Registry Direct receipts up 60pc in Q2 FY22, focus now on product improvement

Tech

Registry Direct has reported strong metrics in Q2 FY22 as it works on improving its platform and looks for growth opportunities in the year ahead.

Online share registry venture Registry Direct (ASX:RD1) has announced a positive Q2 FY22 result with receipts up 60% compared to the previous corresponding period (pcp).

Commenting on the result, CEO Steuart Roe said: “We had another pleasing quarter with strong sales and revenue growth when compared with this time last year. With the capital raised, we aim to accelerate this growth, particularly over the second half of 2022.”

Registry Direct provides software and services to manage the registers of shares, units and other securities issued by listed and unlisted companies and trusts which operate in Australia.

New customers

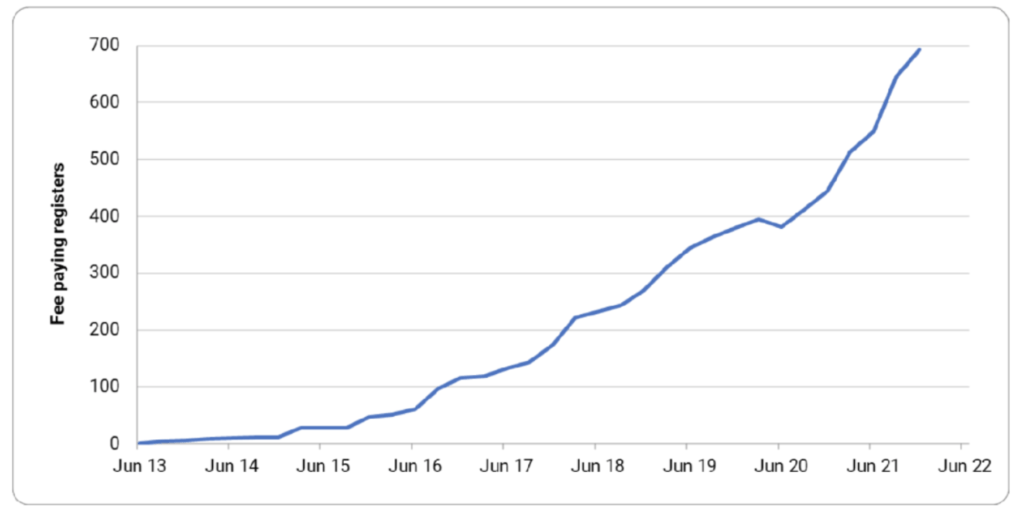

Registry Direct added 48 new fee-paying registers during the quarter, continuing its strong growth trajectory.

Fee paying registers have increased to ~700 with steady growth over recent years. Registry Direct was founded in 2012 and listed on the ASX in 2017.

Capital raises

The company also raised $1.4 million for ordinary shares at .027 cents each during the quarter. The capital raise was an 80% increase over the placement at .015 in the previous quarter.

Shareholders also approved investment by Registry Direct directors Ian (Steuart) Roe and Scott Beeton at the company’s AGM in October. Roe and Beeton both invested $100,000 for ordinary shares at 0.015 cents each.

The capital raises strengthen Registry Direct’s balance sheet and have been earmarked to assist the company implement its growth strategies.

Receipts up

Overall receipts from customers were $286,000 for the quarter, an increase of 60% compared to the pcp.

However, net cash when compared to the pcp was down due to increased expenses and reduced government subsidies.

During the quarter the government received a Federal Government R&D tax incentive grant of $256,000.

Registry Direct said lockdowns imposed due to the COVID-19 pandemic presented logistical challenges to growth plans. The company continues to make online sales and meet customer needs, but business development activities remain constrained.

Ongoing system improvements

Registry Direct has undertaken several upgrades and improvements to its leading-edge technology platform over the quarter, including to ensure its listed customers experience a smooth transition when the ASX migrates to its new CHESS system this year.

The ASX is in the process of replacing their ageing CHESS system with a modern publisher/subscriber blockchain alternative. Registry Direct is focusing on building out the integration into this new CHESS replacement system to ensure as trouble-free transition as possible for its customers.

Enhanced security multifactor authentication for both issuer users and investor users was implemented during the quarter, while different product improvements and bug fixes based on customer feedback were made.

Customers can now download holding statements in bulk as individual PDF files. A guided product tour for newly activated issuers was also implemented showing them how to manage outbound communication, order security in the CAP table and in holding statements along with design improvements to share certificates and inclusion of an example data set to the investor import spreadsheet template.

M&A on cards in 2022

In a statement Registry Direct said its board was exploring inorganic acquisition opportunities to further diversity and grow the company.

Registry Direct’s board said it was committed to driving shareholder value through growth strategies.

In a statement the company said its organic growth strategy was working as evidenced through successive year on year client and revenue growth.