Rivian surged on debut in world’s biggest IPO. Here’s one way ASX investors could get in on global EV action

Tech

Tech

Tesla challenger, Rivian Group, surged as much as 53% on its Nasdaq debut on Wednesday, giving it a monster market cap of over US$100bn.

The valuation makes Rivian the second most valuable US carmaker after Tesla (US$1 trillion market cap), and ranking ahead of General Motors (US$85bn) and Ford Motors (US$77bn).

The US$12bn raised in the IPO was the biggest in the world in 2021 and according to stats, the seventh largest IPO in US stock exchange history.

It was also the biggest IPO listing in terms of market value since Facebook’s US$104bn IPO in 2012.

Rivian makes cars out of its Illinois plant, with initial models that include pickup trucks, SUVs, and commercial delivery van.

It was founded in 2009 but has flown under the radar until Jeff Bezos’ Amazon invested 22% in the company in 2019 and ordered 100,000 delivery vans.

Aside from Amazon, the company boasts big hitting asset managers Blackrock and T.Rowe Price on its register.

With Rivian’s share price blowing past the initial IPO price of US$78 to close at US$100.73 on day one, it’s left Ausie investors wondering if now is a good time to invest in EV-related stocks.

In fast-moving and emerging industries, it can be hard to pick individual winners.

So investing in a diversified fund like ETFS Battery Tech & Lithium ETF (ASX:ACDC) allows investors to access the potential growth across the EV battery technology megatrend.

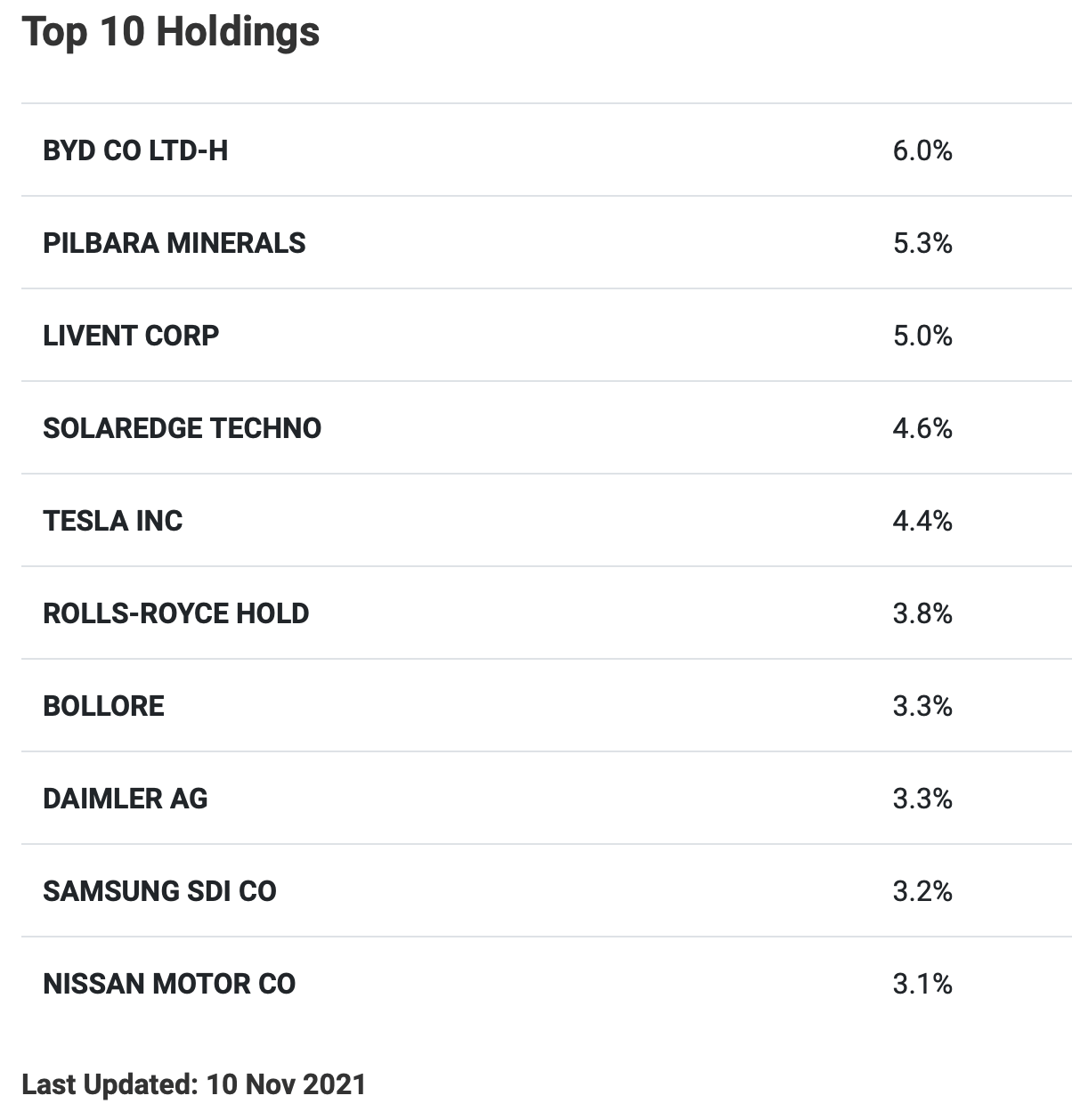

ACDC invests in companies involved in the supply chain and production for battery technology and lithium mining, and even includes car makers themselves like Tesla.

The ETF tracks the performance of the Solactive Battery Value-Chain Index, which comprise mainly of companies that are providers of electrochemical storage technology and mining companies that produce metals.

Stocks in ACDC are equally weighted, meaning each holding makes up the same portion of the portfolio at each semi-annual rebalance, and therefore contribute equally to overall performance.

In terms of stocks selection, the fund has some strict criteria.

For example, for energy storage technology stocks, the fund only chooses those that are identified from the Clean Horizon’s Energy Storage Source, classified as electrochemical, and have an energy capacity of at least 1 MWh.

For mining companies, stocks are chosen from Fastmarkets’ Metal Bulletin, including all companies producing battery grade lithium, with their primary listing on an eligible exchange.

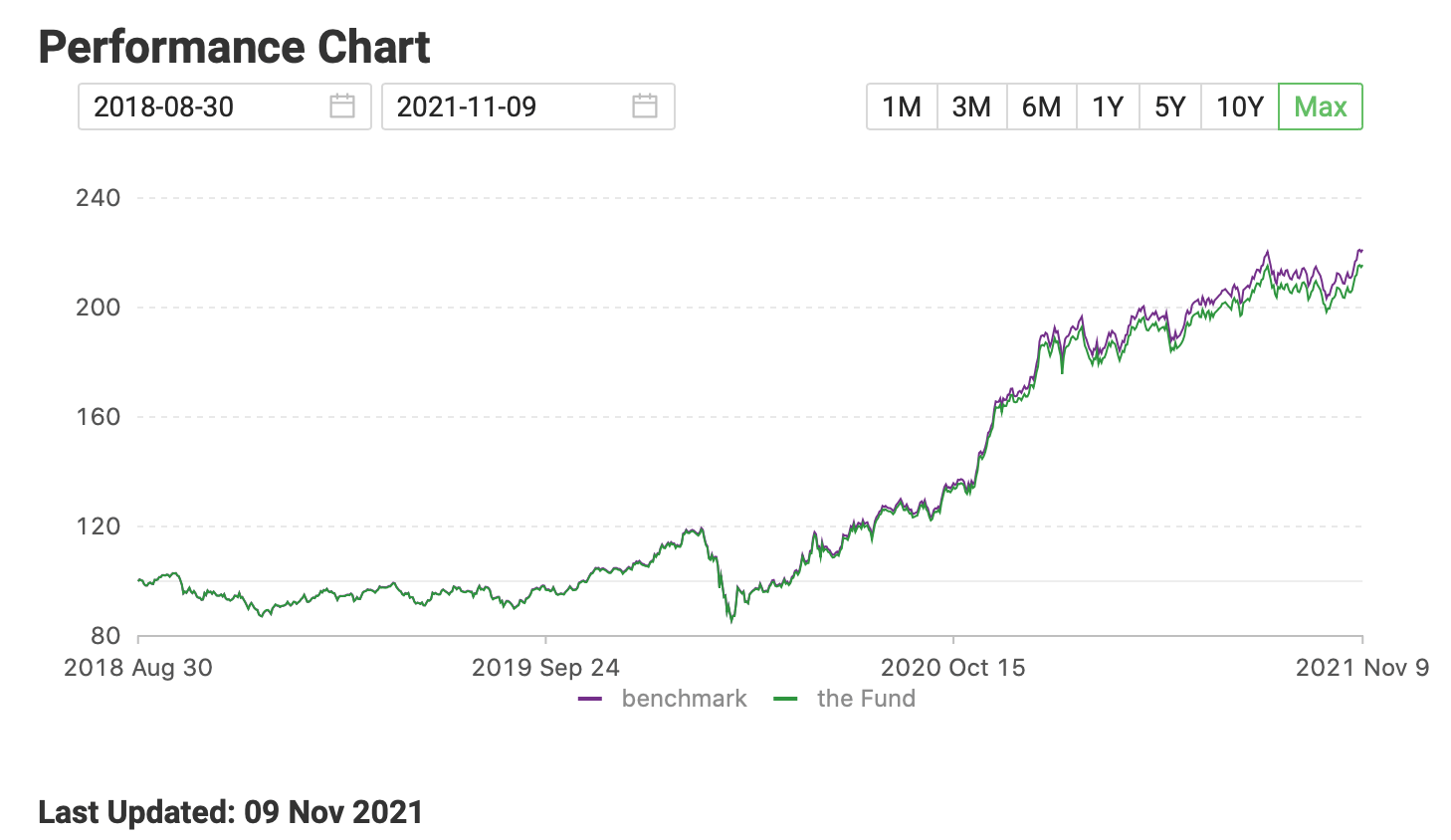

Since inception in 2018, the fund has returned 27%, and 50% in the past year alone, which was the best returning ETF in Australia.

Investors in the ACDC however will have to pay 0.6% in management fees annually, which is relatively high compared to other ETFs.