Beyond Reality: Vection Technologies is bridging the physical and digital realms with B2B tech solutions

Vection's technology has implications for the real estate, fashion and mining industries. Pic via Getty Images.

- Vection Technologies is fine-tuning its digital product suite to service multiple verticals, including fashion, healthcare, real estate and space exploration

- The company wants to deliver further value to shareholders, recording a 40% increase in revenue year-over-year in FY23

- Vection’s recent Invrsion and proposed MYR acquisitions set the company up for the next stage of its growth journey

Special Report: Vection Technologies is driving the digital revolution with its suite of AR, VR and XR solutions, and director Gianmarco Orgnoni believes the future is bright.

There’s more linking the mining, fashion and real estate industries than you might realise.

While these markets have polar-opposite customer bases, products and purposes, they’re all innovating with a flourishing class of technologies that bring the digital realm to life.

Virtual, augmented and extended reality technologies are having their time in the limelight, and Vection Technologies (ASX:VR1) director Gianmarco Orgnoni believes they’re here to stay.

“We are in an emerging kind of technology space, but we’re just at the beginning of the adoption phase,” Orgnoni told Stockhead.

So, what’s in store for Vection as it champions these emerging technologies, and where does the business see itself heading in the months ahead?

Extended reality: a hybrid model with limitless potential

You’re probably familiar – or at least acquainted with – the burgeoning virtual reality (VR) industry.

Valued at a whopping US$59.96 billion back in 2022, this family of technologies is behind fully realised virtual worlds, immersing the user in a completely digital experience.

What’s even more impressive is the growth potential. Grand View Research estimates a 27.5% compound annual growth rate for the industry, namely thanks to VR’s implications in the gaming, virtual training and entertainment sectors.

Rather than being fully immersive, extended reality (XR) is an umbrella term that captures one simple premise: an effort to bridge the gap between the physical and digital realms.

“We’re essentially adding a digital layer within the field of view of the user,” Orgnoni explained.

Extended reality harnesses physical assets, such as handheld devices, wearables, or even the user’s hands to help them interact with digital infrastructure, merging two spheres that would otherwise be worlds apart.

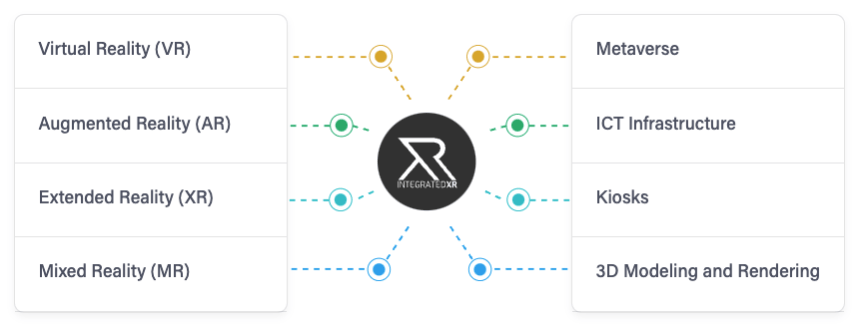

Enter Vection’s IntegratedXR suite: a multi-purpose portfolio which leverages several technologies to make up the company’s primary offering.

IntegratedXR plays hosts to several of the company’s flagship projects, including Mindesk, which supports VR design and real-time rendering in game engine and development software Unreal Engine.

Other Vection technologies help customers create immersive presentations in the metaverse, harness augmented reality to visualise their products, and shake up the in-store customer experience with 3D models.

According to Orgnoni, the inherent possibilities open the doors to a behemoth range of industries, including fashion, retail and real estate.

“And one of the benefits we see with this technology is that it’s not only across verticals, but it can be across regions as well,” the VR1 director explained.

Back in September, Vection dotted the I’s and crossed the T’s on its acquisition of XR player Invrsion, increasing its exposure to 3D and mixed reality solutions amid growing competition.

The company also recently announce its MYR S.r.l. acquisition – a move that will bring a fashion and apparel-centric tech company in line with its broader objectives.

“The combined implementation of traditional technologies, XR, and AI is rapidly gaining traction across various industries,” Vection MD Gianmarco Biagi told the market in September.

“Our emphasis on integrated immersive technologies seamlessly aligns with the global trend towards digitalisation – a trend we are well-prepared to lead.”

The Vection way

Given its work across AR, XR and VR solutions, Vection’s breadth of experience positions it to help myriad companies realise their technological potential – whether they’re early movers or novices in the evolving digital landscape.

“I wouldn’t say we’ve got an idea of a typical customer in the market today – mainly because we’re seeing interest from all different walks of live,” Orgnoni said of the market’s scope.

The variety in Vection’s customer base requires the tech stock to remain agile, tackling each case study with a view to provide bespoke solutions.

“We approach from the outside in – what kind of technologies and IT infrastructure do these businesses have in place? What procedures and workflows can we bring in to enable the adoption of these technologies?” Orgnoni said.

“We really need to look at things in a different way.”

For businesses who are ready to dip their toes into the water, Orgnoni’s advice is simple: take it one step at a time.

“You start with 3D elements – very simple solutions that can be adopted or utilised via traditional devices – and then you build on top of that,” he said.

“Working this way, you can eventually build an end-to-end digital transformation strategy…I think that’s the best way of achieving buy-in from your teams, and then ultimately from customers as well.”

Building momentum

While extended, augmented and virtual reality technologies have implications across a wide range of verticals, Orgnoni believes there are two industries where they’ll have an especially sizeable impact.

“I think healthcare is going to be a strong contender, especially in Europe where you’ve got major government intervention to make hospitals more technologically advanced,” he said.

“The other one is virtual space exploration – allowing people to experience what space is like from the comfort of their homes.”

Even so, the Vection director doesn’t believe that any one industry will be a catalyst for growth; instead, he believes the uptake will remain strong across the full gamut of sectors.

Such burgeoning interest is reflected in Vection’s balance sheet. Since 2019, when the company reported $1m in revenue, Vection has grown its annual revenue figures to circa $26m.

And at the end of FY23, Vection recorded a 40% increase in its revenue year-over-year – momentum Orgnoni wants to see continue well into the new financial year.

“For us, it’s all about growth at the moment, so we are establishing global operations to meet increasing customer need,” he said.

As AR, XR and VR continue to gain traction, Orgnoni is pleasantly surprised by how quickly some businesses embrace the transformation.

“One thing we’ve seen is there are people who get the technology just like that,” he laughed.

With momentum building for Vection’s IntegratedXR product suite, new acquisitions under its belt, and a growing global appetite for tech-led operations, the company has one key message to impart: watch this space.

This article was developed in collaboration with Vection Technologies, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.