Wisr survey reveals Aussies feel financial strain, yet daily coffee remains priority

Tech

Tech

Special Report: Australians are feeling the pinch of rising costs of living, according to a national survey by Wisr, but some items we’re not willing to go without, including our daily coffee.

Fintech lender Wisr (ASX:WZR) conducted a national survey in November to find out what Aussies are doing to survive rising costs of living and the effects on their household budgets.

Interest rates have risen from a record low of 0.1% at the start of May 2022 to now 4.35% – its highest level since November 2011 – although the RBA is working to bring inflation back down to its 2-3% target, having hit the pause button during the recent December meeting.

CPI increased by 1.9% in the December 2022 quarter and by 7.8% over the year, which the RBA says was the highest year-ended CPI inflation since 1990.

While CPI increased by 1% in the September 2023 quarter and by 5.4% over the year, there’s still some way for it to fall.

Homeowners are grappling with higher monthly mortgage repayments but also costs across the board from food to bills, rent, fuel, medical, insurance, clothing and entertainment.

So, just where are Aussies feeling the pinch? And what sacrifices are they willing to make or not make to ensure their funds go further?

WZR surveyed 1,137 Australians across the state and territories, in metropolitan, regional and rural areas.

Respondents ranged in age from 18 to above 65, with the majority aged 25 to 54, and mostly employed full-time across a range of industries.

Females constituted 52%, males 47%, with 0.2% identifying as non-binary and 0.8% preferring not to specify.

In terms of relationship status, 29% were single, 9% were dating but not cohabiting, 19% were in defacto relationships, 36% married, 3% separated, 3% divorced, and 1% widowed.

Respondents included individuals with various income brackets:

Of those surveyed, 46% had an income rise, while 38% stayed constant and 16% fell.

A raise of income for 36% was between $1K to $5K, primarily due to work raises (53%).

Conversely, 26% faced a decrease within the $1K to $5K range, with 30% attributing this to a job change and 21% altered work hours.

Participants rated the mental health impact of the cost of living as a 6 on a scale of 1 to 10.

We’ve all got to eat but, according to the WZR survey, 39% of Australians indicated that groceries are exerting the most pressure on their household budgets.

As a result of these challenges, 68% have opted for cheaper or less ethical alternatives in groceries, such as switching from branded to home brand products or choosing caged eggs. Additionally, 58% now limit their purchases to items on special.

However, in a positive sign grocery relief may be coming, annual food inflation eased to 4.8% in the September quarter, down from 7.5% in June quarter and the peak of 9.2 per cent in December 2022.

Groceries were closely followed by bills (24%), rent (24%), and fuel costs (20%).

Concerningly, 45% have sacrificed necessary medications, while 74% are forgoing or delaying doctor appointments.

Furthermore, 66% have halted their travel plans due to financial constraints.

Other cutbacks include 65% refraining from buying new clothes, 63% avoiding dining out, and 44% reducing subscription services like Netflix.

And it seems 40% have foregone beauty treatments, such as hairdressing, injectables and laser procedures, due to budgetary constraints.

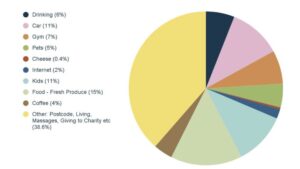

Apart from the kids, vehicle expenses, and fuel costs, many Australians are unwilling to forgo cheese, their daily coffee fix, access to the gym or purchase of fresh produce.

Source: Wisr

This article was developed in collaboration with Wisr, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.