Up, Up, Down, Down: Lithium, iron ore, rare earths tank as uranium shines brightest

Picture: Getty Images

- Uranium price hits year high as optimism for nuclear booms

- Lithium hydroxide falls 33% as iron ore, rare earths and coal also fumble the ball

- Nickel and gold in positive territory in tough month for commodities

WINNERS

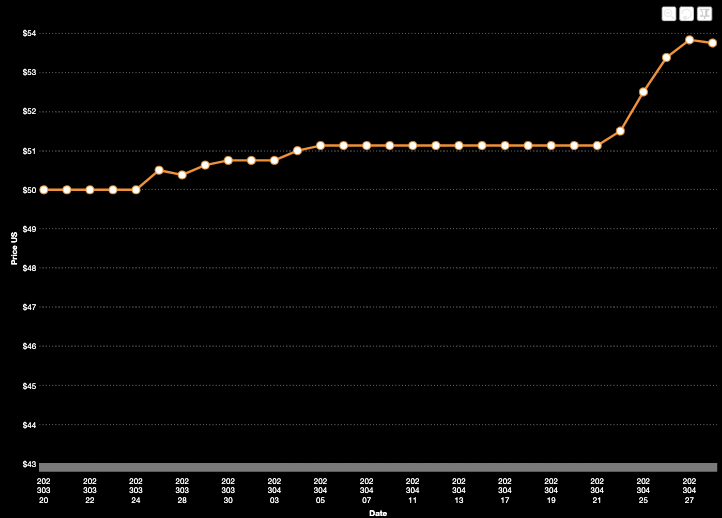

Uranium (Numerco)

Price: US$53.75/lb

% Change: +5.91%

Is this the time uranium finally breaks out of its US$50/lb box?

Yellowcake has finally put on a small, measured run, lifting by US$3/lb in the last week of April after almost four months of stagnation.

The conditions for a big lift in uranium prices, akin to that seen in the manic days of the mid-2000s, are reemerging if you listen to the bulls.

The case for the energy commodity is that we are at the start of the most ambitious nuclear facility build since the Fukushima incident prompted Japan to take its 50-odd reactor fleet offline in 2011.

World Nuclear Association numbers show there are around 60 new reactors under construction, 104 planned and 338 proposed.

“We will see how that all comes to pass. I don’t really have a breakdown in terms of what we view as speculative, we haven’t really delved into the 338,” Canaccord Genuity analyst James Bullen, who has buy ratings on Aussie uranium stocks Paladin Energy (ASX:PDN) and Boss Energy (ASX:BOE), told Stockhead last month.

“But I think the 104 planned is a reasonable number.

“So to put that in perspective, I think if they all play out, it’s about 100% growth in global demand that will happen.

“Obviously that’s not in our numbers (but) if you have a look at the Chinese reactor growth, they’ve got 21 in construction, 47 planned and 156 proposed and that’s all WNA data, not Canaccord data.

“We absolutely see the need for new greenfields. And that’s what underwrites our baseline of US$65/lb. And then if we’re going to see Kazakhstan have less market share, then we think that there’s going to be a need for a US$10/lb Western premium.”

Boss remains on track for production at the restarted Honeymoon mine in South Australia by the December quarter, the developer said last week.

“This timetable was designed to ensure we are in production at the start of the next forecast uranium bull market, not halfway through it,” CEO Duncan Craib said.

“With the outlook for the uranium price continuing to strengthen amid growing use of nuclear power and a shift away from Russian uranium, we are perfectly positioned as we prepare to move into the final stages of construction ahead of commissioning.”

Top industry figures, led by the CEO of Canadian industry giant Cameco, Tim Gitzel, have grown more confident in the pricing outcome of the newest contracting cycle being a positive one for miners.

The failures of previous miners who brought on marginal supply to chase spot prices as they rise are another reason supply is likely to respond slower than needed as demand lifts from utilities.

“We will not front-run demand with uncommitted supply and risk being exposed to a discretionary spot market,” Gitzel told analysts on a conference call on Friday.

“We have seen other companies pursue a spot market strategy many times in the past and every time it failed. It only served to transfer value from shareholders’ pockets into the pockets of utilities, traders or other intermediaries.

“Any company that understands our industry has learned the lessons of the past. They understand that in the near-term, there is very little uncovered demand, you just have to look at UXC’s uncovered requirements in 2023 and 2024, they are very small.

“Contracts being signed today aren’t for in-year demand, they are generally for requirements starting in 2025 and beyond when uncovered requirements start to grow. However, if you wait until then to contract, you will miss the contracting cycle.”

Uranium share prices today:

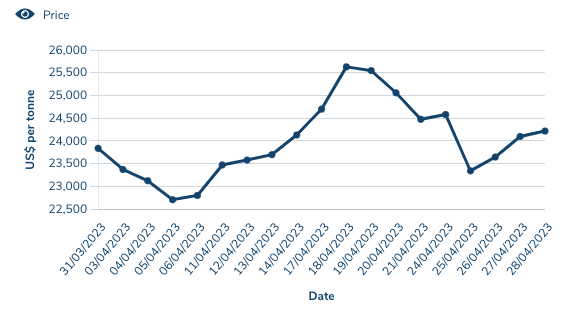

Nickel

Price: US$24,219/t

% Change: +1.6%

It’s hardly been a watershed month for base metals, with demand signals from key market China all over the place.

But nickel has emerged in a poor run for commodities as one of the few to hold its value.

Nickel has fallen from levels of upwards of US$30,000/t at the end of last year. Not unexpected given the International Nickel Study Group sees the surplus for the key EV metal, used in high range lithium ion batteries and electric vehicles, more than doubling to 239,000t in 2023.

The big reason behind that is a massive expansion of supply in Indonesia, where miners like ASX-listed Nickel Industries (ASX:NIC) are growing production at a pace not seen since Rick Moranis tested his kooky experiments on his kids.

Not only are Indonesian miners growing supplies of “Class 2 Nickel”, or nickel pig iron for use by stainless steel producers like Tsingshan, they are also expanding into high pressure acid leach and nickel matte production to carve out a niche in the battery supply chain.

A premium, or at least preference, for Western-sourced nickel could well emerge as China and the West’s markets diverge and amid ESG concerns around Indonesian nickel supply.

We have recently seen Andrew Forrest use his Wyloo Metals private investment vehicle to secure control of Mincor Resources (ASX:MCR) in a cash deal valued at $760m. And experts from RFC say many undeveloped nickel projects in the West could be more attractive now for major miners.

Commbank’s Vivek Dhar says the long-term direction of LME nickel prices could depend on how far LFP (lithium-iron-phosphate) battery chemistries cut into demand for nickel rich cathodes. Additionally tighter ESG requirements in Indonesia could make that country more attractive for ex-China investment.

“The energy intensive process of converting Class II to Class I nickel, combined with the coal power exposure in Indonesia, had raised concerns that the EV sector may reject Indonesia’s converted Class I nickel on the carbon intensity of the nickel,” he said.

“However, these concerns will likely ease due to Indonesia’s plan to tighten environmental regulation, which will lower the carbon intensity of Indonesian battery‑grade nickel.”

Nickel miners share price today:

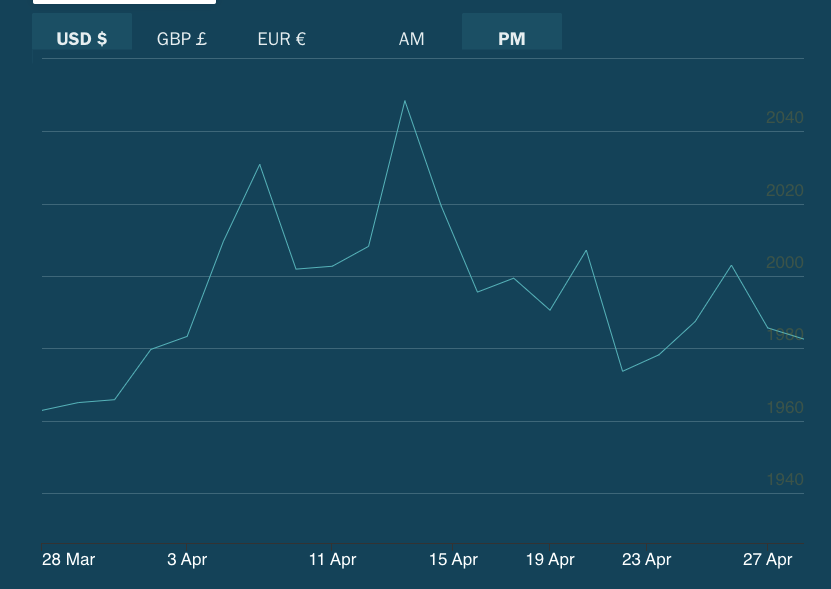

Gold

Price: US$1982.50/oz

% Change: +0.14%

Since hitting nearly US$2050/oz on April 13, gold has retreated from its short term threat to the record highs seen in August 2020.

But many analysts see the safe haven metal moving back there, having enjoyed a strong start to 2023.

“Currently, the market is pricing a 25bp hike in the next FOMC meeting. We expect rate hikes of 25bp in May and June 2023,” they said in a note last month.

“If the Fed pauses earlier than the market expects, it could quickly amplify gains in gold.

“We see gold reaching USD2,080/oz in next the 12 months.”

Gold equities have posted a good start to 2023 as well. Through the first third of the year the All Ords gold sub-index has lifted almost 25%.

Gold miners share prices today:

LOSERS

Lithium (Fastmarkets Hydroxide CIF China, Japan and Korea)

Price: US$40,750/t

% Change: -33.74%

One dominant market story has been the precipitous slide in lithium prices in China this year, something which with the benefit of hindsight could well have been anticipated given just how extraordinarily they exceeded expectation in 2022.

April saw the fastest acceleration in the fall of hydroxide and carbonate prices in China, with a number of factors to blame.

Subsidies for EVs in the Middle Kingdom ended at the same time ICE producers were forced to heavily discount cars which won’t meet emissions standards come July 1, creating a price war between battery and fuel vehicles.

Chinese marginal, high cost lepidolite have increased supplies as well. In the past week however, carbonate prices have begun to lift, suggesting either a plateau or balance was being reached with converters having to idle some production given the still very high cost of spodumene.

Mr Lithium, Joe Lowry, even told delegates at the Resource Connect Asia Future Facing Commodities conference in Singapore, China was “creating a false narrative” to talk down lithium prices despite expectations across most analysts of sustained long-term deficits and rising EV penetration globally.

In the lithium equity space stocks have outperformed the underlying commodity thanks to the afterglow from Albemarle’s $5.5 billion bid for Liontown Resources (ASX:LTR), immediately rejected by the owner of the Kathleen Valley lithium mine.

The takeover attempt and premium on offer demonstrated how bullish major producers remain about the long-term outlook for the lithium and EV market.

Lithium stocks prices today:

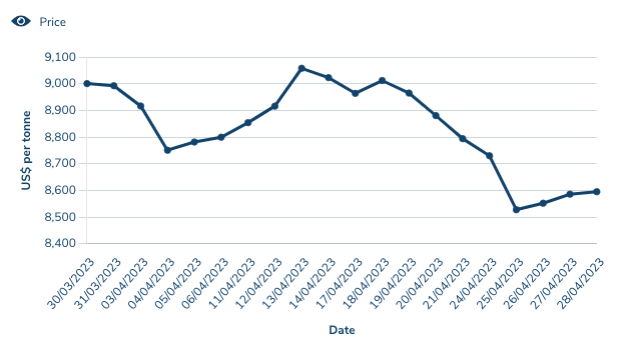

Copper

Price: US$8595.50/t

% Change: -4.42%

Copper has dawdled in 2023 so far, getting through the first third of the year not far off levels seen at the end of the last one.

That will disappoint copper bulls who had been hoping a tough supply situation and revival of demand from reopening China would put a rocket up the red metal, which is yet to return to record levels in excess of US$10,700/t seen in May 2021 and March 2022.

But the activities of the world’s biggest miners, currently splurging billions to buy copper tonnes that would take over a decade to build organically from their own exploration assets in the expectation it will eventually be the big winner from the energy transition.

BHP (ASX:BHP) secured its $9.6 billion acquisition of OZ Minerals last month, while Glencore made a more than US$23 billion play for Teck in Canada.

Commentary out of the CESCO copper conference in Santiago, Chile, last month suggests M & A is on the minds of companies who have run into ESG and regulatory roadblocks on assets they hope to develop in places like the USA.

That means that while for the moment supply and demand are in lockstep, it will not be that way forever. Something about 10 Escondidas and all that.

Chief executive officer of Antofagasta Minerals Ivan Arriagada told Fastmarkets he sees a surplus as new mines open in 2024 with a deficit returning in 2025 and 2026, though many analysts see a major deficit emerging by the end of the decade.

“Despite the fact that we’ve got some new projects coming onstream with fresh copper, we see that supply is going to be tight with respect to demand, and therefore the market will be in a small deficit this year,” Arriagada said in an interview with Fastmarkets.

“We expect to see global demand growth for copper of 2-3% this year. For 2023, the fundamentals of supply and demand are supportive of the type of price levels that we’re seeing now.”

Copper miners share prices today:

Coal (Newcastle 6000 kcal)

Price: US$185.15 /t

% Change: -4.06%

Coal prices are well below levels seen last year, when thermal coal was ‘roided up by the Russia-Ukraine conflict to prices in excess of US$450/t.

No super-profits for coal miners then this year. Just very, very, very good profits.

After big falls through the March quarter, prices appear to have found a temporary bottom in April. Which way they go from here remains to be seen.

They remain strong enough to stimulate what little new coal developments have been approved to proceed in the current regulatory regime.

Whitehaven (ASX:WHC) announced it would be in production at a small scale pilot of the Vickery Extension Project by mid-2024, four years after its approval by the New South Wales Independent Planning Commission in 2020.

Its super-high grade 6400kcal thermal product will replace high ash, low CV coal from the closing Werris Creek operation to the tune of 900,000-1Mt on a sales bases ahead of a decision on a larger 10Mtpa development.

Meanwhile, Australian Pacific Coal (ASX:AQC) has approved a restart of the Dartbrook coal mine, the subject of a corporate tussle between Nathan Tinkler, Nick Paspaley and handful of coal industry figures last year.

Now run on an interim basis by former Oil Search and Coronado CFO Ayten Saridas, AQC has restructured the JV with Matt Latimore’s M Resources, Nick Paspaley’s Trepang Services and Tetra Resources to increase its stake in the mine from 50 to 80% and economic interest to 70% to facilitate its development.

The mine is expected to cost somewhere in the order of $100-120m to bring to market by the fourth quarter of this year.

Coal miners share prices today:

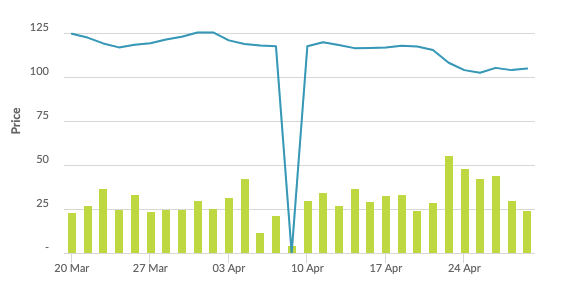

Iron ore (SGX Futures)

Price: US$104.81/t

% Change: -16.37%

After a strong start to the year iron ore flunked in April, falling over 15% as the heat came out of the Chinese economy’s resurgence from Covid.

China’s PMI readings disappointed, giving a hint of the slowdown in factory activity that has impacted the country where, as producer of almost 60% of the world’s steel, the bulk of the iron ore market resides.

Another issue has been the instructed closure of some steel mills struggling to make profits. Despite thin or negative margins, Chinese steel production and blast furnace utilisation had risen for 14 consecutive weeks until mid-April.

It has fallen for the past two weeks, with utilisation dropping 0.87% from April 21-27 amid a rush to maintenance at loss-making factories.

In the Australian market Fortescue Metals Group (ASX:FMG) celebrated the production of its first 68% Fe plus magnetite concentrate from the new Iron Bridge mine.

Meanwhile, FMG and BHP bosses maintained a healthy (or maybe unhealthy) level of optimism on demand in the Chinese market.

“There’s always a level of day to day volatility. We try to look through that to the underlying fundamentals on supply and demand,” new FMG boss Fiona Hick said on a call with analysts and media last Monday.

“When we do that, we’re still quite optimistic on China’s crude steel production and demand for certainly this calendar year and beyond.

“There have been rumours, you’re right, of production (cuts) in recent weeks. But our analysis suggests that demand in China is actually going to increase year on year.

“And so we’re seeing demand in China improve in recent weeks, steel inventories continuing to draw at both traders and mills, and inventories are low.”

Iron ore miners share prices today:

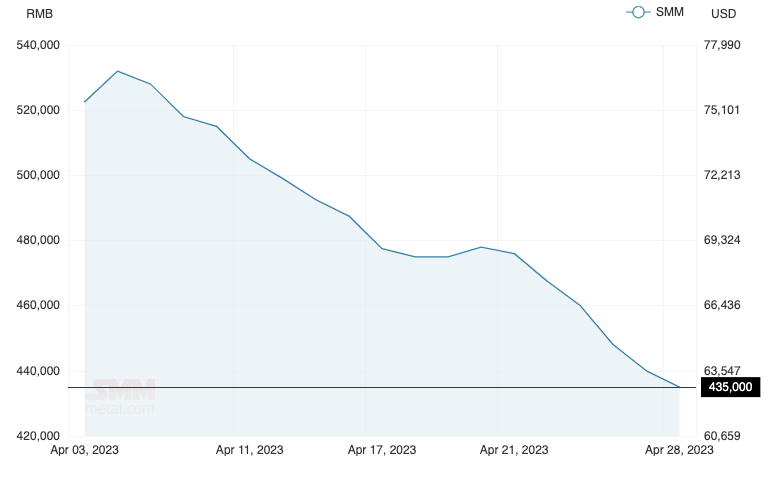

Rare Earths (NdPr Oxide)

Price: US$62.93/kg

% Change: -17.07%

Rare earths prices, so strong throughout most of last year, have returned towards historical levels as production quotas rise in China.

After falling in March, NdPr prices recorded another 17% drop in April.

By way of example, global market leader China Northern Rare Earth saw its income fall 5.9% year on year in the March quarter, with its profits down 40.83% to 922 million Yuan, equivalent to around US$133m.

Lynas Rare Earths (ASX:LYC) managing director Amanda Lacaze, whose Aussie miner is the largest outside China, said at the miner’s quarterly results on April 21 that despite short term issues they still see NdPr prices trending positively in the long term.

Her market expert Pol Le Roux said market pricing for the commodities, used in wind turbines and EVs, was in China’s hands.

“It’s definitely more than ever in the hands of China,” he said.

“Which is the main reason why demand is a bit weak at the moment is also because the Chinese economy’s a bit down.”

At the same time, Lacaze leant some credibility to purveyors of ionic clay rare earths. Distinct to the hard rock carbonatite hosted deposit at Lynas’ world-leading Mt Weld operation, clay rare earths are becoming a popular if largely unproven side of the Australian rare earths investment market.

“Upstream, do we look at alternate resources?” she said when asked about non-core business opportunities.

“Certainly ionic clay deposits with their preference for heavies (heavy rare earths) is of interest.

“Rare earths that are not from hard rock deposits are interesting because you know, anything where the mining costs have already been sunk is of interest.”

Rare Earths share prices today:

OTHER METALS

Prices correct as of April 28, 2023.

Silver

Price: US$24.77/oz

%: +3.68%

Tin

Price: US$26,088/t

%: +0.98%

Zinc

Price: US$2647.50/t

%: -9.41%

Cobalt

Price: US$34,930/t

%: +0.00%

Aluminium

Price: US$2356/t

%: -2.36%

Lead

Price: US$2148/t

%: +1.95%

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.