Who Made the Gains? Here are the top 50 ASX miners and explorers for April

Pic: Via Getty

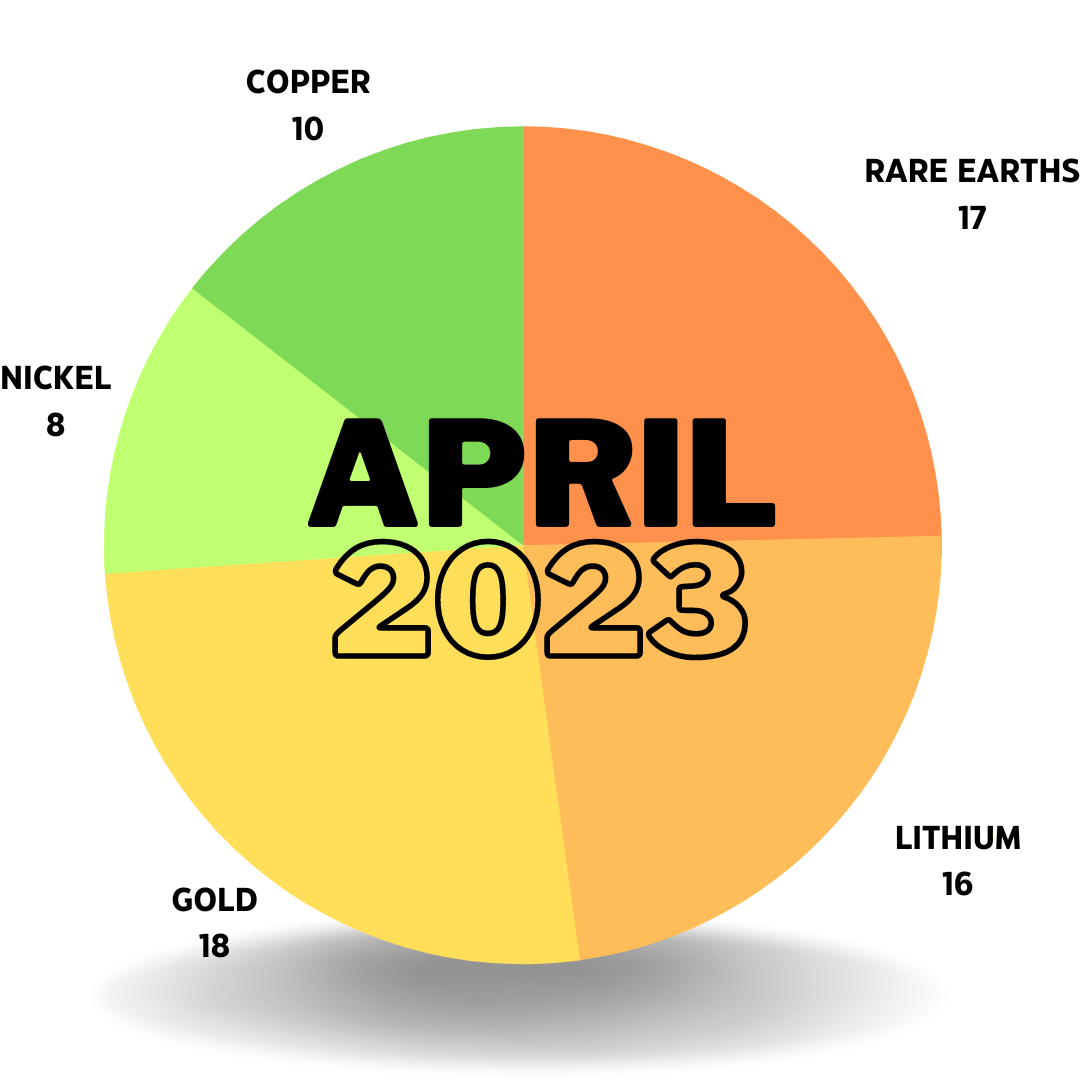

- Favoured commodities in April: gold, lithium, rare earths

- 3 resources companies made gains of 100% or more

- Top ASX resources stocks for April: Western Mines, Larvotto, Besra

April was an okay month if you were invested in the ASX 200 (+1.85% gain), but down the speccy end vibes were subdued.

‘Risk off’ remains in fashion, especially in exploration. Only three mining/exploration stocks gained more than 100% in April, down from January (5), up on February (zilch) but on par with March (3).

Those that made big gains generally had something distinct to offer investors.

There were discoveries. Acquisitions. Hard drilling mine builders. High grade hits. And a fully funded gold developer.

“This is a stock picker’s market,” said someone on Twitter the other day.

There was also a cartload of clay rare earth speccies, despite the REE price dropping harder than my Year 11 lovespuds.

But who am I to judge? You can also read our in-depth analysis of April’s best and worst performing metals here.)

Here’s a breakdown of the five most popular commodities for April:

Here are the top 50 ASX resources stocks for the month of April >>>

Scroll or swipe to reveal table. Click headings to sort.

| CODE | COMPANY | APRIL RETURN % | PRICE | MARKET CAP | COMMODITY |

|---|---|---|---|---|---|

| WMG | Western Mines | 324% | 0.7 | $38,845,560 | nickel, copper, PGE, gold, lithium, REE |

| LRV | Larvottoresources | 121% | 0.32 | $18,495,049 | REE, lithium, gold, nickel, PGE |

| BEZ | Besragoldinc | 107% | 0.2175 | $81,388,234 | gold |

| CHR | Charger Metals | 96% | 0.49 | $20,545,753 | lithium |

| BRX | Belararoxlimited | 89% | 0.36 | $14,219,107 | silver, gold, copper, zinc, lead, lithium |

| OD6 | Od6Metalsltd | 77% | 0.31 | $18,155,114 | REE |

| APC | Aust Potash Ltd | 76% | 0.03 | $31,160,334 | potash |

| WA1 | Wa1Resourcesltd | 74% | 1.795 | $63,881,063 | niobium, REE |

| AQC | Auspaccoal Ltd | 74% | 0.16 | $53,833,198 | coal |

| LIN | Lindian Resources | 74% | 0.4 | $380,796,636 | REE |

| FBM | Future Battery | 72% | 0.115 | $49,202,190 | lithium, nickel |

| MDX | Mindax Limited | 68% | 0.185 | $418,827,029 | gold, iron ore |

| AMD | Arrow Minerals | 67% | 0.005 | $15,118,825 | iron ore |

| DAF | Discovery Alaska Ltd | 67% | 0.05 | $9,866,327 | lithium |

| AR3 | Austrare | 64% | 0.36 | $35,290,586 | REE |

| HMX | Hammer Metals Ltd | 62% | 0.084 | $66,533,995 | copper, gold, REE |

| MTM | Mtmongerresources | 60% | 0.16 | $15,462,572 | REE, niobium, nickel, gold |

| LDR | Lode Resources | 59% | 0.365 | $21,238,158 | silver |

| RDT | Red Dirt Metals Ltd | 57% | 0.455 | $206,974,983 | lithium, gold |

| TYX | Tyranna Res Ltd | 56% | 0.025 | $60,160,633 | lithium |

| ADD | Adavale Resource Ltd | 55% | 0.017 | $8,831,944 | nickel, uranium |

| LLI | Loyal Lithium Ltd | 52% | 0.32 | $19,036,800 | lithium |

| FYI | FYI Resources Ltd | 52% | 0.105 | $36,631,759 | high purity alumina |

| IVR | Investigator Res Ltd | 51% | 0.062 | $91,978,881 | silver |

| KOR | Korab Resources | 50% | 0.027 | $9,910,350 | magnesium |

| RNX | Renegade Exploration | 50% | 0.021 | $20,638,723 | copper, gold, cobalt |

| VTX | Vertexmin | 49% | 0.125 | $4,572,500 | gold |

| AR1 | Australresources | 49% | 0.29 | $93,861,266 | copper |

| EUR | European Lithium Ltd | 48% | 0.092 | $134,031,526 | lithium |

| TSO | Tesoro Gold Ltd | 48% | 0.043 | $42,140,503 | gold |

| AHK | Ark Mines Limited | 48% | 0.31 | $10,729,132 | REE, nickel, cobalt |

| BUR | Burleyminerals | 47% | 0.28 | $17,503,091 | lithium, iron ore |

| PGM | Platina Resources | 47% | 0.028 | $16,202,689 | gold, scandium |

| POL | Polymetals Resources | 47% | 0.28 | $13,780,721 | silver, zinc, lead |

| G88 | Golden Mile Res Ltd | 47% | 0.022 | $5,795,509 | nickel, cobalt, REE, scandium, gold |

| 1MC | Morella Corporation | 43% | 0.01 | $60,985,804 | lithium |

| TGM | Theta Gold Mines Ltd | 43% | 0.08 | $49,852,154 | gold |

| MMI | Metro Mining Ltd | 42% | 0.017 | $74,185,104 | bauxite |

| OLY | Olympio Metals Ltd | 42% | 0.17 | $6,859,391 | REE, niobium, lithium |

| MPG | Manypeaksgoldlimited | 41% | 0.36 | $13,854,360 | gold, REE, lithium |

| TG1 | Techgen Metals Ltd | 41% | 0.086 | $5,144,891 | copper, gold |

| HRE | Heavy Rare Earths | 40% | 0.14 | $8,328,310 | REE |

| VTM | Victory Metals Ltd | 40% | 0.28 | $15,069,235 | REE, scandium |

| C6C | Copper Mountain | 40% | 2.74 | $46,778,942 | copper, gold, silver |

| PNN | Power Minerals Ltd | 40% | 0.405 | $28,898,337 | lithium, nickel, copper, cobalt |

| ENR | Encounter Resources | 39% | 0.16 | $51,551,238 | copper, gold, REE, lithium |

| GCM | Green Critical Min | 38% | 0.018 | $16,770,137 | graphite, REE |

| NWM | Norwest Minerals | 38% | 0.036 | $9,152,735 | REE, copper |

APRIL ASX TOP 5

WESTERN MINES GROUP (ASX:WMG)

Punters love a discovery story.

With only 65m shares on issue this tightly held, $38m capped stock has rocketed since hitting nickel paydirt at its Mulga tank project early April.

It is still early days, but the subsequent news flow is very promising.

By late April, follow up drill hole MTD026 was at ~400m depth “with significant examples of disseminated and remobilised nickel sulphides observed in top 250m”.

The top 250m on this hole appears to contain some of the richest shallow sulphide mineralisation seen so far, WMG managing director Dr Caedmon Marriott says.

The shallow mineralised footprint at Mulga Tank is now ~3.2km long, and “multiple deposits may well be expected given the scale of this clearly well mineralised system”, Marriott says.

LARVOTTO RESOURCES (ASX:LRV)

Clay REES are all the rage amongst investors.

Leading the pack last month was LRV, which reported high grade clay rare earths drill results up to 1.26% (12,611ppm) at the Merivale South prospect, part of the Eyre lithium-nickel-REE project in WA.

That 1m intercept was within a larger 12m at 2326ppm TREO.

The company says the mineralisation may be hosted within ionic clays, making it suitable for simple, cost-effective extraction. Testwork to confirm this theory is currently underway.

If there is an ionic component the reported grades are very high compared to known deposits, which usually grade between 700ppm and 1500ppm.

The size is also potentially significant. LRV’s drilling targeted an 800m section within an 8km-long TREO anomaly, and mineralisation remains ‘open’ in all directions.

BESRA GOLD (ASX:BEZ)

$80m capped BEZ is now up ~400% since inking a $US300m non-binding offtake and funding deal with bullion dealer and major shareholder Quantum Metal Recovery Inc in March.

This cash – paid over 30 months against future production ounces — would cover development of its 3Moz ‘Bau’ project in Malaysia’s Sarawak region.

BEZ has now received initial payment of $US2m from Quantum ahead of finalising the offtake funding facility. It is entitled to a further US$3m upon execution of the agreement, expected very soon.

The company is now updating an old feasibility study completed back in 2013, with initial results due in the second half of 2023. Pilot production is also pencilled in for later this year.

Meanwhile, assay results from 2022 drilling at Bekajang point to a high-grade feeder conduit system below the Bau Limestone-Pedawan Shale Contact (LSC).

Highlights included a very promising 12.6m @ 22.9g/t from 58.4m.

CHARGER METALS (ASX:CHR)

The mid-2021 IPO is focussed on two lithium projects: Lake Johnston in WA, and Bynoe in the NT.

A maiden lithium drilling program at Lake Johnston has delineated a swarm of stacked spodumene-bearing pegmatites up to 13m thick within a 100m wide, 700m long corridor at the Medcalf prospect.

High-grade lithium results, such as 4m at 1.21% Li2O from 208, 3m at 1.33% Li2O from 110m, and 3m at 1.35% Li2O from 136m, will now be modelled to define priority targets for follow-up drilling to test for extensions to the mineralisation.

In late March CHR appointed veteran small cap boss Aiden Platel as managing director and CEO, with lithium stalwart Adrian Griffin moving across to the non-exec chairman role.

At Bynoe — right next door to Core Lithium’s 18.9Mt Finniss lithium mine in the NT — an upcoming maiden drill program will target three sizeable, +500m long peggies.

BELARAROX (ASX:BRX)

Polymetallic explorer BRX says there is lithium upside on its Bullabulling tenements, a stone’s throw from Coolgardie in WA.

This area is an emerging lithium hub. Within a 185km radius of Coolgardie over 347Mt of lithium resources have been estimated by several ASX listed companies, BRX says.

Given the prolific lithium-bearing nature of the district, many explorers are switching their focus to battery metals.

Like neighbouring explorer Future Battery Minerals (ASX:FNM), which recently hit 29m @ 1.36% Li2O from 38m downhole, 11.5km from the BRX tenement boundary.

“Future Battery Minerals’ cumulative RC drilling of 3,440m was its first lithium-focused drilling campaign at what was traditionally its advanced Nepean nickel project,” BRX says.

“The switch of its focus to lithium was inspired after the reassaying of pegmatite intercepts from an earlier RC drill program designed to test a subsurface geophysical anomaly for nickel sulphide mineralisation.”

BRX is now planning early-stage exploration work, including rock chip sampling.

SPECIAL MENTIONS

Punters frontrunning drilling results from WA1 Resources’ (ASX:WA1) Luni carbonatite discovery were bang on the money.

On May 1, arguably the hottest explorer of 2022 unveiled a highlight 13m at 5% niobium, within an overall interval of 31m at 3.5%.

This is tremendously high grade.

There are three or so major niobium mines in the world; two are ‘high grade’ (between 1% and 2.5% ore grade), while the third sits around 0.5%.

Ferroniobium (~65% Nb), the primary saleable form of niobium, currently sells for ~US$45,000/t.

Former bauxite explorer Lindian Resources (ASX:LIN) rerated heavily last year after winning a protracted 2018 dispute for Kangankunde, one of the world’s largest REE projects outside China.

The gains have continued in 2023 as the company gears up for a Q2/Q3 maiden mineral resource estimate at this “tier 1 asset in the making”.

Drilling results announced last month included the best continuous intersections yet, like 184m from 4m to end of hole averaging 3.55% TREO. Monstrous.

Red Dirt Metals (ASX:RDT) has changed its name to Delta Lithium (ASX:DLI), but that’s not the reason this hard drilling WA explorer/project developer gained ~60% last month.

DLI is completely focused on achieving production/lindian growth as quickly as it can, punching in cumulative 25,000m of drilling a month across its Mt Ida and Yinnetharra projects.

It is one of the few ASX explorers with a lithium resource in the bag at Mt Ida (12.7Mt at 1.2%). Extensional drilling hits like 90.1m at 0.95% indicate this thing could get a whole lot bigger.

The company is aiming to kickstart a DSO mining operation at Mt Ida by the end of the year.

Then there’s Yinnetharra further north, where first pass drilling at Malinda is hitting ore grade lithium from surface and to a depth of 350m, along +950m of strike.

With the recent discovery of lithium 20km from Malinda at the Jamesons prospect, DLI boss David Flanagan says “Yinnetharra is looking more like a province than a project”.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.