Which of these tiny exploration stocks will multi-bag next?

Mining

Mining

In September last year, there were 27 ASX resources stocks with a market cap under $5m.

Nine are currently suspended or delisted – always a danger when investing in the shallow end of the pool.

But of the rest, only one has lost ground.

Six of these stocks have multi-bagged, sparked by acquisitions, discoveries, bullish commodity sentiment, and sometimes nothing at all.

They are:

Who’s next? Here’s a current batch of sub-$10m market cap explorers to run a ruler over.

| CODE | COMPANY | PRICE [intraday Tuesday] | MARKET CAP |

|---|---|---|---|

| SBU | Siburan Resources | 0.002 | $ 1,395,664.20 |

| AKN | Auking Mining | 0.002 | $ 1,865,168.92 |

| GCR | Golden Cross | 0.019 | $ 1,930,822.31 |

| CVS | Cervantes Corp | 0.004 | $ 2,144,033.24 |

| AXT | Argo Exploration | 0.014 | $ 2,834,580.00 |

| MDX | Mindax | 0.003 | $ 2,961,836.33 |

| HOR | Horseshoe Metals | 0.012 | $ 3,051,026.28 |

| NIU | Niuminco Group | 0.02 | $ 3,111,307.72 |

| RAG | Ragnar Metals | 0.011 | $ 3,447,664.68 |

| VIA | Viagold Rare Earths | 0.05 | $ 3,499,120.97 |

| TRM | Truscott Mining | 0.029 | $ 3,710,304.78 |

| HGM | High Grade Metals | 0.074 | $ 4,189,676.43 |

| KP2 | Kore Potash | 0.017 | $ 4,481,782.06 |

| LML | Lincoln Minerals | 0.008 | $ 4,599,869.49 |

| KOR | Korab Resources | 0.014 | $ 4,654,901.73 |

| APG | Austpac Resources | 0.0015 | $ 4,748,494.43 |

| NXE | New Energy Minerals | 0.027 | $ 4,980,733.77 |

| OKJ | Oakajee Corp | 0.053 | $ 4,989,656.65 |

| CMD | Cassius Mining | 0.02 | $ 5,170,435.02 |

| DMG | Dragon Mountain Gold | 0.02 | $ 5,270,610.30 |

| MTB | Mount Burgess Mining | 0.009 | $ 5,281,190.39 |

| SXX | Southern Cross Exploration | 0.005 | $ 5,386,216.00 |

| RMI | Resource Mining | 0.017 | $ 5,540,199.39 |

| CMC | China Magnesium | 0.011 | $ 5,563,490.77 |

| VAR | Variscan Mines | 0.027 | $ 5,750,514.65 |

| G88 | Golden Mile Resources | 0.049 | $ 5,781,861.42 |

| RMG | RMG Limited | 0.007 | $ 5,867,154.09 |

| AOA | Ausmon Resorces | 0.01 | |

| GLA | Gladiator Resources | 0.017 | $ 6,137,763.37 |

| KGD | Kula Gold | 0.048 | $ 6,232,225.28 |

| AHN | Athena Resources | 0.02 | $ 6,266,389.86 |

| BDI | Blina Minerals NL | 0.01 | $ 6,268,771.46 |

| RNX | Renegade Exploration | 0.0075 | $ 6,469,699.79 |

| ZMI | Zinc of Ireland NL | 0.053 | $ 6,480,307.03 |

| WSR | Westar Resources | 0.21 | $ 6,485,972.64 |

| CML | Chase Mining | 0.017 | $ 6,597,139.70 |

| CUL | Cullen Resources | 0.025 | $ 6,598,188.45 |

| TMX | Terrain Minerals | 0.009 | $ 6,621,849.08 |

| PAK | Pacific American | 0.021 | $ 6,690,282.90 |

| FIN | FIN Resources | 0.021 | $ 6,708,903.07 |

| THR | Thor Mining | 0.016 | $ 6,781,154.70 |

| MHK | Metal Hawk | 0.19 | $ 6,851,400.00 |

| AVW | Avira Resources | 0.005 | $ 6,875,200.00 |

| NCR | Nucoal Resources | 0.009 | $ 6,917,511.19 |

| BPM | BPM Minerals | 0.295 | $ 7,053,750.00 |

| AQC | Auspaccoal | 0.14 | $ 7,067,873.40 |

| DAF | Discovery Africa | 0.037 | $ 7,113,214.43 |

| WML | Woomera Mining | 0.022 | $ 7,143,919.52 |

| CAE | Cannindah Resources | 0.025 | $ 7,161,116.18 |

| AWJ | Auric Mining | 0.18 | $ 7,288,710.84 |

| MQR | Marquee Resource | 0.061 | $ 7,314,516.22 |

| CDT | Castle Minerals | 0.01 | $ 7,325,008.18 |

| HHM | Hampton Hill Mining | 0.025 | $ 7,370,134.48 |

| RDS | Redstone Resources | 0.014 | $ 7,411,820.22 |

| ERW | Errawarra Resources | 0.22 | $ 7,416,332.88 |

| NMR | Native Mineral Resources | 0.26 | $ 7,491,510.00 |

| MOH | Moho Resources | 0.079 | $ 7,494,653.52 |

| EFE | Eastern Iron | 0.012 | $ 7,506,596.08 |

| ODM | Odin Metals | 0.031 | $ 7,531,860.72 |

| MEG | Megado | 0.19 | $ 7,704,271.62 |

| FNT | Frontier Resources | 0.016 | $ 7,825,631.01 |

| GES | Genesis Resources | 0.01 | $ 7,828,412.94 |

| AAJ | Aruma Resources | 0.075 | $ 7,947,069.53 |

| ANW | Aus Tin Mining | 0.0015 | $ 7,962,318.38 |

| GBR | Great Boulder Resources | 0.043 | $ 8,086,570.11 |

| XTC | Xantippe Resources | 0.002 | $ 8,149,128.80 |

| AX8 | Accelerate Resources | 0.048 | $ 8,156,085.29 |

| KFM | Kingfisher Mining | 0.265 | $ 8,236,250.25 |

| OKR | Okapi Resources | 0.185 | $ 8,319,463.88 |

| PAM | Pan Asia Metals | 0.16 | $ 8,372,630.40 |

| SFM | Santa Fe Minerals | 0.115 | $ 8,374,160.74 |

| MLS | Metals Australia | 0.002 | $ 8,381,807.15 |

| CRB | Carbine Resources | 0.042 | $ 8,389,362.62 |

| SER | Strategic Energy | 0.043 | $ 8,400,010.75 |

| NME | Nex Metals Exploration | 0.03 | $ 8,544,755.97 |

| SUH | Southern Hemisphere Mining | 0.035 | $ 8,555,391.50 |

| BYH | Bryah Resources | 0.063 | $ 8,598,268.45 |

| TEM | Tempest Minerals | 0.032 | $ 8,697,321.79 |

| TMG | Trigg Mining | 0.135 | $ 8,710,416.54 |

| RML | Resolution Minerals | 0.031 | $ 8,774,173.74 |

| GED | Golden Deeps | 0.013 | $ 8,910,791.56 |

| RCR | Rincon | 0.24 | $ 8,992,820.16 |

| M24 | Mamba Exploration | 0.245 | $ 9,065,000.00 |

| QEM | QEM Limited | 0.091 | $ 9,100,000.00 |

| CBY | Canterbury Resources | 0.11 | $ 9,241,574.48 |

| CZN | Corazon | 0.057 | $ 9,272,099.14 |

| OZM | Ozaurum Resources | 0.19 | $ 9,363,600.00 |

| NWM | Norwest Minerals | 0.087 | $ 9,469,095.57 |

| ENV | Enova Mining | 0.028 | $ 9,482,447.63 |

| AEV | Avenira | 0.01 | $ 9,491,381.00 |

| HLX | Helix Resources | 0.015 | $ 9,529,439.14 |

| DCX | Discovex Resources | 0.008 | $ 9,569,312.61 |

| QXR | Qx Resources | 0.018 | $ 9,607,721.80 |

| BUX | Buxton Resources | 0.064 | $ 9,795,991.10 |

| MRZ | Mont Royal Resources | 0.28 | $ 9,963,261.00 |

THE MINE FINDERS

Mont Royal Resources’ (ASX:MRZ) director Michael O’Keeffe is a certified company maker.

His $7m market cap coal explorer Riversdale Mining was eventually taken over by Rio Tinto (ASX:RIO) for $3.9 billion.

That’s a ~7,200 per cent return.

His privately held explorer Riversdale Resources was subsequently recently taken over by Hancock Prospecting for about $740 million.

He was then part of the team that assumed control of iron ore play Champion Iron (ASX:CIA) through its takeover by Mamba Minerals when iron ore prices were as low as $US39/t. The Champion share price has since increased ~3000 per cent.

Mont Royal recently kicked off early stage exploration at its Wapatik gold-copper property in James Bay, a tier 1 Canadian mining jurisdiction.

Moho’s (ASX:MOH) Terry Streeter also has an impressive track record.

Streeter built his name on the success of nickel-focused companies Jubilee Mines and Western Areas.

Jubilee Mines, worth about $20m when it discovered the Cosmos nickel deposit in WA, was eventually sold for over $3bn.

Similarly, Western Areas (ASX:WSA), which floated with a market cap of $5m in 2000, is now an established WA nickel producer with a market cap of ~$715m.

Streeter is also currently on the board of junior explorers Corazon Mining (ASX:CZR), EMU NL (ASX:EMU), and unlisted companies Fox Resources and Riverbank.

ZINC OUTSIDE THE BOX

Busy explorer Variscan Mines (ASX:VAR) and its historic, high grade San Jose-Novales zinc mine in Spain have failed to excite investors.

It’s the same deal with Zinc of Ireland (ASX:ZMI), which reckons is “now in control of what is arguably one of the most prospective exploration land packages for high grade, large tonnage, zinc-lead deposits in the world”.

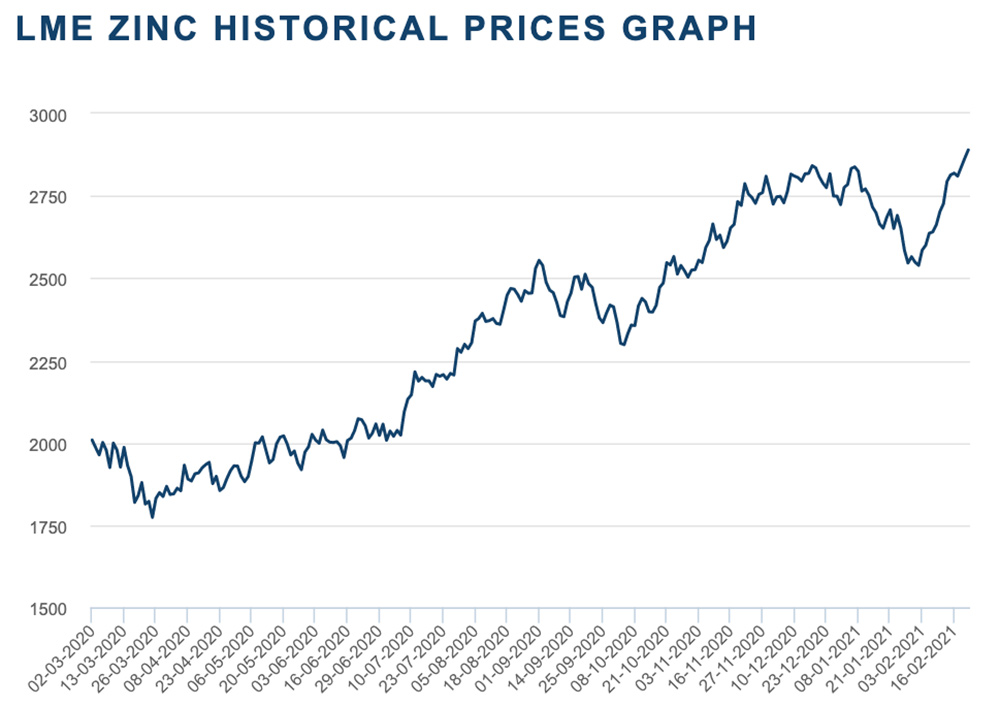

We get it — zinc isn’t sexy. But prices have been running hot for quite some time now.

THE NEAROLOGIST

In 2019, Kula Gold (ASX:KGD) offloaded its share of the Woodlark Island gold project to Geopacific Resources.

The minnow then reviewed “11 projects at varying stages of exploration, from grass roots to advanced” before settling on a big chunk of gold-nickel-PGE exploration ground in WA.

The Brunswick nickel-copper-PGE project is south of (and in the same rocks as) Chalice’s (ASX:CHN) world class Julimar discovery.

The minnow has a knack for acquiring ground in good neighbourhoods: it recently applied for exploration licences around the +2moz Edna May gold mine, also in WA.