Resources Top 5: Is the ‘Mulga Monster’ Australia’s next high tonnage nickel sulphide find?

Pic: Vanya Dudumova / EyeEm, Via getty Images

- Western Mines hits cumulative 693.5m at 0.28% nickel, 128ppm cobalt, 61ppm copper, plus palladium and platinum in one drill hole

- Dart Mining drills into lithium pegmatite at Dorchap project, where exploration is fully funded under $12m JV with major producer SQM

- Up on no news: PolarX, Argent Minerals, Labyrinth Resources

Here are the biggest small cap resources winners in early trade, Wednesday April 5.

WESTERN MINES GROUP (ASX:WMG)

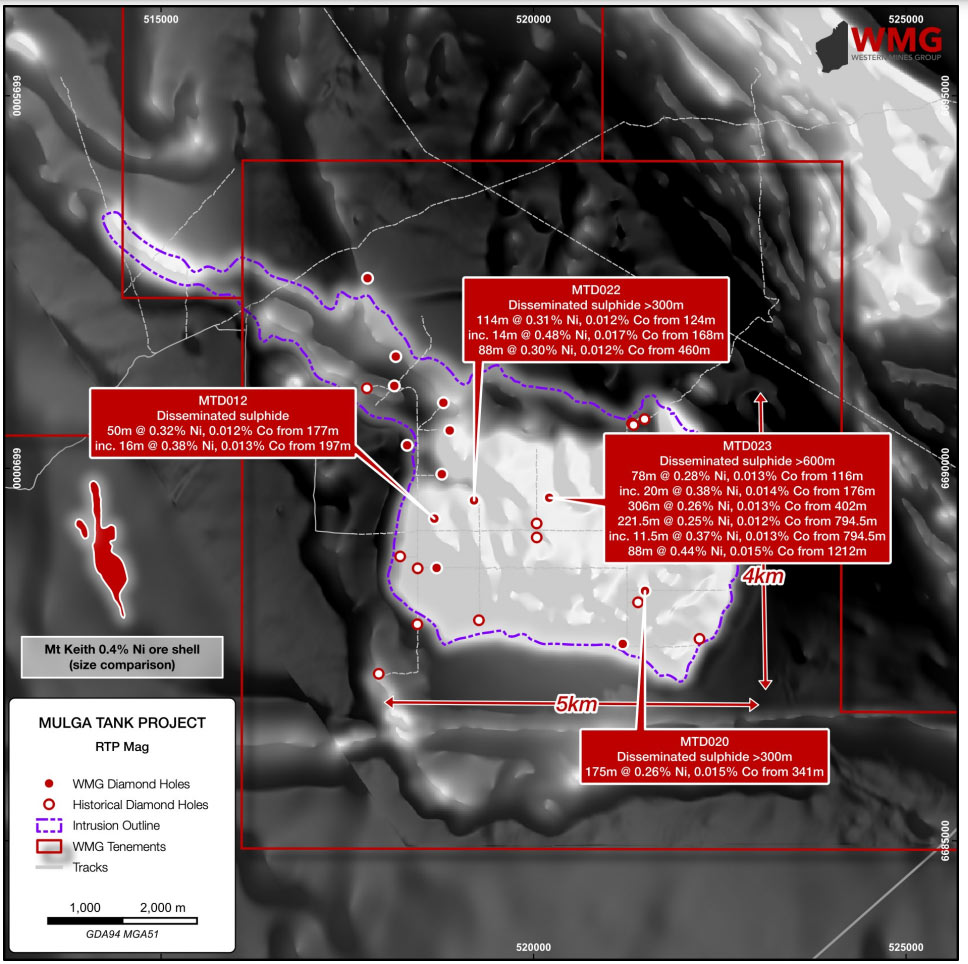

WMG has pulled up a cumulative 693.5m at 0.28% nickel, 128ppm cobalt, 61ppm copper, plus palladium and platinum in one drill hole at its Mulga Tank project in WA.

This is an “extensive nickel sulphide system” with similarities to BHP’s large Mt Keith orebody, it says. WMG’s name is actually a cheeky nod to former Aussie miner Western Mining Corporation, which owned Mt Keith before it was subsumed by BHP in 2005. Is it a sign?

Here’s a rudimentary size comparison with the 0.4% nickel ore shell at Mt Keith, the largest standalone nickel mine in Australia:

The +1400m deep hole – punched straight down the guts of the Mulga Tank complex – is a big one for WMG in more ways than one, says managing director Dr Caedmon Marriott.

“With the aid of our EIS grant we simply aimed to drill the deepest part of the complex – to gather the greatest amount of geological information we could,” it says.

“It could well be a pivotal hole for the company, with these assay results confirming the visual observations of extensive disseminated nickel sulphide mineralisation.

“The hole validates our geological model of the complex and really demonstrates a significant working nickel sulphide mineral system with huge volumes of mineralised ultramafic magma.”

This system has a large footprint across the complex and could host significant tonnes of Mt-Keith-style mineralisation, Marriott says.

A 6 hole, ~5000m diamond drilling program is currently underway to test several follow-up targets.

The $8.5m capped stock is up 50% year-to-date. It had $2.5m in the bank at the end of December.

LABYRINTH RESOURCES (ASX:LRL)

(Up on no news)

LRL is embarking on two significant gold exploration programs.

The company already boasts a 500,000oz at 5g/t resource at its namesake project along the mineral-rich Abitibi greenstone belt in Quebec, Canada. More drilling to grow this high-grade resource is now in the works.

Earlier this week it announced negotiations with Quebec projects vendor GETT Gold are ongoing “regarding the terms and conditions of the project acquisition agreement and the subsequent amendments”, which has pushed out the payment date one month to 30 April.

At its historic Comet Vale project in WA, the company has now embarked on a 20-hole, 15000m program to test the high-grade Sovereign Trend.

It will be the “first genuine surface exploration undertaken at the project for 15 years,” LRL says. An updated resource estimate for Sovereign is due in the current quarter.

The $13m capped company had $1.3m in the bank at the end of December.

DART MINING (ASX:DTM)

DTM has drilled into lithium pegmatite from 77m at its Dorchap project, where exploration is fully funded by JV partner and major US$20bn producer SQM under a $12m, six-year earn in agreement.

SQM is one of the big three in the lithium business, best known for its JV with Wesfarmers (ASX:WES) in the integrated Mt Holland lithium project development in WA.

This hit came from hole one of a 3000m maiden drill program testing five targets at Dorchap — in Victoria near the NSW border – which DTM pegged way back in 2016.

Rock chip highlights from the first target, Eagle Dyke, returned a promising 10m at 1% Li2O.

The $10m capped stock is flat year-to-date. It had $814,000 in the bank at the end of December.

ARGENT MINERALS (ASX:ARD)

(Up on no news)

ARD is also one of the few stocks on the ASX with decent silver exposure via its advanced 52Moz silver equivalent Kempfield gold-silver-base metal project in NSW.

Fresh drilling results announced early March hit new lead and silver rich mineralised zones at depth, including a highlight 31m @ 48.68g/t Ag, 1.04% Pb & 4.06% Zn from 114m.

New drilling has kicked off to extend a bunch of drillholes which finished in mineralisation, and also test other “exceptional” drill targets in the western and northern portions of the tenement.

“The company is currently on track to take Kempfield to the next level,” managing director Pedro Kastellorizos says.

Late last year ARD also picked up a new copper and rare earths project in WA called Copperhead, down the road from Hastings Technology Metals’ Yangibana REE development.

First pass rock chip sampling uncovered five additional copper-silver-zinc targets at the greenfields (untouched) project.

Standout results include 20% copper at the Illirie Creek prospect and strong silver assays between 5-24g/t at Anomaly C.

The $16.5m capped stock is up 40% in 2023. It had ~$3.7m in the bank at the end of December.

POLARX (ASX:PXX)

(Up on no news)

PXX was certified flavour of the month in December-January after major miner Northern Star (ASX:NST) snapped up a 10% stake.

PXX has two flagship assets: the Humboldt Range gold-silver project in Nevada, and the Alaska Range copper-gold project in south-central Alaska.

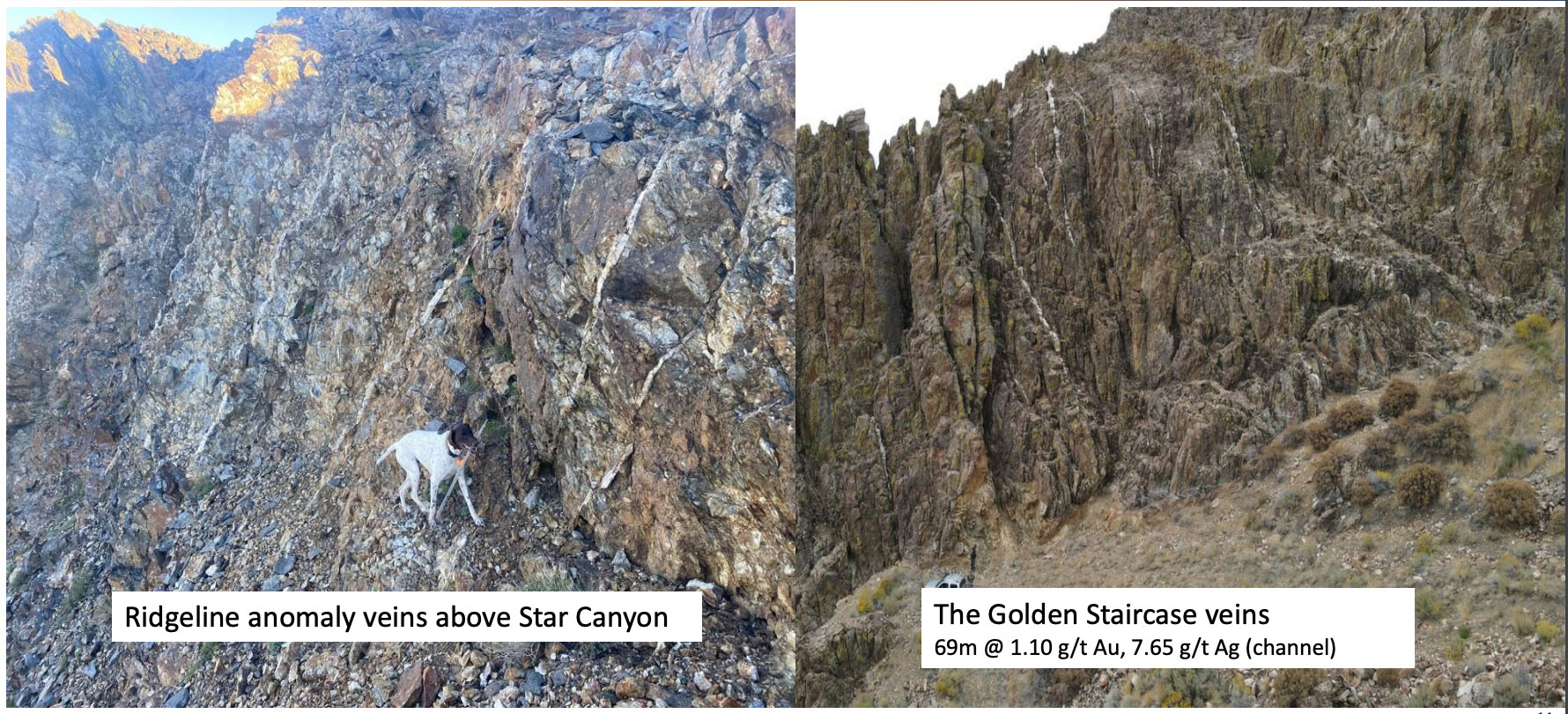

The junior scored one of the biggest gold hits of 2022 – which you can read about here – at Humboldt Range’s Star Canyon prospect, which is just ~3km from the currently operating 5Moz Florida Canyon mine.

Some less than stellar follow-up drilling results at Star Canyon announced in February saw the share price fall just as fast.

But this is early days, the project is big, and PXX is still figuring stuff out. For example, the company – in an attempt to follow these high grades – drilled into a concealed fault structure that has offset the depth continuity of the bonanza gold and silver vein.

Which means they may have just missed the good stuff. They also have a bunch of other undrilled targets to test, like these ones:

The $16m capped stock is down 40% year-to-date. It had $2.5m in the bank at the end of December.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.