Resources Top 6: Krakatoa erupts on thick peggie finds; Azure neighbour Raiden also up on lithium dreams

Pic via Getty Images

- Krakatoa has made an ASX bang today, up 100pc on thick pegmatites at King Tamba

- Hot lithium stock and Azure neighbour Raiden Resources is firing on peggie action of its own

- Also making an impact on the local bourse: IPT, BMM, ZNC, OD6

Here are the biggest resources winners in early trade, Thursday November 9.

Krakatoa Resources (ASX:KTA)

Critical minerals-hunting junior Krakatoa is… erupting (there, we said it) today. Or at least its share price is – spewing out a daily gain of +100% at the time of writing.

Why? It’s intersected some thick pegmatites at the former tantalum mine that is King Tamba – now a site with strong lithium-caesium-tantalum potential.

It’s talking up to 39m pegmatite under the 4.3% Li20 rock chip at the Wilsons prospect.

We mentioned a few days ago that a boom of activity has been taking place at the 42km2 King Tamba project in WA’s mid west, where KTA recently began a reverse circulation (RC) drill program to test high-grade lithium targets.

The company reports that a total of 16 holes have now been drilled beneath high-grade lithium oxide rock samples, with 1,806 metres completed.

And of those 16 holes, 13 have hit pegmatites with consistent intersections of flat-lying pegmatite logged from a depth of 70 metres.

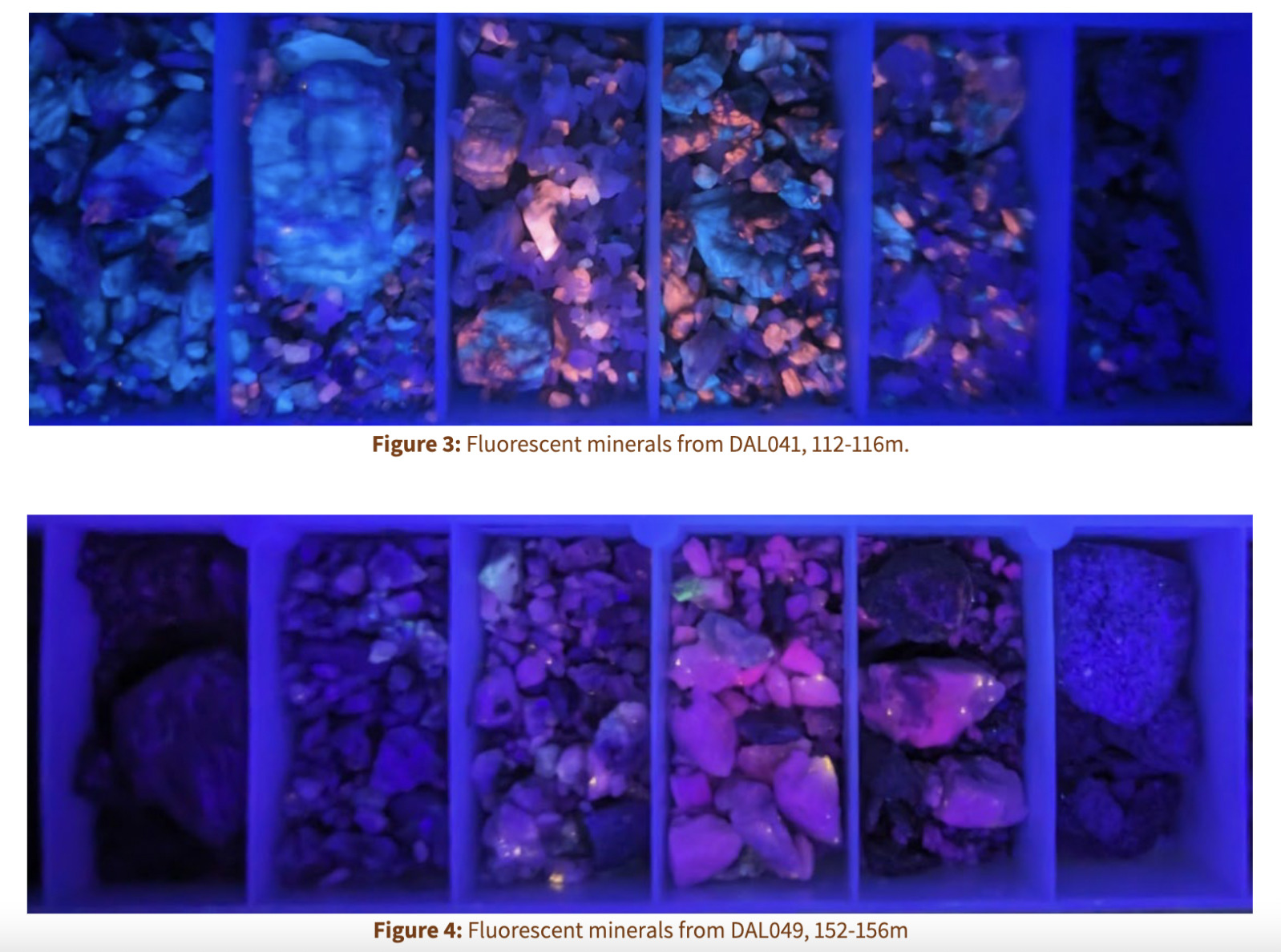

Want some rock pics? Here you go, taken under shortwave UV light…

Assay results are pending and Krakatoa notes that there is potential for additional pegmatites at depth and along strike.

Former tantalum mines are great places to go looking for lithium since the two materials are normally found in concert. It’s the backstory of Wildcat Resources’ (ASX:WC8) hot Tabba Tabba discovery, Bald Hill, Greenbushes and Wodgina for example.

More, in our special report, here.

KTA share price

Raiden Resources (ASX:RDN)

Overheard in the Stockhead office earlier:

“Azure is luring every billionaire under the sun right now but its neighbour Raiden goes and finds more peggies on its doorstep. Anyway, where’s that work experience kid with my flat white?”

Raiden, one of the ASX’s top stocks of 2023 with +952% YTD gains, has indeed tapped into some more pegmatite action at its Andover South tenements in the Pilbara.

Assay results have come in from recent rock chip sampling, and “continue to indicate high potential for significant and mineralised Lithium-Tantalum-Caesium (LCT) pegmatites”.

In fact, the latest sampling yields the highest grade lithium result (3.80% Li2O) defined to date from Andover South.

And further X-Ray Diffraction (XRD) analysis confirms spodumene as the dominant lithium mineral in the sampling.

Raiden MD Dusko Ljubojevic said:

“While the high-grade results from Andover South continues to impress us, we are particularly excited by the definition of further mineralised pegmatites on the western periphery of the high-grade trend we have defined to date.

“The western anomalies are reporting the highest grades defined to date and are characterised by multiple pegmatites.”

Some more recent news from the Raiden camp…

@LtdRaiden (#ASX: $RDN) is pleased to report on the acquisition of 100% of the Li-Cs-Ta rights over the Arrow project in the #Pilbara.

Read the full announcement here: https://t.co/C5mDcypcaB pic.twitter.com/vI6kh372R6

— Raiden Resources Ltd (@LtdRaiden) November 6, 2023

RDN share price

Impact Minerals (ASX:IPT)

This diverse Aussie minerals explorer (HPA, gold, silver, lead, zinc, copper, nickel and PGMs) is well up today after announcing “outstanding economics” from a scoping study at its Lake Hope project in WA.

According to IPT, the results from the study suggest the project could potentially be the lowest-cost producer of high purity alumina (HPA) globally – by up to 50%.

Lake Hope contains a significant alumina (Al2O3) resource, which could become a major global supplier of HPA – and that’s, the company notes, “because of the unique nature of the deposit that allows very cost-effective mining and processing”.

The potential is reportedly there for the project to produce a steady-state production of 10,000 tonnes HPA per year, following a two-year ramp-up.

Meanwhile, the study reveals low capital costs “compared to peers” driven by the unique nature of the clay deposit at the site.

Impact Minerals MD, Dr Mike Jones, said: “This Scoping Study demonstrates the world-class potential of the Lake Hope Project…

“If you are playing in the industrial minerals space, at least one of four things has to be true about your mine otherwise you will not make it through the market cycle: the deposit has to be either the biggest, have the highest grade, be the first to market or, preferably, be the lowest cost producer.

“The unique characteristics of the Lake Hope deposit, both in terms of mining and processing, look like they could possibly deliver HPA at the lowest cost globally by a significant margin”. “

IPT share price

Balkan Mining and Minerals (ASX:BMM)

Balkan Mining and Minerals is set to get drills spinning even harder at its flagship Gorge Lithium project in Ontario, Canada.

The company reports that it’s engaged a major drilling contract to complete a 2,500m diamond drill program underway at Gorge using a fit-for-purpose rig.

Balkan has engaged the services of Canadian outfit Major Drilling Group International Inc – one of the largest drilling companies in the world – and expects that a new rig and drill crew should substantially increase drilling rates and efficiency.

We’re talking round-the-clock drilling from a large crew here – 24-hour, seven-day-a-week shifts. You wouldn’t want to be camping nearby.

Balkan says the drill program has been designed to provide a better understanding of the lithium mineralisation in the shallow subsurface and to test the vertical plunge and extensions alongt he known Nelson and Koshman pegmatite strikes.

The company has already identified the presence of spodumene from one hole, hence the ramp-up in drilling, presumably. Assay results on that are pending in the coming weeks.

MAJOR DRILLING ENGAGED FOR DIAMOND PROGRAM AT GORGE LITHIUM PROJECT

🗞️https://t.co/gh7qSGu4gy$BMM.ax #Lithium pic.twitter.com/ttrbUnHTtN

— Balkan Mining & Minerals (@BalkanMining) November 8, 2023

BMM share price

Zenith Minerals (ASX:ZNC)

Diverse metals (base, industrial, precious, critical/lithium) hunter Zenith Minerals is pumping again today (+30%).

Last week we noted the company had some boardroom shifts that seemed to get the price going in the right direction.

Yesterday, the company has made notification of unquoted securities along with noting the issuance of 970,000 options exercisable at $0.153 expiring October 13, 2026 “to various employees of the company”. So… there’s that.

The options were issued “pursuant to the company’s Employee Share Option Scheme”. ZNC notes that “none of the related parties or key management personnel of the company have participated in the issue”.

ZNC share price

OD6 Metals (ASX:OD6)

Phase-3 drilling results at OD6’s Splinter Rock rare earth element (REE) project near Esperance, WA have returned grades of up to 6,4412ppm total rare earth oxides (TREO), leading OD6 to decide on updating the resource in the new year.

Some info per our special report on this today:

Spilter Rock contains an inferred resource of 344Mt at 1,208ppm TREO with the Centre prospect representing 149Mt of that at 1,423ppm TREO.

Found in a large clay basin within an elevated tableland, the Centre prospect target area has been defined through previous airborne electromagnetic (AEM) surveys and drilling results, which indicated REEs occur in thick clays that vary between 9-77m with TREO intersections of up to 2,379ppm.

“These assay results are truly exceptional, surpassing our previous outstanding results,” OD6 managing director Brett Hazelden says.

“The extent of the Centre prospect is simply massive, with some of Australia’s thickest high-grade clay hosted REE intercepts at up to 77m at over 1,400ppm TREO, with several zones in excess of 2,000ppm TREO.

“The consistency of mineralisation across such a vast 14km by 5km zone highlights the quality and significance of our discovery.”

OD6 share price

At Stockhead we tell it like it is. While Krakatoa Resources, Raiden Resources and OD6 Metals are Stockhead advertisers at the time of writing, they did not sponsor this article.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.