When it comes to returns, small cap acquisitions kick large cap M&A to the kerb: RFC Ambrian

Mining

Mining

Corporate activity and asset acquisitions by ASX-listed resources stocks between 2019 and 2024 shows smaller deals, especially those under US$10m, comprehensively outperform those over US$500m.

The performance of 28 corporate and 33 asset acquisitions on the ASX over this period were scrutinised by corporate advisor RFC Ambrian by answering the question — “would my holding in this company have performed better or worse if it had not done the deal?”

Key criteria for deal inclusion were:

Roughly two-thirds of the 62 deals analysed had eroded shareholder value against an RFC Ambrian customised benchmark by the one-year anniversary of the deal announcement, it says.

‘That’s a bit sh*thouse’, you might say. But wait, there’s more.

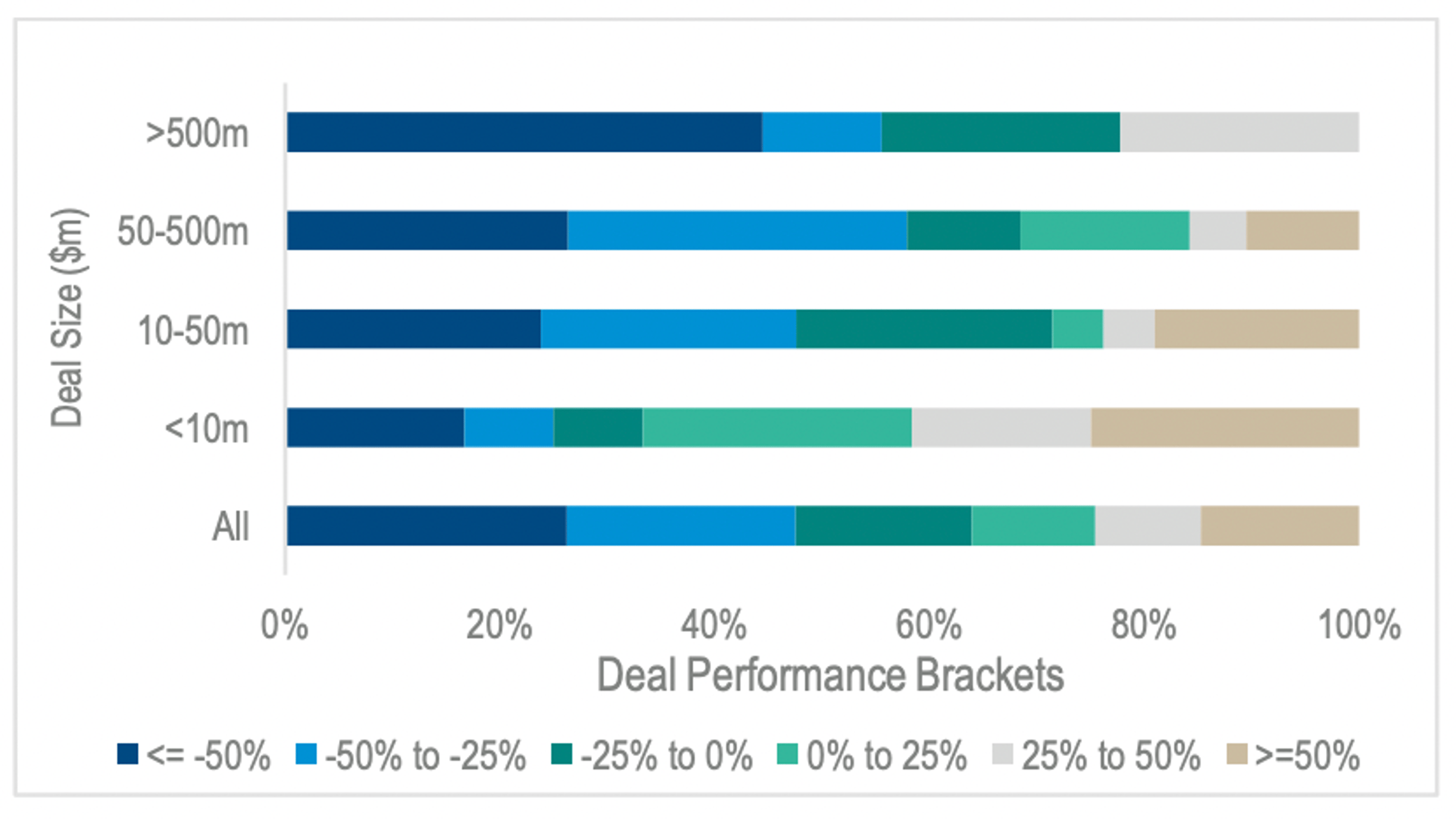

Meanwhile, there is a distinct correlation between deal size and performance, RFC Ambrian says.

“Smaller deals, particularly those under US$10m, demonstrated considerable success against our custom index, with 67% of deals outperforming the index,” it says.

“In contrast, larger deals, particularly those over US$500m, showed a clear tendency to underperform, with only 22% of acquiring companies’ share prices outperforming the index and 44% underperforming by more than 50% relative to the index.”

The below chart is a bit hard to read, but blue and dark green = bad. Brown and grey = good.

“Could it be their more straightforward, more manageable, and less disrupted integration processes, especially during the challenging COVID-19 period?” RFC Ambrian speculates.

“If so, does this imply that larger deals, with their inherently more complex integration challenges, are at a disadvantage in periods of market upheaval?”

Smaller deals can also have higher untapped growth potential for their investment, albeit with increased risk, that larger deals lack.

Larger deals may be more mature or higher quality, and so, likely more fully valued, RFC Ambrian says.

“This perspective leads us to another significant advantage of smaller assets: they offer a way to diversify an acquiring company’s risk without overstretching financial resources,” it says.

“This is crucial in an industry such as mining and exploration, where project risks are high.”

Smaller deals also favour equity financing, avoiding the financial strain that debt financing can impose on larger acquisitions, particularly with rising interest rates between 2020 and 2023.

“This aspect is crucial for assets in fluctuating commodity markets, where resilience is less assured,” RFC Ambrian says.

“It’s possible that financial strains have contributed to the underperformance of larger deals.”

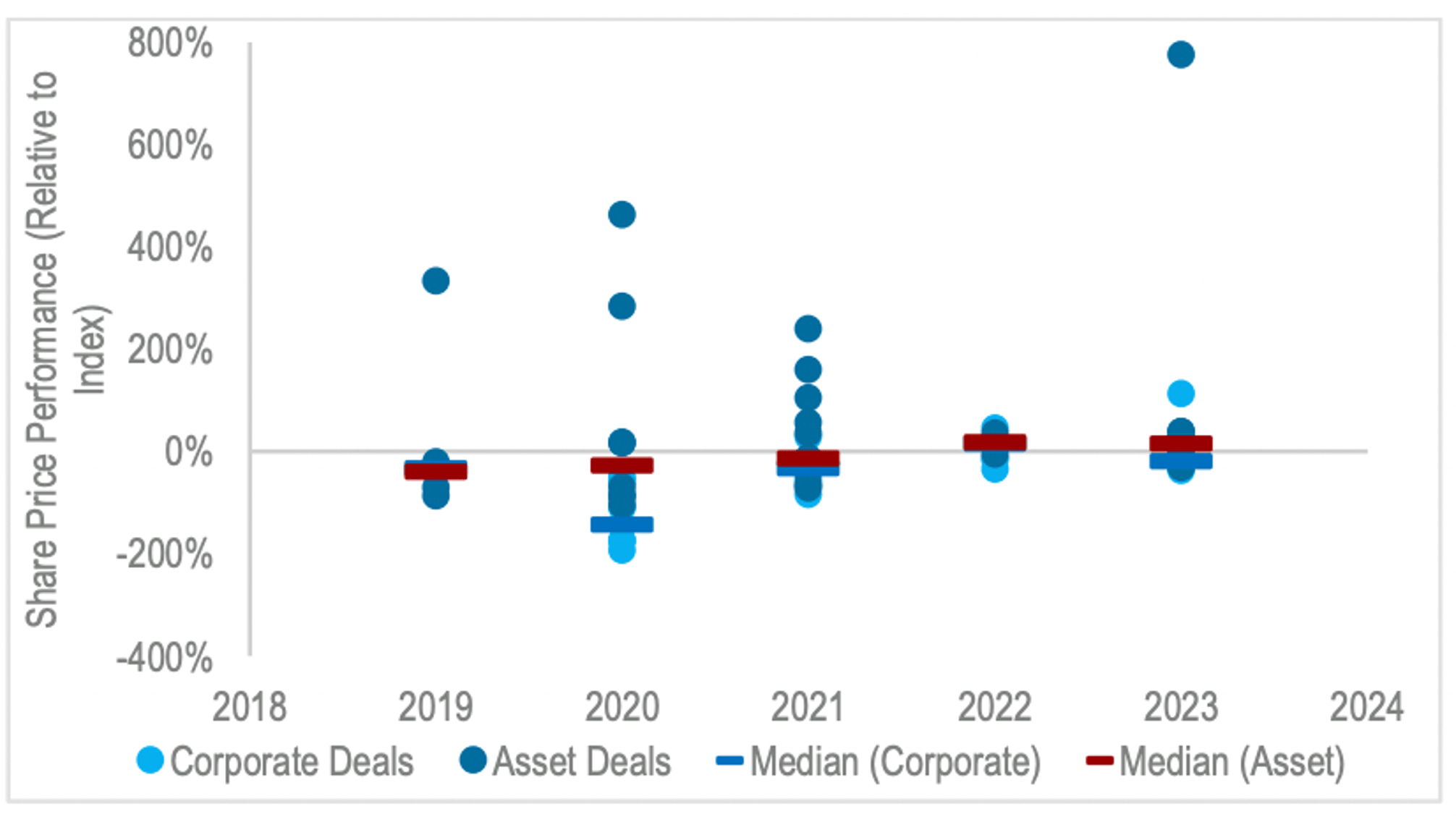

RFC Ambrian says 45% of asset acquisitions outperformed the index, a stark contrast to the 25% for corporate acquisitions (buying the whole company).

“This divide is strikingly evident in the performance spectrum – asset acquisitions claim all top 10 spots in deal performance, while corporate takeovers languish in the bottom four.”

“These results raise the questions: are corporate acquisitions more prone to being overpriced? Are they often improperly structured? Does technical due diligence suffer at the expense of corporate due diligence? Have the deals simply been poorly executed?

“The answer is likely to be a combination of all the above.”