Vection Technologies sees rising revenue for Q4 FY23 with more growth on the horizon

Tech

Tech

Extended reality (XR) tech company Vection Technologies has flagged some solid Q4 FY23 results, noting cash receipts of $8.2m for the quarter – that’s up 45% on Q3.

This brings the total cash receipts for FY23 to $22.9m, up 14% on FY22.

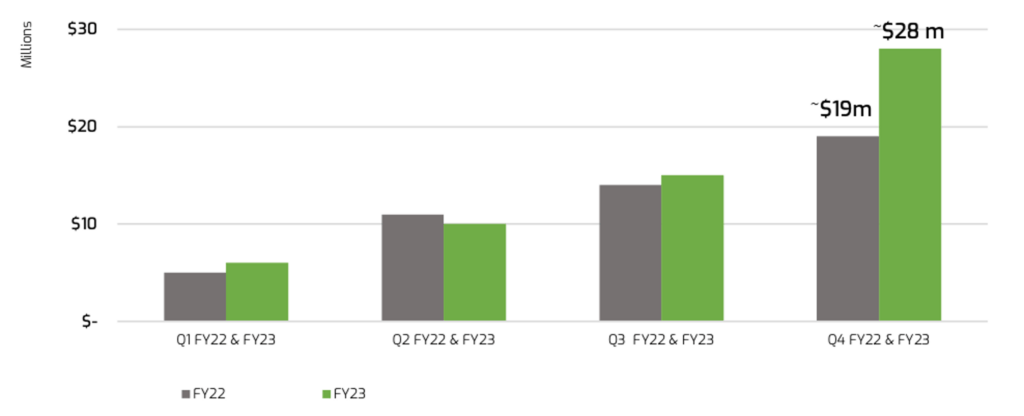

Total Contract Value (TCV) for FY23 was $28m, up 50% on FY22, with stronger revenue in Q4 FY23.

The company puts this growth down to its INTEGRATEDXR technology suite which enabled the growth of its end-to-end digital transformation client strategy, across a multitude of customers across several market segments.

Sales momentum continued during the quarter with notable customers including Bi-Rex Big Data Innovation & Research Excellence Center, Bunnings via The Brand Agency, Marotta S.r.l. via SolidWorld Group S.p.A. (BIT:S3D), Shimizu Corporation, Wurth, Humanitas University – to name a few.

Plus, Vection Technologies (ASX:VR1) also released a ChatGPT-powered mixed reality solution 3DFrame on Apple’s macOS which enables businesses to enhance their immersive product presentations and training experiences in 3D and virtual reality (VR).

The company expects to maintain its growth momentum in FY24, and as market demand for its INTEGRATEDXR solutions continue to rise, VR1 is confident it remains strongly positioned to capitalise on this inevitable growth trend.

“The company has sustained the strong revenue momentum from the third quarter of fiscal year 2023, achieving our revenue guidance, supported by $28m in Total Contract Value (TCV) for the year,” MD Gianmarco Biagi said.

“Throughout the fourth quarter, the increase in invoicing activity has led to enhanced utilisation of invoice financing, effectively maintaining our cash reserves.

“Revenue growth will continue to require working capital support aligned with this non-dilutionary capital management strategy.”

“Looking ahead, we are exploring numerous opportunities to expand the organic growth of our customers, new sales activity, and the development of the INTEGRATEDXR technology suite.

“We will continue to bolster industry expertise by adding skilled professionals to our team in line with our resource needs.”

Cash as of 30 June 2023 was $11.4m.

Negotiations are progressing towards a binding agreement for the virtual reality space travel partnership with Thales Alenia Space, Next One Film Group, and ALTEC – expected to be finalised by September 2023 – for the development of Lunar City, a space-focussed Virtual Reality (VR) metaverse platform.

This platform aims to promote space travel and inspire future generations as NASA’s Artemis Program prepares to return astronauts to the lunar surface.

VR1’s also announced a partnership with Bedshed during the quarter, to supplement its traditional photography with 3D-powered computer-generated imagery (CGI) to showcase furniture products.

“To be able to create unlimited combinations of bedroom backdrops and product suites adds enormous value to the business,” Bedshed assistant marketing manager Louise Kaminskis said.

“We’re saving time and money while elevating the level of presentation of our products. Our franchisees were blown away by the realism.

“This validates what we believe is a really innovative marketing approach.”

Also, during the quarter, the company announced a partnership with expert.ai, a leading company in Artificial Intelligence (AI) for language understanding and language operations, to create an XR/AI-powered solution for digitising technical manuals.

Another critical part of the company’s plan of increasing organic revenue growth is through technology and people acquisitions, which is why VR1 proposed the acquisition of Invrsion, a 3D technology company specialising in the fashion, retail, consumer goods, and real estate sectors.

“This acquisition is strategic for Vection Technologies as it strengthens the company’s INTEGRATEDXR solutions suite for the fashion, retail, consumer goods, and real estate sectors, enhancing customer experiences and enabling them to remain relevant in a rapidly evolving market,” the company said.

“The acquisition of Invrsion also enhances Vection Technologies’ commercial value and customer trust.

“By immediately commercialising these technologies and offering industry-specific solutions and services, the company aims to deliver substantial benefits to its customers, drive organic profitable growth, and establish long-term partnerships.”

VR1 expects to settle the proposed acquisitions of Invrsion by mid-September 2023.

This article was developed in collaboration with Vection Technologies, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.