You might be interested in

Tech

Gefen delivers muscular 1H customer growth, setting up a bright outlook

Tech

The US$4.5 billion valuation Wefox gives validation for ASX-listed Gefen. Will its share price follow suit?

Tech

Tech

Gefen’s technology automates a lot of the sales process for advisors in the insurance and financial planning sectors. And the market potential is huge.

In the last 20 years, disruptive technology has all but shifted power from the product owner to the distributor.

Think about the way we plan for travel – we no longer have to call the hotels (the product owner) directly but instead, book our rooms from one of the many online travel marketplaces.

What about riding apps like Uber and Lyft that we use instead of calling the taxi company?

That’s all well and good, but for some products like insurance or financial planning, complexities and regulations will always necessitate a customer to deal with a human advisor.

The agency business model hasn’t changed much for decades and maybe even centuries, with surprisingly little change in the way of digitisation.

ASX-listed Gefen International (ASX:GFN) wants to change all that, as it embarks on disrupting the traditional model by allowing insurance and financial agents to digitise and rapidly grow their sales.

Stockhead caught up with Gefen co-founder and CEO, Orni Daniel, to understand what exactly the company is doing to disrupt the advisors market, and how big the potential market opportunity is.

Daniel, who’s been flying F15 fighters with the Israeli Air Force for the last 25 years, says that Gefen has built a digital distribution technology to help advisors scale their businesses.

“If you look at the highly regulated insurance sector, around 91% of policies are still done with advisors,” Daniel told Stockhead.

“Due to regulation, customers need financial advisors to explain to them about the risks and complexities surrounding life insurance or financial products like pension plans for example.”

“But the business for these advisors hasn’t had any digital transformation at all, and we’re talking about tens of millions of advisors serving customers around the world, “ Daniel said.

Gefen’s award-winning Moments platform was specifically built to disrupt this traditional ecosystem, which includes the carriers (the insurance or financial corporation), the advisors/agents, and customers.

To be clear, the platform itself does not replace agents in the sales process, because it understands that they are necessary to the process itself.

What it does provide is a highly compliant platform that advisors can leverage – tools such as messaging and sales & marketing that would otherwise have not been available to them.

Gefen says the total addressable market for advisors’ commissions is a huge one, around $358bn now and growing by 19% to over US$420bn 2023.

The five-year old company has so far managed to secure contracts with some of the biggest companies in the world including TAL, Generali, Manulife, and Lloyd’s.

In short, Gefen’s platform connects advisors, carriers, and consumers within a network, and automates the way they interact.

The technology analyses customers’ data as well as their digital journey, providing automatic insights into their past decisions as well as buying preferences.

This enables advisors to offer a more relevant offering.

“Our technology looks into data such as how much time a customer spends on a particular website page, or how they responded to different offers in the past,” Daniel explained.

“This invaluable data means that an advisor would already have a lot of information about a customer when they see them face to face.”

“Whether they need family protection insurance for the growing family, or if they need new car insurance for a bigger car.”

A key feature of the platform is the fact that it allows advisors to recommend other experts within the distribution network.

“If I’m just an insurance agent and don’t have an expertise in, say financial planning, I can recommend a financial expert within the distribution network to the customer, allowing me to earn a split commission,” said Daniel.

Daniel says that an advisor would be more than willing to share the commission, because the acquisition cost of getting that customer has essentially been reduced to zero.

In fact, the Gefen platform reduces the overall customer acquisition costs for the corporation, which in turn increases the carrier’s revenue per customer.

Traditionally, financial and insurance advisors spend the bulk of their time in the office calling customers, telling them about new products, preparing contract new renewals, and making cold calls.

It’s an outdated and inefficient process that’s hard to scale up, Daniel says.

With Gefen’s platform, an advisor can automatically personalise new product offerings to individual customers depending on their specific needs, because that data is available.

“Say you have a new car — here’s the premium price comparisons for that type of car. This kind of engagement can all be done automatically without the advisor having to call each individual to make the offer,” Daniel says.

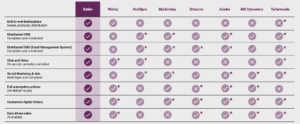

The Gefen technology essentially does the work of the services offered by other platforms in one, easy-to-use ecosystem.

Daniel likens Gefen’s offering to that of Shopify, an ecommerce platform that provides online shop operators with all the essential tools they could possibly need.

“Shopify provides ecommerce owners tools like website design, social pages, marketing and CRM capabilities. And in our case, Gefen puts the tools into the hands of the advisors,” Daniel said.

“Advisors are not experts in every field or necessarily tech savvy. Most are not able to utilise all the different tools like Salesforce, Hubspot or Adobe, and use their data to pull in customers.”

“And that’s what our platform does, simplifying all these for them,” says Daniel.

Daniel believes the platform could easily be expanded to other sectors.

“Real estate, pharmaceutical, healthcare, automotive, electronics. Basically we can extend the platform to every sector where there is a complex product and where an advisor is needed,” Daniel said.

Gefen operates a high gross margin business of over 80%, and Daniel says he’s just onboarded five large agent networks which are still not reflected in the company’s financials.

“We operate in a huge addressable market, and expect to see high jump on revenues during 2022,” Daniel said.

This article was developed in collaboration with Gefen International, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.