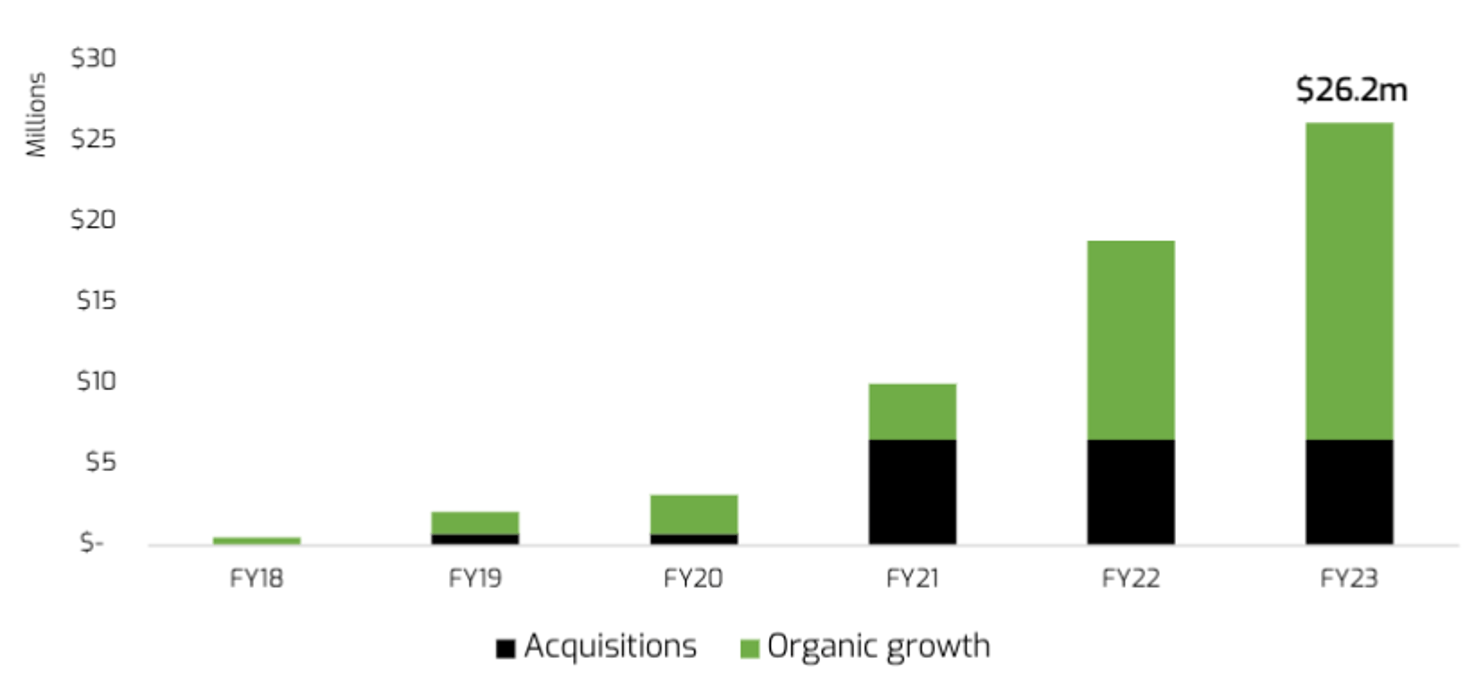

Vection highlights $26m FY23 revenue in emerging INTEGRATED-XR market

The company uses XR technology in sectors like defence, space, real estate and healthcare.

- FY23 unaudited revenue up 39% to $26m, in line with full year guidance

- Total Contract Value (TCV) was $28 million, up 47% from FY22

- The company says emerging INTEGRATEDXR market is set to grow

- VR1 focused on acquisitions to gain competitive advantage

Extended Reality (XR) company Vection Technologies has reported strong financial performance in its FY23 preliminary (unaudited) results, with 39% revenue growth to $26m in line with full year guidance.

The company is focused on tailoring integrated XR technology solutions to specific industries such as defence, space, real estate, fashion, manufacturing, education, and healthcare.

Vection Technologies’ (ASX:VR1) is developing Lunar City, a space-focussed Virtual Reality (VR) metaverse platform ahead of NASA’s Artemis Program which is preparing to return astronauts to the lunar surface.

The company also recently released a ChatGPT-powered mixed reality solution 3DFrame on Apple’s macOS which enables businesses to enhance their immersive product presentations and training experiences in 3D and VR.

The applications are practically endless, with the company also using the 3DFrame platform to assist the design of the European Space Agency’s hypersonic aircraft prototype.

VR1 even has a partnership with Bedshed that could transform the way retailers showcase their product range via XR.

Total contract value jumps 47%

Total Contract Value (TCV) was $28 million, up 47% compared to FY22, which the company put down to its ability to consistently expand its business and secure valuable contracts.

Vection Technologies’ (ASX:VR1) cash position was $11.4m as at 30 June 2023, with an additional $15.2m invoiced and due to be collected from customers.

XR and AI tech is gaining traction

“The combined implementation of traditional technologies, XR, and AI is rapidly gaining traction across various industries,” Vection MD Gianmarco Biagi said.

“The synergy between these technologies will drive operational efficiencies and open avenues for cost savings.

“Our INTEGRATEDXR technology portfolio continues to be of paramount importance to our clients.

“By solidifying our relationships and nurturing strategic partnerships, we anticipate a favourable impact on our profit margins. This, in turn, will fuel a more dynamic and sustainable growth trajectory.”

Biagi says integrated XR technologies have emerged as a dominant force in the emerging market.

“Major market-leading enterprises are increasingly embracing these transformative technologies, notably in sectors such as CAD, ERP, CRM, and more, resulting in significant growth and global investment within the industrial sphere,” he said.

“Despite the tough global economy with rising interest rates, inflation, and conflicts, the company managed to achieve a successful result, even more remarkable considering we’re in the early stages of market adoption in an emerging market.”

Expansion via selective acquisitions

Biagi said the company prioritized its strategic partner relations focusing on technology, client engagement, and value creation for customers, with partners including Accenture and Cisco Webex.

“Furthermore, ground-breaking technologies like ChatGPT have catalysed disruptive innovation within our market,” Biagi added.

“In response, we have empowered our technology team to innovate at the intersection of ICT, 3D and AI.

“This fusion empowers our clients with distinct advantages and positions us at the forefront of the industry’s evolution.”

And while Vection is evaluating and optimising its business cost structure, Biagi acknowledges the necessity of strategic investments to “gain a competitive advantage, foster international expansion through both existing partnerships and new collaborations, as well as facilitate selective acquisitions.”

The company recently inked a deal to acquire MYR S.r.l. (MYR), a 3D tech company which it says is revolutionising the fashion and apparel industry.

That comes just weeks after a deal to acquire Invrsion, a tech company developing 3D and mixed reality solutions for the fashion, retail, consumer goods and real estate sector.

“By combining organic growth and selective acquisitions, our strategy positions us as a global contender, mitigating business risks and reinforcing our market presence,” Biagi said.

Growing market presence in Europe, USA

“Vection Technologies’ strategy boosts us toward a path of continuous growth, poised to grow our market presence in Europe, the USA, Australia, and subsequently, the Asian market,” Biagi said.

“Our emphasis on integrated immersive technologies seamlessly aligns with the global trend towards digitalization, a trend we are well-prepared to lead.”

This article was developed in collaboration with Vection Technologies, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.