Vulcan Energy (ASX:VUL) shares are up a tidy 2200% over the past year so it is little wonder its spinoff Kuniko (ASX:KNI) stormed onto the ASX boards on its listing today.

The Scandinavian base metals explorer was up a remarkable 325% above its 20c IPO offer price to an 85c close, having climbed as high as 500% during the day’s trade.

Kuniko has some of the flagship assets held by Vulcan in its old guise as Koppar Resources and, like its renewable energy and geothermal lithium toting cousin, is planning to be a “zero carbon” producer and explorer.

Kuniko share price today:

Copper and cobalt mines dating back to pre-industrial times

Its projects are strategically located in Norway, the world’s fastest adopter of electric vehicles. As many as 74% of Norway’s new light vehicle sales were electric last year.

The projects include 262 square kilometres of nickel, copper and cobalt licences across the Feoy and Romsas mining districts in south-western Norway, the Skuterud mining district in central-southern Norway — which was once the most prolific cobalt mining district in the world — and the Undal and Vangrofta projects near Trondheim.

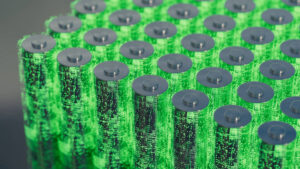

Some of that tenure includes mines that produced base metals as far back as the 1600s, but are being reimagined by Kuniko as ingredients for the electric vehicle and battery revolution.

The Vignes, Rodkleiv and Feoy underground mines in particular were mined for copper, zinc and nickel-copper-cobalt-PGEs from the mid to late 19th centuries, with Vignes and Rodkleiv producing ~4 million tonnes of copper and zinc ore between 1865 and 1971. Feoy delivered 37,000t of nickel and copper sulphide ore at high average grades of 2.1% and 2.6% respectively.

The Skuterud mine meanwhile was at one time the largest cobalt mine in the world and Norway’s largest company, operating between 1776 and 1898 before the use of cobalt in pigment went into decline.

The Modum trend is a ~9km long, north-striking mineralised trend where several Co-Cu-Au deposits were worked until the Skuterud mine shut in 1898, with estimated historic production of around 1 million tonnes with 0.1-0.3% cobalt, that was upgraded to 3% by simple hand separation.

Spinoffs find favour with investors

Kuniko, in which Vulcan is retaining a handy ~25% stake, is one of a number of resources spinoffs this year that have found favour with investors. More are on their way.

Gold hopeful Medallion Metals (ASX:MM8) announced the timeline for the $7-10 million IPO of Ravensthorpe nickel explorer NickelSearch today, with the offer due to open on August 31. It is expected to list on the ASX on October 6.

Ardea Resources (ASX:ARL), itself born after the Kalgoorlie Nickel Project was hived off of Heron Resources, will also turn its gold assets into $12 million float Kalgoorlie Gold Mining.

You might be interested in