Zenith Minerals regains full control of two highly prospective WA lithium projects

Mining

Mining

Zenith Minerals has regained 100% control of its Split Rocks and Waratah Well lithium projects in Western Australia after a failed earn-in by Saudi-backed EV Metals Group (EVM) voided the deal yesterday.

Back in January 2022, Zenith Minerals (ASX:ZNC) granted EVM an earn-in opportunity for 60% of the two lithium projects of which EVM paid $6 million for 20 million ZNC shares at 30c/sh on January 19 last year as part of the deal.

The T&C’s of the deal were such that EVM was to complete a feasibility study that showed a minimum resource of 35Mt @ 1.2% Li2O capable of producing 330,000t of spodumene concentrate with a grade of not less than 6% for a minimum of a 10 years, before January 10 this year.

While exploration by EVM was conducted during the period, both the minimum resource and feasibility requirements were not met and 100% ownership has subsequently been returned to ZNC.

The company says EVM also owes ~$1 million worth of refunds to Zenith concerning tenement rents, rates, staffing and other exploration costs incurred across the last ~2 years.

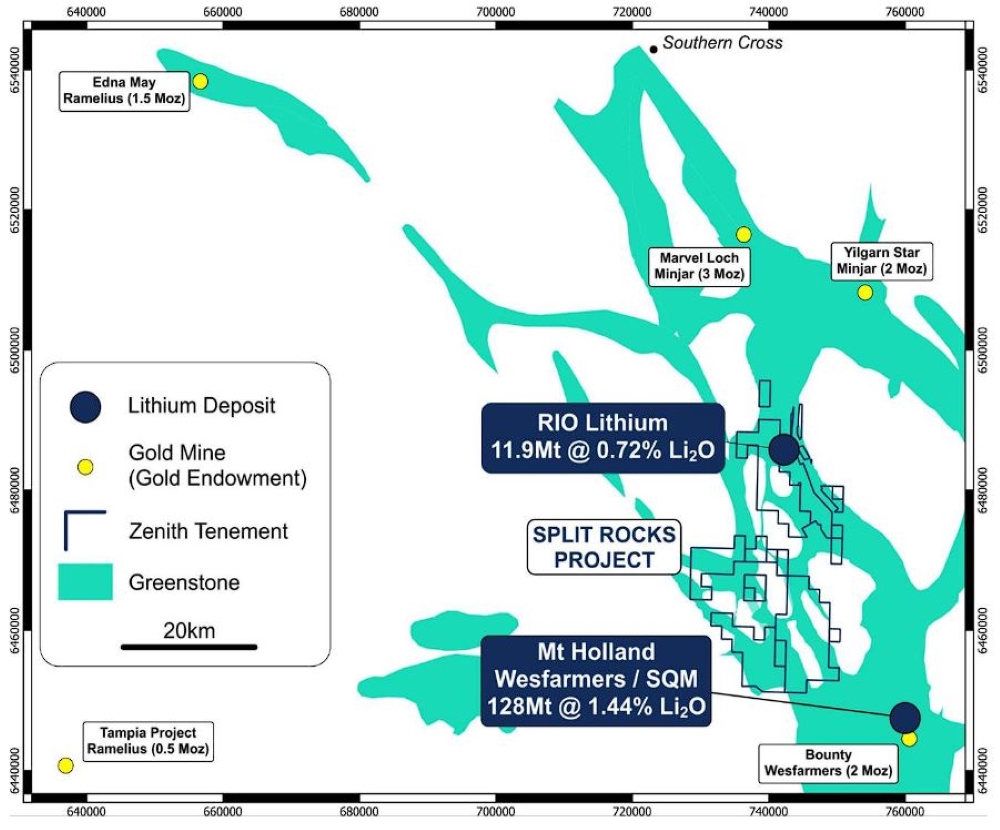

Located directly north of SQM and Wesfarmers’ giant 128Mt @ 1.44% Li2O producing Mt Holland mine and covering ~367km2 in the highly prospective Forrestania greenstone belt, Split Rocks contains the Rio lithium-caesium-tantalum (LCT) pegmatite deposit.

Exploration last year produced a maiden resource of 11.9Mt @ 0.72% Li2O – as well as pathfinder elements of caesium, tantalum, niobium and tin – where ZNC has announced 83 additional lithium targets for drill testing for a total of 318 holes permitted and ready.

Permits are in place for a further 193 AC drill holes which cover the Cielo lithium target, as well as 14 others at the tenure.

ZNC says heritage surveys have been completed and permits of work are in place for a substantial follow-up drilling program to define the extent of the mineralisation.

Initial exploration at Waratah Well early last year confirmed the presence of high-grade lithium pegmatites beneath soil cover, showing 14m @ 1.0% Li2O, including 8m @ 1.5% Li2O and 10m @ 1.4% Li2O including 6m @ 2.0% Li2O.

ZNC MD Michael Clifford says despite no drilling in 2023, under the previous earn-in agreement, the technical team has diligently advanced exploration at Split Rocks and Waratah Well.

“In September 2023, we reported a maiden inferred mineral resource for the Rio lithium pegmatite deposit at Split Rocks, highlighting its considerable potential with 11.9Mt at 0.72% Li2O,” Clifford says.

“In December 2023, we further announced the identification of 83 additional lithium targets at Split Rocks.

“Now, with 318 drill holes now fully permitted, including 50 at the Rio lithium deposit and permits for 193 AC drill holes at the expansive Cielo lithium target and other sites, we are well positioned for a 2024 extensive exploration campaign.”

Clifford says the Waratah Well project has also shown promising results, with initial exploration drilling confirming high-grade lithium pegmatites beneath soil cover.

“The potential extent of this mineralisation, which remains open in multiple directions, is yet to be fully explored,” Clifford says.

“We have all necessary permits in place for a substantial follow-up drill program in H1 2024 and are seeking expressions of interest from strategic investors.”