Tech-Heavy: Cybersecurity giant is a sell; Zuck v. Musk cagefight is off

Tech

US stock futures were higher on Monday morning in Sydney as plucky US investors apparently spent the weekend shaking off doubts around risk, tech and inflation.

Futures contracts tied to the three major indexes were all up at least 0.1%.

Last week was a bits’n pieces week of business as jittery traders rotated out of the Nasdaq’s mega-tech, chip-related (and other) growth stocks into more cyclical and defensive positions.

Throughout the week the Dow gained 0.62%, the S&P 500 lost 0.3%.

Of the 11 S&P sectors, four closed in negative territory, lead by Technology. Among the seven gainers, Energy was the most popular on Friday. The tech heavy Nasdaq Composite, which has suffered over the past two weeks, ended 93.14 points lower, or 0.68%, to end at 13,644.85.

The Nasdaq Composite lost almost 2%, its second straight weekly downer.

Chip stocks AMD (AMD) and Nvidia (NVDA) lost circa 3.5% last week, while the US-listed shares of Chinese tech giants Alibaba (BABA) and JD.com (JD) fell 3.5% and 5.3%, respectively.

No one is happy when Beijing doesn’t stimulate. And deflation is on the menu in the Middle Kingdom after new data shows a powerhouse economy running on post-pandemic vapours.

More importantly the word from the street is that uber-nerd and META boss Mark Zuckerberg has posted on his Twitter-cage-fighting Threads that his ultimate cage fight with X boss Elon Musk won’t be happening, saying Elon just “isn’t serious”.

The billion dollar brawl earmarked for June looked to be in the bag when Elon X’d that he was so “up for a cage fight”.

Zuck replied with this:

Elon X’d this one, which Mark didn’t like: Somehow giving the whole thing to Italy AND charity has the stank on it.

The fight will be managed by my and Zuck’s foundations (not UFC).

Livestream will be on this platform and Meta. Everything in camera frame will be ancient Rome, so nothing modern at all.

I spoke to the PM of Italy and Minister of Culture. They have agreed on an epic location.

— Elon Musk (@elonmusk) August 11, 2023

But overnight a clearly downbeat, but possibly goading Zuckerberg wrote:

“I think we can all agree Elon isn’t serious and it’s time to move on”.

I for one, will never.

The US Census Bureau releases retail sales data for July on Tuesday (NY time).

The census-consensus is for spending to rise 0.4% month over month following a 0.2% increase in June.

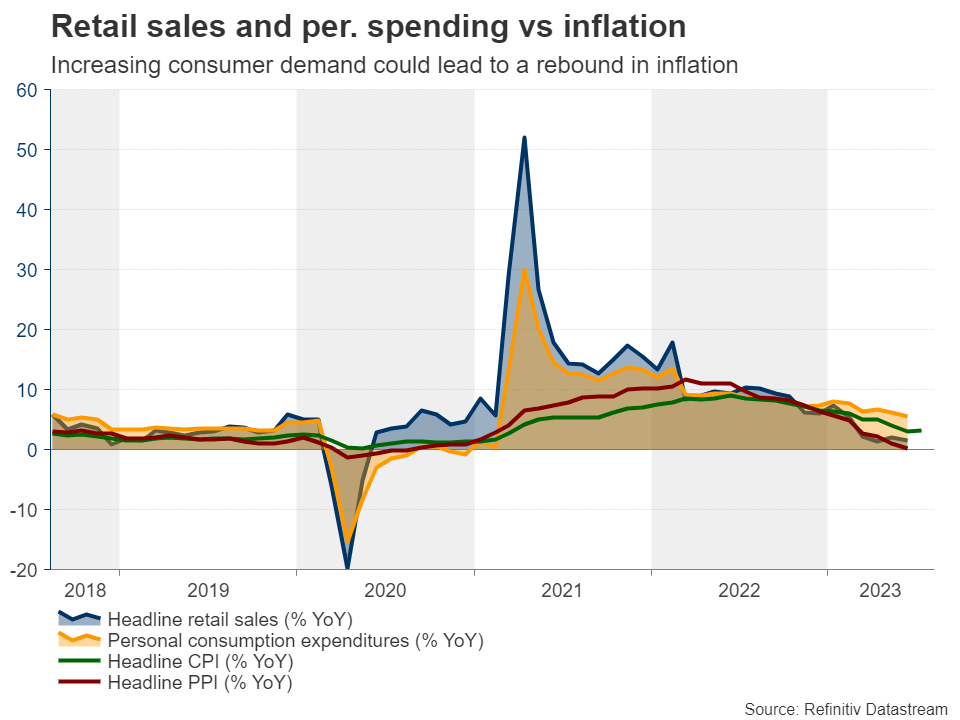

Punchy Americaland consumers have bought their economy out of and into trouble so far this year in the face of rising prices, inflation and the cost of money – as well as a a contracting manufacturing sector.

In that regard the US National Association of Home Builders will also release its Housing Market Index for August.

Data from China on national retail sales and industrial output is out on Tuesday, which will be closely watched given that the country’s economy has fallen into deflation after consumer prices declined in July.

On the corporate front in Americaland, while the retail sector will be in sharp focus, fans of tech will be awaiting the numbers on Palo Alto Networks (PANW) – which reports after the close, Friday, so Saturday morning for us.

PANW has a swag of of diversified IT tools, and currently holds the largest market share across several key cybersecurity categories, and thus, according to the Nasdaq’s Richard Saintvilus, is expected deliver more growth on both the top and bottom lines.

“Investors are expecting another strong quarter, evidenced by the stock’s strong performance. Its shares have risen 57% year to date, including 33% over the past six months, compared to a year-to-date rise of 16% for the S&P 500 index,” Saintvilus says.

Wall Street pegs Palo Alto to earn US$1.28 per share on revenue of US$1.96 billion. This compares to last year when Q2 earnings were just 80 cents on revenue of US$1.55 billion.

PANW have been the pace-setters for a few years now on the overall cybersecurity front when it comes to selling solutions and making money.

However, the brokers at Wedbush pulled the cyber security gurus from its famed “Best Ideas List” last week, with the epithat that PANW’s near-term upside is limited, due to fears around the growth in the cyber security sector.

Despite maintaining its Outperform rating on Palo Alto, Wedbush removed the name from its Top Picks List, citing limited upside due to near-term growth worries.

Oppenheimer Securities’ analyst Ittai Kidron, also says now is probably a good time to take some profits, pointing to the year-to-date surge in the stock price.

“With the shares now trading above pre- and post-COVID averages, we’d look to lock in some gains near term and therefore are removing PANW from our Top Picks list for the year,” Kidron wrote in an investor note.

“To be clear, our action only reflects near-term dynamics, Kidron added. “We remain bullish long term and suggest long-term investors stay the course.”

Oppenheimer also holds Palo at an Outperform rating with a price target of US$290.

And while the stock is still up well over 50% in 2023, shares of PANW, also collapsed by double digits 8% in a single Friday session earlier this month which Morgan Stanley pinned on management’s “surprising decision” to host a 2-hour call on a Friday to provide FQ4 earnings as well as mid-term FY26 targets. And those numbers the firm says, ‘apparently fuelled the sell-off .’

Cisco (CSCO) reports this week too.

Home Depot releases second-quarter earnings on Tuesday.

The share price has under-performed the market for much of the year. The company has been adversely impacted by soaring interest rates, which have helped to slow the housing market.

Wall Street expects Home Depot to earn US$4.45 per share on revenue of US$42.24 billion against the same quarter last year of US$5.05 per share on revenue of US$43.79 billion.

HD will be followed by Target (TGT ) on Wednesday. In keeping with the retail thematic Ross Stores (ROST), Tapestry (TPR), and Walmart WMT will confess on Thursday.

Foxconn, the Southern China-based company responsible for driving underpaid workers to madness and for manufacturing Apple’s iPhone reports on Monday.

Monday

Suncor Energy (SU) and Rumble (RUM).

Tuesday

Home Depot (HD), Agilent Technologies (A) and CAVA Group (CAVA).

Wednesday

Cisco (CSCO), TJX Companies (TJX), Target (TGT), JD.com (JD).

Thursday

Walmart (WMT), Ross Stores (ROST), Farfetch (FTCH), and Tapestry (TPR).

Friday

Deere (DE), Palo Alto Networks (PANW), and Estee Lauder (EL).