Brightstar’s Linden takeover will add gold production and resources, backing its goal of becoming a mid-tier producer

The acquisition of Linden will increase Brightstar’s resources by 350,000oz to 1.4Moz. Pic via Getty Images

- Brightstar’s acquisition of Linden will add the Second Fortune mine, which has produced 13,000oz gold in FY2024 to date

- Acquisition will also increase the company’s resources by 350,000oz to 1.4Moz

- Most of this is contained within the Jasper Hills project which is the subject of a very promising scoping study

- Increased resource base will de-risk the potential restart and upgrade of the Brightstar plant

Special Report: Brightstar Resources is bolstering gold production and resources in its portfolio by acquiring public unlisted company Linden Gold Alliance via an unanimously recommended off-market scrip takeover offer.

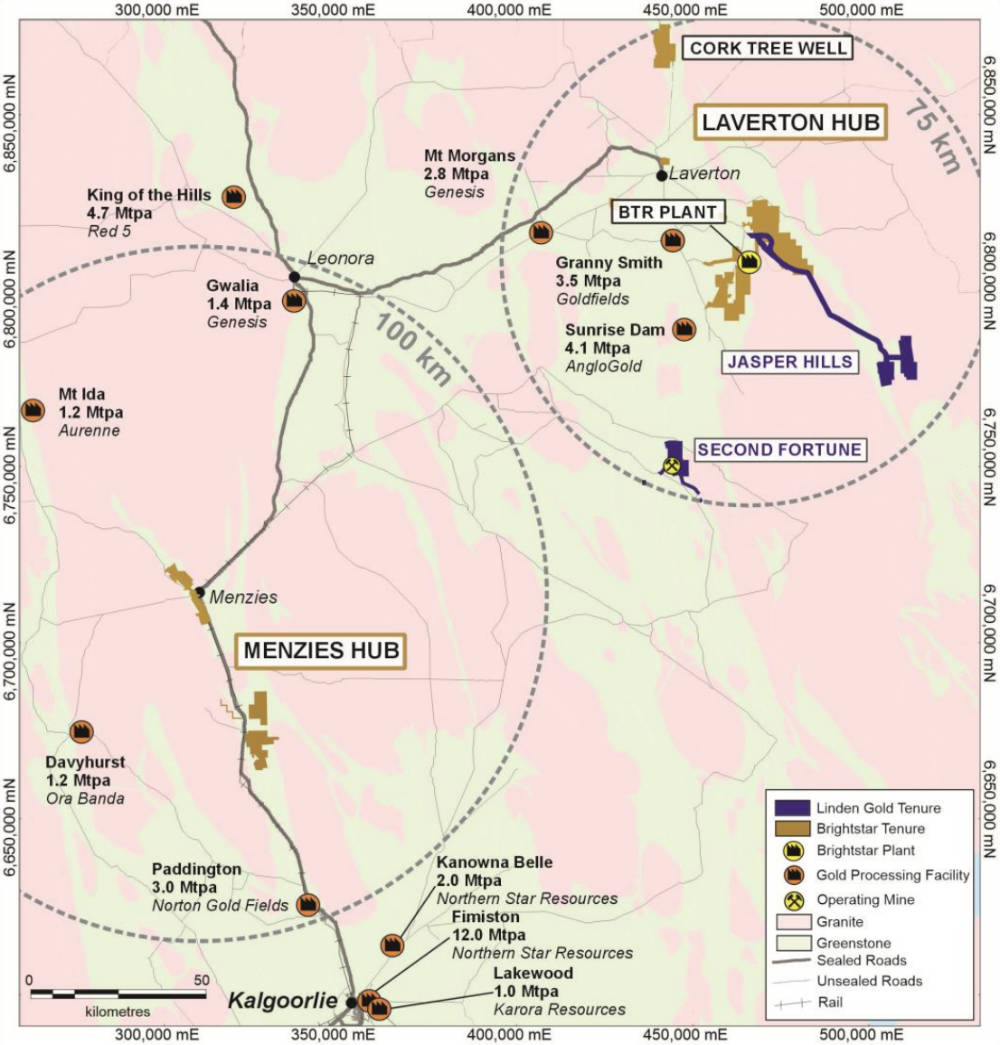

Linden has existing gold resources of 350,000oz @ 2.1g/t near the company’s assets in WA’s Laverton district.

This includes the operating Second Fortune underground gold mine that has produced 13,000oz of gold to date in FY2024 through Genesis Minerals’ (ASX:GMD) Gwalia processing facility, which had similarly toll treated ore for Brightstar Resources (ASX:BTR) and its Selkirk joint venture.

Acquiring Linden will also add the development-stage Jasper Hills project, which has a resource of 4.9Mt @ 1.8g/t for 293,000oz of contained gold, to BTR’s portfolio.

The Jasper Hills scoping study outlines the potential to deliver 35,000oz per annum gold production with an initial 141,958oz mined over ~3.75 years, generating pre-tax net present value and internal rate of return of $99 million and 736%, respectively.

Combining the two companies will create a gold producer with +20,000ozpa output – putting BTR on the path towards a low risk, low capex path towards +100,000ozpa production – with an increased resource base of 1.4Moz.

This larger resource base provides the critical mass to de-risk the potential mining restart, upgrade of the Brightstar plant to “bring forward” production ounces and greater flexibility for development scenarios.

Majority-backed offer

Under the offer, Linden securityholders will receive 6.9 BTR shares for every Linden share they hold and 6.9 BTR options exercisable at 3.6c each and expiring on 25 February 2025 for each Linden option that is not exercised before the offer closes.

Linden directors, who collectively hold 13.2% of Linden’s shares, have unanimously recommended that shareholders accept the offer in the absence of a superior offer.

Additionally shareholders – including St Barbara (ASX:SBM) – representing ~67.3% of Linden’s shares have signed pre-bid agreements with BTR or have signed intention statements to accept the offer.

On completion of the offer, which is subject to a minimum 90% acceptance condition, Linden directors Andrew Rich and Ashley Fraser will respectively be join BTR as executive director and non-executive director, while highly regarded natural resources industry professional Richard Crookes will become the company’s non-executive chairman.

Following implementation of the offer, BTR’s shareholders will hold 62% of the merged company while Linden shareholders will own the remaining 38%.

BTR managing director Alex Rovira, who will remain in his position, said the transaction was outstanding for shareholders of both companies and is aligned with BTR’s strategy of becoming a mid-tier gold producer in the near term.

“This combination will create a gold producer and development company with a material resource base, synergistic operations, strengthening in-house operational expertise and a strong balance sheet that will drive development and growth,” he says.

Linden managing director Andrew Rich says the offer provides his company shareholders with a range of benefits, including exposure to a liquid, growing ASX listed gold producer, a strengthened balance sheet and the ability to utilise BTR’s existing infrastructure and resource base.

Accelerating activities

Separately, BTR is raising up to $12 million through a two-tranche placement of shares priced at 1.4c to build its cash at hand up to $22 million in order to accelerate exploration and development activities across its portfolio.

This has received strong cornerstone support from BTR and Linden major shareholder Collins Street Asset Management and St Barbara, who have committed to take up $4.3 million of the placement, while mining investment house Lion Selection Group (ASX:LSX) have committed to take up $2 million of the placement to become a BTR shareholder.

The placement price of 1.4c represents a 4.9% discount to the 30-day volume weighted average price of BTR’s shares.

This article was developed in collaboration with Brightstar Resources, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.