You might be interested in

Mining

Brightstar Resources’ drilling returns intriguing gold hits below current Cork Tree Well deposit

Mining

Emerging Brightstar Resources continues to build gold inventory with maiden 70,000oz resource at Aspacia

Mining

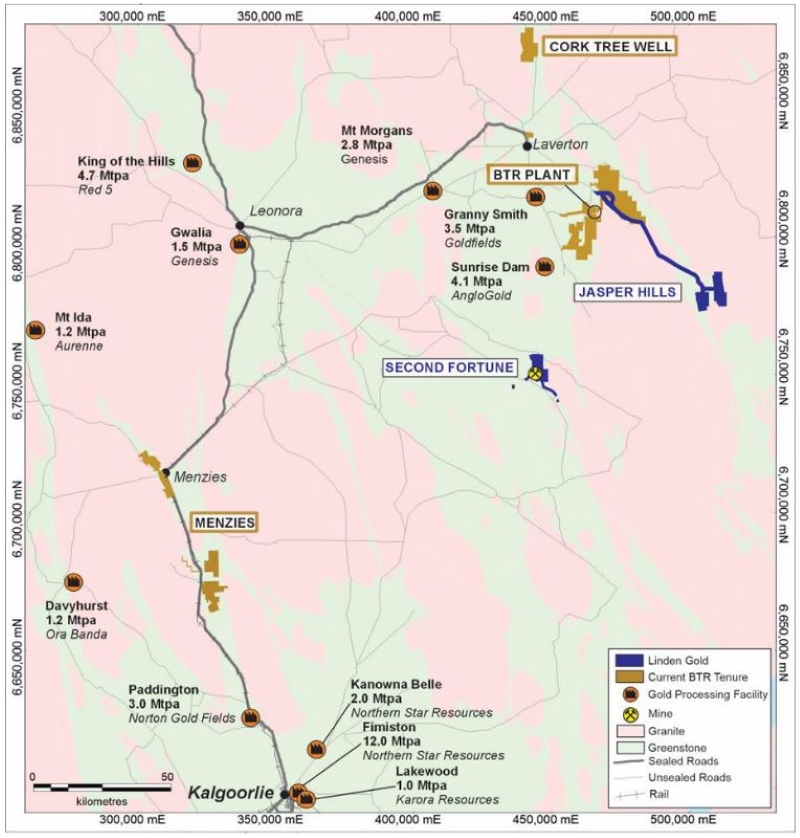

Special Report: Right on the back of wrapping up the small-scale mining of its Selkirk JV with BML Ventures, Brightstar Resources has released a compelling scoping study to restart the Jasper Hills mine south of Laverton, WA, for an initial 141,958oz gold mined over ~3.75 years.

Jasper Hills – just 50km from Brightstar Resources’ (ASX:SBM) existing processing infrastructure – is part of the package of projects that it is picking up via a Board-recommended off-market takeover offer of St Barbara (ASX:SBM) backed Linden Gold Alliance Limited.

The main focus will be on the Lord Byron open pit and Fish underground deposits, which the study shows can “deliver high-quality outcomes at low upfront capital costs”.

BTR reckons that from the study, it can get the mine up and running within six months at a low pre-production capex of just $12m.

This will deliver robust returns with pre-tax net present value and internal rate of return – both measures of a project’s profitability – estimated at $99m and a stunning 736% respectively.

Other metrics of the study include:

Open pit and underground optimisations come in at $2,800/oz for Jasper Hills, with an assumed study gold price of $3,000/oz used in financial modelling, which is ~A$300/oz below the current spot gold price and represents significant upside potential to financial metrics and outcomes.

BTR managing director Alex Rovira says the study outlines an attractive pathway to cashflow, featuring a low-capital approach with approximately $12m in pre-production funding required to commence operations at Jasper Hills, with the high-grade Fish underground deposit able to generate ore within six weeks of portal establishment.

“The study outlines a readily deliverable ~4-year LOM plan which complements Brightstar’s existing scoping study released in September 2023; which, if combined, will result in the company becoming a meaningful gold producer in the WA Goldfields,” Rovira says.

“The staged mined development has been optimised to minimise up-front capital costs, utilising operational cash flow to self-fund the larger cutbacks at Lord Byron generating high tonnage, baseload open pit ore feed to nearby processing facilities.

“The mine plan has been designed to minimise risks associated with ramp up and deliver a profitable gold producer in WA with significant upside to expand on the production profile and mine life.

“In parallel with our efforts of combining the Brightstar and Linden Gold assets into a larger pre-feasibility study (PFS), we continue to advance exploration efforts across the portfolio with the intent of finding additional ounces to add to the mine plan.”

This article was developed in collaboration with Brightstar Resources, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.