 500m pegmatite strike length.

Assays are pending. The company recently raised $7.8m to explore Manindi, as well as the ‘Lac Rainy’ graphite project in Canada.

#6 CENTREX (ASX:CXM) +175%

Earlier this month construction kicked off on non-process infrastructure for the initial production plant at CXM’s 800,000tpa ‘Ardmore’ phosphate project in Queensland.

First production is on schedule for July this year with first shipment in August.

“Planning and contract discussions are well advanced for production and shipment of five individual 5,000 tonne trial parcels (25,000t total) to be sent to customers for their prequalification,” the company said.

“Negotiations continue with these customers for potential longer-term arrangements over the remaining 50% of uncommitted first right production offtake.”

#5 AUSTRALIAN VANADIUM (ASX:AVL) +188%

The vanadium project developer was awarded a $49m government grant in March.

It’s all part of a wider $250m cash splash designed to build our own industrial capacity and reduce reliance on China for critical metals.

“China currently dominates around 70 to 80 per cent of global critical minerals production and continues to consolidate its hold over these supply chains,” Energy and Industry minister Angus Taylor said.

“This initiative is designed to address that dominance.”

Vanadium is used in critical aerospace and chemical applications, is a key component in high strength and specialty steel products and has an important and growing use in vanadium redox flow batteries (VRFB).

The Australian Vanadium project is one of the most advanced vanadium projects being developed globally.

It would cost ~$US399m ($541m) to build and expects to produce 24.3 million pounds (11,022 tonnes) of V2O5 per annum at a low all-in cost of $US5.04/lb, over an initial mine life of 25 years.

A bankable feasibility study – the most advanced of all studies prior to making a final investment decision – is well underway.

#4 LATIN RESOURCES (ASX:LRS) +268%

The Brazilian lithium explorer keeps hitting high grade lithium at its ‘Salinas’ project.

First assay results from the initial two drill holes at the ‘Southern Target’ area of the ‘Salinas’ project “confirmed a potential new high-grade lithium discovery”, LRS says.

Highlights include 4.31m at 2.22% Li2O from 83.82m and 8.13m at 2.00% Li2O from 111.3m.

Ore grade is usually around 1%, so this is good stuff.

#3 RECHARGE METALS (ASX:REC) +308%

In late March, newly listed REC hit 300m of copper mineralisation in drilling at the flagship ‘Brandy Hill South’ project in WA.

Historical drilling at Brandy Hill recorded some nice hits, including 75m at 0.55% copper with a 23m zone returning 1.29% copper, with silver and tungsten values.

Initially, REC was looking to confirm some of the historical hits as well as extending mineralisation in a maiden drilling campaign.

Three holes from that drilling program were recently extended with diamond ‘tails’ to chase the vein-hosted mineralisation at depth.

It is the first of those holes, BHRCD019, which has hit the copper motherlode.

Assays are pending.

#2 RIVERSGOLD (ASX:RGL) +326%

Going all-in on lithium continues to pay off handsomely for this tiny explorer.

The proposed acquisition of four lithium-prospective tenements in the Pilbara early March sent the share price flying.

‘Tambourah’ is the project RGL seems most excited about. On March 22, the explorer picked up rock chips grading up to 2% lithium during an initial site visit.

It’s a solid start — these rock chips are from one 200m section of what is potentially a 26km-long mineralised corridor at Tambourah, RGL CEO Julian Ford says.

#1 TEMPEST MINERALS (ASX:TEM) +639%

TEM took the top spot by a big margin. Why?

A potentially big copper discovery.

The first 709m-long hole of a two-hole diamond drilling program at ‘Orion’, part of the flagship ‘Meleya’ project in WA pulled up three mineralised copper sections:

- 8m of interbedded semi-massive (pretty high grade) base metal/magnetite minerals from 18m;

- 10m of copper bearing semi-massive sulphides within a 20-metre disseminated sulphide zone from 422m; and

- 18m of copper bearing disseminated and stringer veins within a broader ~100m disseminated sulphide zone from 610m to end of hole.

‘To end of hole’ means the third mineralised zone probably keeps going at depth.

This is a spectacular outcome, TEM managing director Don Smith says.

“To make a new discovery on our very first hole into an entirely untested region far exceeds our expectations,” he says.

“This drilling was designed to help understand the geology and to inform future exploration and we’ve actually hit multiple zones of sulphides and copper mineralisation.”

Meleya is part of TEM’s 900sqkm ‘Yalgoo’ tenements, where the company has unearthed more than 50km strike length of a previously unrecognised and unexplored segment of the Yalgoo greenstone belt which hosts several world class mines.

They include one of Australia’s most successful high-grade copper-zinc and precious metal operations, Golden Grove.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.