‘Under-valued’: Another analyst puts a big Christmas buy on Aussie edtech Schrole

Tech

Tech

Schrole Group is top of the buy list this Christmas with the Edtech specialist making the perfect gift of relative value and strong growth potential.

Provider of global SaaS and training solutions for teachers and educational institutions Schrole Group (ASX:SCL) is trading at a substantial discount to its Edtech and HR focused peers according to the latest analyst report.

Trading at $0.01 per share with a market cap of $12.9m, ATM Research has followed RaaS Advisory with a report showing SCL’s stock is “under-valued” and worth adding to the Christmas stocking.

The ATM report comes as SCL has closed an oversubscribed capital raise of more than $2.5 million to support its global growth drive, including marketing new SaaS products in new regions.

SCL is positioned as the complete Human Resources Software as a Solution (HR SaaS) offering – it’s a business which comprises recruitment, background checks, onboarding, relief teacher management and professional development, predominantly for the international and domestic education sectors.

The company’s flagship full SaaS product suite called “Schrole HR” is made up of five Human Resources SaaS offerngs, including Schrole Connect and Events, Verify, Engage (expected to be released Q1 2022), Cover, and Develop.

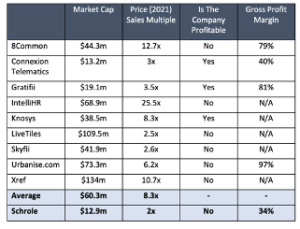

ATM Research also compared its price-to-sales or P/S ratio (also known as sales multiple) to smaller Australian-based HR focused SaaS companies that operate in niches.

The P/S ratio is particularly relevant when used to compare companies in the same sector. A low ratio may indicate the stock is undervalued, while a ratio significantly above the average may suggest overvaluation.

“The table shows that SCL screens as under-valued,” the ATM report noted.

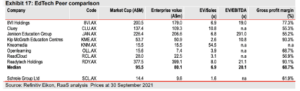

The ATM report follows one by RaaS Advisory, which also compared SCL against its Australian HR SaaS and Edtech peers. Again, SCL stock presented as a good buy.

RaaS noted the median Enterprise value-to-sales (EV/sales) for ASX Edtech stocks is 6.9x, which is at a 420% premium to the current multiple that Schrole trades on at 1.6x.

The EV/sales multiple provides investors a quantifiable metric of how to value a company based on its sales, while taking account of both the company’s equity and debt.

“If we were to apply this multiple to our FY21 revenue forecast of $5.86 million, the Edtech peer valuation is $0.028 per share,” the RaaS report noted.

“At the current share price Schrole Group is trading at a significant discount to two groups of observed SaaS peers.”

SCL was launched in its current form by Managing Director Rob Graham in 2013 as an HR software solution company developed and designed by educators for educators.

Graham had more than 20 years’ experience across six countries working with international schools as a teacher and principal and designed the software to address challenges he encountered in the industry.

SCL started with just two software products, Schrole Cover and Schrole Connect, designed to make life simpler for school administrators.

The company is now looking beyond servicing international schools with plans to target higher education and other sectors, including public and private hospitals. SCL’s training services (Schrole Develop, formerly ETAS) help the resources and government sectors as well as the international education market.

SCL has a strong balance sheet, having recently completed a capital raising. Furthermore, it is also showing strong growth momentum, with 28% growth in cash receipts in September Quarter 2021 vs June Quarter 2021. and

Average revenue per client and margins are increasing through strong upsell and cross-sell from existing customers.

SCL has targeted expansion in average contract value per customer from ~$10k pa to ~$30kpa through increased cross-sell of its new SaaS offerings.

SCL is targeting further growth through its expanded direct sales team selling in regions previously restricted by a now terminated sales distribution contract with International School Services (ISS).

“Our estimates assume that FY22 marks an inflection point in the earning trajectory of the business,” the RaaS report noted.

RaaS found the discounted cashflow methodology was the best way to value SCL, given its “early-stage nature”.

Discounted cash flow (DCF) is a valuation method used to estimate the value of an investment based on its expected future cash flows.

Using the DCF method derives a base value for SCL of $0.035 per share, which equates to a market value for the company just shy of $50 million.

“Our valuation implies an EV/sales multiple of 8.2x SCL’s FY20 revenues and 7.9x our FY21 revenue forecast which would put it at a premium to the peer group multiples discussed,” the report noted.

“However, we note that more than 60% of these peers are still in loss-making while our expectation is for Schrole Group to move into profitability in H1 2022.”

ATM analyst Pavan Sharma told Stockhead there were several reasons why SCL may be trading at a discount, including its now terminated agreement with ISS.

“The previous alliance with ISS did not help with the company’s margins which are important for any SaaS companies – adding to the current overhang,” Sharma said.

RaaS director Finola Burke agreed SCL’s “disengagement from the ISS partnership,” which did not deliver the financial advantages the company or market expected, may be impacting its depressed stock price.

“This partnership has been in operation for more than three years and while it delivered scale to SCL in terms of international school clients, it did not bring the revenues that the company flagged,” Burke told Stockhead.

“I think the market is waiting to see whether SCL on a standalone basis can retain those clients and deliver increased revenues.” Growth of 28% in cash receipts in the September Quarter 2021 results suggests that SCL is delivering.

Burke said the market may have perceived SCL would be adversely impacted by the COVID-19 pandemic, given SCL predominantly services international schools.

However, SCL has grown during COVID-19, benefitting from the structural shift to online in education and human resources, demonstrated in its latest trading results and record renewal rates of 90%.

“The market may also have expected headwinds in the international schools’ market due to COVID, when in fact the case has been the opposite,” Burke said.

She expects the rollout and take up of Schole Connect 3.0, Schrole Events 1.0 and Schrole Engage under the Schrole HR banner to be key drivers for SCL’s share price performance.

“Evidence of successful cross-selling of these products to existing clients and potential new clients, including those introduced by SCL’s largest shareholder Faria, should underpin SCL shares,” she said.

“We’d expect to see this coming through in the final quarter of FY21 and the first and second quarters of FY22 and ongoing.”

Sharma said it would take a solid quarterly update, with new sales staff showing traction, and increased sales in Europe and the US to lift the SCL share price.

“Any traction with new schools added, existing schools being cross sold with new or existing products and increasing average revenue per user will be key metrics to look out for,” he said.

“Next would be if SCL was able to deliver a breakeven quarter next year, other than the fourth quarter which has traditionally been stronger, and then eventually over the medium-term how earnings and margins improve.”

ATM Research has added a BUY (High-Risk) rating on SCL as a solid stock to put in your Christmas stocking for the new year.

This article was developed in collaboration with Schrole Group, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.