Beyond the sell-off in battery metals stocks, here’s why lithium is standing tall as other commodities fall

Pic: Wavebreak/iStock via Getty Images

- Lithium prices have been relatively unscathed by China’s economic slowdown despite big falls for iron ore and other battery metals

- Experts say market will remain in short supply due to strong demand and long lead times to bring production online, despite Goldman Sachs’ oversupply call

- Shaw and Partners’ Adam Dawes says big lithium stocks should be favoured in tough market conditions after a major sell-off across the sector

There’s no two ways about it, battery metals have been hammered by China’s economic slowdown, with Covid lockdowns hitting downstream demand from property, infrastructure or whatever manufacturing industry you like.

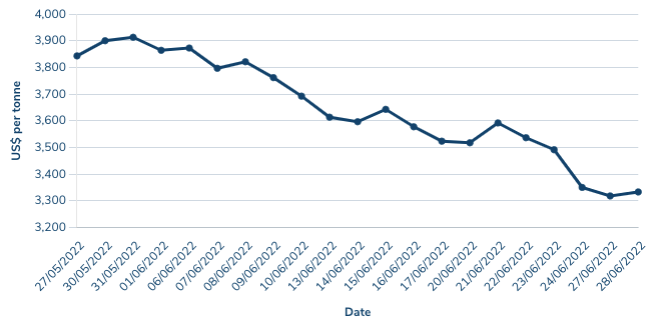

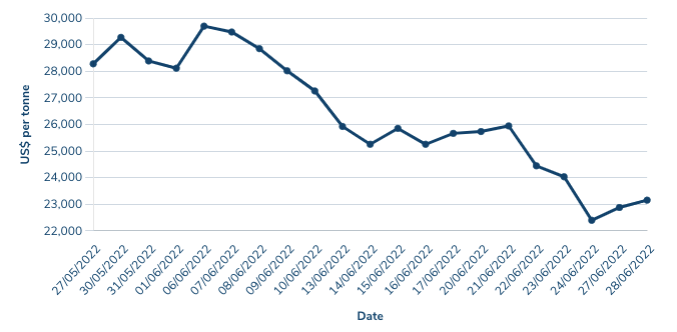

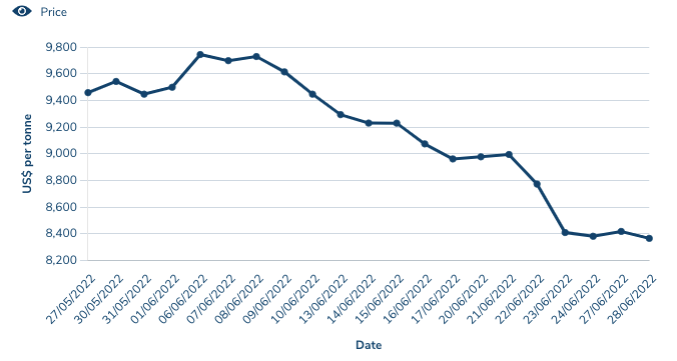

Take a look at these price charts for some key battery metals.

That’s zinc, nickel and copper by the way, three previously flying commodities whose wings have been clipped by China’s struggles.

You may be forgiven for thinking one of those charts is lithium given the pain befalling companies exploring and mining the key input in lithium ion batteries.

The Global X Lithium & Battery Tech ETF is down 8.83% year to date, but even that is mild given the performances of large Chinese lithium stocks have tempered the losses.

Australian miner Pilbara Minerals (ASX:PLS) is down 34.66% year to date, Allkem (ASX:AKE) has fallen almost 6% but 22.76% over the past month, while all the players in the emerging company space have been categorically smashed.

Sayona (ASX:SYA) is still up ~14% YTD but has slid 27% in the past month. Argentine brine hopeful Lake Resources (ASX:LKE), whose MD Steve Promnitz resigned last month, suffered a big sell off just days after entry to the ASX 200.

Want to see a dictionary definition of cognitive dissonance?

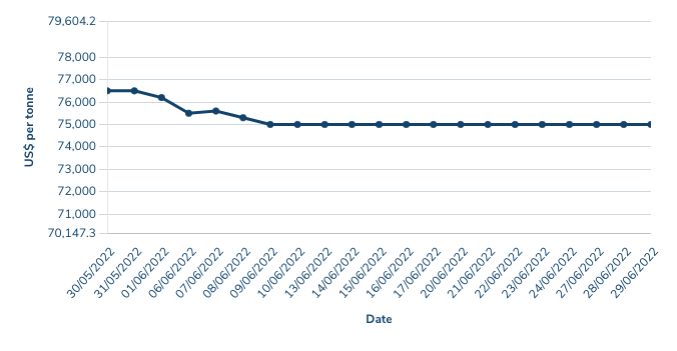

This is what’s actually happened to lithium hydroxide prices in Asia this month.

Lithium carbonate has been similarly steady while spodumene spot prices are up above US$6000/t after Pilbara Minerals showed just how hungry converters are for the limited supply of raw materials available on the spot market by selling its latest Battery Materials Exchange cargo pre-auction for a price of US$7017/t on a 6% Li2O basis.

Why has lithium avoided the pain suffered by other major commodities amid China’s Covid Zero frenzy and is the lithium sector oversold right now?

Glad you asked.

Why has lithium avoided a correction

While other battery metals have entered into correction mode in the past month, lithium has continued to sell at a fancy free US$75,000/t.

Oblivious to the cacophony of global economic dysfunction like a teenager bumping Drake through their Airpods during the Apocalypse, lithium prices have been a shoulder shrugger despite heavily publicised calls from Goldman Sachs that oversupply would send prices tumbling to US$16,000/t.

Lithium, as exposed to Chinese manufacturing as iron ore, rare earths or base metals, seems to have avoided the bitter effects of the downturn.

The final year of EV subsidies in China is one factor, with the EV market remaining solid despite a collapse in the new car trade from the lockdowns that saw exactly zero sales in the financial Mecca of Shanghai in April.

With global EV sales in 2022 expected to outstrip the record 6.6 million recorded in 2021, the lockdowns may have held back demand, but not enough to ease supply shortages for the metal.

“We see the lockdowns as constraining demand, rather than demand being weak,” Fastmarkets senior price development manager Peter Hannah told Stockhead.

“This is likely to be creating pent-up demand in China, as lockdowns end we expect a strong rebound in demand.

“As we have often seen when economic activity slows, while overall vehicle production might fall, EVs demand continues to see strong gains – that is why prices have held up well.”

The 500% and more increase in lithium prices over the past 18 months have seen miners move fast to switch on new sources of supply or approve brownfields expansions to catch the wave.

Within 24 hours on Monday and Tuesday, ASX listed Sayona Mining (ASX:SYA), Liontown Resources (ASX:LTR) and Pilbara Minerals (ASX:PLS) approved almost $1 billion worth of investment to bring 750,000t of new spodumene concentrate (a little over 100,000t lithium carbonate equivalent) into the market.

While a rapid increase in mined supply out of Australia came too quick for the EV market in 2018, leading to a crash in prices, Hannah said conditions were different in 2022.

“We think the increases will ease the tightness but not create a rerun of 2018 when new supply led to oversupply,” he said.

“The market is that much bigger now and has destocked so demand, restocking, building working stock and stockpiling are expected to absorb the new supply as it ramps-up.”

Lithium demand ‘not just a China story’

Liontown Resources MD Tony Ottaviano, whose company approved the $545 million development of its 500,000tpa Kathleen Valley mine in WA’s Goldfields on Tuesday, says the lithium demand story is about more than just China.

“I think that the important point to note with the electrification of mobility, the EV market specifically, is that it’s not geographically specific, i.e. it’s not a China play,” he said.

“This is a structural change occurring worldwide so you require the electrification of vehicles in Europe and North America, greater Asia and China itself.

“That’s unlike other commodities, where the demand is dominated by Chinese internal consumption like iron ore, copper, and to some extent some of the other commodities, that’s my view.”

Kathleen Valley is one of a number of operations and expansions slated to send either spodumene or lithium chemicals into the global market over the next three years.

Most of its output is already assigned for its first five years, ahead of a planned ramp up to 700,000tpa, to auto and battery giants Tesla, LG and Ford via offtake agreements.

Separately, Ford is providing a $300 million loan to back the mine’s construction.

While he believes Liontown can meet its ambitious schedule to produce first concentrate in the second quarter of 2024 as planned, Ottaviano said supply would be more challenged than analysts like Goldman Sachs suggested in the coming years.

“In our view there is still significant shortfall and that’s why we believe prices will remain strong,” Ottaviano said.

“The amount of new greenfields supply that’s coming on is going to be tougher than people think.

“There’s existing operations that are simply expanding, brownfields expansions. Pilbara is one, Wodgina — MRL and Albemarle — is another turning on capacity that was previously shuttered (as is) Sayona, maybe Nemaska is another that will come on at some point with Livent.

“That type of expansion capacity is well known and understood and it’s factored in already. It’s more the greenfields that will turn this, the new supply.

“And other than ourselves, if people aren’t turning soil by July or August this year there is no way they’ll bring on supply before the back end of 2024. Especially when you see the supply chain issues worldwide in getting equipment, labour shortages you’ve got a struggle to bring on new capacity.”

Jurisdictional risk could be a concern as well.

“If they believe they can build new capacity in continents like Africa and countries like the Congo and Mali, maybe, but in the next 18 months I don’t know,” Ottaviano said.

Liontown Resources (ASX:LTR) share price today:

Chemical supply could struggle to meet demand as well

Issues ramping up new supply are not just on the mining side of the equation.

Approving a chemical product for use in batteries can be a long process as well, as Tianqi and IGO (ASX:IGO) have found with their drawn out opening of the Kwinana lithium hydroxide plant in Perth.

“We think supply will struggle to keep up with demand for three main reasons: 1 – Supply increases inevitably face ramp-up issues and delays in getting the quality up to spec,” Fastmarkets’ Hannah says.

“2 – Output from new production lines needs qualifying which can take 6-18 months, although in these times of tightness those times may speed up to some extent.

“3 – With demand growing so fast, demand is greater than consumption as the downstream manufacturers need to build up working stock.”

While Hannah thinks current prices are unsustainable, he believes they will remain elevated.

“We do not think prices at these levels are sustainable in the long term, but as in all markets you can have periods when prices stay at painful levels for consumers for an extended period,” he said.

Three stocks providing value in mini-bear run

Bullish as the industry may be that strong (if not all time high) lithium prices will continue, the sell-off in stocks is real.

Shaw and Partners senior investment advisor Adam Dawes says in times of economic upheaval investors should look for quality.

He said the stockbroking firms’ main lithium picks are all established producers.

“They’re all larger cap stocks, especially when we get these falls, you’ve got to play the quality,” he said.

“You don’t need to be a hero and pick the small ones, you need to just pick the quality ones.”

Dawes likes Allkem (ASX:AKE), the $6.5 billion lithium beast formed from last year’s merger of Orocobre and Galaxy Resources.

It owns both brine and hard rock lithium assets in the Olaroz project in Argentina and Mt Cattlin mine in WA, with two large development assets in each style in Sal de Vida (brine) and James Bay (hard rock).

Allkem is also commissioning a 10,000tpa lithium hydroxide plant at Naraha in Japan.

“The stock’s up 70%, but down 23% for the month, so it’s had a little bit of profit taking,” Dawes said.

“But I think contract prices for lithium are going to continue to go higher.

“So I think it’s a good opportunity to potentially look at some of the better quality businesses, not the smaller ones, but the better quality ones to look at potentially picking up some.”

His other stock picks in the sector are Mineral Resources (ASX:MIN), which Dawes likes for its exposure to both the ‘old world’ commodity of iron ore and ‘new world’ in lithium, as well as IGO, which owns around a quarter of the world’s biggest lithium mine Greenbushes alongside a nickel unit it has restocked with its recent takeover of Western Areas.

Lithium miners share prices today:

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.