Fintech lender MoneyMe says scale and automation driving strong returns in FY23

Tech

Tech

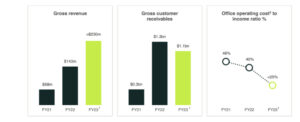

Scale and automation benefits are driving strong returns for MoneyMe, which has announced gross revenue of more than $230 million for FY23 beating guidance of $220 million and up 60% from $143 million in FY23.

In its Q4 FY23 update non-bank personal lender MONEYME (ASX:MME) says the increase in revenue was reflective of the scale benefits from its $1.3 billion loan book achieved in FY22.

MME says the focus on moderating originations resulted in a slight loan book reduction to $1.1 billion in FY23.

The group is realising $20 million per annum in cost synergy savings following the acquisition of credit lender SocietyOne in March 2022.

MME says the savings, alongside increased automation, have delivered a robust office operating cost to income ratio of below 25%, down from 40% in FY22 and 46% in FY21.

Principal originations of $127 million for Q4 FY23 were up 30% from $98 million on Q3 FY23, which the fintech says reflected healthy underlying product demand and a controlled increase in originations.

“It’s impressive to see how quickly the team has shifted the business from two years of high growth to consolidate the benefits from scale, transitioned the business to a higher credit quality portfolio, increased its automation capabilities, and recalibrated its capital base to deliver returns in a less favourable credit environment,” MD and CEO Clayton Howes says.

He says the financial performance from Q3 FY23 has continued into Q423 with realisation of SocietyOne acquisition synergies benefits and increased originations from servicing the high demand for Autopay.

The credit profile of MME’s loan book continues to improve in line with its ongoing focus on credit risk management and targeting of higher credit quality borrowers, resulting in a closing average Equifax credit score of 724 for FY23.

The company said 83% of the loan book had an Equifax score greater than 600, up from 79% in FY22 and 63% in FY21.

MME’s net losses reduced in Q4 FY23 to 5.6% from 5.9% in Q3 FY23 in line with expectations, which the company attributes to the significantly higher credit quality of the book and lower credit quality assets rolling off.

“We continue to protect our margins through targeted pricing and cost management and elevate the credit profile of our loan book through more conservative credit risk management whilst the macroeconomic uncertainty exists,” Clayton Howes says.

“It is pleasing to see the downward trajectory of net losses continue as the higher credit quality of the portfolio is coming into effect.”

MME repaid the SocietyOne acquisition component of its corporate debt facility in May 2023, using proceeds from a $37 million institutional placement which also settled that month.

The repayment restored the corporate facility principal to its original size, which will deliver ~$6m per annum in interest cost savings.

MME also completed a $4.3 million Share Purchase Plan (SPP) in June.

MME says its unrestricted cash at the end of Q4 of $16 million was up from $14 million in Q3 FY23, reflecting the net impact of the equity raise, partial corporate facility paydown and investment in new and existing loan receivable assets.

The company forecasts its cash position to increase further in FY24, as cash optimisation strategies take effect, including realisation of significant interest cost savings from lowering the corporate debt.

Completion of a $150 million term securitisation deal for SocietyOne personal loan assets in May 2023 marks the Group’s third term securitisation.

Howes says the significant funding milestones achieved in Q4 despite tight capital markets have effectively reset MME’s capital structure.

“The $41.3 million capital raise and repayment of the SocietyOne acquisition debt and the $150 million term securitisation deal for SocietyOne personal loan assets have reset MoneyMe’s capital base and strengthened our funding and liquidity position, enabling us to continue to deliver profits and lay the groundwork for future growth.”

During FY24 MME has plans to capitalise on its technological edge by focusing on product innovation, enhancing automation, and extending its AI capabilities.

The company will persist in creating a high credit quality portfolio, increasing the proportion of secured assets, and leveraging its current scale and cost efficiencies to achieve profitable and sustainable growth.

Additionally, MME is preparing for a return to high growth to further capitalise on scale advantages when the macroeconomic environment becomes suitable.

This article was developed in collaboration with MoneyMe, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.