Has WA1’s niobium-rare earths discovery unlocked a new mineral province? These ASX explorers are about to find out

Pic: Tetra Images. Via Getty Images

- Explorer WA1 Resources (ASX:WA1) gains 500% on new niobium-rare earths discovery at West Arunta in WA

- Only two holes had been drilled in the region border prior to this

- Rio is also actively exploring region, alongside ASX juniors Encounter and Norwest

On Wednesday last week, the share price of explorer WA1 Resources (ASX:WA1) jumped a barely believable 420%.

The junior explorer finished the week up 500%, from 14c to 84c per share.

Why the rocket? Well, WA1 hit thick, high-grade niobium in its first hole in a remote, lightly explored, but highly mineralised region (we’ll get to that in a minute).

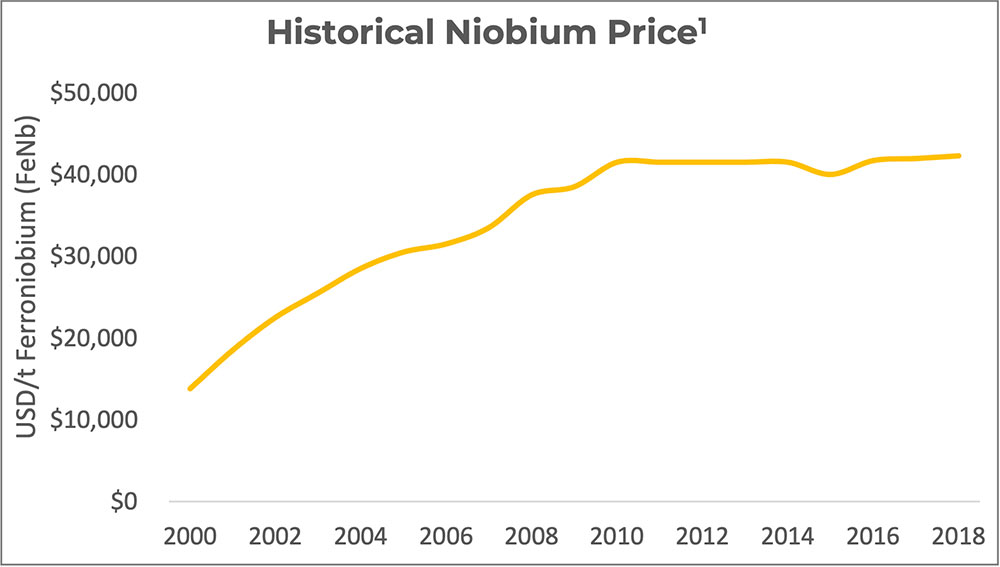

Niobium is mainly used to make steel better, but also has growing uses in lithium-ion batteries, intelligent glass, solar panels, 5G tech, and nuclear energy.

Ferroniobium metal (65% Nb) currently sells for ~US$45,000/t.

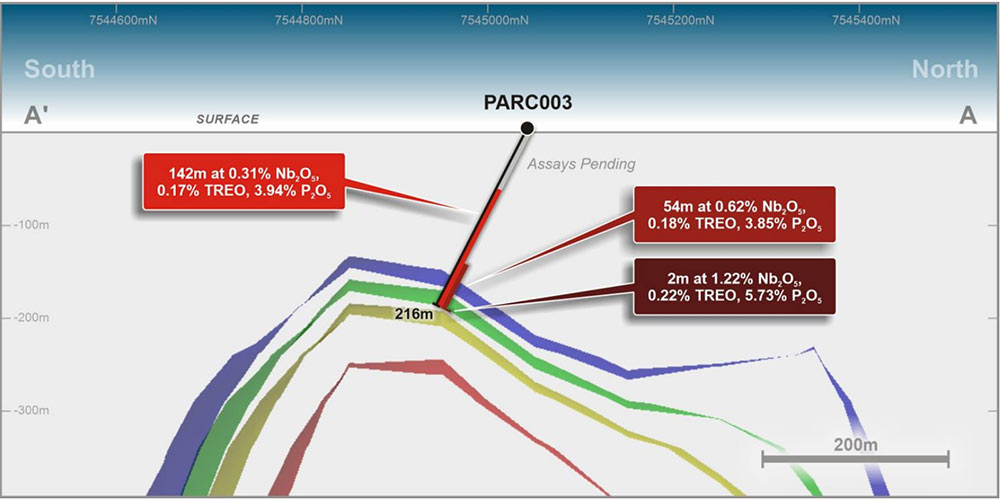

WA1’s only drillhole into the P2 target, at the West Arunta project in WA, pulled up 54m at 0.62% niobium, 0.18% rare earths and 3.85% phosphorus from 162m.

The 216m-long hole ended in 2m at 1.22% Nb2O5, 0.22% TREO, and 5.73% P2O5.

Those are good numbers, especially for a maiden drillhole.

For reference, there are three major niobium mines in the world; two are very high grade (between 1% and 2.5% ore grade), while the third sits at around 0.5%.

Meanwhile, the Panda Hill niobium project, previously owned by Cradle Resources (ASX:CXX), had an ore reserve grade of 0.68%, while Globe Metals and Mining’s (ASX:GBE) advanced Kanyika project has a resource of 68Mt at a grade of 0.283%.

The fact that WA1’s hole finishes in material grading 1.22% means this thing could be getting better at depth.

P2 also extends for 3km and has significant future exploration potential, WA1 says.

Furthermore, because WA1 was hunting for deep IOCGs (iron oxide copper gold deposits) they didn’t assay the top +70m of the hole.

Managing director Paul Savich told Stockhead the highest-grade stuff in a lot of rare earths deposits is in the weathered material at the top.

“We knew we knew nothing about the belt, so it came as a surprise but not a complete shock that the mineralisation we were chasing wasn’t there, and it ended up being something else,” he says.

“When we look at REE deposits like [Lynas Corp (ASX:LYC)] Mt Weld, [Northern Minerals (ASX:NTU)] Browns Range or [RareX (ASX:REE)] Cummins Range, the highest grade portions are usually in the weathered material at the top.

“That’s the part of the hole we didn’t assay, so we have submitted that [top 70m] to the lab.

“But regardless of that, this high-grade niobium in the fresh rock is telling us something exciting.

“We have so much to learn. The only way to figure this thing out is to do some more geophysics to refine the targeting, and then do more drilling [after the wet season] early next year.”

West Arunta: the next big mineral province?

This emerging discovery is exciting for all the explorers in the region.

People have been talking about West Arunta as something special for a while but no one has really proven it, until now.

Historically, only two holes had been drilled in West Arunta before WA1 drilled seven in July this year.

“We are drilling huge, first order geophysical anomalies,” Savich says.

“No doubt there is huge potential out there.”

Savich say West Arunta first made headlines when major miner Rio Tinto (ASX:RIO) locked up the southern belt a bit over a year ago.

“When we were saying ‘we want to go explore this new belt that has no historic information’ everyone thought we were nuts, but as soon as Rio rock up on your doorstep it was validated,” he says.

Which other companies are exploring the region?

There’s a bunch of private companies with ground in the area, including project generator Tali Resources (Savich’s old company), which sold WA1 its flagship project and is now majority shareholder.

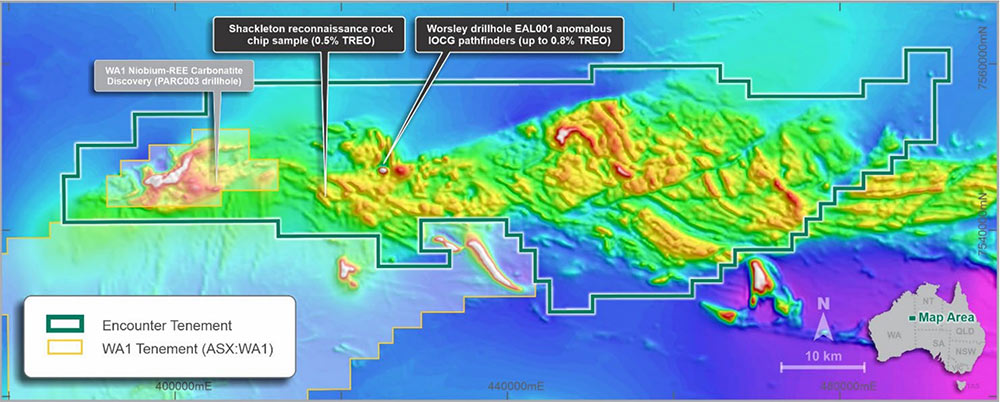

The Big Kahuna is Rio, which has pegged a bunch of ground and also inked a $58.5m Farm-in and Joint Venture Agreement with Tali.

Other listed explorers with ground in the area include Encounter Resources (ASX:ENR), whose Aileron project abuts the WA1 discovery, Norwest Minerals (ASX:NWM), and Meteoric Resources (ASX:MEI), which holds a minority 15% stake in some nearby exploration tenements.

ENCOUNTER RESOURCES

ENR’s project surrounds WA1’s discovery and then extends for another 80-100km to the east.

“The district was essentially a blank sheet of paper when we moved in ~2017-2018,” ENR managing director Will Robinson told Stockhead.

“Aileron was initially part of a project generation JV with Newcrest Mining (ASX:NCM). We subsequently got the project back 100% when NCM withdrew from that JV.

“In 2020 we drilled a hole, and we got up to 0.8% rare earths, it had some niobium in it, and some copper up to 0.1%.

“We were highly encouraged about what that meant for the belt.

“We subsequently sampled up to 0.5% rare earths 7km away in a small bit of outcrop we identified from a helicopter.”

ENR’s main focus is still to find an IOCG out here, but the confirmation of a carbonatite in the district which host niobium and rare earths is pretty important, Robinson says.

“We are geared up for drilling in 2023. A very large radiometric survey over the project area kicked off [last week] to help us define those drill targets for next year once the wet season is over,” he says.

West Arunta is increasingly recognised as a potential new mineral belt for WA, Robinson says.

“[WA1’s discovery] is a good step forward, but so little work has been done here,” he says.

“It’s the sort of place where you could find an outcropping orebody simply because so little work has been done.”

NORWEST MINERALS

Feeling the nearology love last week was $10m market cap explorer NWM, which has a rare earths-lithium-IOCG project ~90km away from WA1 called Arunta West (not West Arunta, don’t get them confused).

In the June quarter the company completed a program of field mapping, rock chip collection, and infill soil sampling.

A staged drilling program across some REE, lithium, and IOCG target anomalies is planned to commence after the wet season earlier next year.

In a phone call with Stockhead, NWM boss Charles Schaus said the explorer had already defined a large 3km by 2km rare earth anomaly “that we want to drill as soon as we can get up there”.

It is also examining some WA1 discovery lookalikes on its own tenure for priority testing.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.