Gefen delivers muscular 1H customer growth, setting up a bright outlook

Picture: Getty Images

Gefen International has delivered another strong half with a huge surge in commission revenue validating its recent pivot to a new transactional model.

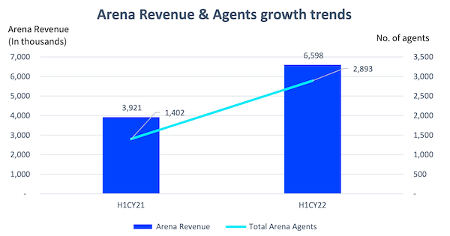

Gefen International (ASX:GFN) continues to drive strong growth in its flagship Arena platform during the first half of the calendar year, boosting its commission revenue by 68% on pcp to US$6.6 million.

During the half year, Gefen’s agent base on the platform grew by 106% to 2,983, while the number of customers increased to 477,669, up a massive 208% on pcp.

This growth positions Gefen to strongly ramp up its revenue further, as the company continues to increase its distribution coverage in Israel, as well as progressing other opportunities for wide-scale adoption.

The strong growth in metrics validated the company’s recent decision to change its revenue model from license fees to a transactional / commission model.

“This was a pivotal half for Gefen, with further validation of the revenue model change and continued strong uptake of our technology by both agents and customers,” said Gefen co-Founder and co-CEO, Orni Daniel.

Daniel says Gefen’s Arena platform delivers a robust ecosystem for agents and customers, where agents’ ability to sell complex products to customers can be significantly amplified.

“It is for this reason that we are continuing to grow our scale in the Israeli market, and progressing other very exciting opportunities for future wide-scale adoption,” he said.

Acquisitions

Prior year revenue included $2.8 million in license fees – when stripping this out to compare only transactional revenue (i.e. Arena revenue), this was up 68% to $6.6 million.

Total revenue for the half was up 4% to US$7.0 million (H1 CY21: US$6.8 million), including the license revenue, which Gefen is transitioning away from to focus only on transactional revenue.

Gefen has demonstrated during the half that the new fee structure provides greater incentives for partnering firms and agents to join the Arena platform.

Operating expenses for the first half increased 111% on pcp, reflecting investment in the business to build scale, as well as commission-related expenses associated with the new revenue model.

Earnings Before Interest, Tax, Depreciation, and Amortisation (EBITDA) for H1 was a loss of US$4.9 million.

This compares to the H1 CY21 profit of US$1.2 million.

Excluding shared-based payments, the adjusted EBITDA loss was US$3.7 million (H1 CY21: profit of US$1.5 million).

During the half, Gefen acquired several agent networks to support its distribution coverage in Israel in order to build scale.

This has resulted in significant one-time costs and increased cash burn associated with the acquisitions, as well as initial costs of onboarding new agent networks.

In the second half, Gefen expects to lower these spending costs and focus on agent partnerships rather than acquisition.

With anticipated higher levels of cash receipts, Gefen says it has adequate cash to pursue its immediate growth strategy.

Technology upgrades

Gefen’s Arena platform is building an ecosystem of agents and connecting them to more customers, resulting in more products to boost their share of wallet.

During the half, the company continued to enhance the capabilities of the platform by utilising online opportunities as input data to provide in-depth insights to its Arena agents.

The Business Intelligence module was rolled out to agents and agency managers in the half, providing them with a new dashboard with added insights and AI recommendations across vendors and different product lines.

The CRM II module providing over 100 new features was also completed. This module is being rolled out gradually and will replace CRM I, with plans of full deployment by the end of the year.

Over 50 new connectors were built and deployed during the half to vendors, resulting in deeper integrations to Open Insurance and Open Pension government platforms.

A new search engine was built and released, with comprehensive access to customers’ data and actions to gain deeper data insights to customer’s preferences and needs.

Outlook

Gefen says that growth in agents will drive its revenue going forward.

“The strong growth we have achieved over the half in new agents added to the platform will support revenue growth going forward,” Orni said.

“We will continue to aggressively pursue multiple avenues to expand our agent network over the second half to continue growing our network.”

Longer term, Gefen sees multiple opportunities to expand into new agent-based industries and new geographies.

“We have a globally scalable platform that offers transformational technology to a huge global market.

“The feedback received from agents on our platform gives us significant confidence that we can grow Gefen into a truly global technology provider,” said Orni.

This article was developed in collaboration with Gefen International, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.